2 Overlooked Stocks Who Just Raised Their Dividends Above 10%

Two Stocks To Add To Your Watchlist

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

Thanks for reading Dividend_Collectuh’s Substack! Subscribe for free to receive new posts and support my work.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

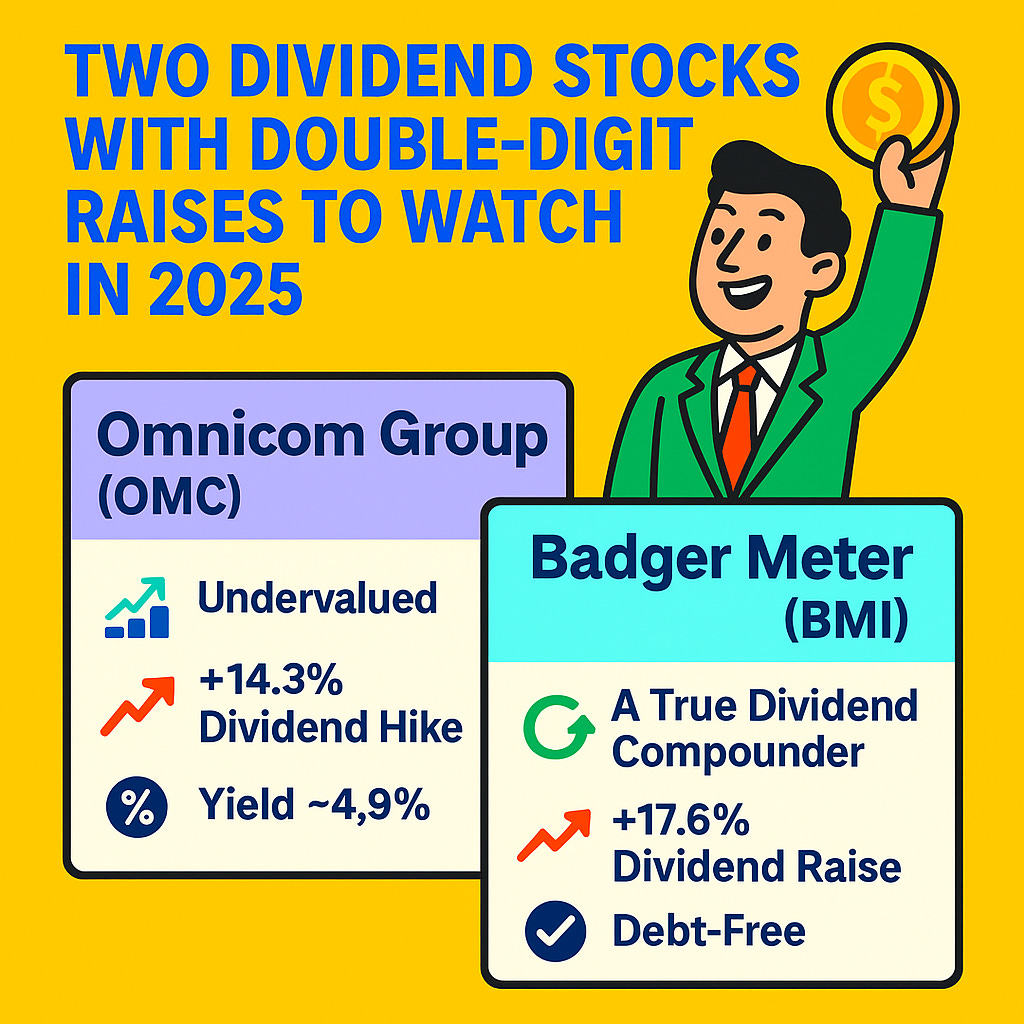

Current Price: $73.15 Omnicom Group (OMC) & $177.21 Badger Meter (BMI)

Portfolio Purpose: Income 💰

When it comes to investing, nothing excites me more than discovering high-quality companies that reward shareholders year after year.

As a dividend-focused investor, I’m constantly scanning the market for undervalued opportunities. Especially now, with AI hype dominating headlines and interest rates still elevated.

As the Federal Reserve likely guides rates lower over the next few years, yields on fixed-income products will naturally decline. And when that happens, investors historically rotate back into equities.

Dividend stocks tend to benefit the most during this shift.

Recently, two companies jumped onto my radar after delivering dividend increases well above 10%.

One I’ve followed for years; the other is a new addition to my watchlist. Both offer compelling opportunities for income-focused investors.

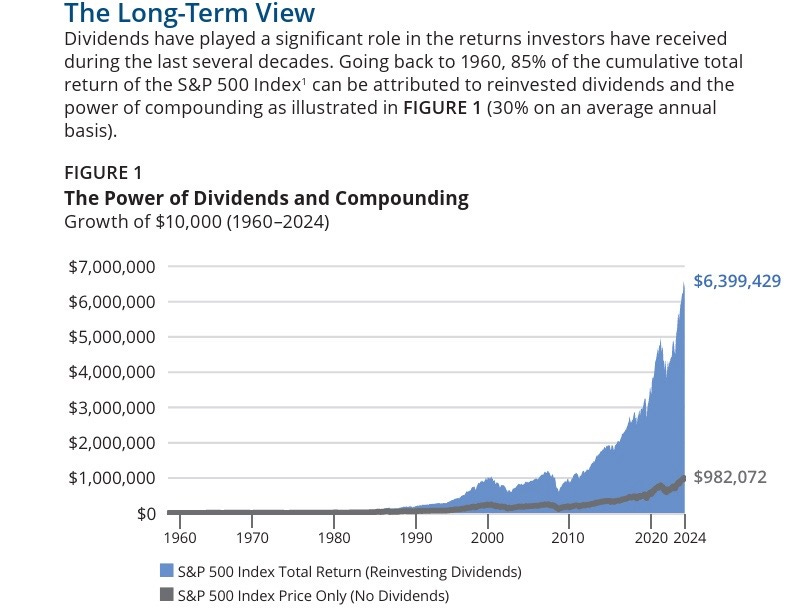

Why Dividends Still Matter 💵

Dividend investing may seem “boring” to some—but boring often wins. Especially, during time of economic volatility.

Major indices and Bitcoin (BTC-USD) have pulled back recently, yet treasury yields remain elevated. That gives dividend investors a rare moment to scoop up discounted stocks and build their income.

Since 1960, dividends have contributed a significant portion of total market returns. And with inflation still sticky, reliable, growing income becomes even more valuable.

(Chart: Hartford Funds)

Let’s take a closer look at the two standouts.

1. Omnicom Group (OMC) — Undervalued + A 14.3% Dividend Hike ↗️

Omnicom doesn’t attract much attention, but after a softer-than-expected Q3 report, shares sold off sharply. The stock is down ~29% year-over-year and continues drifting lower.

Despite inflationary pressures, tariff impacts, and weakness across segments, Omnicom surprised investors with a 14.3% dividend increase, bringing the yield to ~4.9%. Before the increase, OMC kept its dividend flat for four consecutive years.

Why the Dividend Raise Matters 💸

✔️ Payout ratio: 31% — extremely conservative

✔️ Balance sheet: Leverage cut from 1.4× to 1.2×

✔️ Cash flow: Strong enough to support continued dividend growth

✔️ Merger: Integration with Interpublic Group could create long-term synergies

Valuation

Forward P/E: 8.65×

Historical avg: ~15×

Price target: $155 over two years

✅ Bottom line: OMC looks deeply undervalued and offers a rare blend of high yield + meaningful upside.

2. Badger Meter (BMI) — A True Dividend Compounder 🏧

Badger Meter, a century-old water solutions leader, has also sold off—down ~20% year-over-year. And as a result, is creating a potential long-term entry point.

BMI delivered an impressive third quarter, posting double-digit revenue and EPS growth, with gross margins expanding to 40.7%.

What Makes BMI Stand Out 🌟

✔️ Debt-free balance sheet

✔️ 33 consecutive years of dividend increases

✔️ 17.6% dividend raise in August

✔️ Capital-light operating model

✔️ Strong free cash flow generation

Their SmartCover acquisition ($185M) was funded entirely with cash, and they still finished the quarter with $200M in cash plus an unused revolver. That’s elite capital discipline.

Growth Outlook 📉

Analysts expect low-to-mid-teens EPS growth powered by:

Continued margin expansion

A long secular runway in water automation

Disciplined acquisitions

Dividend hikes tied closely to earnings growth

Even with a sub-1% yield, BMI’s consistency and compounding power make it an elite long-term dividend grower. Shares offer ~16% upside to the $204 target.

Risks to Consider ⚠️

Both companies face similar macro challenges:

Higher-for-longer interest rates

Tariff-related cost pressures

Signs of economic slowing and rising layoffs

Even as cuts begin, true relief may not arrive until 2026–2027. Expect short-term volatility.

Bottom Line ✅

Omnicom Group and Badger Meter may look beaten down, but their fundamentals remain strong—and both rewarded shareholders with double-digit dividend increases.

For long-term dividend investors, this pullback could be an opportunity:

OMC: Deep value, high yield, merger synergies

BMI: Zero debt, strong FCF, elite dividend growth

With rate cuts and tariff relief expected over the next 12–24 months, I believe both companies deserve a spot on every dividend investor’s radar.

Happy Investing!

If you’re looking to create passive income and build your wealth from one of the top rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started. ☎️

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Exciting! Have been doing some research on companies that regularly pay out high dividends. This is welcome information. Thank You.