2 ETFs To Give Your Portfolio Growth Exposure

"If You're Looking For High Growth Exposure, Consider These Two"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

With 2026 off to a fresh start—and the S&P 500 (SP500) finishing 2025 up double digits—many investors are reassessing how they’re positioned for the years ahead.

More gains? More volatility? Or a period of underperformance?

I don’t attempt to time or predict the market. Instead, my portfolio strategy is built around two simple goals:

✅ Long-term growth

✅ Reliable income

To achieve this balance, I’m focusing on making two ETFs my core positions in 2026 and beyond.

And in this article, I explain why—and how they fit into a forward-looking portfolio.

What Strategy Works for You? 🫵🏾

An investor’s strategy should evolve alongside their life.

Age, lifestyle, and expectations all matter.

Conventional wisdom often suggests:

Older investors should focus on income

Younger investors should prioritize growth

Personally, I don’t believe either approach is superior on its own. A blend of both is essential.

Early in my investing journey, I leaned too heavily into income and not enough into growth. Over time—and with experience—I’ve adjusted my portfolio to better reflect my long-term goals.

That shift matters even more today. With the rapid adoption of artificial intelligence across the U.S. and global economy, focusing too narrowly on income risks long-term underperformance.

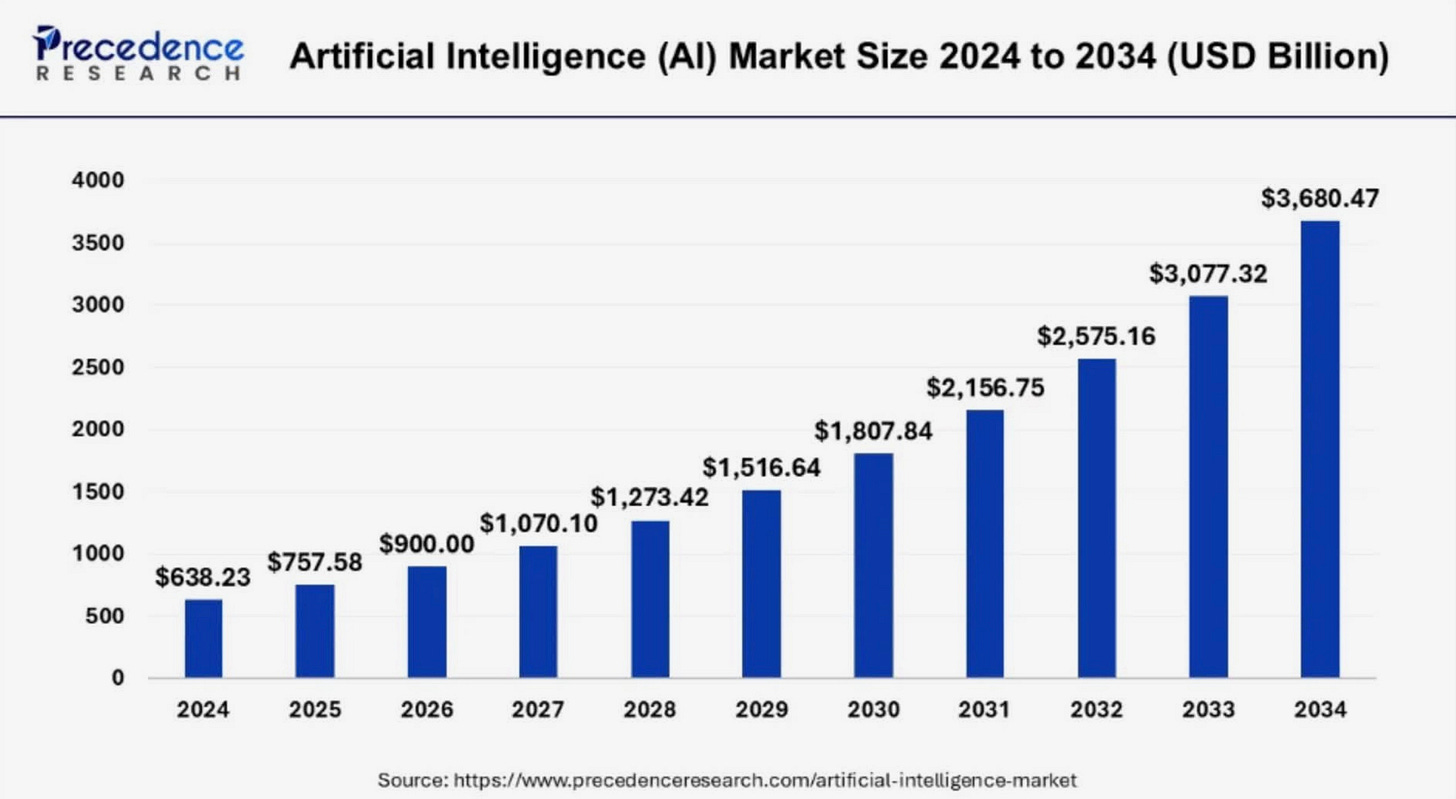

AI-driven capital expenditures are expected to continue supporting GDP growth, with the global AI market projected to reach roughly $3.7 trillion by 2034.

Whether we see a correction or recession in the near term is anyone’s guess. But over time, economic expansion remains the most likely outcome. Inflation also appears unlikely to return to the historically low levels investors became accustomed to—even as the Fed gradually lowers interest rates.

Against this backdrop, I want exposure to durable growth engines without abandoning income entirely.

That brings me to the two ETFs I’m building around in 2026.

A Dividend Fund Hiding Growth Underneath 😶🌫️

The first ETF I’m buying aggressively in 2026 is Capital Group Dividend Value ETF (CGDV).

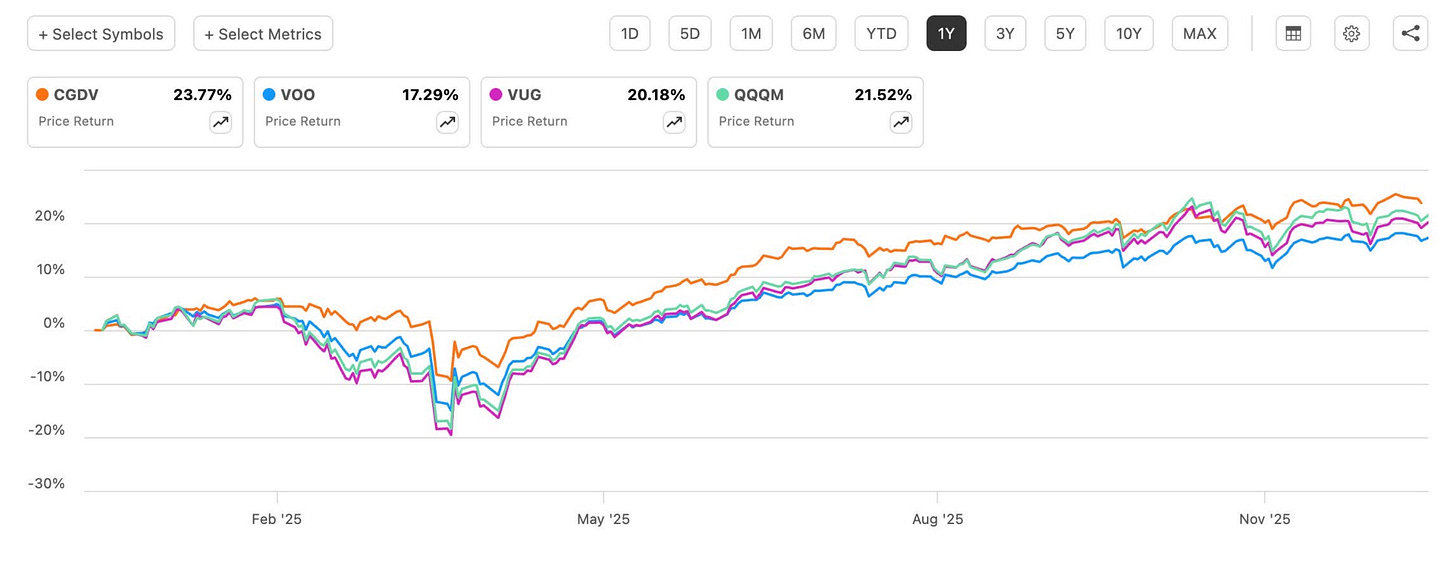

Over the past year, CGDV has outperformed several well-known ETFs, including Vanguard S&P 500 ETF (VOO), Vanguard Growth Index Fund ETF (VUG), and Invesco NASDAQ 100 ETF (QQQM).

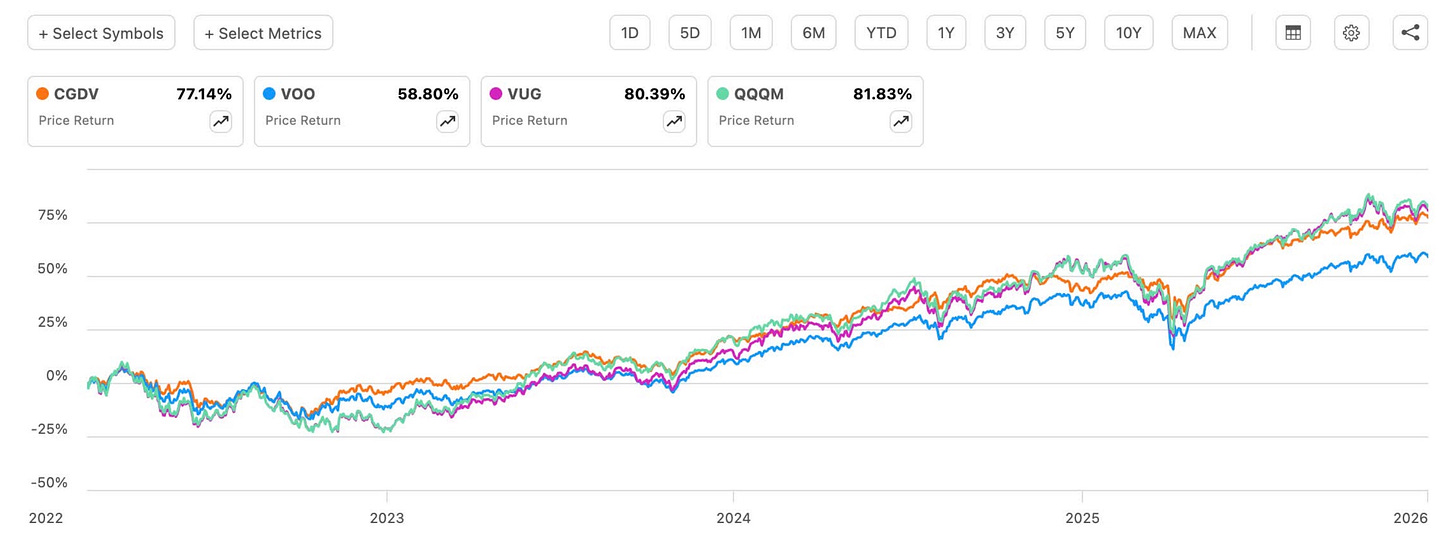

Since CGDV’s inception in February 2022, it has outperformed VOO and only slightly trailed VUG and QQQM—by less than 5%.

At roughly $44 per share, CGDV offers an attractive entry point. While its track record is still relatively short, I believe the fund is well positioned for continued outperformance.

Why CGDV Works in My Portfolio 👍🏾

Technology (XLK) is the largest sector, allowing the fund to participate in AI-driven growth

Industrials (XLI) and Healthcare (XLV) round out the top three sectors, providing diversification and downside resilience

A concentrated portfolio of just 52 holdings, reducing dilution

Managed by five separate portfolio managers, each responsible for a specific sleeve

I’m also comfortable with CGDV’s active structure. The 0.33% expense ratio is reasonable given the strategy, and I view the multi-manager approach as a potential advantage rather than a drawback.

From an income standpoint, CGDV yields around 1.3%, roughly in line with the broader market. The fund invests at least 80% of assets in dividend-paying companies or those with dividend potential, and its objective is to exceed the S&P 500’s average yield over time.

While I hold CGDV for growth, the qualified dividends are a bonus, Especially, for compounding in a taxable account.

I’ve already started adding to my position this year, and I expect CGDV to become one of my largest holdings by the end of 2026.

A Long-Term Wealth Compounder 📉

The second core position is Schwab U.S. Large-Cap Growth ETF (SCHG).

Unlike CGDV, SCHG has a long and proven track record, with an inception date of December 2009. Its performance history gives me confidence in its role as a long-term compounder.

SCHG is unapologetically growth-focused:

Technology accounts for roughly 48% of the portfolio

Communication Services (XLC) and Consumer Discretionary (XLY) are the next largest sectors

The fund tracks the Dow Jones U.S. Large-Cap Growth Index (DJUSGL)

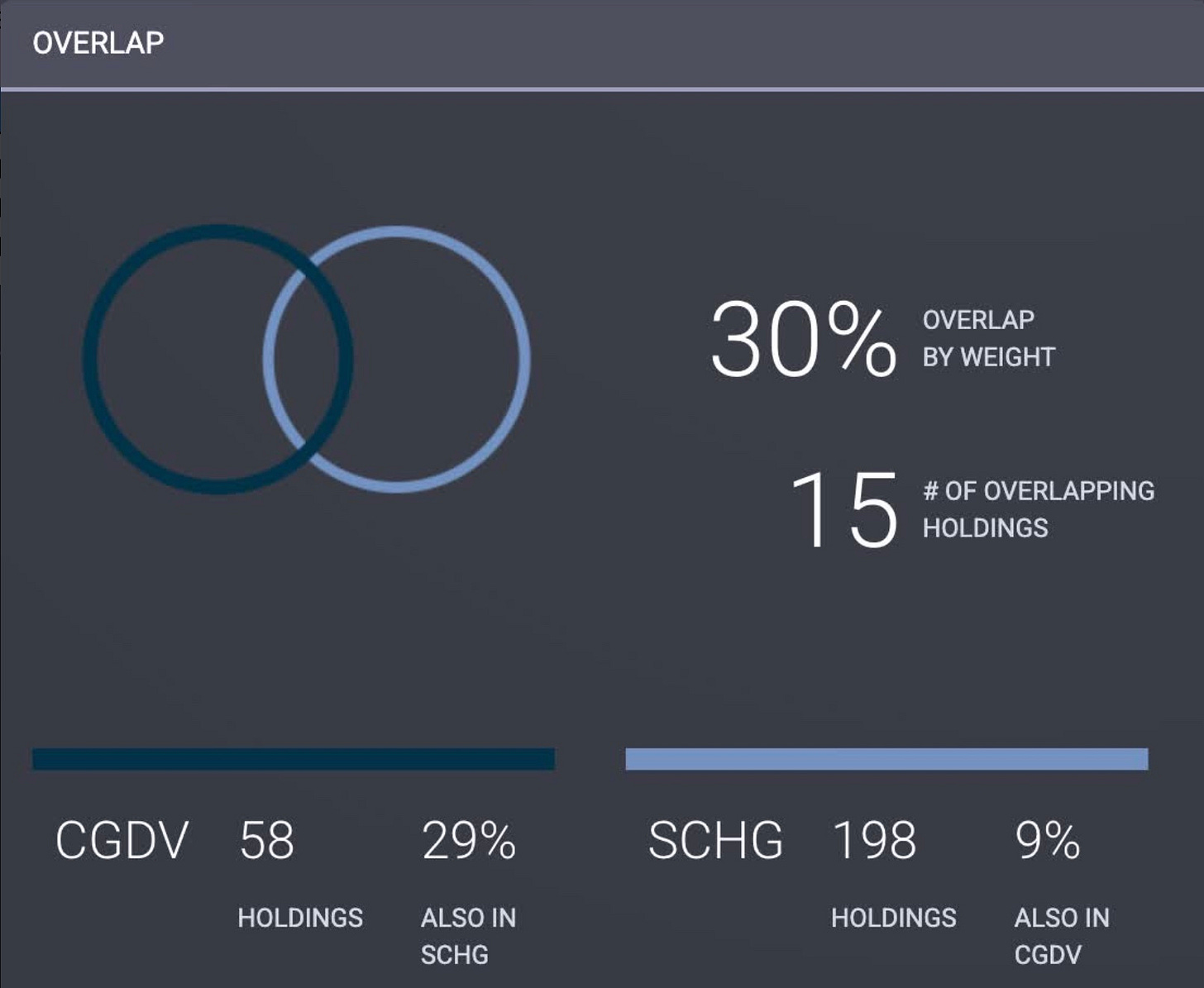

Despite both funds leaning into growth, portfolio overlap remains modest. Only about 29% of SCHG’s holdings overlap with CGDV, well within my personal comfort zone.

As a rule of thumb, I prefer overlap between ETFs to stay below 30–40%, and the lower the better.

SCHG also benefits from Schwab’s low-cost structure. As a passively managed fund, it carries an expense ratio of just 0.04%. Recent stock splits have also made the ETF more accessible from a price standpoint, currently trading around $32.

While SCHG slightly trailed peers over the past year, it has:

Outperformed most competitors over 3-, 5-, and 10-year periods

Delivered consistent long-term compounding with minimal drag from fees

SCHG does pay a distribution, but it’s minimal—roughly 0.3%. For 2025, distributions averaged about $0.03, which I largely ignore from an income perspective. The upside is that distributions are qualified, making them tax-efficient in a taxable account.

Like CGDV, I plan to continue dollar-cost averaging into SCHG and expect it to remain a top holding throughout 2026 and beyond.

Risks to My Thesis ⚠️

No strategy is without risk.

Both ETFs are heavily exposed to Technology, meaning a prolonged sector downturn would likely lead to underperformance

SCHG currently trades at a rich valuation, with a price-to-earnings ratio north of 38x

CGDV’s shorter history may concern investors looking for performance data through a full recessionary cycle

These are real considerations, but not deal-breakers for me.

Final Thoughts ✅

When it comes to ETFs, I don’t place excessive emphasis on P/E ratios. Diversified portfolios of high-quality businesses often appear “expensive” but still deliver strong long-term results.

For ETF investors, I believe consistent dollar-cost averaging—regardless of market conditions—remains one of the most effective strategies available.

With artificial intelligence likely to continue driving productivity, earnings growth, and GDP expansion, I’m focused on capturing that upside while still building income over time.

That’s why CGDV and SCHG will remain the foundation of my portfolio in 2026 and beyond.

What are your core holdings? Let me know in the comments.

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha.

Here’s How: Click the Seeking Alpha link here. Click investing group, subscribe now, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Agreed. Without the right mindset, even a good strategy falls apart under pressure. That intersection is where most mistakes creep in.

I dig into that balance quite a bit at After the Close, especially how mindset shows up in real decisions, not just theory. Always good to compare notes.

I like the way you frame growth within a longer term mindset. ETFs are tools, not shortcuts, and picking them with clear intention beats chasing random themes.

I write a lot about process and capital allocation at After the Close if you want another angle on how to think about positions beyond just tickers. Good discussion here.