How To Boost Your Dividend Income With Weekly Yields Above 50%

Two New, Risky Covered Call ETFs

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

When it comes to generating strong streams of passive income from higher-yielding investments, depending on various factors like your age, time horizon, etc, the risk may not be worth the reward.

Buying and holding blue-chip stocks with higher than average yields like Verizon (VZ) & AT&T (T), or investing in sectors like (XLRE) and (BIZD) are typically safer ways to collect decent yields.

But, the plethora of derivative income investments popping up over the past few years, collecting yields upward of 50% or 100% had never been plausible, that is until now.

Most investors know these are high-risk, high-reward investments. So, when looking to buy these funds, just know risks like loss of capital and underperformance are trade-offs when buying them, especially covered call ETFs.

In this article I discuss two brand new, weekly-paying covered call ETFs; what they do different than their competitors, and why income-focused investors may consider them.

Before diving into these two covered call ETFs, I wanted to give a brief overview of their shared manager. Both funds are managed by GraniteShares, an ETF firm founded nearly a decade ago in 2016.

The firm has a slew of ETFs with their first ETF listed in the U.S. a year after the firm was founded. As of July, GraniteShares had more than $10 billion in assets under management.

#1 GraniteShares YieldBOOST SPY ETF (YSPY)

First ETF on the list is YSPY. Unlike many competitors, YSPY looks to write and sell options on the leveraged version of the S&P (SP500), instead of the SPDR S&P 500 ETF (SPY).

They hold Direxion Daily S&P500 Bull 3X Shares ETF (SPXL). One difference of SPXL is the ETF looks to track 3x the performance of the S&P.

As a result, YSPY garners high distributions above 50%, or basically 3x your income by selling and buying puts instead of call options on a 3x leveraged ETF, a bit different from other covered call funds.

GraniteShares YieldBOOST SPY ETF is actively managed and also holds U.S. treasuries to generate income. They don't directly invest in SPXL, but instead sell synthetic options, which does cap their upside potential.

And while their put options are supposed to offer some downside protection, the fund's share price has declined as a result of their high distributions. And YSPY's short track record is also something to consider with only 7 months since its inception, meaning there's very limited data to analyze.

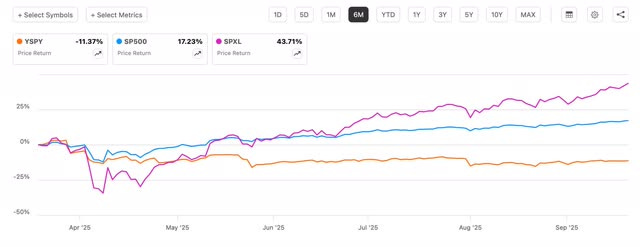

You can see in the chart below that their underlying holding, SPXL has performed exceptionally over the past 6 months, up close to 44%, compared to YSPY being down 11.37%.

And this is because many of these funds that pay high distributions often experience consistent NAV erosion. Since inception, YSPY's NAV has declined over 9%, while SPDR S&P 500 ETF has grown their NAV over 4.5%. But to be fair, any fund that pays distributions weekly is likely to see higher NAV erosion vs those who pay monthly or quarterly.

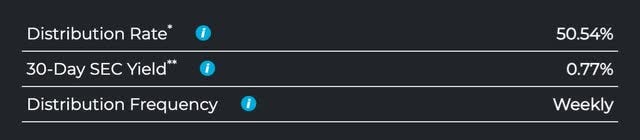

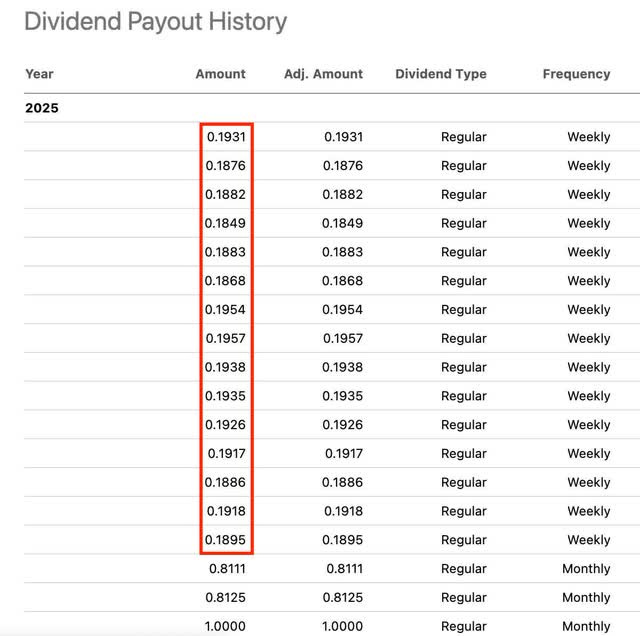

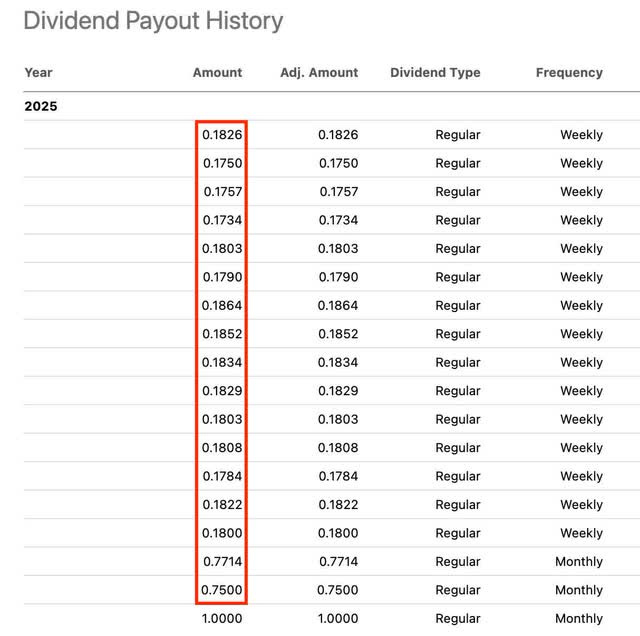

And going forward, this is likely something the fund could continue to experience. But their weekly distribution could also be the attractive trade-off. Below you see the fund has paid weekly distributions and as of earlier this month, had a distribution yield of 50.54%.

So, although YSPY's short track record, NAV erosion, and underperformance are risks to consider, their weekly distribution could be considered attractive if you're an investor strictly focused on income.

Since switching from monthly to weekly, YSPY's distributions have averaged around $0.18 a share. And at their current price of $20, investors can generate a solid stream of income without breaking the bank.

While other weekly-paying ETFs like YieldMax Ultra Option Income Strategy ETF (ULTY) and YieldMax Universe Fund of Option Income ETFs (YMAX) have cheaper prices, YSPY's higher distributions per share and 3x leverage strategy may be considered more appealing.

#2 GraniteShares YieldBOOST QQQ ETF (TQQY)

TQQY is another fund managed by GraniteShares and implements the same exact strategy as YSPY. The exception is the fund sells put options on the 3x leverage ETF, ProShares UltraPro QQQ ETF (TQQQ).

TQQQ seeks to track 3x the daily performance of the Nasdaq-100 instead. As expected, this gives them more exposure to Technology (XLK) stocks, meaning a higher potential for outperformance.

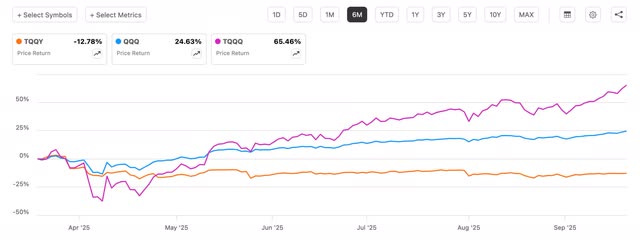

So, for income-oriented investors looking to own these funds, you also get diversification. Below you can see TQQY has expectedly underperformed both TQQQ and Invesco QQQ Trust ETF (QQQ) over the past 6 months.

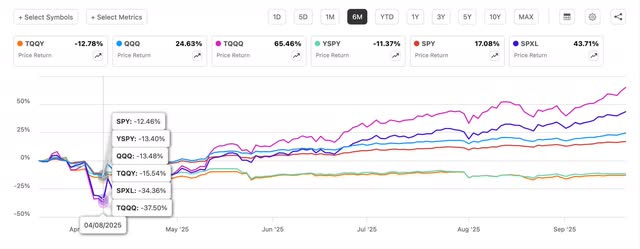

TQQY is down more than YSPY, 12.78% compared to 11.37% for YSPY. TQQQ has outperformed QQQ, up an impressive 65.46% vs 24.63% for the latter. But something I want investors to pay close attention to is that during the April Liberation Day crash, both YSPY & TQQY saw less of a decline than their underlying holdings.

In fact, YSPY and TQQY's declines were relatively in-line with SPY and QQQ's, while TQQQ & SPXL experienced higher drops in price. So, the downside protection by selling put options seems to be apparent. Moreover, both could outperform in volatile, or flat markets.

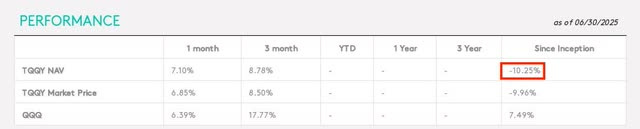

Expectedly, TQQY has experienced NAV erosion over the past 7 months, with its NAV down double-digits, while QQQ's NAV has grown 7.49%. As a result, TQQY's price has declined.

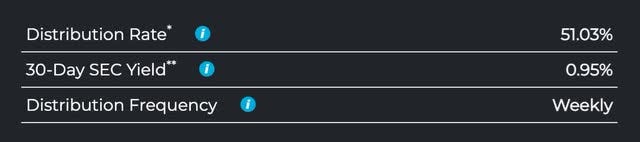

TQQY has a slightly higher distribution yield than YSPY at 51.03%.

And they've also averaged a similar distribution to YSPY at around $0.18 in weekly distributions since switching from monthly.

Distribution Taxes

Like many covered call ETFs, TSPY & TQQY look to pay return of capital. Because of this, investors' taxes are deferred until the time of sale or your cost basis reaches zero. This makes them feasible for taxable accounts and also appeals to younger investors unable to withdraw tax-free distributions from a tax-advantaged account.

Conclusion

If you're an investor strictly focused on income, then TSPY and TQQY could be attractive additions to your portfolio.

Moreover, their weekly yields above 50% makes it easier for investors to use their income in retirement, or use this to place inside more growth-focused positions.

However, these high-yield ETFs are high risk, high reward investments. And YSPY & TQQY could continue to see NAV erosion, which would result in underperformance and share price declines.

But if you're income-focused and care less about price performance and more about income, YSPY and TQQY's unique strategy could be great additions for your portfolio.

Like & subscribe if you’re active duty, a veteran, or just love investing.