Equity Doesn't Pay Your Bills, But Cash Flow Does

"Buy Stocks Instead Of Homes"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

Most people I know are fascinated with owning a home. Me, personally, I never cared for owning a home as this required a lot of responsibility, time, and money. Although homes can be great investments, they are liabilities.

They do have the potential to become assets in the future. But until you make a return from your home, it’s a liability. I have nothing against owning real estate as I plan to own a home in the not too distant future.

But while everyone is fascinated with the idea of owning a home, no one ever talks about the downsides of owning one. Buying a home typically requires a lot of capital. Money down, closing costs, insurance, maintenance, etc.

And if you took out a loan at the wrong time, you’re likely paying a high interest rate. While 7% doesn’t sound like much, it adds up over time. In the military, I often heard people mentioning how they were going to buy a house and rent it out once they received new orders.

While this may sound like a great plan, what if it doesn’t work that way?

The rent still has to be paid.

Even if you successfully rent it out, you’re receiving a few hundred dollars in cash flow?

Many often talk about how houses go up over time. While this is true, quality stocks do as well. Home owners also never talk about their tenant problems. Or when they need $10,000+ to replace a new roof.

I asked a family member who bought his home roughly 6 or 7 years ago how much equity he had in it today. Buying it for about $150,000, he mentioned it was appraised at about $200,000. So he has $50,000 in equity. And yes, he could use this as a down payment on an additional home.

But having equity in a home doesn’t pay your bills, cold hard cash does.

And the housing market tends to experience crashes the same as the stock market does. So, trying to sell at the wrong time could be bad for business.

My family member also mentioned how they had to spend $6800 recently to replace their air conditioner unexpectedly, something else homeowners never think much about. This doesn’t include the other maintenance issues he’s complained about this year alone. And these can add up over time.

I had a former co-worker mention how his tenant hadn’t paid rent in 3 months. Again, who’s going to pay the bank? Because they could care less about your tenant’s financial problems.

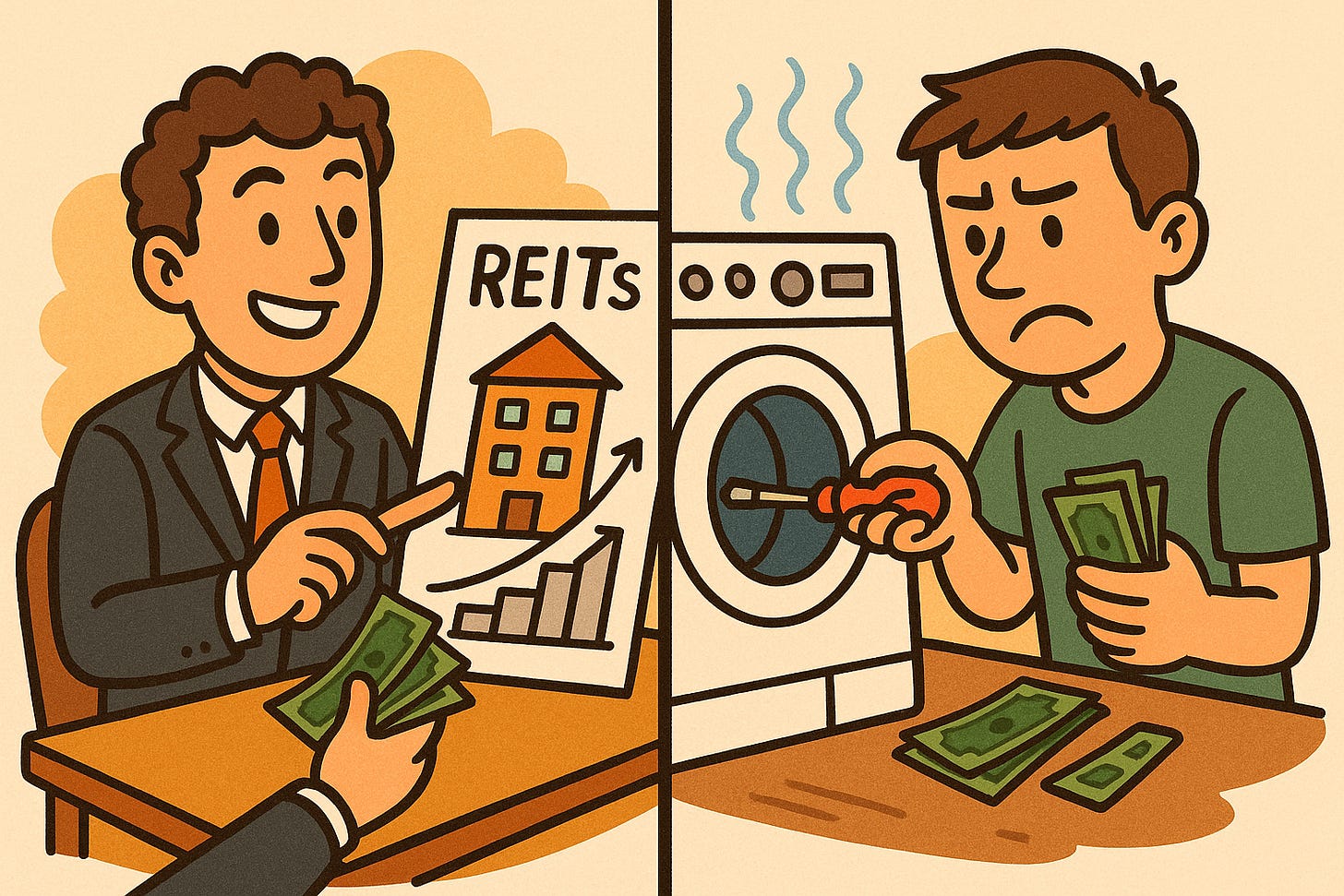

I say all of this to say while a home can become a great investment or asset, buying Real Estate Investment Trusts (REITs) are great ways to generate cash flow. And if held in a taxable account, this can be used in emergency situations. And reinvesting your dividends will only build a larger income stream for the future.

Like & subscribe if you’re a active duty, a veteran, or just love investing.