Article Of The Week

BDC Investors Remain Cautious

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

And the platform allows writers to share one article once a week free of charge. So, I like to share them with all my current & future subscribers.

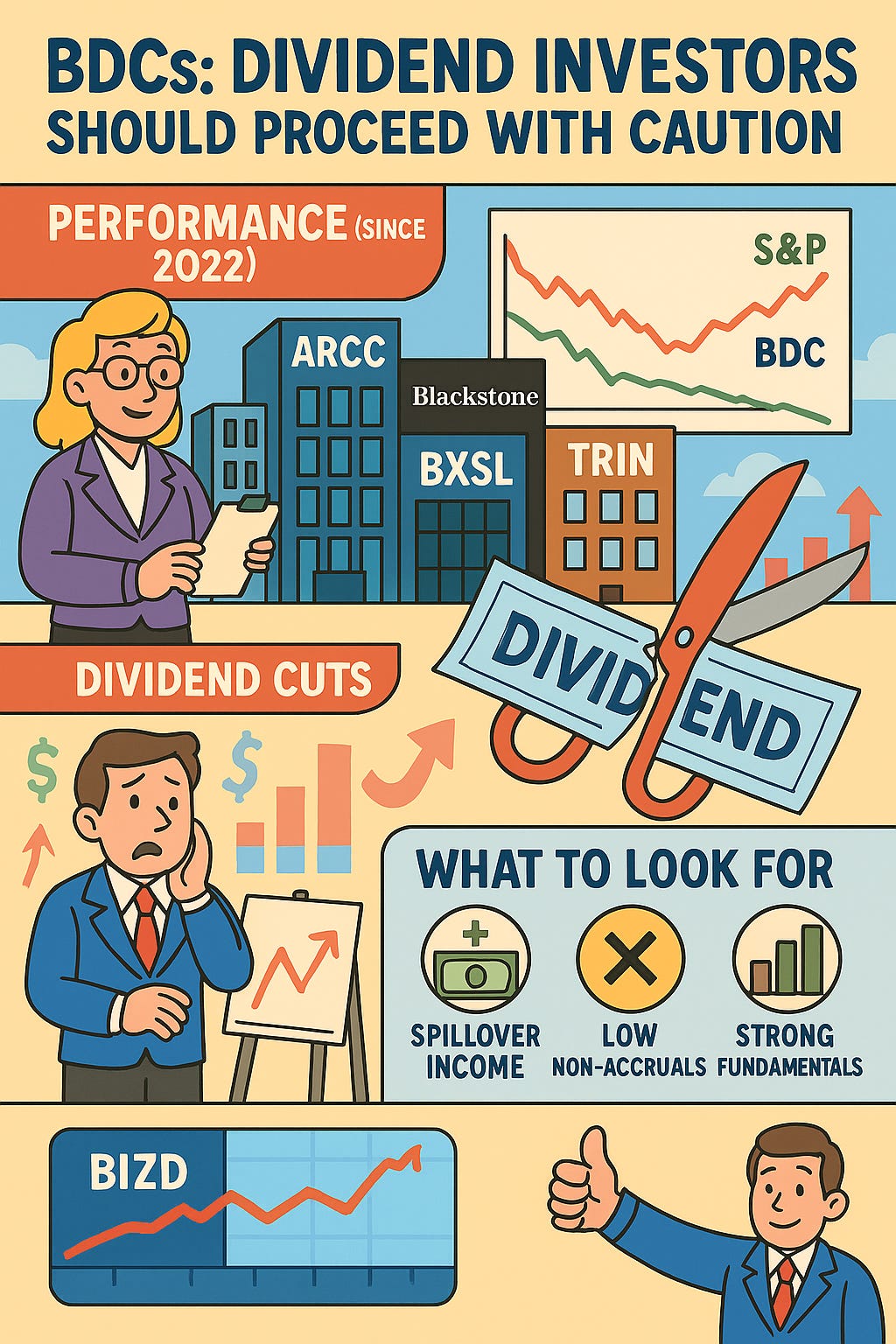

During the recent Jackson Hole speech, the FED chair Jerome Powell gave the market some good news about potentially cutting interest rates in September. Now, the market anticipates interest rates to be 3.95%, down from the current rate of 4.50%.

While this provides relief for some businesses & consumers, this is a double-edged sword for Business Development Companies, or BDCs. Business development companies are very popular among retirees and income-focused investors because of their high yields.

These are usually in the 8% - 12% range or sometimes even higher. Like any company, BDCs come with risks. Think of these like banks for private companies. They lend money to mostly private businesses since they don’t have access to capital from large institutions like JPMorgan (JPM) or Bank of America (BAC) like say a Tesla (TSLA) or Starbucks (SBUX).

And because the businesses they loan to are smaller, this makes BDCs riskier investments. Moreover, BDCs borrow debt at fixed-rates and lend at floating-rate (debts). So, when rates are higher, BDCs earn more in interest from their borrowers. When interest rates go down, BDCs earn less because their portfolio yields fall as a result.

And this usually impacts their ability to cover the dividend. This can also have a negative impact on their share price. If a BDC, or any company for that matter, cuts the dividend, their share price usually declines.

And with interest rates expected to be lower, some BDCs may experience a cut to their dividend. But if you’re an income investor, BDCs can be attractive investments. If you currently own some, or are looking to buy, here’s an article I suggest you read.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Heard Jerome Powell. The market apparently relieved by the prospect of a 5 point rate cut in September. But you make an important distinction; it’s not great news to the Business Development Companies who cater to retirees. Nice article. Hope you don’t mind my reposting it for others.