Article Of The Week

"Create A Big, Beautiful Income Stream With Special Dividends"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

And the platform allows writers to share one article once a week free of charge. So, I thought I would share it here with all of you.

When it comes to investing there are various ways to achieve your goal. Many investors prefer to invest for growth.

While this is a great way to build wealth, dividend stocks are another way to accumulate this, allowing you to receive passive income at the same time .

If you’re familiar with Canadian businessman, Kevin O’ Leary (Shark Tank), he’s adamant about only investing in stocks that pay him dividends.

Myself, I share the same sentiment; although I’m not against owning non dividend-paying companies.

Personally, I think investors should have at least 2 to 3 portfolios. Each with a different goal. A portfolio for passive income, and at least one IRA of some kind, whether it be a Roth or Traditional IRA. The backdoor Roth is always a good idea.

In my opinion, dividend stocks have grown in popularity over the years, but I rarely hear investors mention special dividends. These are payments from companies made to shareholders in addition to their regular dividends.

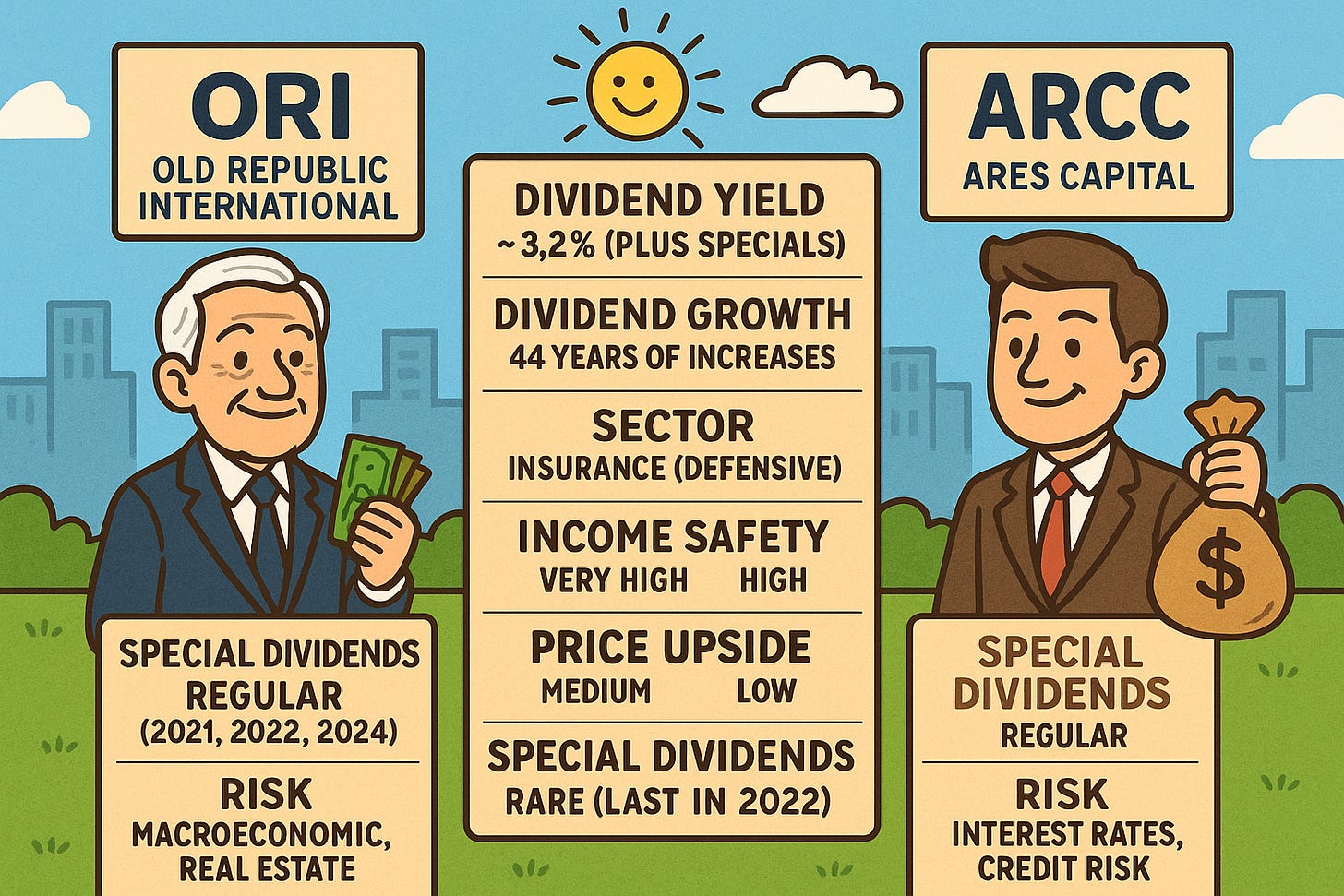

Two companies I discussed in my Seeking Alpha article pay special dividends occasionally, Old Republic International (ORI) and Ares Capital (ARCC). ORI is an insurance company, while ARCC is a BDC, or Business Development Company.

Another company we’re all likely familiar with, and one you may not expect who also pays special dividends on occasion is Costco (COST).

Just as a note, companies usually pay special dividends at the end of the year.

Costco paid a $15 special dividend at the end of 2023. This was in addition to the $3.96 annual dividend for a total of $18.96! So, if you held just 100 shares of COST, you received $1,896 at the end of the year.

Now imagine if you had 1,000 shares? In one payment you would have received $15,000, a great gift to receive at the end of the year. This is why I say every investor should have an income-focused portfolio.

Like & subscribe if you’re active duty, a veteran, or just love investing.