Article Of The Week

"A Growth ETF For A Core Holding"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

And the platform allows writers to share one article once a week free of charge. So, I like to share them with all my current & future subscribers. (see below)

When it comes to investing, every person has a different investment style based on their goals. If you’re a day trader, you probably like options and are looking to get rich as quickly as possible. While I don’t particularly agree with this style, it’s a strategy that works for some investors.

As a simple guy, I take a more long-term approach. I also focus on passive income as I plan to live off dividends in the not-too-distant future. I take a similar approach to Canadian businessman, Kevin O’Leary, who once stated he wouldn’t own a stock unless it paid him.

This is why I solely focus on income-producing stocks like Blue Chips, REITs (XLRE), and BDCs (BIZD). But this doesn’t mean I’m against owning stocks that don’t pay dividends like Amazon (AMZN).

As someone who considers himself pretty good at picking individual stocks, rated the top 1% according to the website TipRanks; I was also against owning ETFs until the last year or so.

And I realized that although I was collecting solid income from my portfolio, it lacked something, growth. Because I overlooked growth stocks, I missed out on capital appreciation although I was collecting passive income. Having a balanced portfolio is essential when investing, especially for the long-term.

And ETFs are a great, alternative way to get growth and often income. Me, personally, I rely on my ETFs for more growth and less for income. I use my individual holdings as my income vehicles.

And ETFs offer not only growth, but instant diversification due to their basket of holdings in one portfolio. That diversification can give you exposure to sectors you are missing out on. Especially, if it is a sector where you are not too familiar with the business model.

For example, I want the growth Technology (XLK) provides, but do not understand the business model as well as I would like to invest in individual companies.

If you’re an income-focused investor, it’s likely you’ve heard of Schwab’s U.S. Dividend Equity ETF (SCHD). And if you’re a long-term growth investor, the ever so popular S&P 500 ETF by Vanguard (VOO).

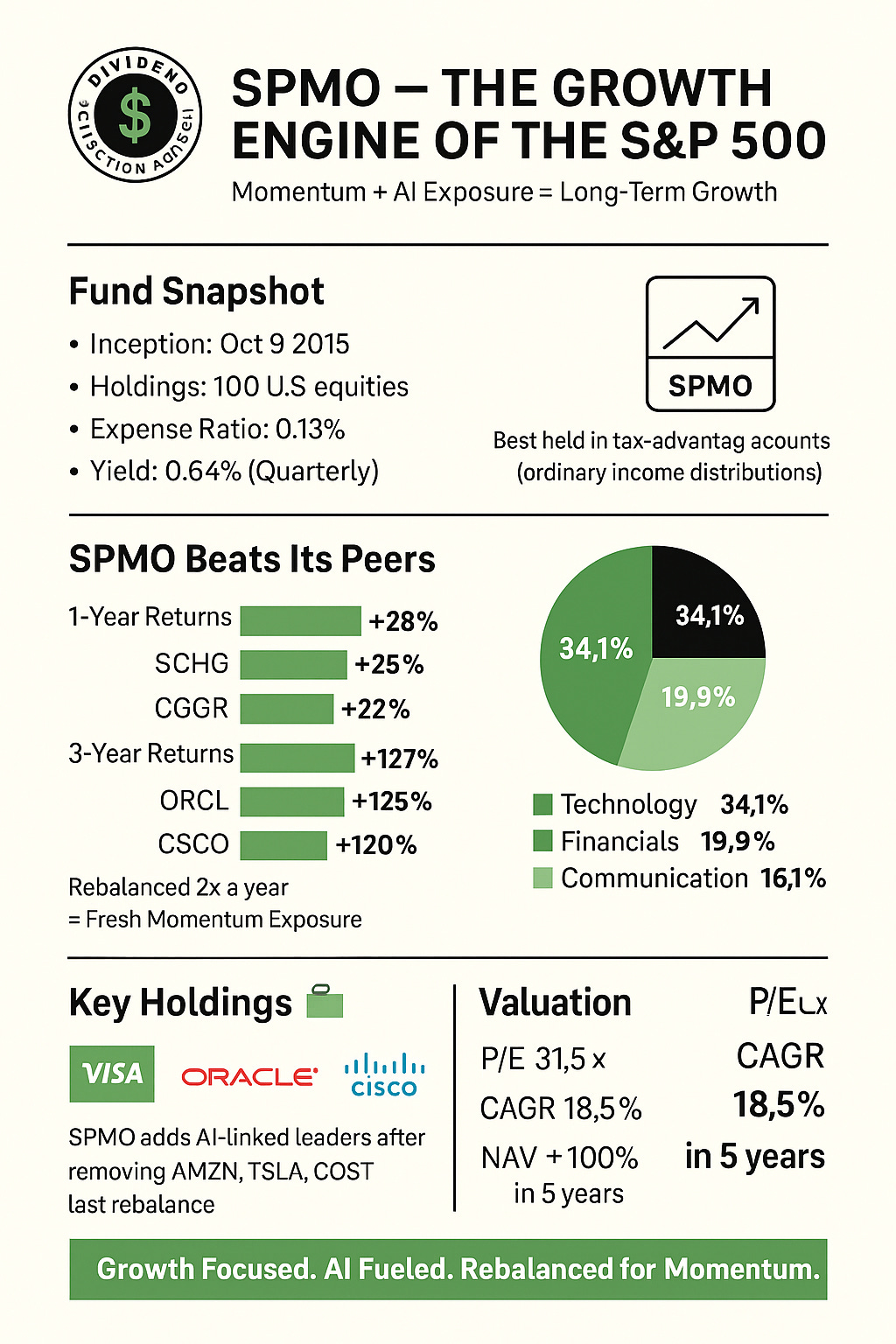

Well, this week’s article of the week gives you an alternative that offers both income and growth. They’ve also outperformed both ETFs mentioned above in the past 1 & 3 years. As a result of their fundamentals, I think this ETF could continue their winning streak for the foreseeable future.

Like & subscribe if you’re active duty, a veteran, or just love investing.