How To Become A Great Investor Like Buffett

My Top 3 Tips To Becoming Wealthy With Dividend Stocks

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

Although I’ve been interested in investing for as long as I can remember, I didn’t really get serious about it until a few years before my retirement from the military.

But as a 18 year old kid who joined the Navy directly after high school, I knew I wanted my life to look different from the average military retiree. Honestly, I didn’t know if I was going to retire from the military and thought about getting out plenty of times.

But something the military offered was stability & opportunity. When I was younger, I would always hear military members close to retirement talking about having jobs lined up afterward.

They would talk about going right back to work after completing 20+ years of military service. I always thought this was weird because of the money they made. The stories of going on multiple deployments, the benefits, and the re-enlistment bonuses - I would wonder why they would go right back to work.

But after some time in the Navy, I realized most would retire broke. And this is because the military spoiled them. The chances of getting fired or losing your job were slim. We got money for housing, free medical, dental, and extra money while being deployed, life was good.

But even at 18 years old, I knew the military was going to end one day. And honestly, this is the reason why many military members struggle today. Because they aren’t forward-looking.

Many make good money when you add up their pension, disability, free medical & dental, and money for college. But ask them what’s their net worth, and you’re likely to get a deer in headlights look. I’ve mentioned this before, making money is easy, managing it and growing it are the hardest parts.

And this is what led me to become an investor and a financial analyst on Seeking Alpha. Honestly, in the 2 years I’ve done this, I’ve become pretty good. Last time I checked, I was ranked in the top 2% by TipRanks, not too shabby.

Honestly, I’m a self-taught investor. I’ve always been interested in Warren Buffet. And this is because we have many similarities. The most obvious one is we both seem boring and prefer investing in boring businesses. And since investing can be considered boring as well, becoming successful at it is difficult.

So, I wanted to share some tips of what got me to be in the top 2%. And also, what helped me grow my wealth and make money because that’s the most important part. These are just some important tips as there are many. And believe me, I can talk about investing tips all day.

Here are 3 of my main tips:

Never Lie To Yourself

This is probably my most important tip! No matter what you think of a company, never lie to yourself. And this is because you can’t trust anyone more than yourself. If something doesn’t look right, smell right, or act right then it’s probably not right.

Although you may buy a company because you like their business model, it doesn’t alway work out. I’ve avoided many dividend cuts in stocks I was invested in because I saw the writing on the wall.

Instead of lying to myself, I looked at the fundamentals and exited those investments when those fundamentals started to show cracks. One example is Walgreens (WBA). I bought this stock around $36 during their attempted turnaround.

At the time, they were a well-known company approaching Dividend King status (50 years of paying a dividend). But the turnaround wasn’t successful and the stock’s price has declined as a result. But when the cracks in the company started to show, I sold out. If I would have lied to myself, I would have lost a lot of money.

Below is when I wrote on WBA and was starting to become skeptical about their dividend sustainability in August of 2023.

Here’s another article I wrote in October of 2023, stating that their chances of cutting the dividend were high. Some readers argued with me and said Walgreens would not cut their dividend.

Well, 3 months later in January, Walgreens cut their dividend by 48%. In my first article they were around $29, today the stock trades at $11.96. And they have traded as low as $8 in the last year. So, instead of getting out at a small loss in the high $20’s, if I would have lied to myself and not paid attention when the fundamentals deteriorated, I would be down significantly today.

Be Forward-Looking

Being forward-looking has helped me make a lot of money in the stock market. Being forward-looking means looking years ahead, not just days or months.

What do you see the business doing in the next few years? How will they grow? What have they been doing recently that will benefit them long-term?

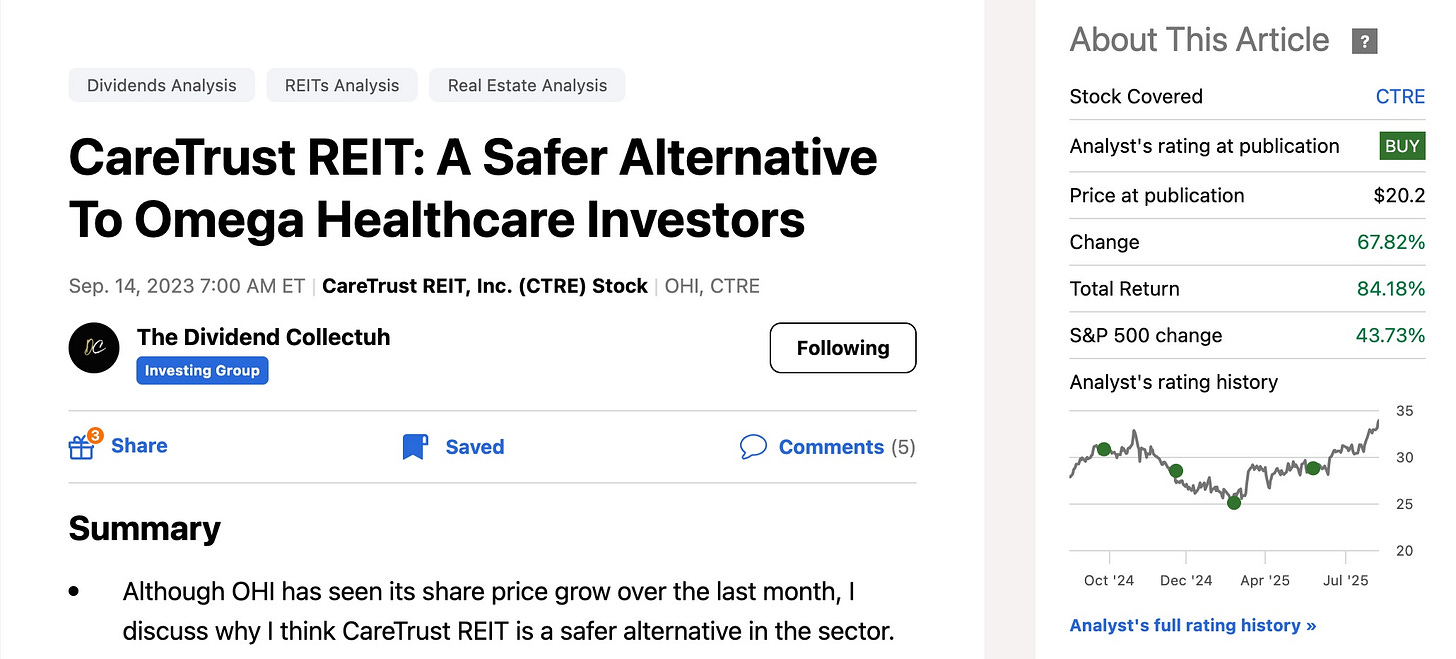

Below is a stock I’ve been bullish on since 2023, CareTrust REIT (CTRE). Here’s the first article I wrote on them. And you can see how CTRE has beaten the S&P (SP500) since then, up nearly 68% compared to the roughly 44% for the index.

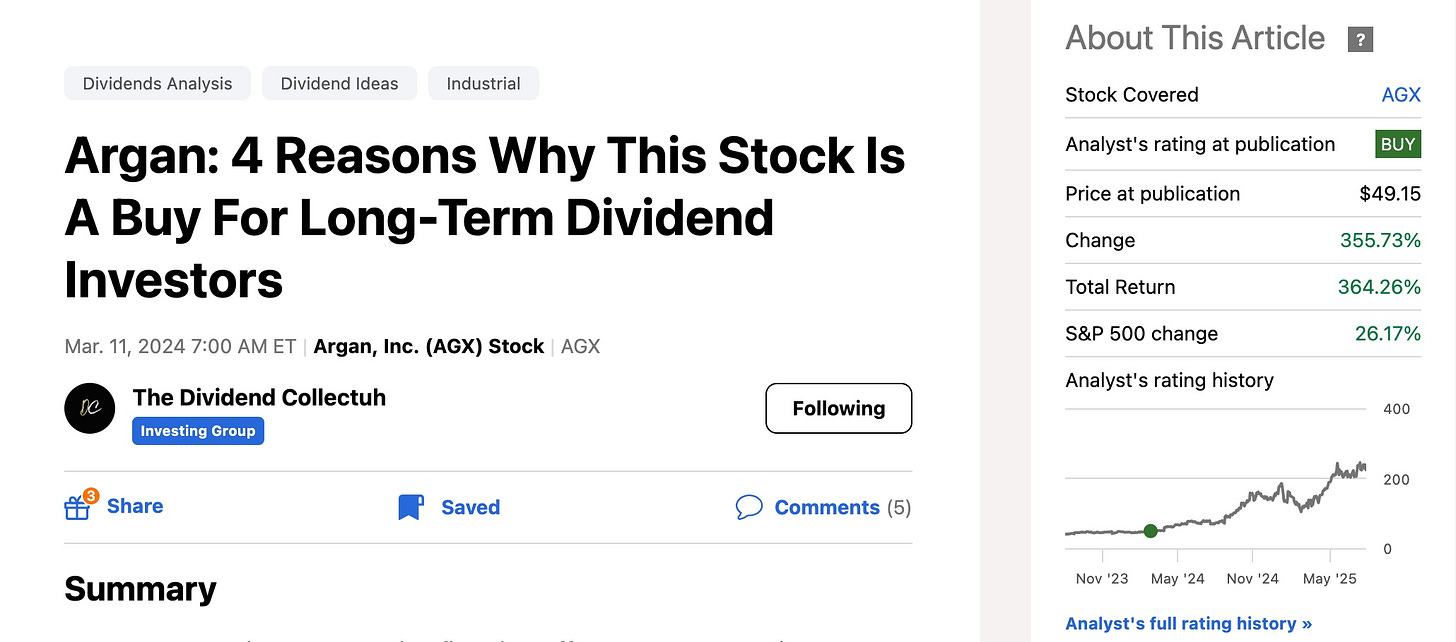

Here’s another stock I was bullish on in 2024, Argan, Inc (AGX). The stock was around $49 at the time. Today it trades at $224 a share, up nearly 356% compared to just 26.17% for the S&P. And to date, this has been my best recommendation.

Because I have never lied to myself no matter how much I like a business and am forward-looking, this has allowed me to make it into the top 2% of more than nearly 42,000 financial experts. Actually as of writing, my ranking was #658 out of 41,790 experts, my actual ranking being the top 1.57%.

Know The Business & Their Purpose

If you own a stock, you should look at it as a business. Warren Buffett has mentioned this for years, look at it as if you are purchasing a piece of a business. This helps you make sound decisions.

What does the business do? What benefits them? Hurts them?

What are they doing to grow? Why is the stock going up? Why is the stock going down? Why did you purchase the stock in the first place?

What’s the goal for your portfolio? Is it for growth? Income? A little bit of both? Is it a shorter-term play? Long-term investment?

Asking those types of questions takes the emotion out of the investment. This allows you to focus on the metrics of the company - what job can it do for me? I like to look at my stocks as dividend growers and dividend showers.

Examples of current stocks in my portfolio I expect high dividend growth from are: Visa (V), Otis Worldwide (OTIS), and Build-A-Bear (BBW). My dividend showers, ones with higher yields and lower growth used mainly for income are Verizon (VZ), Pepsi (PEP), & Altria (MO).

If you owned a business, would you sell it just because your numbers aren’t that great for a few months? You’re seeing less customers, making less money? You have to ask yourself, why are those things happening? What’s the root cause? Is it something you have control over? Can you recover? What’s the time frame? Months? Years?

These are questions you have to ask yourself about your investment. And if you don’t lie to yourself, are forward-looking, and know the company inside & out, this will help you become a successful investor.

As previously mentioned, I’ve read and listened to a lot of Warren Buffett. I don’t blindly follow his investments, but I’ve studied him over the years and used his advice to a become successful dividend investor in the stock market and a top financial analyst on one of the largest online investment communities, Seeking Alpha.

Like & subscribe if you’re active duty, a veteran, or just love investing.