Get International Exposure & Outperformance With This ETF

What Makes JIVE Unique

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Current Price: $78.70

Portfolio Purpose: Growth 📉

With the sheer number of ETFs hitting the market in recent years, I’ve grown accustomed to owning them as core positions for diversification. However, thanks to two readers on Seeking Alpha, I was recently introduced to an ETF I had somehow overlooked.

After digging deeper, it became clear that this fund could be a superstar in the making.

As economists increasingly project stronger growth outside the U.S., funds with international exposure. So, those like JPMorgan International Value ETF (JIVE) may be positioned to outperform in the years ahead.

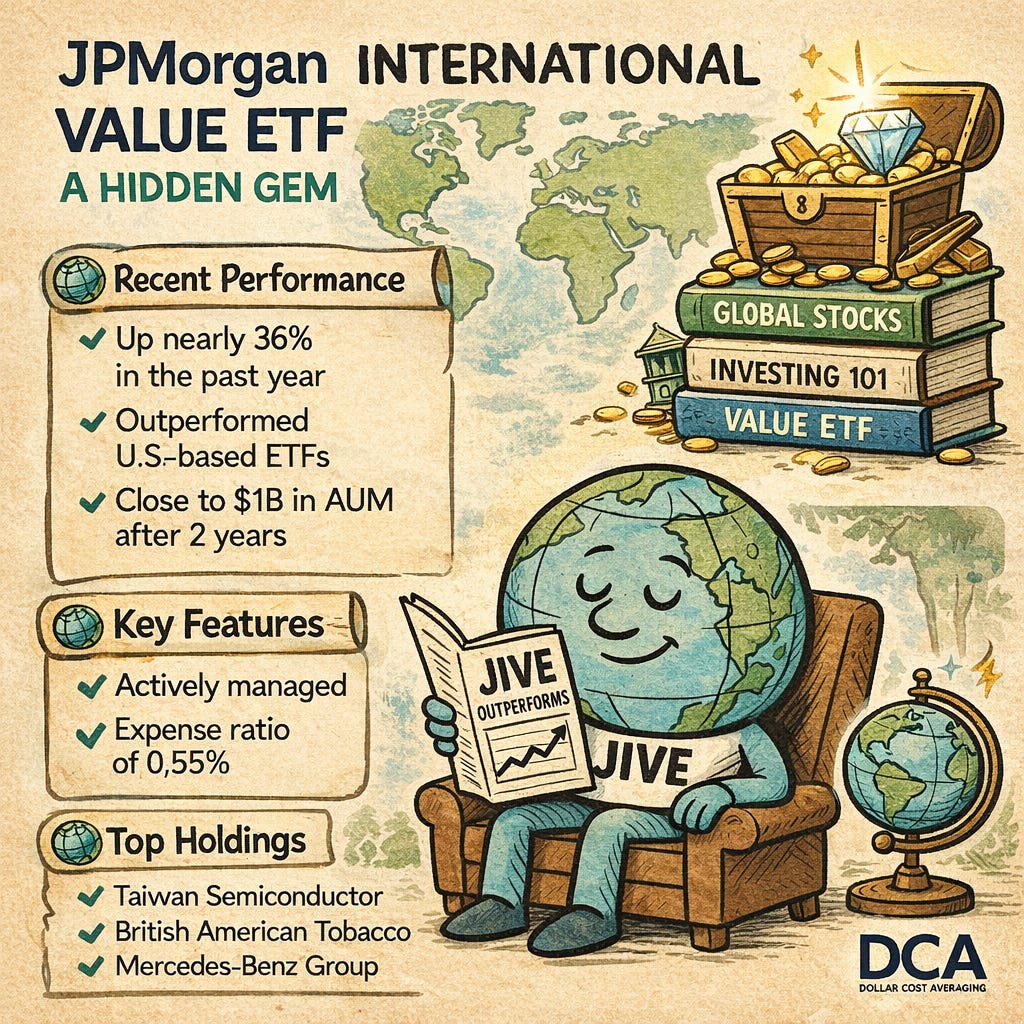

Despite being relatively new, JIVE has delivered impressive results, rising nearly 36% over the past year. And significantly outperforming many peers and even popular U.S.-based ETFs.

If you’re looking for an ETF that offers diversification, modest income, and strong outperformance potential, JIVE may be a hidden gem worth considering.

Why International Diversification Matters 🌍

For U.S.-based investors, it’s reasonable to ask:

Why diversify outside of U.S. equities?

For decades, the United States has been the world’s dominant economic power. However, in recent years, the U.S. dollar has weakened, and global growth dynamics have begun to shift.

According to Charles Schwab, international equities could be poised for strong growth in the years ahead. Emerging economies such as India, the Philippines, and Saudi Arabia are expected to experience above-average GDP growth in 2025—potentially outpacing the U.S.

This growth is being driven by:

Population expansion

Rising consumer demand

Increased adoption of artificial intelligence and digital infrastructure

Additionally, non-U.S. equities have spent years trading at significant valuation discounts compared to U.S. stocks. As valuations normalize, international markets may offer a compelling opportunity for long-term investors seeking diversification and return potential.

Why JIVE Stands Out ☝️

The JPMorgan International Value ETF is an actively managed fund launched on September 13, 2023, by JPMorgan Asset Management.

While actively managed funds often carry higher costs, JIVE’s 0.55% expense ratio remains reasonable given its strategy and results. For every $10,000 invested, the annual cost is just $55.

For comparison:

Schwab International Dividend Equity ETF (SCHY) has a much lower expense ratio of 0.08%

However, over the past year, JIVE has dramatically outperformed SCHY, gaining nearly 39% versus roughly 21%

This outperformance highlights the potential advantage of JIVE’s active management, which focuses on identifying attractively valued international stocks with strong fundamentals—rather than simply tracking an index.

Performance Since Inception 📉

JIVE may be young, but its early performance has been impressive.

A $10,000 investment at inception (September 2023) would now be worth approximately $16,690, outperforming both:

The tech-heavy Invesco QQQ Trust (QQQ)

The flagship S&P 500 ETF, Vanguard S&P 500 ETF (VOO)

This strong performance has also helped JIVE grow its assets under management to over $1 billion in just over two years—an impressive milestone for a new ETF.

Distributions & Tax Considerations 📑

JIVE pays annual distributions, which partially explains why QQQ slightly edges it out in total dollar returns over certain periods.

Key distribution details:

JIVE yield: ~1.72%

QQQ yield: ~0.45%

S&P 500 average yield: ~1.0%–1.3%

While JIVE’s yield isn’t exceptionally high, it is competitive and adds to total return.

Importantly, JIVE’s distributions are taxed as ordinary income, making the ETF best suited for tax-advantaged accounts such as:

Roth IRAs

Traditional IRAs

This structure may also appeal to retirees or near-retirees seeking growth-oriented diversification rather than pure income.

Portfolio Breakdown 📊

JIVE currently holds 341 securities, offering broad diversification across sectors and geographies.

Sector Allocation

Financials: ~36%

Industrials: 10.3%

Materials: 7.8%

The heavy financials exposure may be viewed as a risk, but it also reflects JPMorgan’s conviction in attractively valued global banks and insurers.

Top Holdings Include:

Taiwan Semiconductor Manufacturing (TSM)

Mercedes-Benz Group (MBGAF)

British American Tobacco (BTI)

Mitsubishi UFJ Financial Group (MUFG)

Bank of Nova Scotia (BNS)

While some holdings may be unfamiliar to U.S. investors, these are globally recognized, cash-generating businesses.

Geographic Exposure:

EMEA: 49.7%

Asia ex-Japan: 25.3%

Japan: 15.5%

North America: 4.1% (entirely Canada)

NAV Growth: The Real Driver ↗️

JIVE’s strong price performance has been driven by consistent NAV growth.

Outpaced its benchmark over the 1-month, 3-month, and YTD periods

Since inception, JIVE has beaten its index by roughly 6%, with NAV growth of 26.97%

For ETFs, sustained NAV growth often precedes continued price appreciation. Notably, JIVE was recently recognized as one of the top non-U.S. ETFs, further validating the fund’s quality.

Risks to the Thesis ⚠️

Potential underperformance as investor enthusiasm fades after the ETF’s early success

Continued dominance of U.S. equities, particularly if AI-driven growth remains concentrated domestically

Sector concentration, particularly in financials

JIVE’s trajectory could mirror other once-popular ETFs—such as SCHD—if sentiment shifts or relative performance declines.

Investor Takeaway ✅

While still relatively new, JIVE’s outperformance versus U.S.-based ETFs like VOO and QQQ underscores the strength of its underlying holdings and active management strategy.

JIVE has:

A reasonable expense ratio

Strong NAV growth

Global diversification

Competitive yield

And all this makes it stand out as a compelling option for investors seeking non-U.S. exposure with long-term outperformance potential.

If you’re looking to diversify beyond U.S. equities while maintaining both growth and income characteristics, JPMorgan International Value ETF deserves a spot on your watchlist.

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.