A Relatively New ETF That Has Outperformed VOO ...So Far

"An ETF For The Perfect Blend Of Value, Income, & Growth"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Current Price: $43.64

Portfolio Purpose: Growth ↗️ & Income 💰

Over the past few years, ETFs have become the foundation of my long-term investing approach. While many dividend-focused ETFs lag high-quality stocks or the broader market, Capital Group Dividend Value ETF (CGDV) has been a standout performer since its 2022 launch.

Despite its short history, CGDV’s blend of dividend-paying companies and growth exposure has allowed it to beat Schwab US Dividend Equity ETF (SCHD), iShares Core Dividend Growth ETF (DGRO), Schwab US Large Cap Growth ETF (SCHG), and even every investor’s favorite ETF, Vanguard’s S&P 500 ETF (VOO) over 1- and 3-year periods.

1-year vs VOO price return:

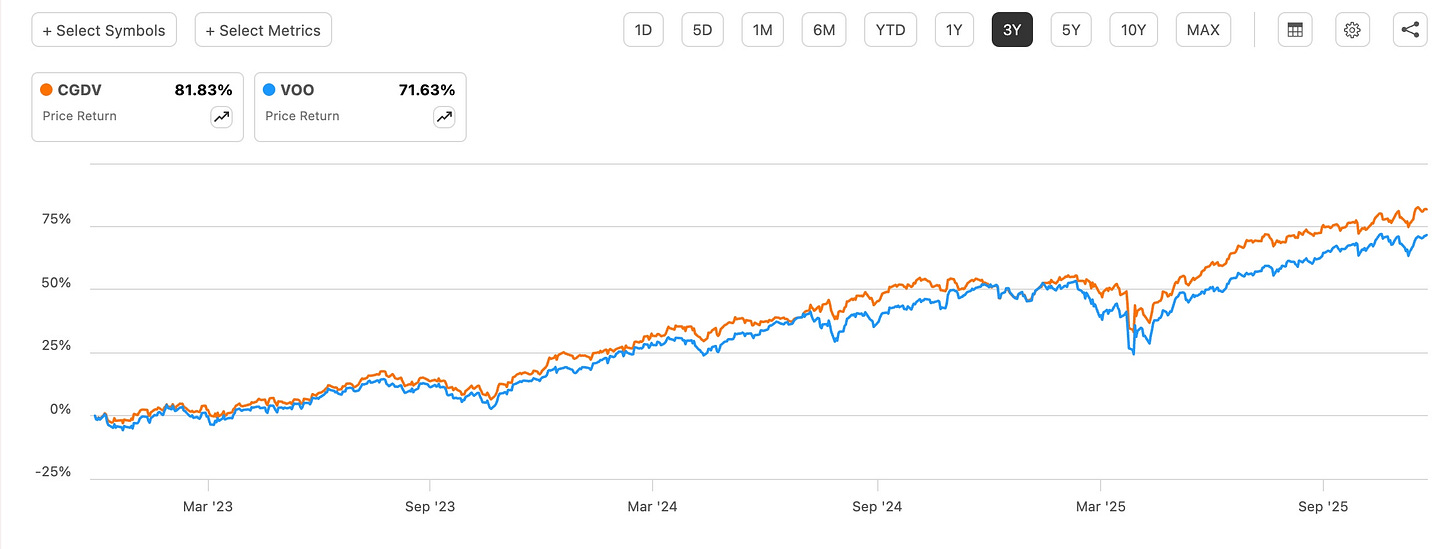

3-year price return:

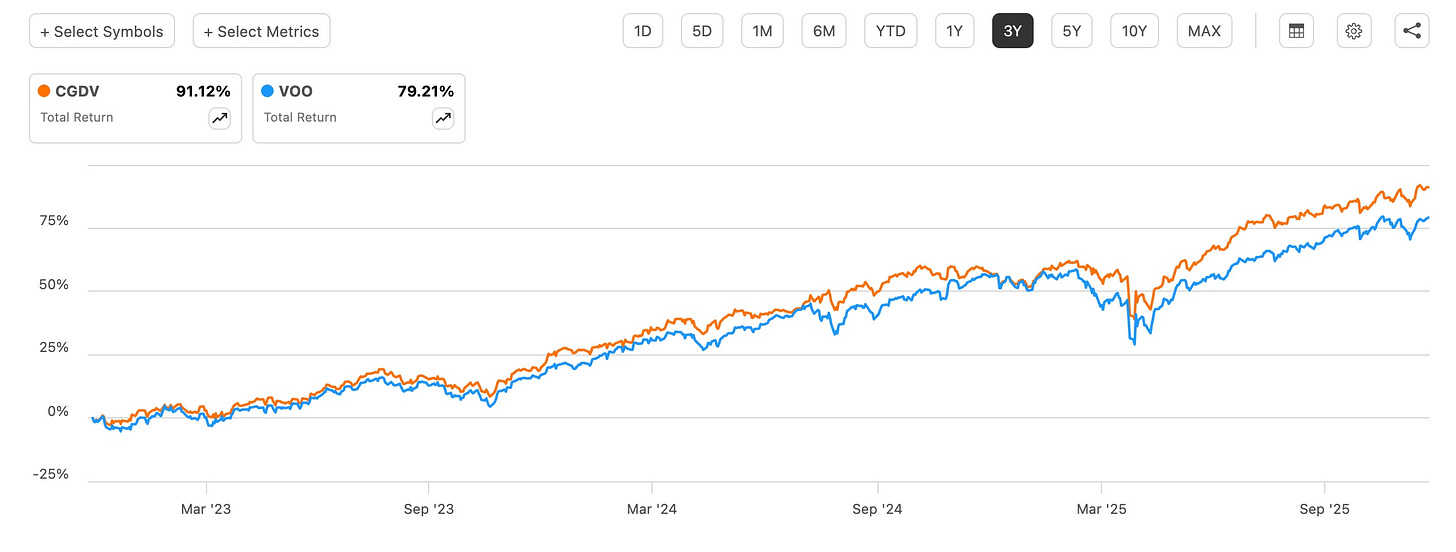

3-year total return:

Why CGDV Outperforms 📉

CGDV is actively managed with a reasonable 0.33% expense ratio and a unique structure. It is comprised of 5 portfolio managers, each overseeing a different slice of the ETF.

This has helped the fund balance growth, quality, and risk. ⚖️

The ETF invests mainly in large-cap companies with strong or rising dividends. Its sector mix leans growth-heavy with Technology (XLK) , but stays defensive with Industrials (XLI) and Healthcare (XLV), which help stabilize returns in uncertain markets.

CGDV also holds only 52 companies, which I prefer. This smaller focus allows more potential for outperformance. Small, but mighty.

Dividend Growth & NAV Strength 💪🏾

Even with a modest 1.28% yield, CGDV has delivered strong dividend growth:

• 2022: $0.32

• 2023: $0.49

• 2024: $0.56

• 2025 YTD: $0.372 (through Q3)

Dividends are qualified, making them tax-efficient for younger or taxable-account investors.

Impressive NAV growth: ☝🏾

• YTD NAV: +25.08%

• Lifetime NAV: +17.78% vs +15.08% for the S&P

This NAV strength supports future dividend growth and price appreciation.

Valuation & Risks ⚠️

CGDV remains attractively valued with a lower P/E and P/B than the S&P. I believe this makes dollar-cost averaging into the fund a sensible long-term strategy.

Key risks include:

• Heavy reliance on Technology and AI-driven growth

• Potential underperformance if AI enthusiasm fades

Bottom Line ✅

CGDV combines income, growth, focused management, and strong NAV expansion. Its track record suggests it can continue outperforming over time.

And I believe CGDV is a solid buy due to its strong fundamentals, smart structure, and long-term upside.

If you’re looking to create passive income and build your wealth, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started. ☎️

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.