Clorox's Near 5% Dividend Yield Is Getting Hard To Ignore

Collect Passive Income From Your Everyday Products

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

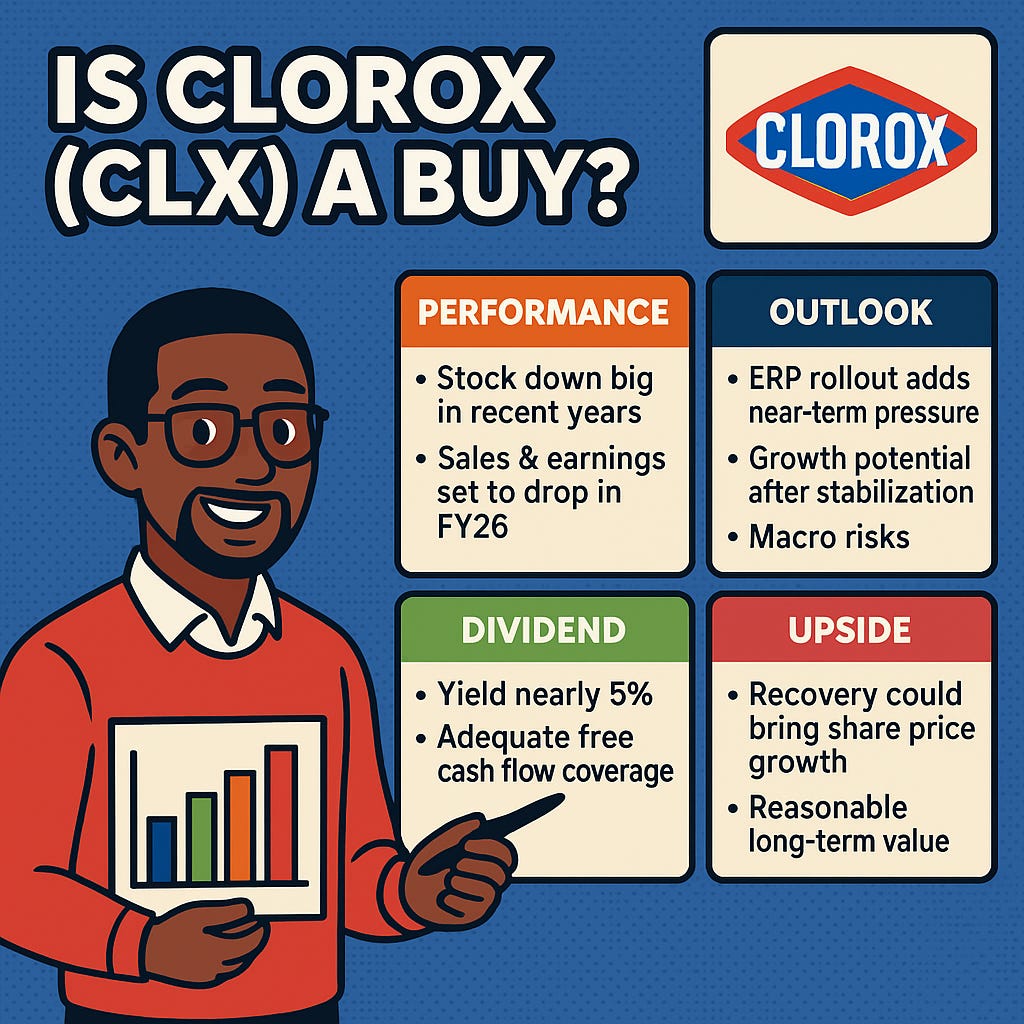

Most of us are familiar with the iconic brand, The Clorox Company (CLX). The company has been around for more than a century, and many of us use their products daily without even realizing it. Yet despite its household-name, Clorox’s share price has struggled in recent years.

Even when zooming out over a five-year window, CLX has been a disappointing investment. But with a near 5% dividend yield and a compressed valuation, long-term investors may find the stock worth considering.

Clorox: A Brief Overview 🧼

Clorox has been on my watchlist for several years. Founded in 1913 and publicly traded since 1928, the company owns many household brands that consumers purchase on autopilot:

• Clorox Bleach & Wipes

• GLAD trash bags

• Brita

• Burt’s Bees

• Pine-Sol

Clorox operates in four key segments: Health & Wellness, Household, Lifestyle, and International.

While the business remains stable and widely used, the stock’s performance tells a different story.

A Disappointing Investment 📈

Over the past year, Clorox shares have fallen more than 38%, far underperforming the broader market. Over the last five years, the stock has dropped nearly 48%, largely unwinding the pandemic-era valuation bubble.

During 2020, demand for cleaning products surged and CLX traded near $240—a level that was never sustainable once pandemic tailwinds faded.

Since then, the company has faced several headwinds:

• Tariffs and inflation

• Shifting consumer behavior

• Divestiture of its Argentina business

• A 2023 cyberattack

• Ongoing digital transformation and ERP rollout

Despite these challenges, FY25 wasn’t all bad. While sales were flat, margins improved, and earnings per share grew 25% to $7.72. Gross margins expanded 220 bps, and free cash flow increased as well.

But FY26 appears to tell a very different story.

A Bleak Fiscal 2026 Outlook 📆

Clorox reported Q1 FY26 results last month and beat expectations on both revenue and earnings:

• Revenue: $1.43B (beat by $30M)

• EPS: $0.85 (beat by $0.07)

However, both metrics were sharply down from the prior year. Revenue declined from $1.76B, and EPS dropped from $1.86.

Two major factors are expected to weigh on results this year:

1. The sale of the Better Health VMS business, reducing revenue and profit contributions.

2. The ERP transformation, which benefited them last year but will now create first-half pressure as the system stabilizes.

Management expects improvement in the back half of FY26 as consumption increases and market share strengthens. Still, full-year guidance remains weak:

• Sales expected to decline 6%–10%

• Gross margins expected to contract 50–100 bps

• EPS expected to decline ~21% (midpoint guidance: $6.125)

Notably, peer Church & Dwight (CHD) expects 1.5% sales growth, further highlighting CLX’s relative weakness.

Management continues to frame FY26 as a temporary setback, but macro conditions may limit upside in the near term.

Dividend & Balance Sheet: Stability With Constraints ⚖️

Clorox’s July dividend raise was lackluster—just 1.6% or $0.02 per share.

Prior to COVID, dividend growth was much stronger, but recent increases have slowed as the company prioritizes transformation spending.

Even so, the dividend remains appealing:

• Yield: ~4.6%

• Above the S&P 500 avg (1%–2%)

• Above the consumer staples avg (3.24%)

• Above CLX’s 5-year average (3.15%)

Free cash flow coverage remains adequate:

• FCF (FY25): $761M

• Dividends paid: $602M

• Payout ratio: ~79%

While the payout ratio is higher than ideal for a consumer staple, it is not dangerously high in my opinion.

The balance sheet is in solid shape:

• Long-term debt: ~$2.5B

• Cash: $166M

• Revolving credit capacity: $1.5B

• Upcoming maturities: $90M in both 2026 & 2027

• Investment-grade credit ratings across agencies

From a financial stability standpoint, Clorox remains sound.

Upside Potential: Meaningful, But Not Immediate 📉

At today’s valuation, CLX trades at a forward P/E of 17.3x—well below its long-term average. If the company can resume growth post-FY26, the stock could re-rate meaningfully higher.

Based on current long-term projections, Clorox could reach a price target of:

• $153 by FY28

• Representing ~44% upside from ~$106 today

However:

• Near-term upside is likely limited

• FY26 volatility could persist

• Macroeconomic weakness could further delay recovery

For long-term dividend investors, I think dips below $100 present the most attractive entry point.

Risks to Consider ⚠️

Macro uncertainty remains the biggest overhang for Clorox. Rising unemployment and potential recession risks could push consumers toward private-label alternatives.

Key risks include:

• Margin compression

• Declining volumes

• Loss of market share

• Prolonged ERP disruption

• Slower-than-expected recovery

If a downturn occurs, earnings and the stock price could face renewed pressure before fundamentals stabilize.

Bottom Line ✅

Despite near- to medium-term headwinds, I remain optimistic about Clorox’s long-term potential. The company’s digital transformation and ongoing product innovation could drive meaningful value over time.

At its current valuation, CLX offers:

• A nearly 5% dividend yield

• A reasonable earnings multiple

• Long-term upside nearing 40%+ once growth resumes

But patience is required. I expect stabilization to occur late 2026 into 2027, with limited near-term upside until margins and earnings regain momentum.

Until then, Clorox offers a compelling dividend play for long-term investors willing to weather short-term volatility.

What do you think?

Happy Investing!

If you’re looking to create passive income and build your wealth from one of the top rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started. ☎️

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.