How To Use Strategy To Get Your Dividend Snowball Rolling

"Six dividend-paying companies that are paying me in December"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

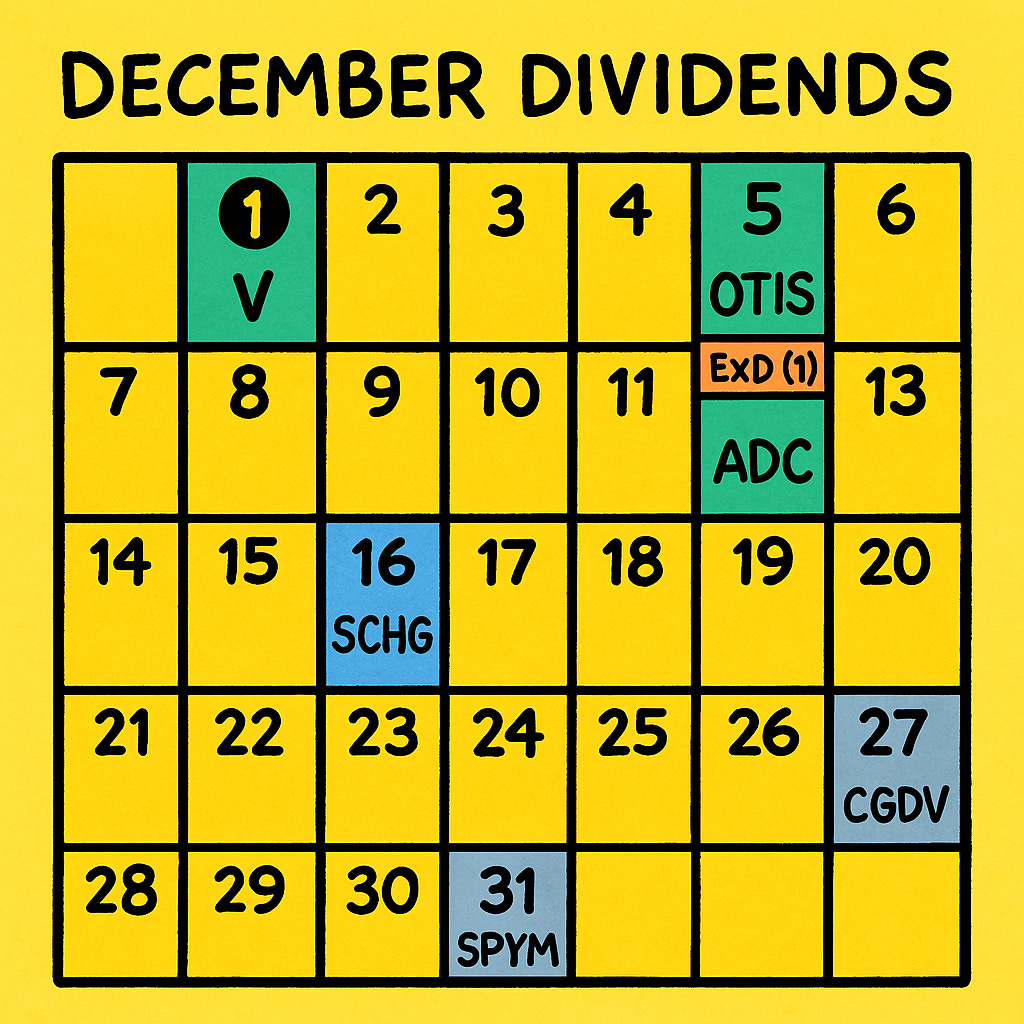

The calendar above shows my dividends for the month of December.

SIX dividend checks from the following stocks:

✅ Visa (V): 3 out of 4 Americans have a credit card. Visa’s market share is around 50%

✅ Otis Worldwide (OTIS): Moves 2.4 billion per day. Companies will continue to be built. As long as real estate exists, elevators & walkways will too.

✅ Agree Realty (ADC): Real estate. Mostly investment-rated tenants like Walmart (WMT), Costco (COST), AutoZone (AZO), etc.

✅ Schwab U.S. Large-Cap Growth ETF (SCHG): Low-cost, growth-focused ETF. High technology exposure that will benefit immensely from AI adoption.

✅ Capital Group Dividend Value ETF (CGDV): Dividend-focused ETF with a yield slightly above the S&P. Outperformed the index over the past 1 and 3 years. Higher technology exposure that typical dividend ETF.

✅ State Street SPDR Portfolio S&P 500 ETF (SPYM): Owns the top 500 largest and most profitable companies in America.

Every stock in my portfolio was purchased with a specific purpose.

Each company has a different job.

I see so many portfolios online overweighted in AI and / or crypto.

Why?

Because they chase the hype, which usually leads to buying overvalued companies. And this often leads to underperformance in the long-term.

This is a quick indication that someone doesn’t know what they own.

That’s not investing, that’s speculating. 🤔

Peter Lynch once said: “If you can’t explain to an 11-year old why you own a stock, then you shouldn’t own it.”

Every check I receive I choose what I want to do with it. Pay bills, vacations, etc. Right now, I choose to reinvest and grow my wealth. 💰

Dividend investing starts out slow. That’s why you don’t hear it talked about often.

Instead, everyone loves options. While you can make quick money, you can also lose that money just as quickly.

With the right strategy and consistency, you can build a solid income stream with dividend investing.

No matter if the market is up, down, around, or even sideways, I still get paid. 💵

Every dividend stock you buy is a step towards your financial freedom. While speculators panic during market volatility, I get to build my income stream at a discount. Being a successful dividend investor takes a different mindset.

Strategy + Patience = SUCCESS

Think of your dividends like a snowball rolling down a mountain. As it picks up steam, that snowball grows larger. As you buy more shares, or companies, your passive income stream grows bigger.

First dividends pay for:

✅ Dinner 🍽️

✅ Groceries 🛒

✅ Car payment 🚗

✅ Vacations 🏝️

And ultimately:

✅Your lifestyle 🏠🏝️🛫

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha 20% off for Black Friday. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

This is not financial advice. I am not a financial professional. This is for educational purposes only. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.