A Mispriced REIT Yielding Over 6%

"VICI Properties Continues To Grow Rent, FFO, & AFFO Despite Declining Sentiment"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

If you’re reading this, you’re probably thinking the same thing many investors have been saying for years: “We’ve been hearing that REITs are undervalued forever—and yet many have continued to underperform.”

That’s a fair critique. I won’t argue it.

But I will argue that now may be the best setup we’ve seen in years.

As Warren Buffett has famously stated, it’s hard to make money in an asset when everyone loves it. Excess enthusiasm often leads to overvaluation—and ultimately, underperformance.

Since 2022, REITs—represented by the Real Estate Select Sector SPDR Fund (XLRE)—have lagged badly. Meanwhile, capital has poured into growth and AI-linked equities.

But over the next year or two, I believe that narrative is poised to change.

In this article, I outline why REITs may finally be approaching an inflection point and discuss one high-quality REIT I believe is attractively valued for income-focused investors.

REITs in an AI-Obsessed Market

Artificial intelligence has taken the investing world by storm. Since the launch of ChatGPT in late 2022, AI-related stocks have driven market performance, helping push U.S. equities to nearly 17% returns in 2025.

While I expect AI dominance to continue, history suggests that capital eventually rotates.

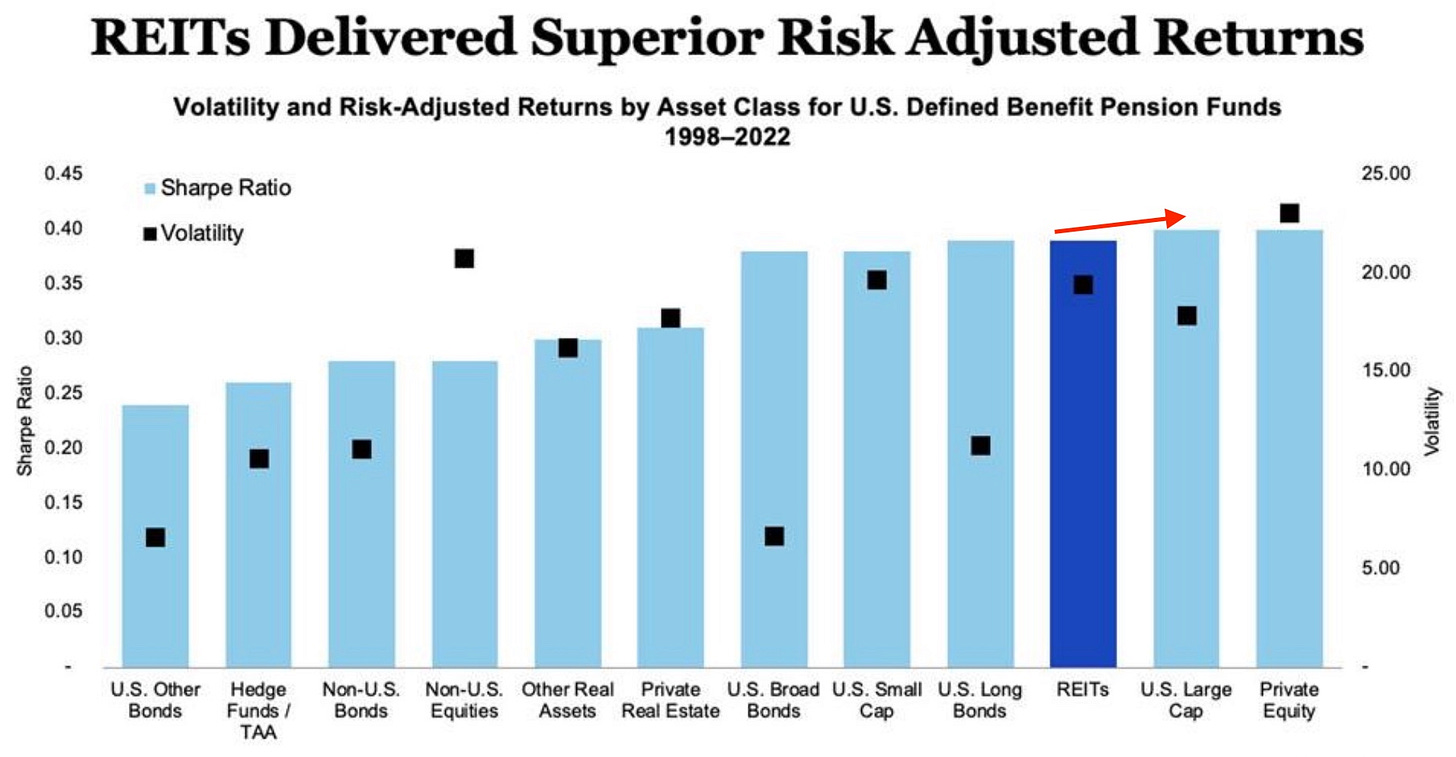

From 1998 through 2022, REITs kept pace with U.S. large-cap equities on a total return basis. Their recent underperformance has largely been driven by higher-for-longer interest rates, volatility in long-term Treasuries, and elevated macro uncertainty.

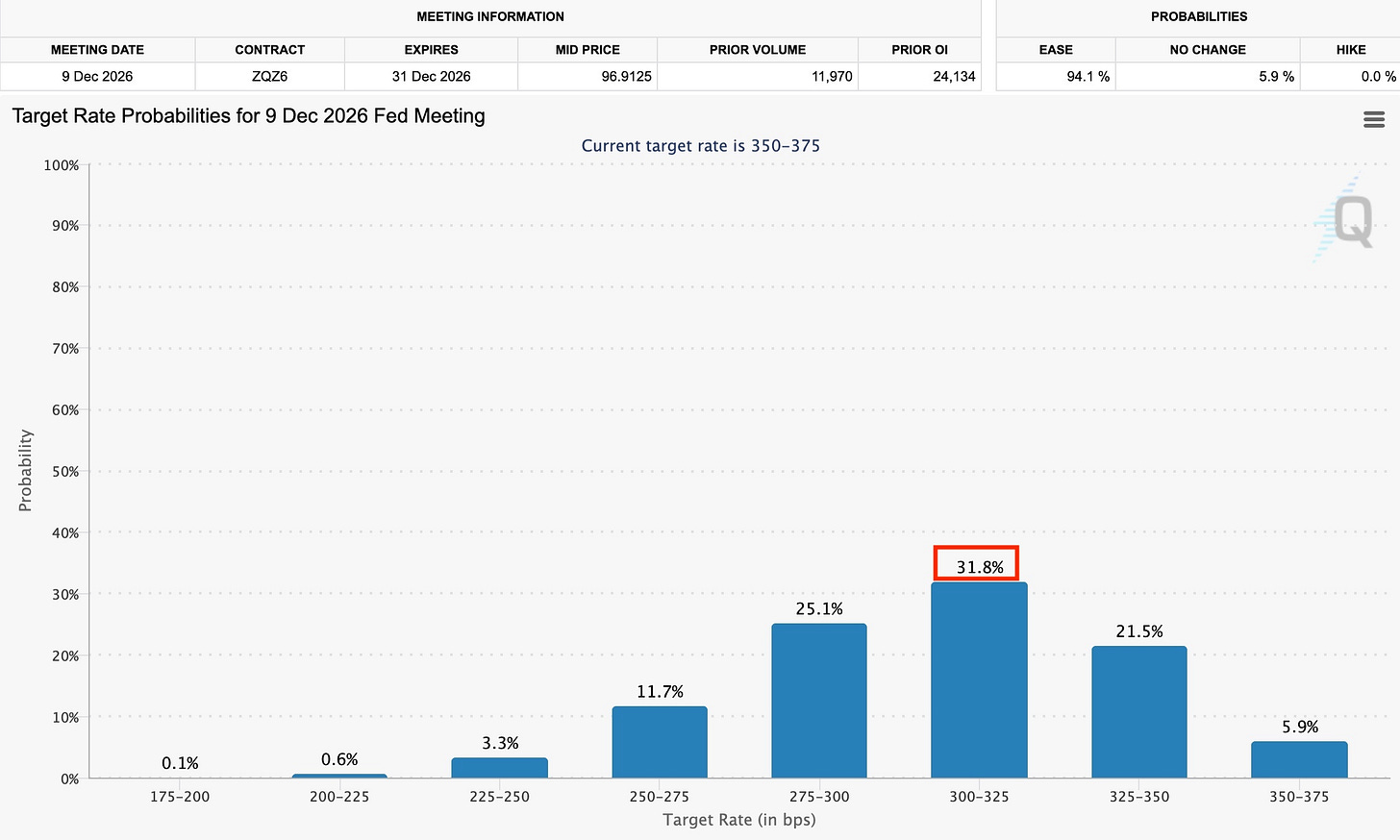

In the near term, those pressures may persist due to geopolitical risk. However, current expectations suggest base rates could fall to roughly 300–325 basis points by the end of 2026.

As yields on fixed-income investments compress—especially toward the 3% range—I believe investors will begin rotating back into higher-yielding assets. Many REITs, trading at deeply discounted valuations, should benefit from that shift.

VICI Properties: Misunderstood, Not Broken 🎰

VICI Properties (VICI) is no stranger to attention. Some critics argue it’s a chronic under performer, but I strongly disagree.

Despite negative sentiment surrounding declining Las Vegas foot traffic as international travel has dwindled, and tenant concerns—particularly Caesars Entertainment (CZR)—VICI’s fundamentals continue to improve, not deteriorate. Which is important for long-term investors.

Recent Performance Highlights 💵

In its most recent quarter (October):

FFO grew 4% YoY

AFFO grew 5.3% YoY

EBITDA & revenue rose from $778M to $825.6M

Annual revenue surpassed $1 billion

Full-year AFFO guidance was raised, implying 4.6% growth from the prior year

Balance sheet strength has also improved:

Leverage declined from 5.4x to 5.0x year-over-year

Investment-grade ratings from all three major agencies

Liquidity of $3.1 billion, comfortably covering $1.75 billion of upcoming maturities in 2026

Strategic Growth Beyond the Las Vegas Strip 🏙️

VICI continues to diversify outside the Strip—an important move, in my view.

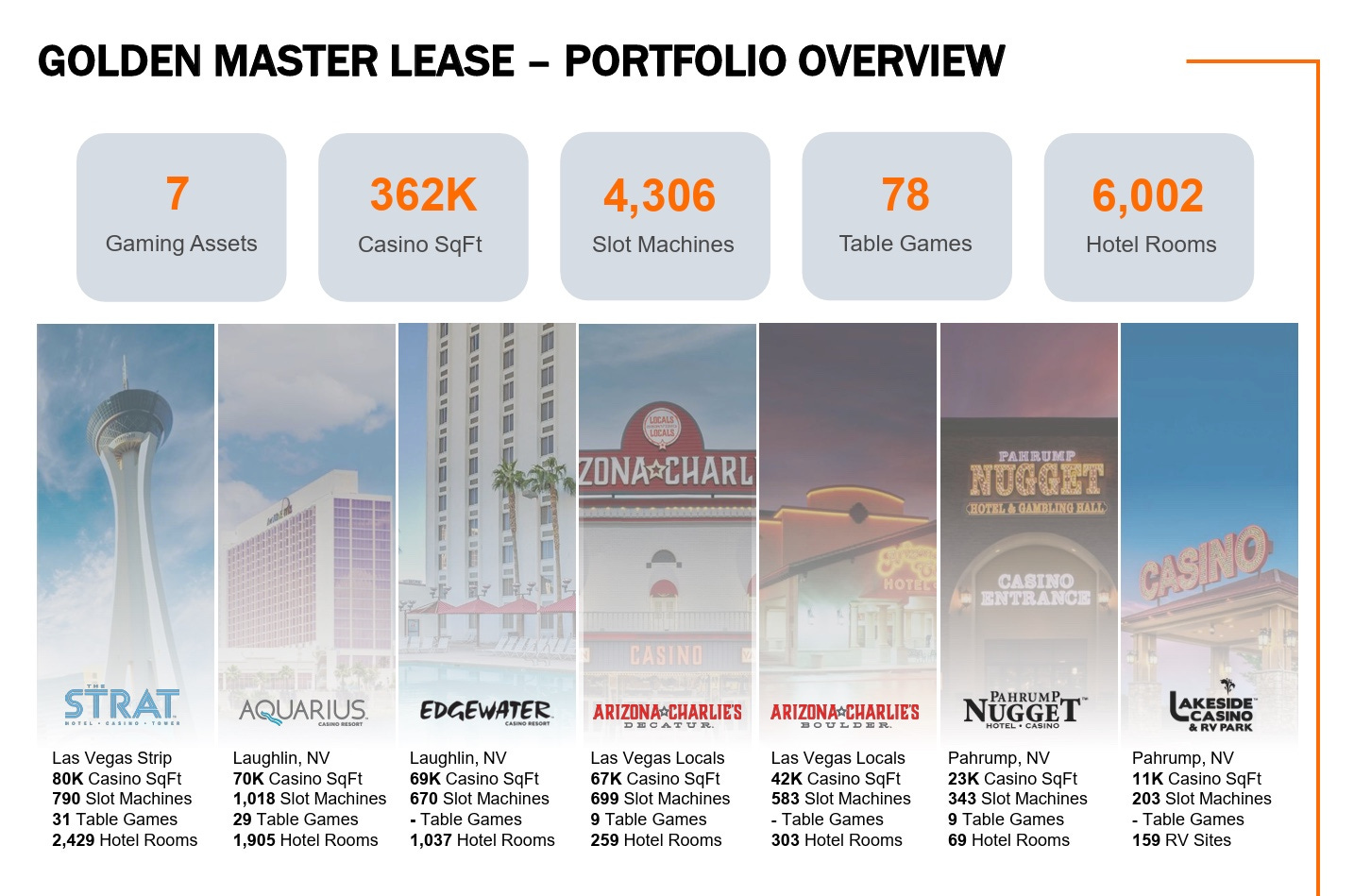

Recently, the REIT acquired seven assets from Golden Entertainment (GDEN), adding exposure to local Las Vegas markets. This transaction adds $87 million in initial rent and more than 6,000 additional hotel rooms, backed by 30-year lease terms.

With Strip pricing elevated and inflation still above historical norms, many consumers appear to favor regional and local experiences over high-priced tourist destinations. This acquisition helps capture that trend.

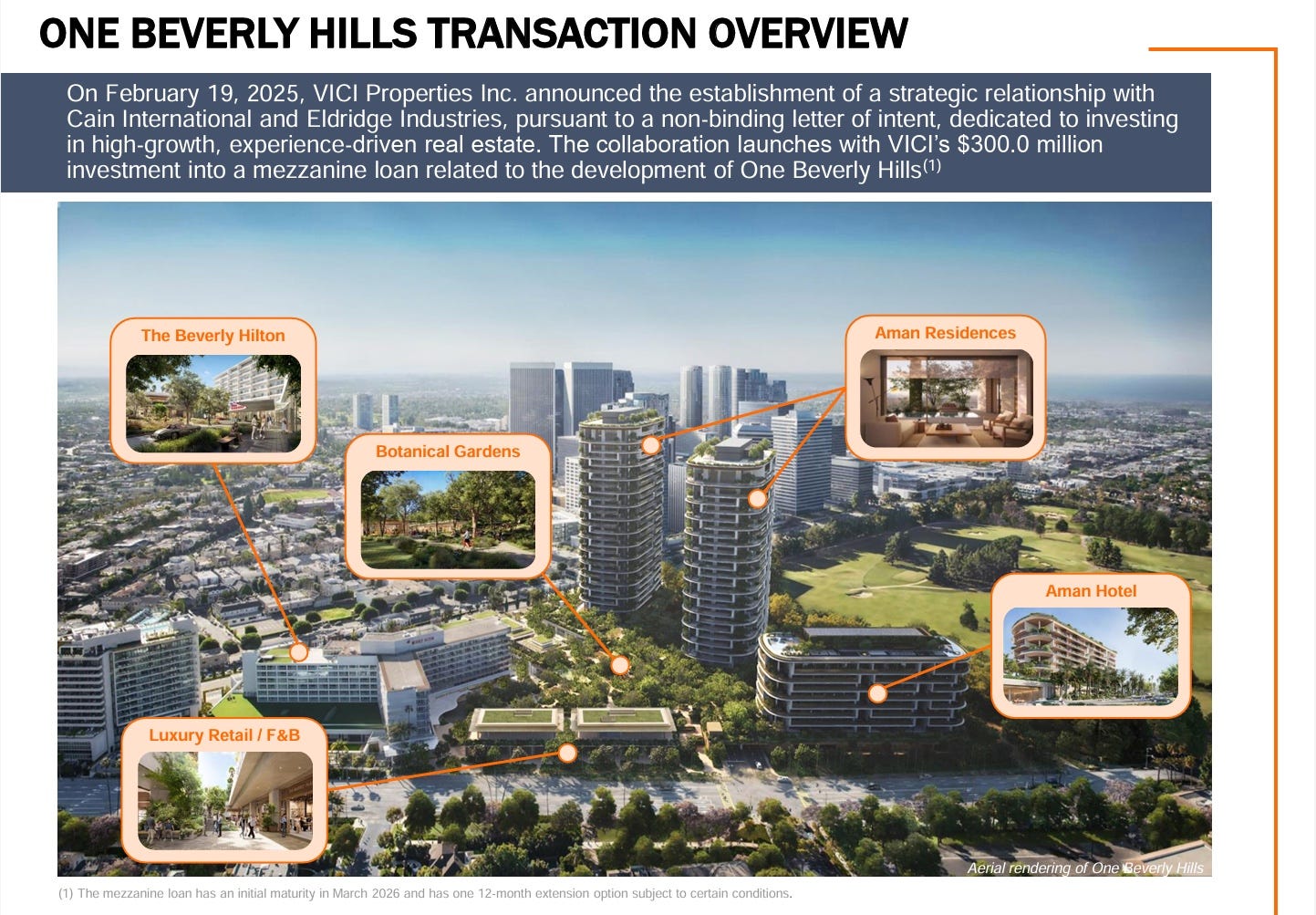

Additionally, VICI maintains its strategic partnership with Cain International and Eldridge Industries announced back in February of 2025. VICI provided $300 million in funding for One Beverly Hills, located a half a mile from the famous “Rodeo Drive.”

This 17.5-acre mixed-use luxury development, expected to come online in 2027, should attract affluent shoppers and enhance long-term cash flow growth.

Risks, Volatility, and Valuation ⚠️

In the near term, I expect continued share price volatility. VICI was recently downgraded due to CZR-related risks, declining foot traffic, and softer gaming revenue.

While management expects improvements in Q1 2026, international travel trends could weigh on Las Vegas for most of the year.

There is also ongoing risk that Caesars could seek a rent reduction. If that were to occur, I would expect meaningful volatility, potentially pushing VICI shares into the $25–$26 range.

That said, I view this scenario as unlikely.

Investors are currently being paid a 6.4% dividend yield, well covered by cash flows, while waiting for sentiment to improve.

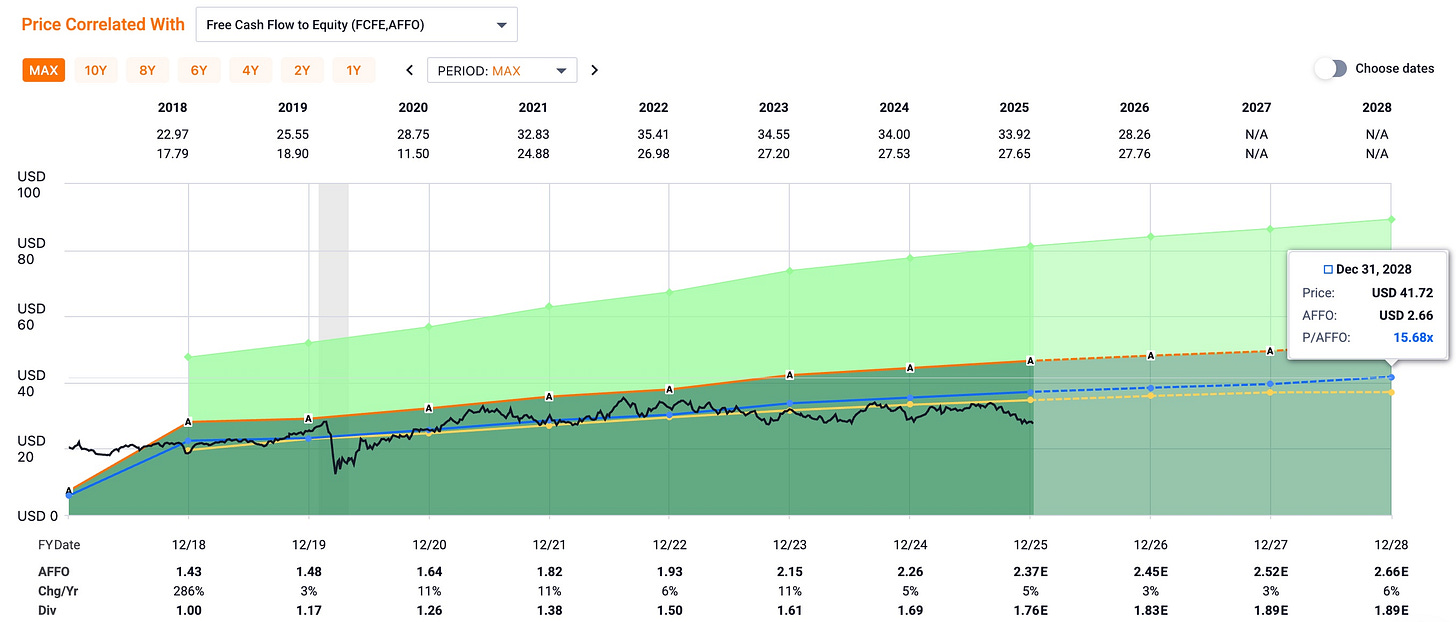

Using FAST Graphs, VICI’s fair value multiple of ~15.7x AFFO appears reasonable. I believe VICI deserves to trade in a 15x–16x range over time.

At today’s 11.8x P/AFFO, upside is compelling. My long-term price target is approximately $42 by the end of 2028.

Final Thoughts ✅

Over the next 12 to 18 months, I believe conditions are aligning for REITs to finally regain investor attention.

While uncertainty remains, improving rate clarity, stabilizing fundamentals, and discounted valuations create a favorable risk-reward setup. If macro stability improves even modestly, REITs could deliver attractive, income-backed, risk-adjusted returns.

After years of being ignored, REITs may finally be ready for their moment.

What do you think?

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha.

Here’s How: Click the Seeking Alpha link here. Click investing group, subscribe now, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.