Growth Stocks Can Underperform Too

"Why Invest For One When You Can Do Both"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

When it comes to investing, there’s no one-size-fits-all strategy.

Age, retirement status, lifestyle, risk tolerance, and even personality all play a role in determining what works best.

Personally, I’ve always been a Warren Buffett–style investor—simple, boring, and disciplined. That’s why dividend investing has always resonated with me. While it may seem slow or unexciting to some, I think it removes a lot of guesswork.

Getting paid regardless of market conditions is a powerful concept.

That said, dividend investing isn’t perfect. Dividend-focused portfolios can underperform during strong bull markets. Especially, when technology dominates returns. And with AI enthusiasm still driving markets, that trend may continue.

But the opposite extreme—focusing only on growth—comes with its own risks.

Below, I explain why growth-only strategies can lead to underperformance, why dividends still matter, and how combining both approaches can create a more resilient portfolio.

Dividends Still Matter 💵

One common criticism of dividends is double taxation. While that concern is valid in certain accounts types, dividends remain one of the most reliable wealth-building tools in market history.

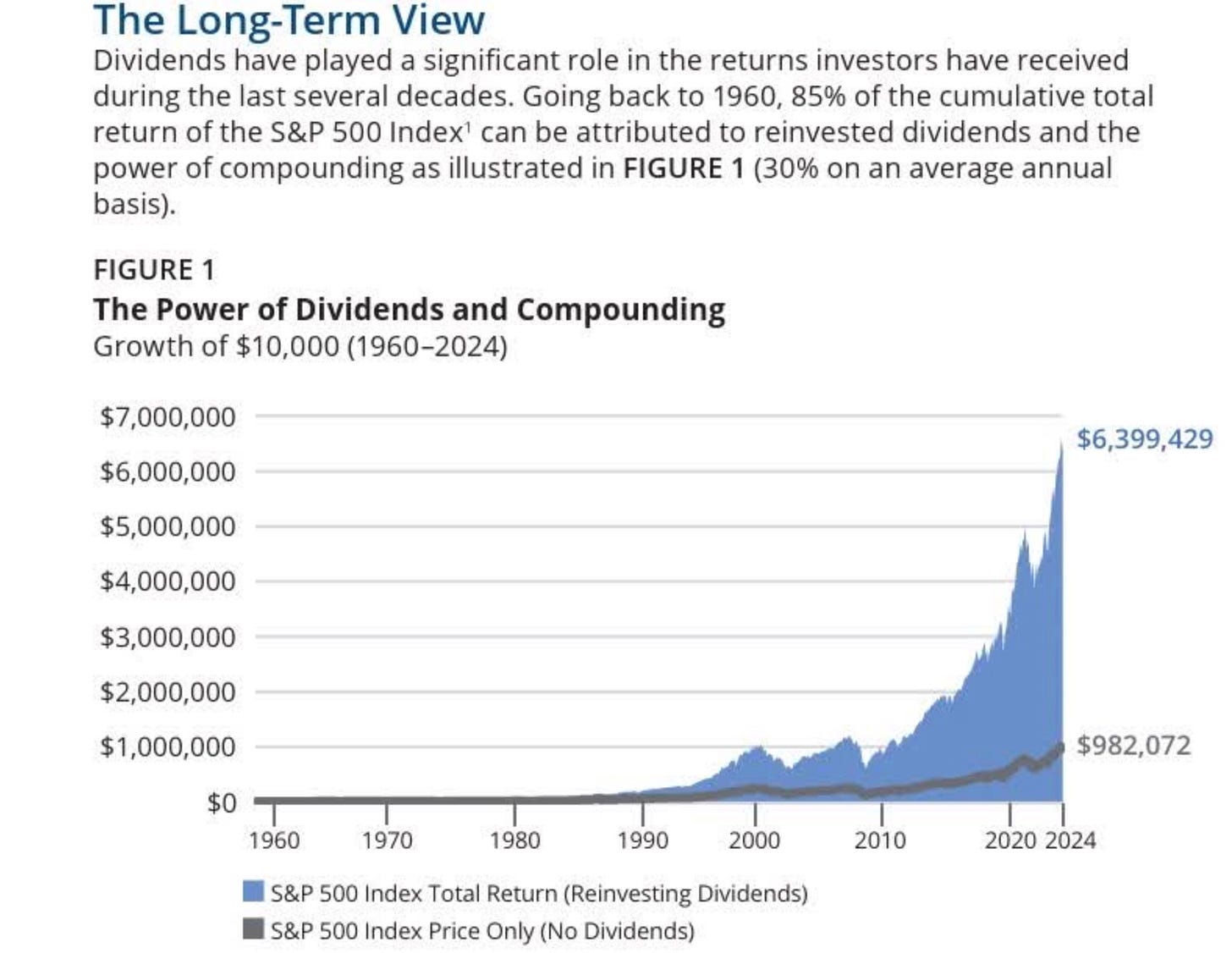

From 1960 through 2024, a $10,000 investment in the market would have grown to less than $1 million on price appreciation alone. With dividends reinvested, that same investment would be worth roughly $6.4 million.

Dividends do more than boost returns:

They reduce reliance on market timing

They provide psychological stability in downturns

They generate cash flow without selling assets

I’ve never liked the idea of living off withdrawals using the 4% rule. That approach assumes ideal conditions—steady markets, predictable expenses, and no prolonged drawdowns.

Dividends offer a different path. Instead of selling assets, I prefer owning companies that produce sustainable income above inflation.

And for those already living off dividends in retirement—this isn’t theory. Dividends pay real bills.

Growth Stocks Underperform Too 📈

With AI dominating headlines, it’s easy to assume growth stocks are a one-way ticket to outperformance.

Companies like NVIDIA (NVDA), Broadcom (AVGO), Microsoft (MSFT), and Oracle (ORCL) have crushed the market over the past five years. But their dividend yields remain below 1%.

History reminds us that hype fades.

After the dot-com bubble burst, the market fell more than 70%. One of the most well-known casualties was Cisco Systems (CSCO).

From 2000 through 2023:

Cisco had a negative price return

The S&P 500 gained over 230%

Investors waited 24 years just to see meaningful recovery

Growth investors who piled in at peak valuations severely underperformed—even if they held on.

Why I Blend Growth and Income ⚖️

At 41, some might argue I should focus purely on growth. But my situation is different.

I’m a military retiree with:

A pension

Lifetime medical and dental

No urgency to liquidate assets

In 5–10 years, I want dividends to supplement my income—not replace it overnight.

That’s why I’ve split my strategy:

Main portfolio: increasingly tilted toward growth

Income portfolio: covered-call ETFs, BDCs, REITs, and MLPs

Because income-heavy assets have limited upside, I balance them with growth elsewhere.

Recently, I’ve added:

Netflix (NFLX)

Capital Group Dividend Value ETF (CGDV)

T-Mobile US (TMUS)

Netflix remains a high-growth compounder—with or without Warner Bros. Discovery (WBD)—and I believe it has a realistic path to joining Microsoft, Apple (AAPL), and NVIDIA in the trillion-dollar club.

CGDV offers tech exposure with income, while T-Mobile’s recent pullback below $200 created an attractive long-term entry.

Blending those with steady income plays like VICI Properties (VICI) and Agree Realty (ADC) provides balance.

Know the Strategy That Works for You 🫵🏾

Personality matters just as much as math.

Retirees may benefit more from income stability

Younger investors can lean into growth—but shouldn’t chase hype

Overpaying for great companies still leads to underperformance

Even high-quality names like Costco (COST) can lag when valuation gets stretched.

Dividend stocks aren’t just for retirees either. Dividend Kings like Altria (MO), PepsiCo (PEP), and Procter & Gamble (PG) have rewarded shareholders for decades.

For older investors, income-focused assets—especially undervalued REITs like Realty Income (O), VICI Properties, and Getty Realty (GTY)—can make sense.

Bottom Line ✅

Growth builds wealth—but can underperform for years

Dividends provide stability, income, and downside protection

Valuation matters more than hype

Blending growth and income reduces fragility

Dividend investing may be boring to some—but boring often wins.

And for investors looking to eventually retire, a strategy that combines growth today with income tomorrow may prove to be the most durable approach of all.

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.