Blue Owl Capital Corporation: Big Discount... But Is It A Trap?

"After Q3 Earnings - Proceed Carefully"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

With interest rates now lower and expected to continue declining in the coming months, many BDCs now trade at attractive valuations due to their interest rate sensitivity.

Although many have high dividend yields and attractive valuations, income-focused investors should proceed with caution as BDCs could get even cheaper in 2026. The perfect example: Blue Owl Capital Corporation (OBDC).

Current Price: $13.15

Portfolio Purpose: Income 💰

Earnings Miss & Price Drop 👎🏾

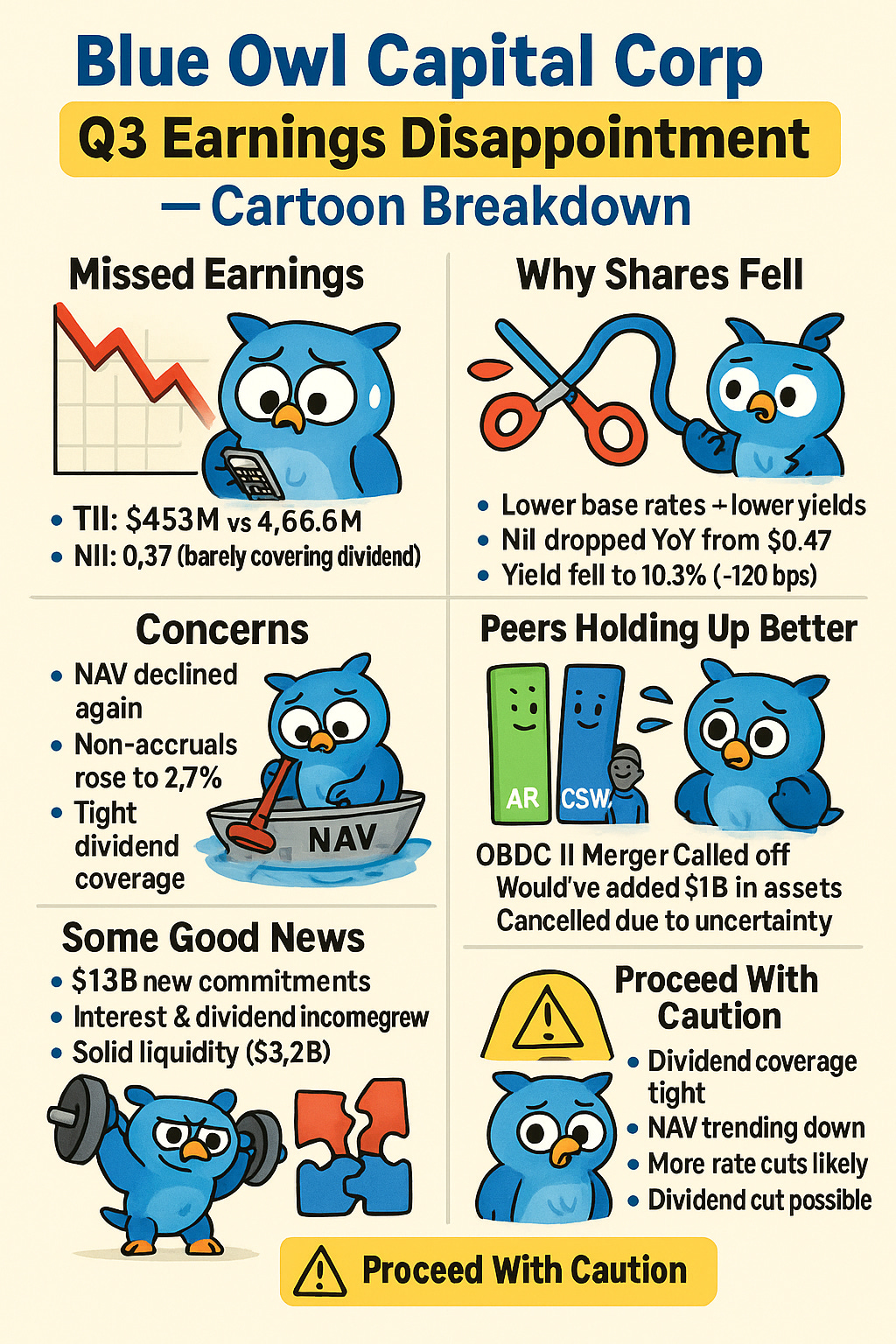

OBDC reported disappointing Q3 results, missing analysts’ estimates on both revenue and net investment income (top & bottom lines).

• TII: $453M vs $466.6M expected

• NII: $0.37 → slightly below $0.37 dividend run rate

• Dividend stays intact for January, but coverage is tight.

Why the Market Reacted Negatively

• Lower base rates = lower portfolio yields

• NII fell from $0.47 YoY

• Q3 yield dropped to 10.3% (-120 bps YoY)

• Non-accruals increased to 2.7% cost basis

• NAV continued declining — a key concern for BDC investors

When compared to peers: Ares Capital Corporation (ARCC) & Capital Southwest (CSWC) shares held up far better over the past 6 months, helped by stronger NAV trends.

Balance Sheet & Activity ⚖️

Some positives:

• $1.3B in new commitments

• $1.1B funded (activity improving)

• Interest & dividend income grew, partly from the OBDE merger

• Solid liquidity: $3.2B including revolver

• Leverage of 1.22×, within target range

But the company does have large maturities coming due in 2026 & 2027.

And recently the merger with Blue Owl Capital Corporation II (OBDC II) that was supposed to be highly accretive, was called off.

Merger With OBDC II Called Off

This was expected to add $1B in assets and boost scale/liquidity.

Now canceled due to economic uncertainty.

Share repurchase plan remains active.

Valuation & Risks ⚠️

OBDC trades at a steep 0.81× P/NAV discount.

Peers trade much richer (CSWC 1.24×, HTGC 1.43×).

But the discount reflects legitimate risks:

• Tight dividend coverage

• Lower yields from falling rates

• Rising non-accruals

• Merger cancellation

• Potential dividend cut in 2026

• NAV trending downward while peers show growth

Bottom Line ✅

OBDC remains a large, liquid BDC with a solid balance sheet and attractive discount currently. But in my opinion the risk vs reward isn’t ideal in the current market.

With weaker earnings trends, higher non-accruals, and more rate cuts likely ahead, caution is warranted. And a dividend reduction is possible if the macro environment worsens.

So, for now I would like to see more stability from Blue Owl Capital before buying.

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha 20% off for Black Friday. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

This is not financial advice. This is for educational purposes only. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.