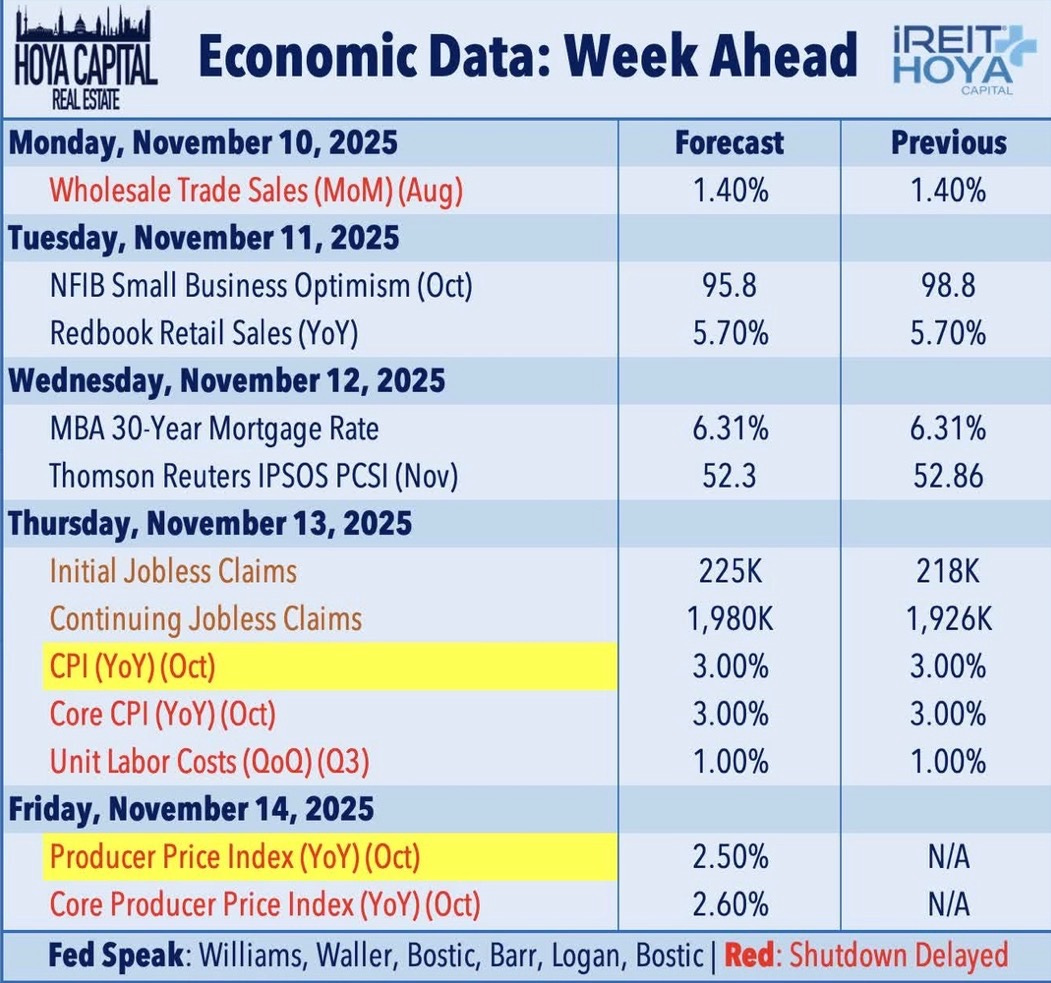

Economic Data For The Week

"Prepare For Another Week Of Potential Market Volatility"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Check out economic data for this upcoming week! 📊

Source: iREIT & Hoya Capital

With CPI & PPI reports releasing this week, I suspect the market will remain quite volatile. Especially, if these numbers increase.

But I wanted to point your eyes to the 30-year mortgage rates at 6.31%.

During my 21 years in the military, I rarely heard people talk about the stock market. Everyone usually followed the same trend. Buy physical real estate and rent it out to build wealth & passive income. 🏡.

This sounds good and all. And owning physical real estate can definitely build your wealth. But according to military members, this seems to be the only way to get there.

As I’ve mentioned, the FED does not control mortgage rates. I always heard people (especially military) say they can just refinance their mortgages when interest rates come down.

But what they don’t tell you is that when you refinance, your loan terms start over. So, if you’ve paid on your 30-year mortgage for 10 years and refinance, your clock starts back at 30 unless you change your loan terms. 🏦

Yes, you have a lower interest rate but you’re often locked in debt for 40 years instead of 30 (years). They also don’t tell you that there are closing costs when you refinance.

Yes, you can do a cash out refi and take out equity, but what if the housing market is in a crash? Contrary to belief, the housing market crashes just like the stock market.

I’m not knocking owning physical real estate as this typically appreciates over time. But one should know what comes with this before buying:

✅ Down payments

✅ Closing costs

✅ Insurance

✅ Fees (maintenance, HOA, reassessment, etc.)

✅ Property taxes

And with high inflation, these all increase. Ask someone who’s owned a home how much their costs have risen since 2022.

So, before buying a home, make sure you know what you’re getting yourself into long term.

Owning a home is nice, but don’t become house broke in doing so.

If you’re looking to start investing check out our investment group over on Seeking Alpha for 2 weeks FREE. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

This is not financial advice. This is for educational purposes only. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.