5 Things I Wish I Knew...

"Before I Joined The Military"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

When I joined the Navy at 18 years old, I didn’t know anything about the military. I only joined because my cousin was joining and I knew it was a great way to travel the world.

The free health care, VA loans, free college, and other incentives military members get didn’t cross my mind. I also didn’t plan to stay long enough to retire. I just viewed the military as a regular job at the time.

But after spending some time in the service, I quickly realized that the military was a life hack. The free medical, dental, housing allowance, college tuition, and bonuses service members get could enable me, or anyone else in the military, to become financially free.

Especially, if they decided to do 20+ years and had financial intelligence. I’ve known some people that received $75,000 tax-free for re-enlisting. Although every job in the Navy doesn’t provide huge bonuses, the military allows the financially savvy to retire a multi millionaire.

Imagine if you invested that $75,000 into an S&P index fund for 20+ years?

Or if you lived below your means and consistently invested your housing allowance and lived off your regular paycheck? What if every time you made rank and got a raise you invested that amount?

These are all things that I thought about and tried to do throughout in my career. But it wasn’t until a few years before retiring that I really got serious about investing. And that’s when dividend investing came along.

In the Navy, everyone always talked about buying physical real estate and rarely talked about investing in the stock market. I believe this was because owning physical real estate is tangible.

You can brag about it and show your friends your house that you’re renting out. But owning a home is associate with a lot of costs. And with inflation running hot the last few years, homes have only gotten more expensive.

Insurance, property taxes, and maintenance & upkeep costs are just some of them. If yore roof needs replacing or your water heater goes out, there goes your extra cash flow.

And many don’t know that the real estate market moves in cycles, similar to the stock market. While houses typically go up over time, the housing market does experience setbacks.

In 2025, the housing market is seemingly in a bubble. It seems like a great to be a seller right now and not a buyer. Like stocks, timing is also important than just going out and buying stocks.

This is because, although a company may be a great business, buying them when they’re overvalued can lead to underperformance.

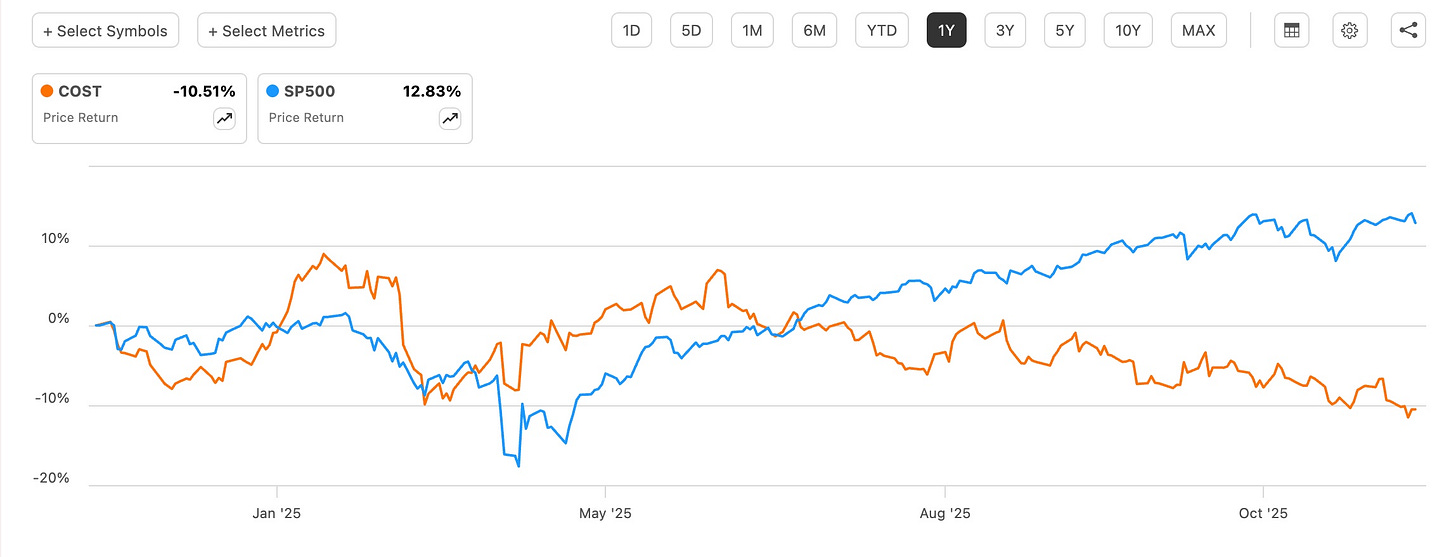

For example, Costco (COST), one of the highest quality businesses has underperformed the S&P (SP500) in the past year. While COST is down double-digits, the index is up nearly 13%.

Why?

Because the stock was overvalued. If you had bought in February when the stock was near $1,100, you’d be down significantly as they currently trade at $884 a share.

Moral of the story?

Knowing when to invest or buy is much more important than going out and buying. This goes for physical real estate as well.

But to be a successful investor, there are some important things I think everyone should understand. And the earlier you know them, the better.

Here are five that I wish I knew:

Credit cards are tools, not free money 💳

Many people think credit cards are for when you don’t have the money. This is far from the truth. Credit cards should only be used when you have the money but want the perks. These can help build your wealth. Additionally, credit card debt is what keep most people working until the traditional retirement age. When people say they don’t have extra money to invest, it’s usually because of revolving credit card debt. While I’ve always had good credit and never misused credit cards, in the past my lack of knowledge made me scared of them. It wasn’t until I became financially savvy that I realized credit cards are tools that can help me build wealth.

Compounding is the 8th wonder of the world 🌎

Charlie Munger once said to never interrupt compounding unnecessarily. Having your money make money is the best way to achieve wealth. This is why I prefer dividend investing.

Dividends are a hedge against inflation 💰

Dividend investing is often considered boring and slow. And because of this, many overlook its attractiveness. Investing consistently in dividend-paying stocks is what speeds up compounding and allows you to achieve financial freedom. Buying and owning dividend stock with yields above the current rate of inflation is one way to beat inflation. Prices go up over time. Dividends can help alleviate the pain.

Never rely on one income stream 1️⃣

With high inflation likely to stick around, it’s never been more important to create multiple streams of income. Whether it be dividend investing, physical real estate, or side hustles. One income stream is too close to none. The more income streams you have, the more extra income you can invest and compounding can work much quicker.

Investing is a must if you want to be financially free 💸

Saving money is always important and I believe everyone should have a savings for emergencies. However, if you want to not work until the traditional retirement age (which seems to keep moving higher) then you must invest. No one saves their way to being rich. And I believe every investor should have at least one portfolio dedicated to passive income, or dividend investing.

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.