Are You Someone Looking To Create Passive Income & Build Wealth?

"Book A Call To Get Started Today"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

When I retired from the military in 2023, like most service members, I wasn’t sure what field what I wanted to go into afterward. Like most, I was confident in getting a job as a contractor.

A few months before going on terminal leave, an Amazon (AMZN) recruiter reached out to me for a potential job offer.

They wanted someone who could start immediately and offered me $220,000 a year including stock options. I was excited and would have taken the job. But the company wasn’t willing to wait a few months until I retired.

In short, I never received the call back. And looking back at it, I’m glad. Because I would’ve taken the job in a heartbeat. But during our conversation, the recruiter told me that the job required long hours and I would be on call 24/7.

At the time, it didn’t matter to me; I was used to working 15/16 hour days, or sometimes being up more than 24 hours without sleep. I mean I had 21 years in the military. So, this was nothing new.

But as I’ve had time to reflect and grow as a financial analyst, I’ve realized that time is much more important that a high-paying job. Something that annoys me is how military members retire after 20+ years and go right back into a full-time job for another 20+ years.

And I was almost one of them.

Many military members, and even civilians, follow the same life trajectory.

Work, pay bills, and die.

Of the three, only one is guaranteed, death. Realizing this, I wanted to do something so people didn’t have follow that path.

I am creating something that provides financial education to help everyday people achieve financial freedom and build wealth. And what I am creating honestly motivated me to become a financial analyst in the first place.

One, I’ve always enjoyed stocks. And two, I like to help people.

Money is important, but this isn’t about the money. It’s about providing something that can change people’s lives.

And I’m doing this through honesty and perspective. It’s why I created The Dividend Collection Agency. I see many “financial gurus” on social media talk about stocks. But how many are credible? How many can intelligently write about stocks?

As someone who was always inspired by the likes of Warren Buffett, Peter Lynch, Charlie Munger, and Kevin O’ Leary, the goal at DCA is to make investing simple.

K.I.S.S.: “Keep Investing Simple Stupid”

Peter Lynch once said:

“If you can’t explain to an 11-year old in two minutes or less why you own a stock, then you shouldn’t own it.”

For me, investing is easy. But for others, often not so much. Because if it was everyone would be a successful investor. DCA is here to provide the tools and education to be successful.

And this starts with my newly launched website: dividendcollectionagency.com.

We’re in the beginning stages and I have some investment tools and a guide coming down the line.

For now, if you’re someone looking to get started on your investment journey and don’t know where to start - you can start by booking a 1-on-1 call with me.

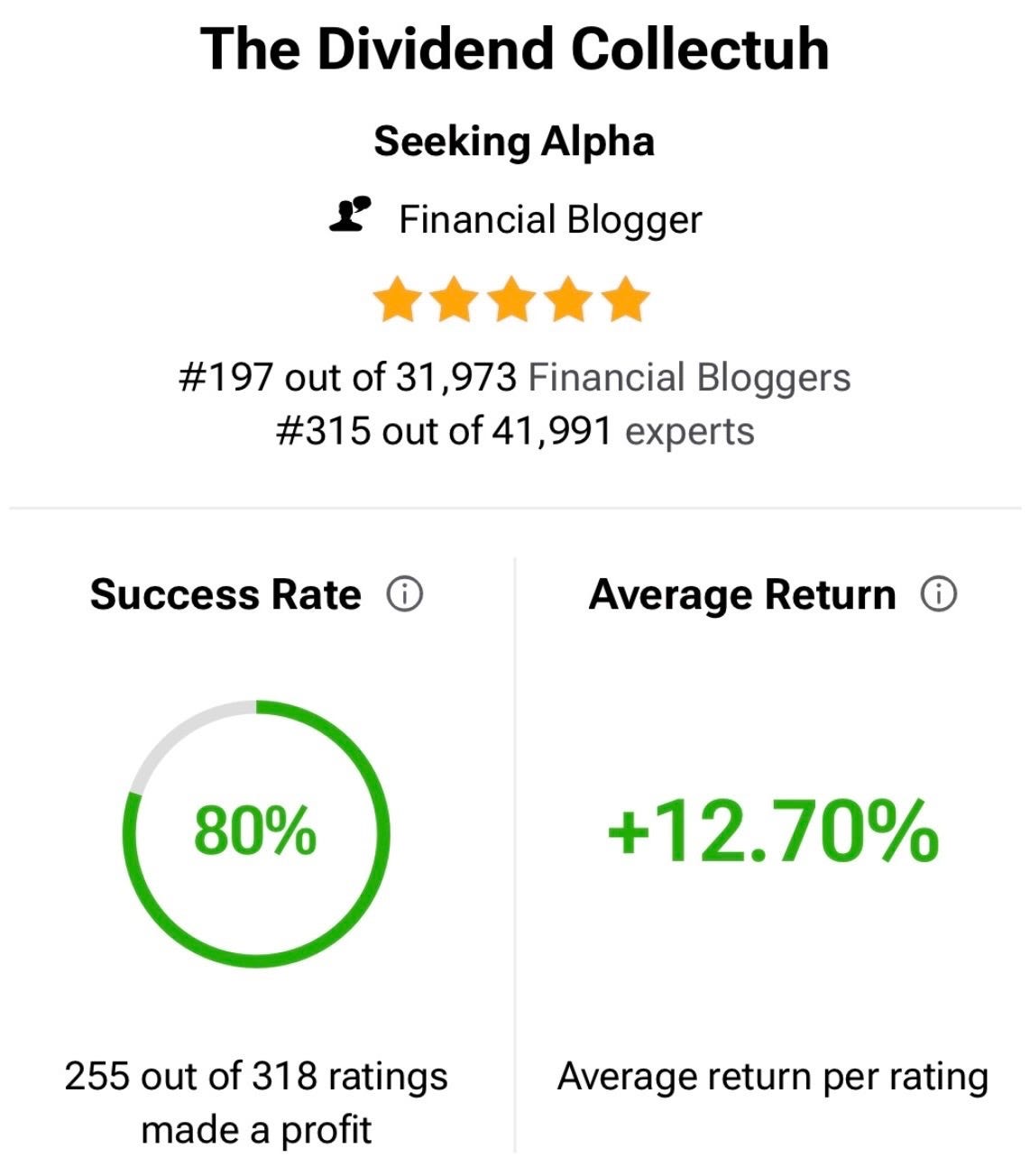

No ebooks, no courses, no discords, just a 1-on-1 call with one of the top-rated (1%) financial experts.

And you can do this by clicking the “book a call” links on my website.

As someone who looks at everything from the other person’s point of view, I don’t want people to waste their hard-earned money . I want people to know what they’re getting.

Below are some of my successes. This is how I’ve managed to achieve a nearly 13% average return and make into the top 1% of financial experts according to TipRanks. (subject to change)

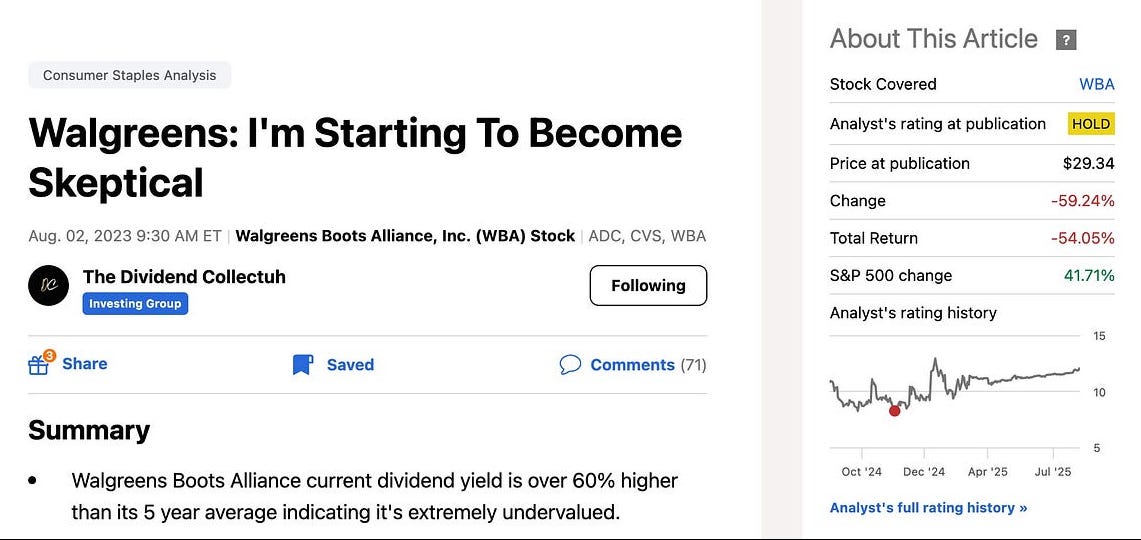

Before Walgreens went private, I warned investors about their continued issues and potentially cutting the dividend. This was after paying and raising it for 48 consecutive years!

At first, I rated them a hold:

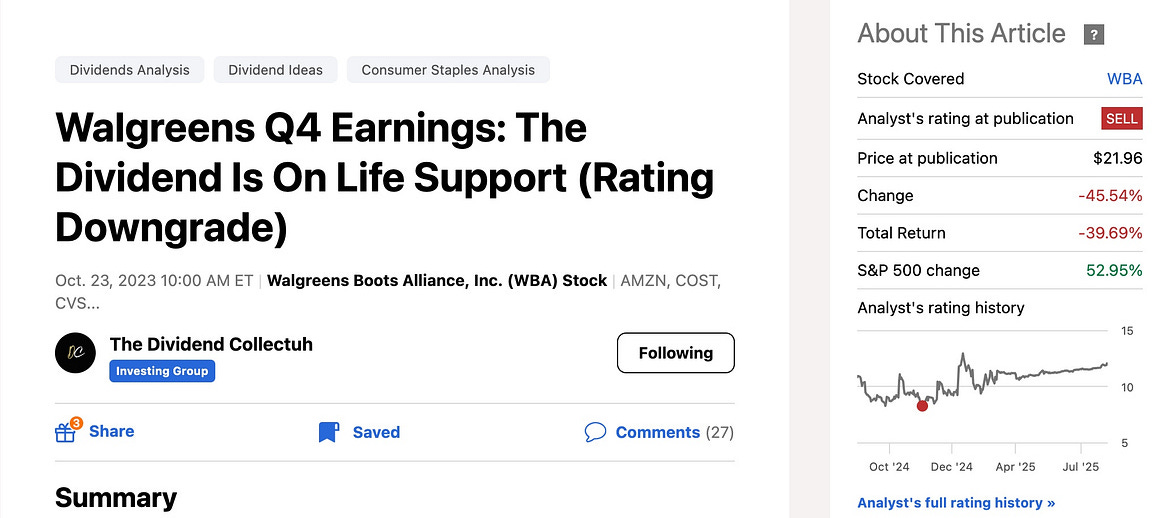

After seeing the writing on the wall; rating them a sell two months later right before they cut their dividend and the share price plunged.

And if you were an investor who held, you never recovered your money because the company was taken private in August 2025.

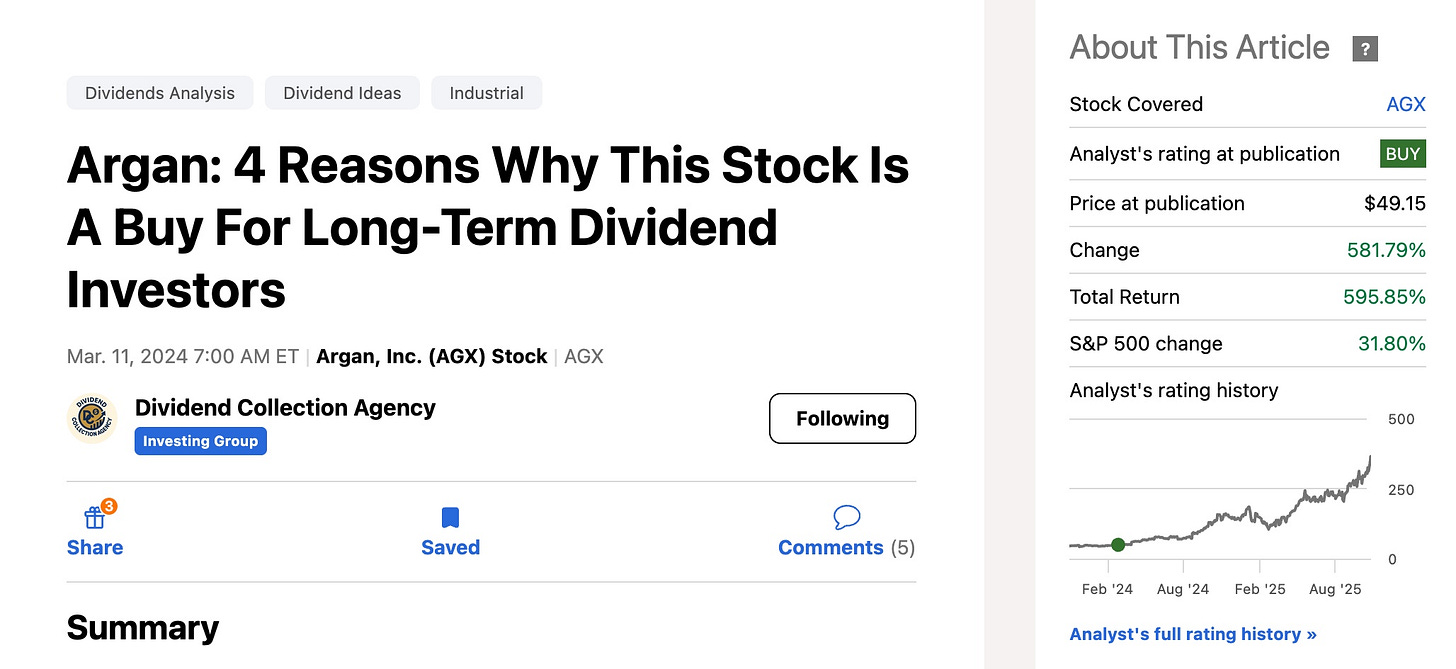

Below is a stock few may know. But I rated Argan (AGX), an energy company, a buy at $49.15 back in March of 2024. Since, the stock is up nearly 600% and currently trades at $351.64!

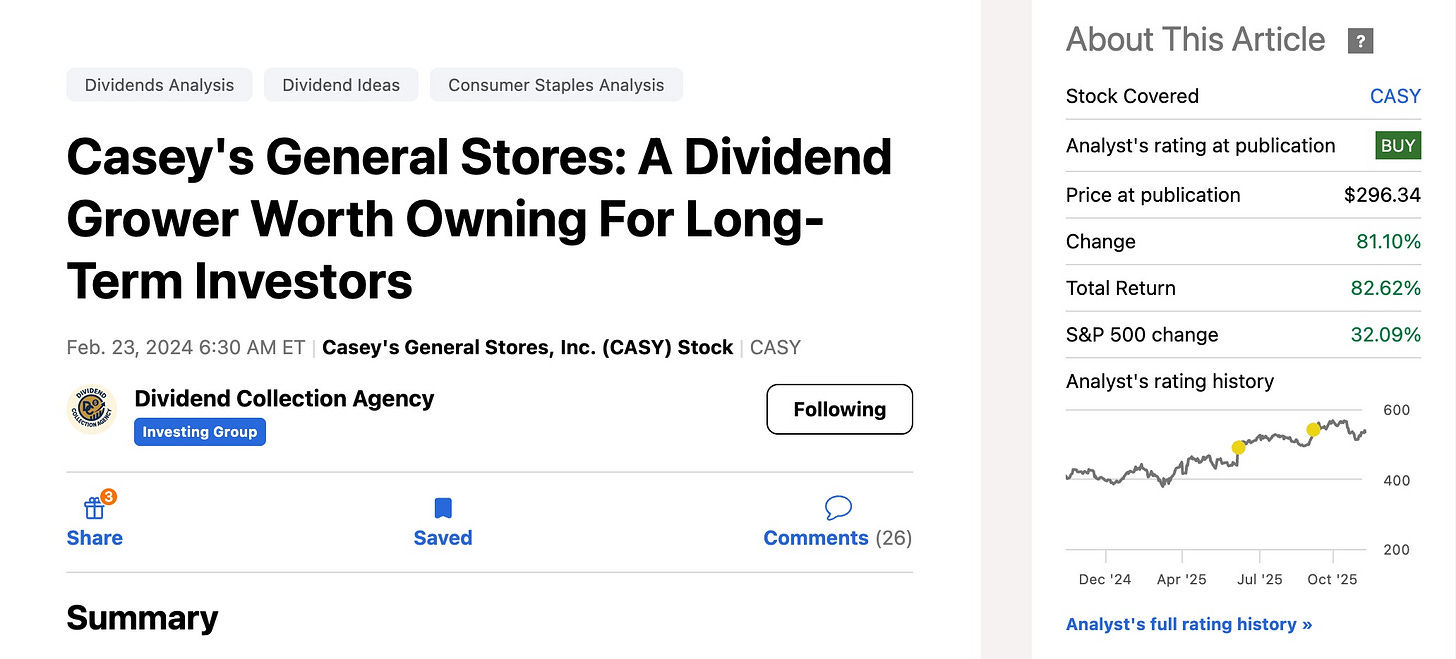

Casey’s General Stores (CASY), likely another little known stock. I rated them a buy in February of last year and they’ve significantly outperformed the S&P (SP500) since, up over 81% compared to over 30% for the index.

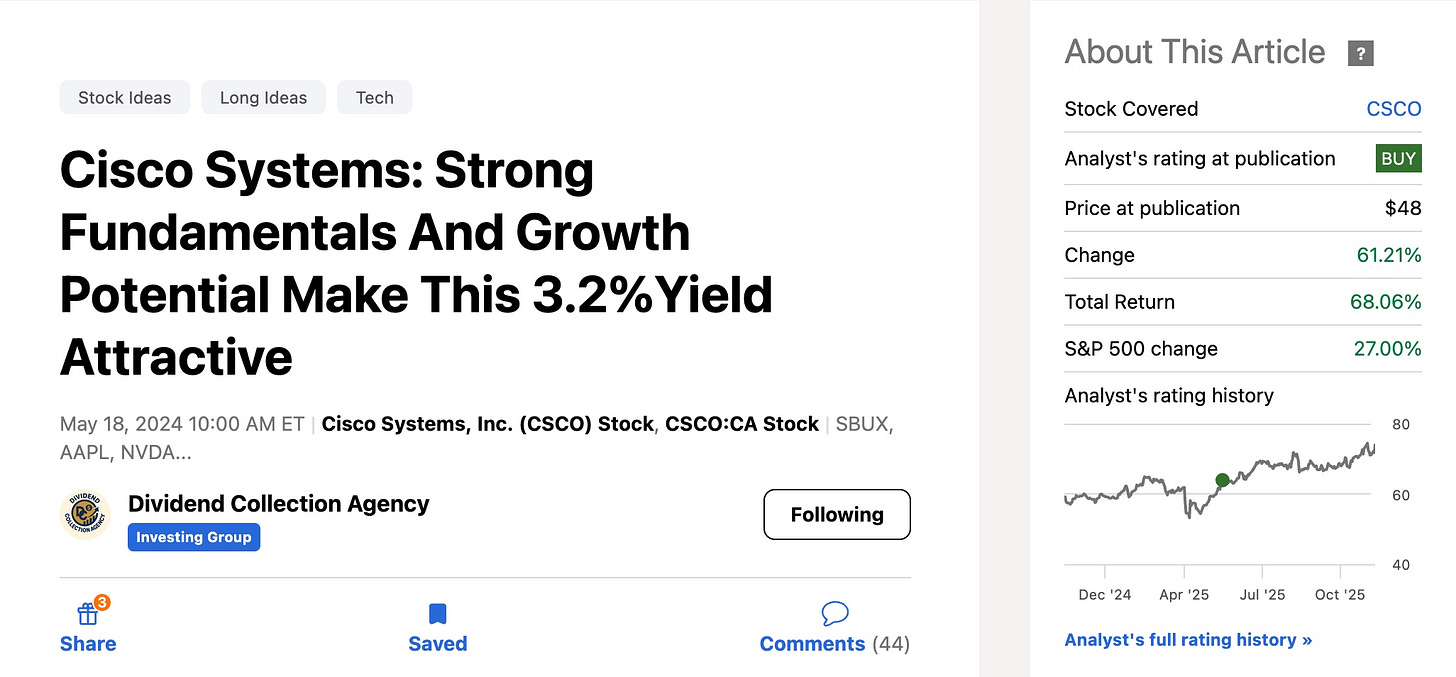

Cisco Systems (CSCO), beloved in the early 2000’s was considered dead money after underperforming for years. Back in May of 2024, I rated them a buy when it traded at $48 a share. Today it trades at $78, a new 52-week high.

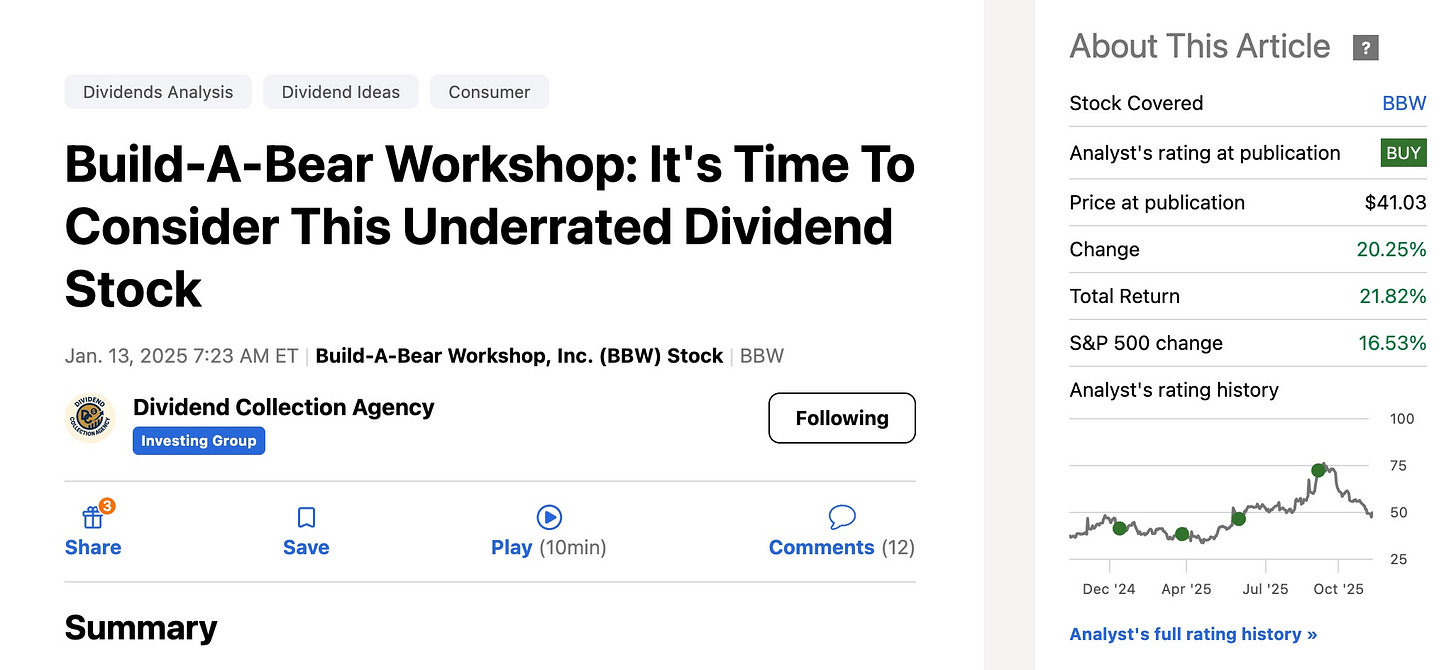

And lastly, Build-A-Bear Workshop (BBW), another stock not on too many investors’ radars. Some people even told me I was crazy being high on this stock. I’ve covered BBW in numerous Seeking Alpha articles and here on Substack. I discussed how the stock has beaten tech giants in recent years.

Although they’ve pulled back from their new high in September 2025 of nearly $76 a share, the stock has still beaten the S&P, up over 20% compared to nearly 17% for the index.

Moral of the story?

Many investors lose out on building wealth because they blindly follow others and chase popular stocks. Any investment, no matter the quality, can become a bad investment if bought at the wrong price.

True wealth is made by sticking to the fundamentals and buying high-quality companies that can grow over time.

So, if you’re looking to get started on your investing journey, or know someone who is, feel free to check out my website and book a call.

You can also message me here on Substack or Instagram with any questions.

At DCA, we’re about teaching the correct mindset to build wealth and achieve financial freedom.

No courses. Just perspective.

Mindset = Strategy.

And this is how you can become successful at investing.

Happy Investing!

Also feel free to check me out on Seeking Alpha and try out my investing group iREIT+HOYA Capital for 2 weeks free. Just go to the link in my profile and click either of the blue links in my Seeking Alpha profile.

This is not financial advice. This is for educational purposes only. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.