Article Of The Week

"Looking To Start Building Passive Income?"

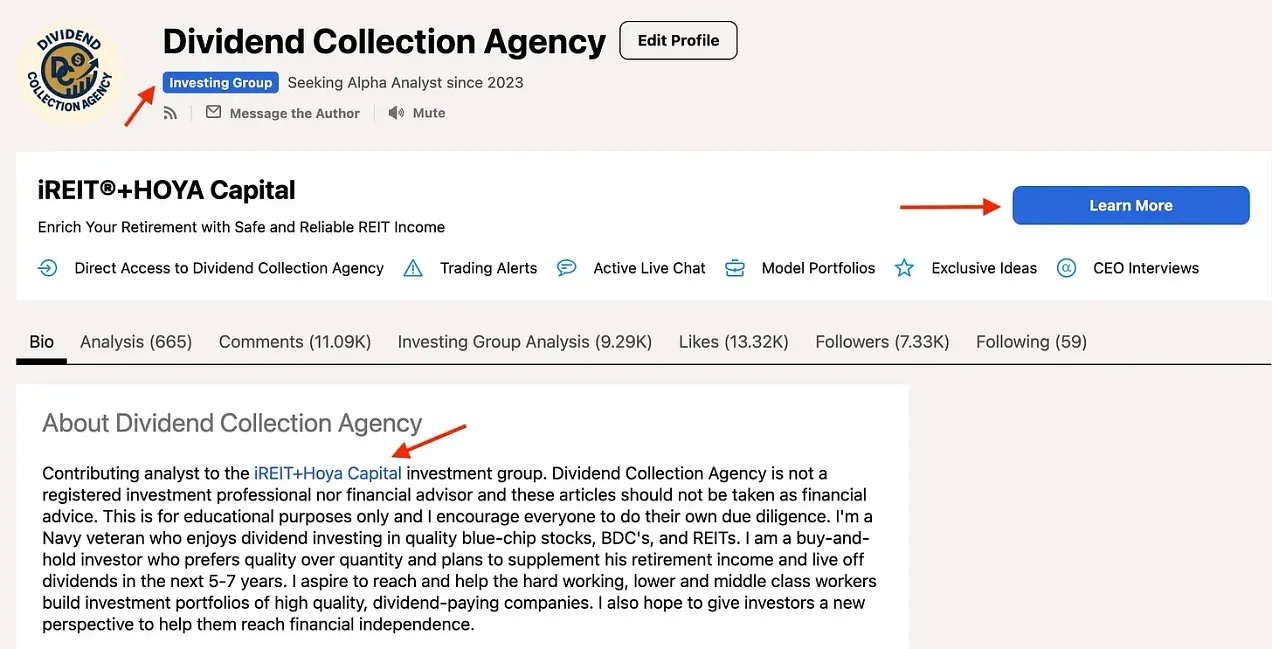

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

And the platform allows writers to share one article once a week free of charge. So, I like to share them with all my current & future subscribers. (see below).

With inflation remaining above historical levels for the past 3 years, consumers have likely felt the impact. Higher home costs, higher rents, and higher prices on everyday goods & services.

And I think 2025 and beyond is pivotal for people to think about creating passive income.

While there are several ways to achieve this, buying dividend-paying stocks is a great one in my opinion. And there is a plethora of ways to collect income. From covered-call ETFs, traditional ETFs, closed-end funds, and even BDCs.

But another way, that many likely deem safer, is by buying blue chip companies that we use on a daily basis. This is because blue chip companies usually have strong, and reliable cash flows.

And this allows them to pay dividends for a long time. And if you’re looking to collect passive income, I would personally start with blue chip companies instead of chasing high-yield investments.

While there’s a place for these, higher yields usually come with higher risk. And at Dividend Collection Agency, our motto is “quality over quantity.”

In this week’s article of the week, I suggest 3 solid, blue-chips stocks that are trading at attractive valuations that investors should consider.

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha for 2 weeks FREE. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

For educational purposes only. I am not a licensed professional. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.