2 Long-Term Growth Stocks That Looks Ripe For The Picking

"Why I'm Bullish On These Two Powerhouses"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

With December more than halfway over and Christmas upon us, I couldn’t help but treat myself to a few stocks that I believe are currently trading at attractive valuations.

These additions are also a bit different from my existing holdings. Over the past few years, I’ve increasingly tilted my main portfolio toward growth-oriented stocks. And also simultaneously building out a separate all-income portfolio focused on covered call ETFs, BDCs, and REITs.

If you follow my work, you know I’ve long advocated for investors to maintain two or more portfolios:

One tilted toward growth

One focused strictly on passive income

While my primary portfolio blends both styles, this month marked a milestone—I added my first non-dividend-paying stock, along with another company I’ve been bullish on for some time but previously felt was overvalued.

Recent price pullbacks finally gave me the opportunity to act.

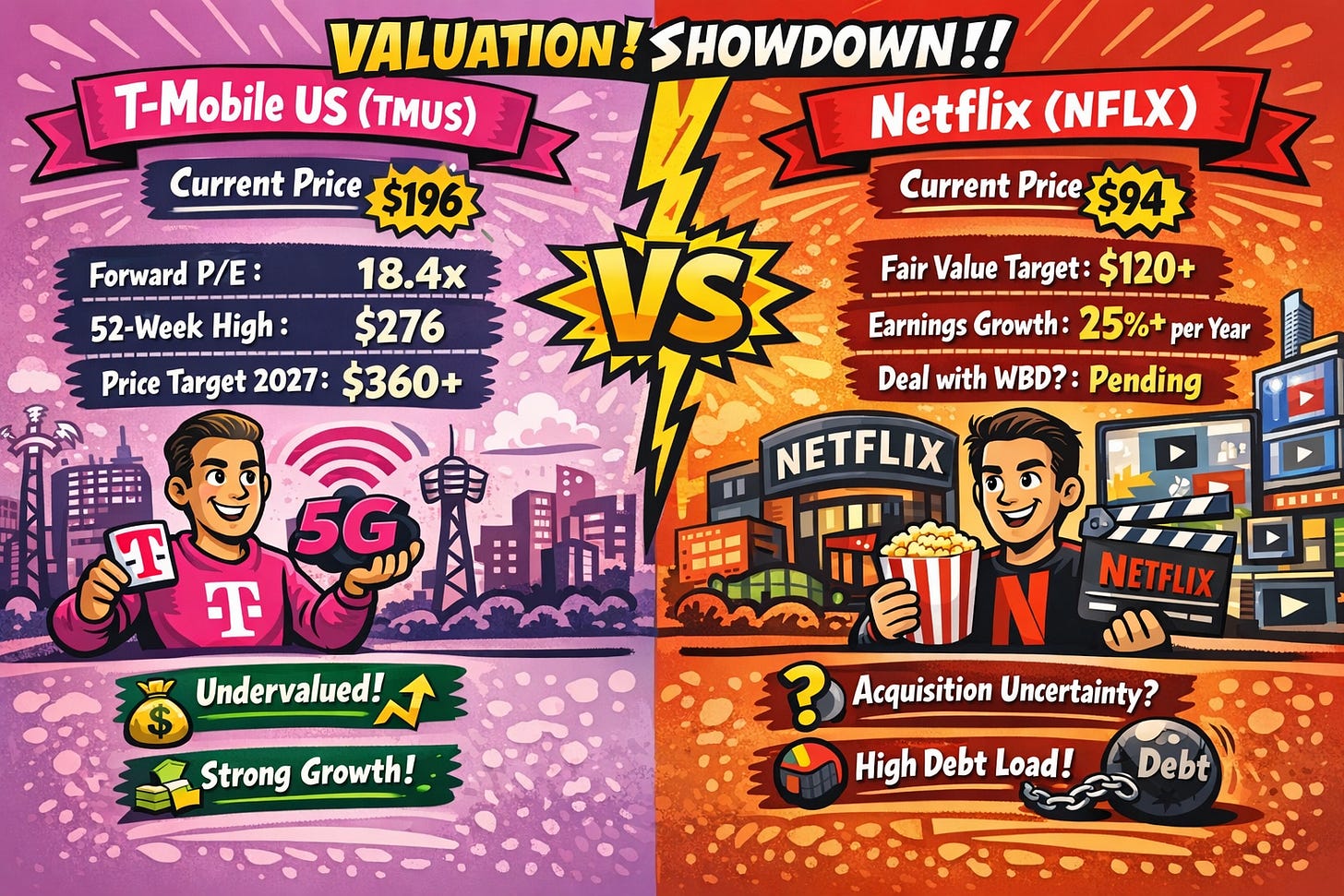

T-Mobile US (TMUS) 📱

Current Price: $197.00

I’ve been bullish on T-Mobile for quite some time. The company continues to outperform its peers, including Verizon (VZ) and AT&T (T) particularly in customer retention and subscriber growth.

Traditionally, telecom stocks are known for three things:

• High debt

• High dividend yields

• Low growth

T-Mobile has been the clear exception.

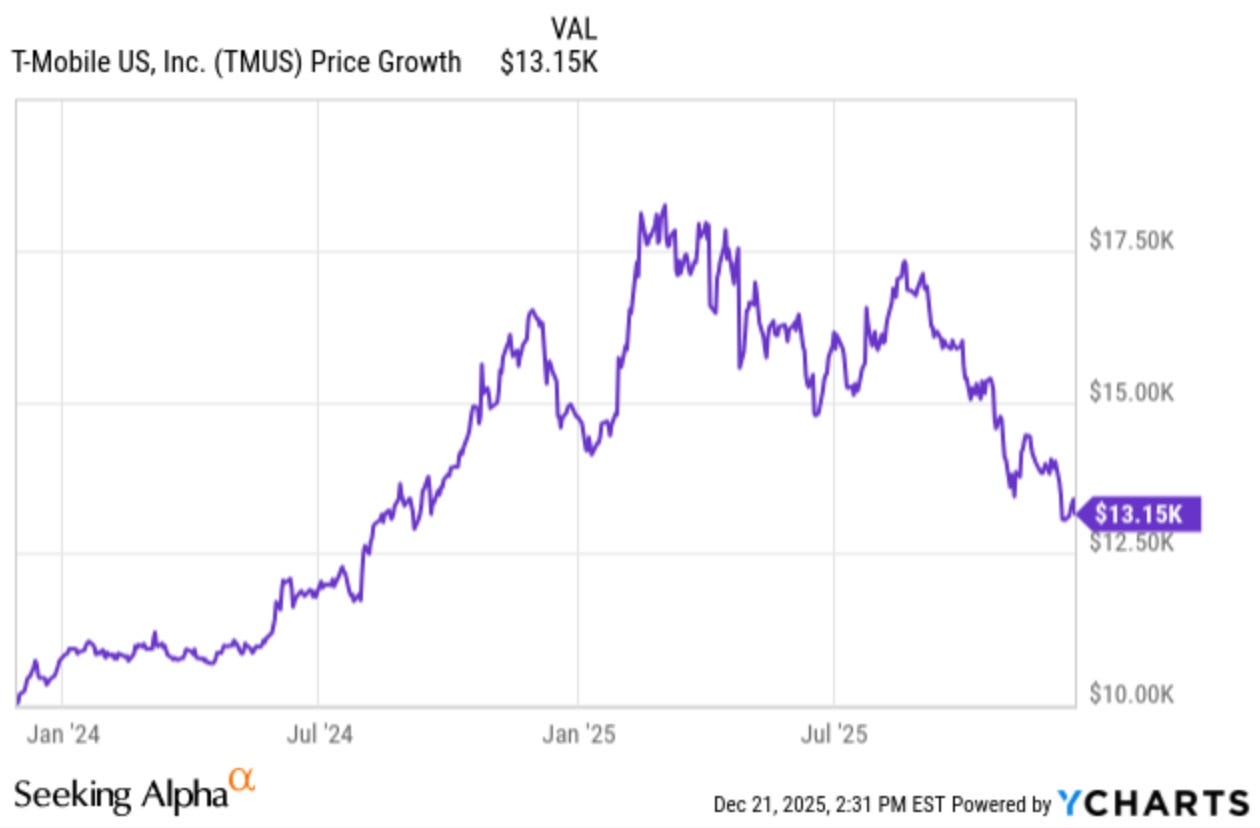

Thanks to strong execution and continued market share gains, TMUS significantly outperformed over the past three years, reaching a 52-week high of $276 earlier this year.

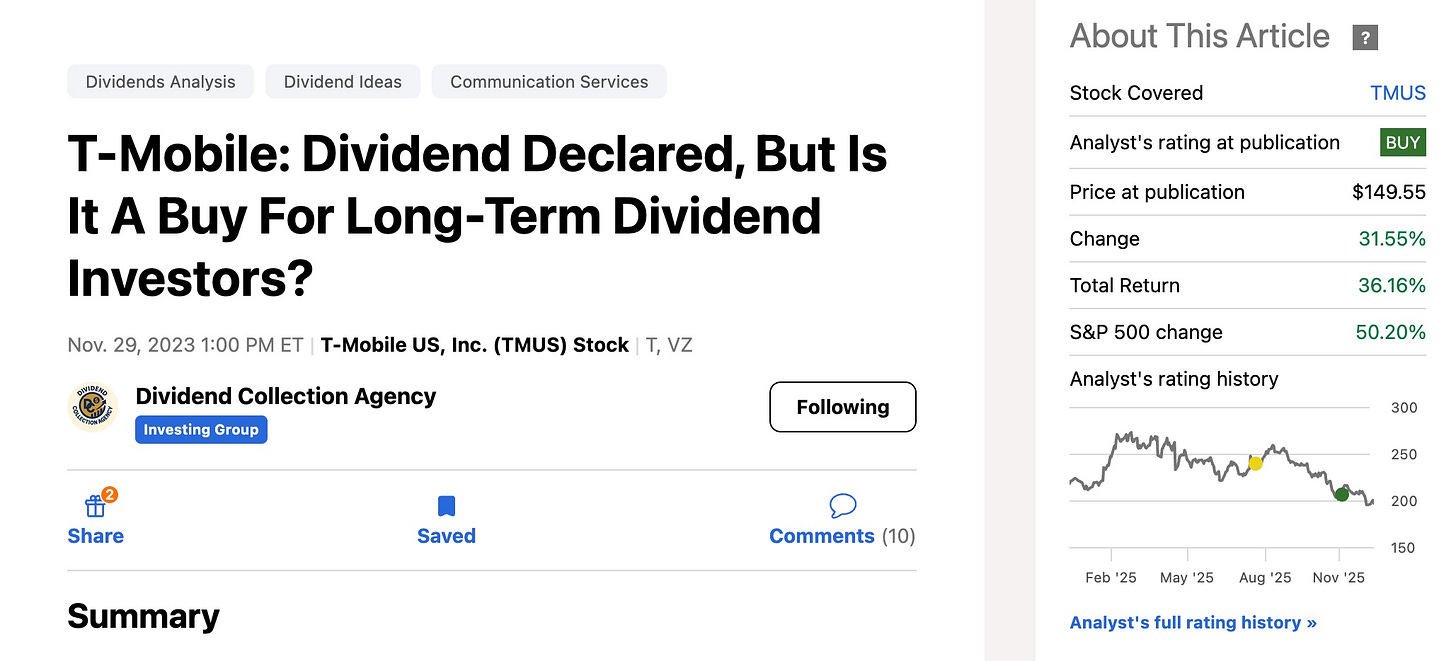

I first turned bullish in late 2023 shortly after the company declared its first-ever dividend, when shares traded below $150. Since then, the stock surged close to 85% to $276.49 before recently pulling back.

So, if you would have invested $10,000 into TMUS when I first suggested it, you would have made nearly $18,000 at its peak. Currently, you’d still be up over $3k on your investment.

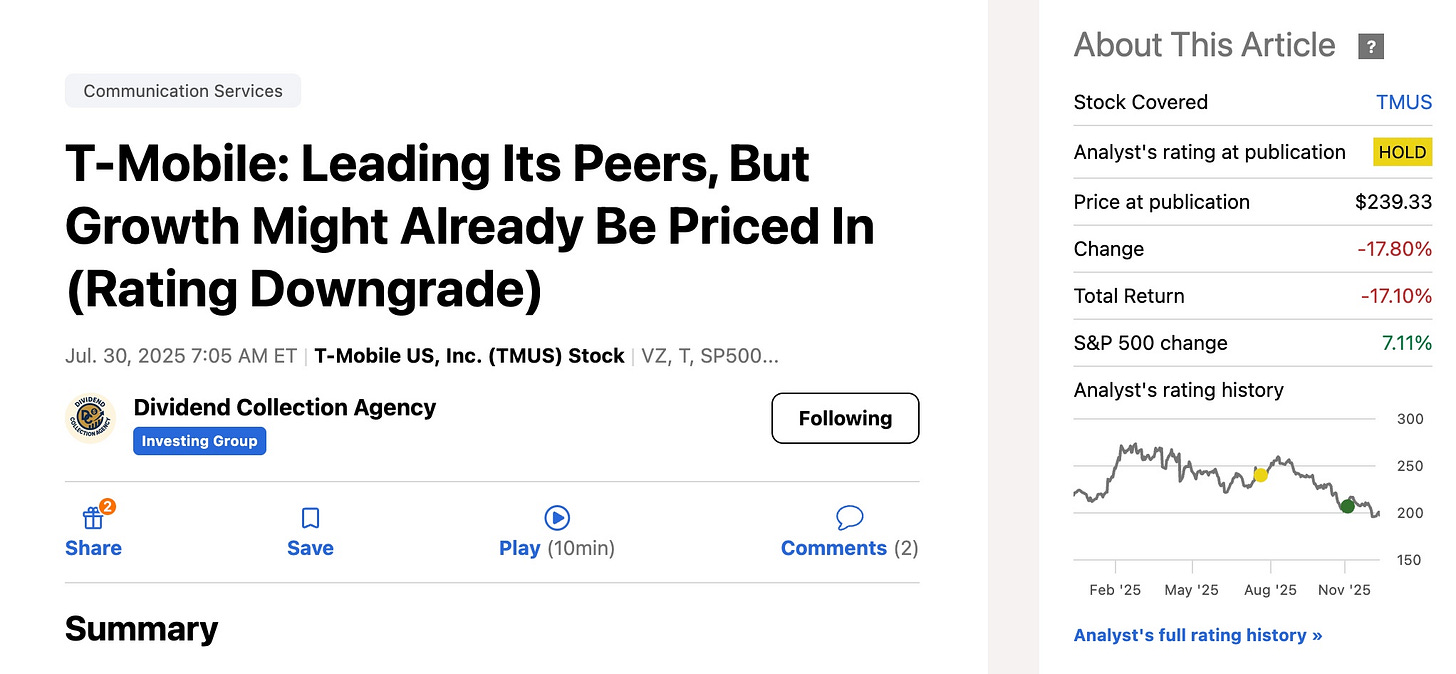

Back in July of this year, I downgraded TMUS from a Buy to a Hold as its valuation became stretched. And that hold rating proved timely. The stock has since fallen close to 18%, while the S&P 500 is up over 7%. This is why knowing when to profit is valuable. Buying great companies when they’re overvalued can and often leads to underperformance.

Why I Bought the Dip 🧾

With shares now trading below $200, I believe TMUS once again offers an attractive entry point for long-term investors.

During Q3 earnings, the company delivered:

• Double-digit EPS and revenue growth

• 560,000 broadband net adds, compared to just 110,000 for Verizon

• A raised full-year outlook

Despite a lower dividend yield than peers, the payout is extremely well covered, with a free cash flow payout ratio of just 21.6%.

The balance sheet remains strong:

• Leverage ratio: 2.5x

• Cash & equivalents: $3.31 billion

• Plenty of retained cash flow after dividends

Analysts’ project double-digit earnings growth beyond 2025, helped by lower base rates.

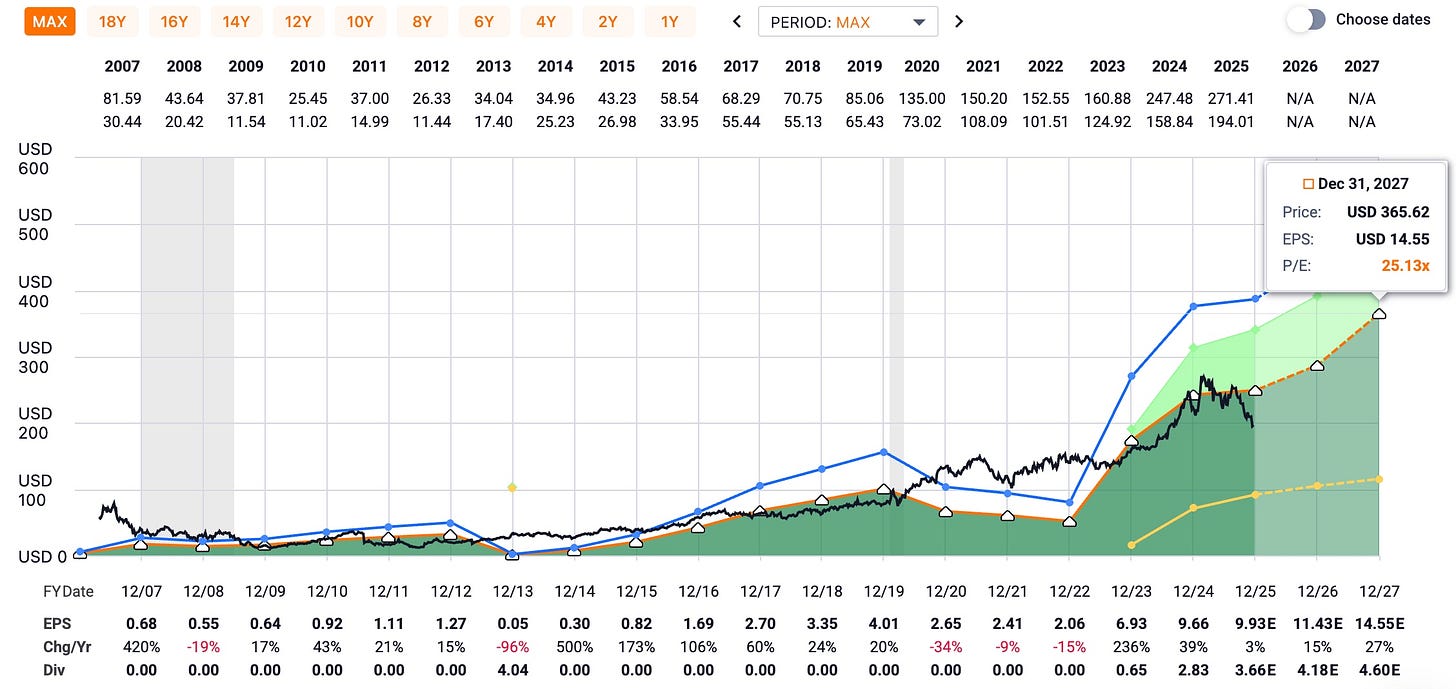

TMUS is now trading below its historical P/E of 25x, with a forward multiple of just 18.4x.

If the stock returns to its normal valuation, upside is substantial—with a potential price target north of $360 by 2027.

Netflix (NFLX) 🎬

Current Price: $94.72

The second stock I bought this month was Netflix—my first non-dividend-paying stock.

In November, Netflix completed a 10-for-1 stock split and later won the bid to acquire Warner Bros. Discovery (WBD), a deal that initially rattled the market due to concerns over leverage and regulatory scrutiny.

While a counteroffer from Paramount Skydance added volatility, I remain confident Netflix ultimately prevails.

And if so, I believe Netflix will join Microsoft (MSFT), Apple (AAPL), and NVIDIA (NVDA) in the trillion dollar market cap club.

Why Volatility Is an Opportunity 💰

Shares are currently down over 6%, but I view this volatility as a long-term buying opportunity.

Netflix’s financial position easily supports the acquisition:

Q3 debt: $14.46 billion

Cash on hand: $9.2 billion

No short-term debt maturities

Market cap north of $400 billion

Even assuming ~$80 billion in additional debt, Netflix’s strong cash flows and lack of dividend obligations allow management to aggressively deleverage over time.

While earnings may temporarily soften due to paused share repurchases, management expects the deal to become accretive by year two.

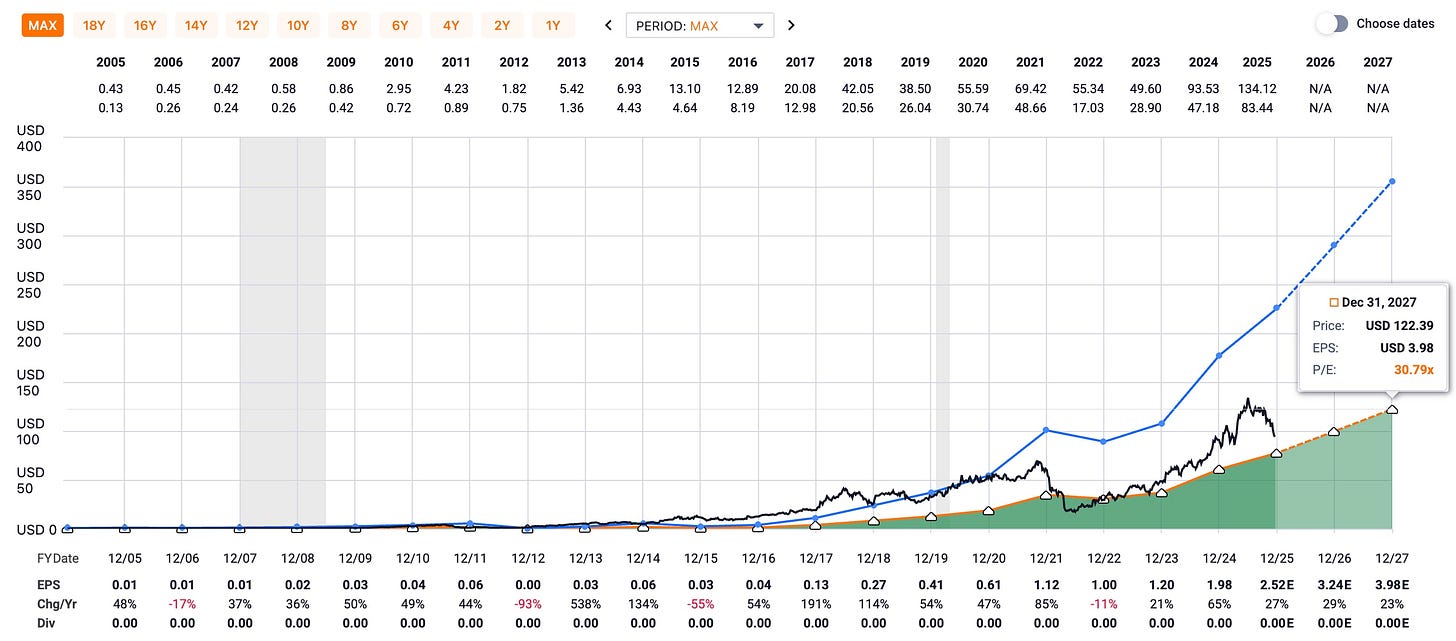

Analysts project 25%+ average earnings growth over the next three years, and I believe high-double-digit growth remains achievable long-term.

Using F.A.S.T. Graphs’ fair value multiple of ~31x, Netflix appears close to fair value today, with upside toward $120+ per share over the next few years.

Transactions 💲

I began accumulating Netflix earlier this month, while T-Mobile is my most recent position. As someone who prefers dollar-cost averaging, I plan to continue adding—even if volatility persists.

Risks & Final Thoughts ✅

T-Mobile Risks

A weakening economy could pressure subscriber growth

Aggressive pricing from Verizon’s new leadership may increase competition

Netflix Risks

Regulatory hurdles or DOJ intervention

Losing the Warner Bros. Discovery bid could push shares into the $70–$80 range short term

That said, both stocks are projected to deliver strong double-digit growth over the next several years. While near-term volatility may persist, I believe these pullbacks represent opportunities, not warnings.

For patient investors willing to look beyond short-term noise, both TMUS and NFLX offer compelling upside over the next 2–5 years.

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.