2026 S&P Outlook: Can It See 8,000?

"Will REITs Finally Deliver Income & Alpha?"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

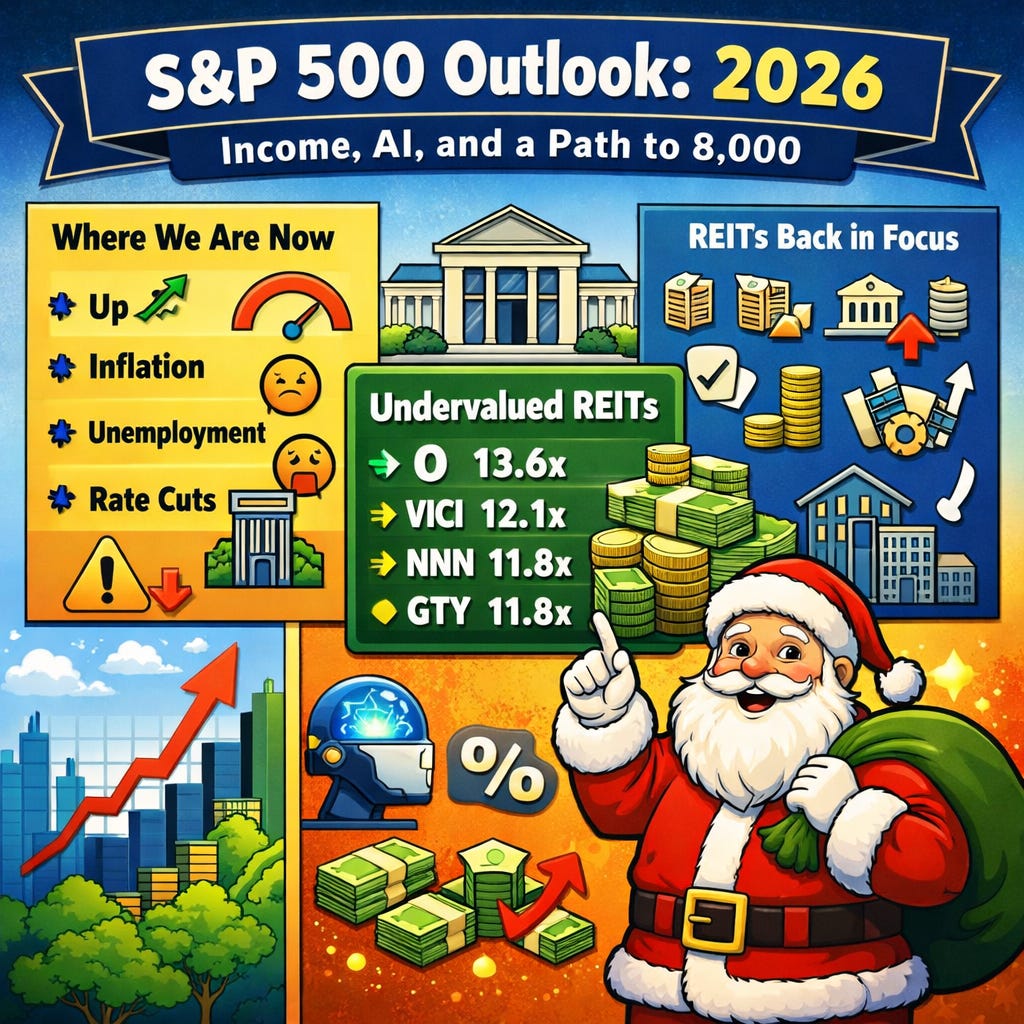

With 2025 coming to a close, investors are naturally wondering how the market may fare heading into 2026. So far, performance has been strong, with the S&P 500 (SPX), Dow Jones Industrial Average (DJI), and Nasdaq (NDX) all up double digits.

However, inflation remains elevated and unemployment has begun to trend higher. Both potential indicators of a slowing economy despite resilient consumer spending.

While the Federal Reserve has already cut interest rates multiple times this year, monetary policy typically operates with a lag, often taking 12 months or more to meaningfully impact economic activity.

Despite these concerns, I expect the broader market to continue trending higher and potentially reach new highs—barring a true black swan event. AI-driven enthusiasm remains a powerful tailwind.

And while mega-cap technology has led the charge, I believe another sector could meaningfully contribute to returns in 2026: real estate investment trusts (REITs).

Below I discuss my outlook for the S&P 500 in 2026 and explain why I believe REITs could deliver both income and alpha in the year ahead.

Chronic REIT Underperformance 📈

Since 2022, REITs have materially underperformed the broader market. The primary culprit has been the “higher for longer” interest-rate environment, which increased borrowing costs and pressured valuations.

Higher rates impacted REITs in several ways:

Increased cost of capital

Slower acquisition activity

Higher vacancies in certain property types

Financial stress among weaker tenants

Perhaps one of the most surprising developments was Alexandria Real Estate Equities (ARE) cutting its dividend by 45%. Given my prior bullish stance on life science REITs, this took me by some surprise.

Office-focused REITs were hit even harder, with lingering work-from-home effects continuing to suppress occupancy levels.

Meanwhile, broader equity ETFs—such as SPY, QQQ, IVV, VOO, and IWM—have all posted strong double-digit returns over the past three years.

This was driven largely by technology stocks. In contrast, REIT-focused ETFs like VNQ and XLRE have delivered only low single-digit returns over the same period.

That said, headline performance doesn’t tell the full story.

Fundamentals Tell a Different Story 📖

While some REITs struggled, many high-quality names quietly navigated the rate storm and continued strengthening their balance sheets.

Several REITs not only maintained but raised their dividends, including:

Realty Income (O)

VICI Properties (VICI)

Agree Realty (ADC)

NNN REIT (NNN)

Even Medical Properties Trust (MPW)—a name many had written off (including myself) —managed to raise its dividend this year.

These dividend increases highlight an important point: fundamentals across large parts of the REIT sector remain intact.

Why REITs Could Deliver Income & Alpha 💰

With the Federal Reserve now having cut rates a cumulative six times—bringing the Fed Funds rate to roughly 3.5%–3.75%—the headwinds that plagued REITs may begin to fade.

Most expectations point toward rates remaining steady in the near term, but by the end of 2026, markets anticipate an additional 50 basis points of cuts. Historically, REITs perform well during periods of falling or stabilizing interest rates.

And several high-quality REITs still trade at meaningful discounts to historical and sector averages:

Forward AFFO multiples

Realty Income (O): 13.55x

VICI Properties (VICI): 12.11x

NNN REIT (NNN): 11.80x

Getty Realty (GTY): 11.76x

All four offer dividend yields above 5%, supported by durable cash flows and conservative balance sheets.

As yields on fixed-income products compress, income-focused investors searching for value may increasingly rotate toward REITs. This will support both price appreciation and income generation.

Why the S&P 500 Could See More Strong Returns 📉

While 2025 returns will likely trail the outsized gains of 2023 and 2024, I believe 2026 has the potential for another double-digit year.

Much of this optimism stems from two factors:

Continued AI-driven growth

Improved economic clarity as rate cuts work through the system

Despite the S&P 500 being up roughly 13% this year, uncertainty around inflation, labor markets, and geopolitics have muted returns. As those uncertainties ease, sentiment could improve.

Another potential catalyst is capital rotation. Money market funds, high-yield savings accounts, and CDs have seen massive inflows over the past three years as investors earned attractive yields with minimal risk.

Once those yields fall closer to 3%, I expect capital to rotate back into equities—particularly dividend-paying stocks and income-producing sectors.

AI Remains a Structural Tailwind 💨

Artificial intelligence is no longer a speculative theme—it’s becoming a core driver of economic growth. AI-related components have already contributed meaningfully to U.S. GDP growth since early 2022, and adoption continues to accelerate across industries.

Lower interest rates should further benefit capital-intensive AI investments, reinforcing tailwinds not just for technology stocks but for the broader market.

Given this backdrop, I’ve continued to tilt parts of my portfolio toward growth:

Initiated a position in Netflix (NFLX) following its 10-for-1 split and proposed Warner Bros. Discovery acquisition

Added Capital Group Dividend Value ETF (CGDV), which maintains meaningful exposure to technology while balancing income

Where Will the S&P 500 End Up? 🧐

Assuming a soft landing, continued AI adoption, and easing financial conditions, I believe the S&P 500 could reach 8,000 or higher by the end of 2026.

Yes, valuations are stretched. Yes, uncertainty remains.

But liquidity, earnings growth, and structural technological change continue to favor equities over the long run. For these reasons, I rate the index a buy.

Risks & Investor Takeaway ✅

Despite my optimism, risks remain elevated—particularly in early 2026. Labor market weakness could persist, consumer spending may soften further, and elevated debt levels could weigh on growth.

While the probability of recession remains relatively low, I believe rising unemployment, household leverage, and lingering rate pressure raise the odds meaningfully. If a downturn materializes, the back half of 2026 could see returns fall into the single digits.

Even so, my base case remains constructive:

Lower rates

Capital rotation

Continued AI-driven growth

REITs contributing income and alpha

Taken together, I believe these forces support a bullish outlook for 2026—with the S&P 500 pushing toward 8,000. And REITs playing a larger role in the rally than many expect.

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.