A Beaten Down Industrial With Strong Upside Potential

"This Company Moves 2.4 Billion People A Day."

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Current Price: $87.60

Portfolio Purpose: Growth 📉

With 2025 coming to an end and Technology (XLK) stocks dominating headlines amid AI enthusiasm, it’s become easy for investors to overlook high-quality industrial names trading at reasonable valuations.

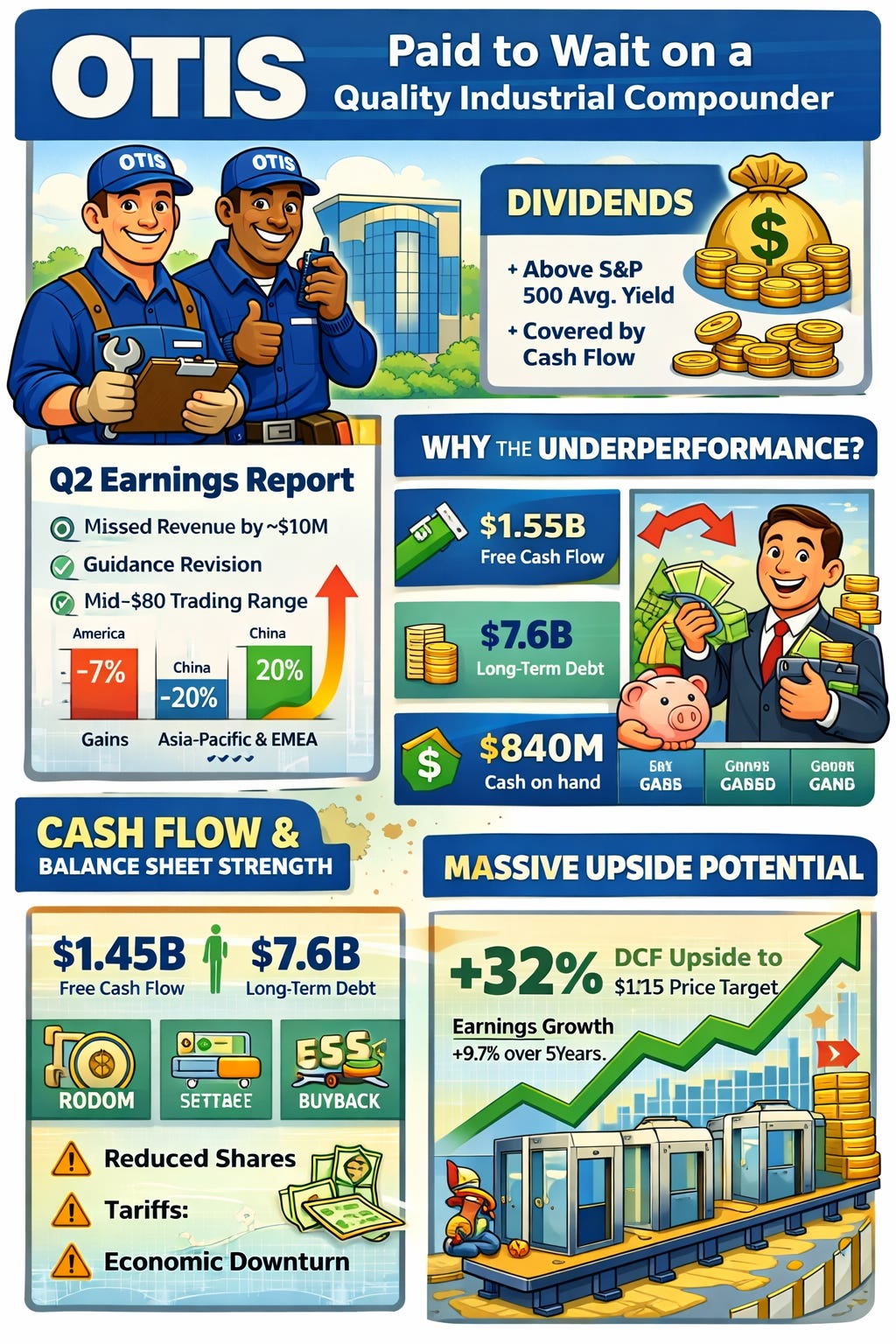

Otis Worldwide Corporation (OTIS) is one such stock, in my view. Shares are down more than 7% year-to-date at the time of writing, despite the company remaining resilient while navigating tariff headwinds and persistent inflation.

While I wouldn’t call OTIS a deep value bargain at current prices, I do believe the stock offers an attractive entry point for long-term investors. Shareholders are also paid to wait, with a dividend yield above the S&P 500 (SP500) average of 1% to 2%. OTIS’s yield sits closer to 2%. And is well covered by free cash flow.

Why the Underperformance 📈

Until July, OTIS was performing well, trading above $100 per share. That changed following its Q2 earnings report, when the company missed revenue estimates by roughly $110 million.

EPS of $1.05 beat expectations by $0.02, which I viewed as a respectable result given the macro backdrop. However, management’s revised guidance proved to be the catalyst for the sell-off.

Since then, the stock has traded largely in the mid-$80 range.

Free cash flow also declined, with the New Equipment segment driving most of the pressure. In the most recent quarter, this segment continued to weigh on results, largely due to:

• A 20% decline in China

• A 5% overall sales decline in New Equipment

• A 30% drop in operating profit within the segment

The Americas saw a 7% decline, while strength in Asia-Pacific and EMEA partially offset weakness. Management expects headwinds to persist but has emphasized cost-savings initiatives, targeting $240 million in savings by year-end.

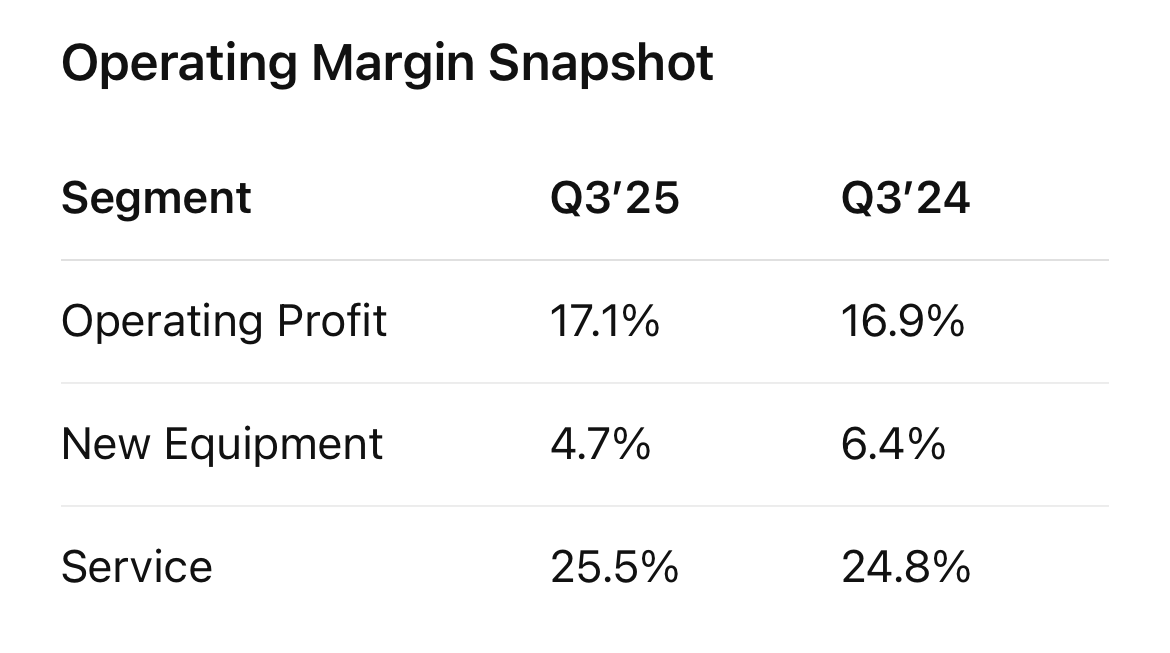

Margin Pressures Weigh on the Share Price ⬇️

Beyond cost-cutting, OTIS has introduced flexible package options designed to help customers manage costs, timelines, and project pacing. I view this as a smart strategic response in a higher-for-longer rate environment that continues to pressure both consumers and businesses.

OTIS has also remained active globally, providing service elevators across Canada, Dubai, Egypt, and India, reinforcing the resilience of its Service segment.

Another key offset has been aggressive share repurchases. In the latest quarter, the company completed its $800 million buyback authorization, repurchasing $250 million of stock in Q3 alone. This contributed to 9% year-over-year EPS growth, despite margin pressure.

With OTIS shares still depressed, I wouldn’t be surprised to see management authorize a new repurchase program, which could continue to support earnings growth.

That said, margin pressure (especially in New Equipment) will likely cap near-term upside.

Despite the decline in New Equipment margins, OTIS still achieved modest top- and bottom-line growth and slight overall margin expansion through the first three quarters.

Cash Flow, Dividends & Balance Sheet Strength 💵

Free cash flow is expected to total approximately $1.45 billion, down from $1.57 billion last year. However, dividend safety remains strong.

• Shares outstanding declined from 402.7M to 392.8M

• Estimated dividend cash requirement: ~$652 million

• Long-term debt: $7.6 billion

• Cash & equivalents: $840 million

Even after dividends, OTIS retains ample capital, enhanced by expected cost savings, to reinvest in the business and support shareholder returns.

Valuation & Upside Potential 📉

Using a Discounted Cash Flow (DCF) approach, I estimate 32% upside, with a fair value near $115 per share. Investors should be patient—this upside is more likely to materialize over the next 2–3 years, not immediately.

Key assumptions:

• 9.7% earnings growth over the next 5 years (analyst consensus)

• 7% long-term growth thereafter

• 11% required rate of return

While conservative, I believe OTIS could exceed these assumptions as macro headwinds ease.

Adding to the bullish case:

• Recent analyst upgrades citing diminishing China pressure

• The global elevator market is expected to grow ~38% over the next 5 years

• OTIS remains a dominant player with meaningful market share

Risks to the Thesis ⚠️

• Continued margin pressure over the next 1–2 quarters

• Ongoing tariff impacts, particularly in China

• A potential economic slowdown or recession

In a recessionary scenario, shares could retest the mid- to low-$70s. However, with interest rates now meaningfully lower than last year, I expect headwinds to gradually dissipate over the next 3–4 quarters barring a severe downturn.

Bottom Line ✅

Investors shouldn’t expect immediate upside from OTIS. Meaningful appreciation likely requires sequential margin improvement, which may not arrive until the back half of 2026.

That said, downside appears limited at current levels, and the stock offers a compelling risk-reward setup for long-term investors. As headwinds fade and earnings growth reaccelerates into the high-single- to low-double-digit range, I expect OTIS shares to revisit $100—and potentially climb toward $115 over the next few years.

For patient investors seeking a high-quality industrial compounder with a reliable dividend, OTIS looks like a solid “buy and wait” opportunity.

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.