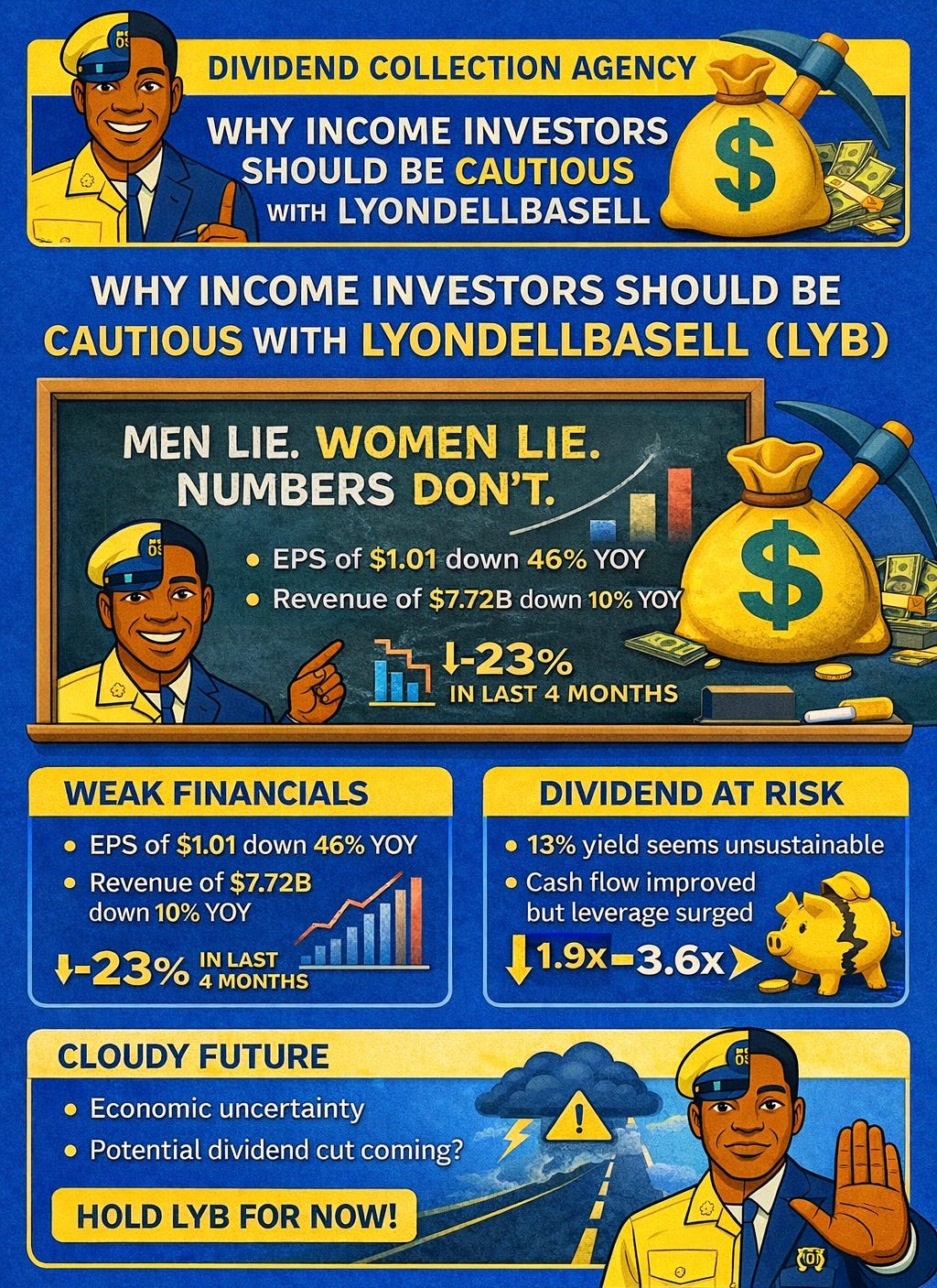

Is LyondellBasel's 13% Yield At Risk?

"Why Investors Should Tread Carefully"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

We’ve all heard the phrase: men lie, women lie, numbers don’t.

In the case of LyondellBasell Industries (LYB), the numbers are telling a very clear story. One of deteriorating fundamentals and mounting pressure on a dividend the market increasingly doubts can be sustained.

While management remains publicly committed to protecting the dividend, investors should recognize that economic uncertainty and prolonged segment weakness could force management’s hand within the next 6–12 months.

Below, I review LYB’s latest earnings, fundamentals, and why income-focused investors should approach the near-13% yield with caution.

Recap: Cautious Since August 2025 ✋🏾

At the time:

The 10% yield appeared attractive

The forward P/E of ~20x looked expensive

Cash flows were deteriorating

Dividend sustainability was already questionable

Since then, the stock has declined another ~23%, while the S&P 500 has risen over 5% during the same period. This confirms that investor concerns were well-founded.

Q3 Earnings: More of the Same 🔁

LYB’s Q3 results reflected continued pressure across the business:

EPS: $1.01 (beat estimates by $0.21)

Still down 46.3% YoY

Revenue: $7.72B

Down 10.2% YoY, despite a $330M beat

Management pointed to incremental improvements, but the financials contradict the optimism. While lower interest rates may eventually provide tailwinds, meaningful benefits are unlikely for another 9–12 months.

But the company did note improved polyethylene demand:

+2.5% overall

~3% in Europe

However, demand improvements have yet to translate into sustained earnings recovery.

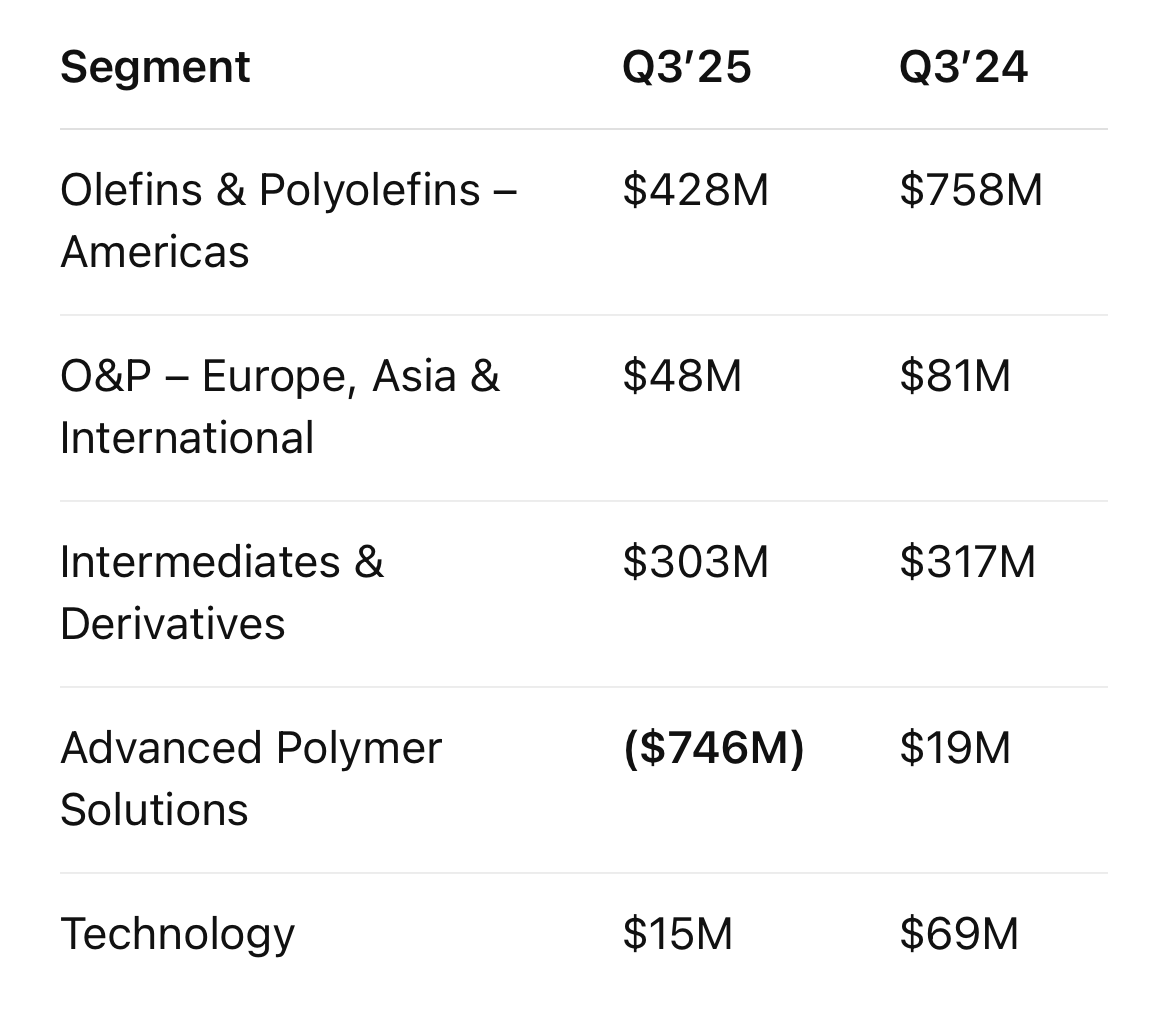

Segment Performance Remains Weak 👎🏾

Quarter-over-quarter, EBITDA improved due to a 23% increase in polyethylene margins, driving a 35% QoQ EBITDA increase. Still, this wasn’t enough to offset broader segment deterioration.

All five segments posted declines, driven largely by impairment charges:

Key issues:

$411M impairment in International O&P

$782M impairment in Advanced Polymer Solutions

Net loss of $746M in APS alone

Can LYB Sustain the Dividend? 💵

This is the core issue for income investors.

At current prices:

Dividend yield ≈ 13%

For a blue-chip chemical company, this is often a warning signal, not an opportunity

Some positives:

Cash from operations rose from $700M → $983M

Dividends paid: $443M

Improvement driven by lower CAPEX

Management expects:

~$600M in annual cash flow

$150M in YTD cost savings

Near-term, I believe the dividend is likely safe. Medium-term, the risk rises meaningfully if segment recovery stalls. This mirrors what we saw earlier this year with peer Dow Inc. (DOW), which ultimately cut its dividend.

Balance Sheet: Flexibility, But Rising Leverage ⚖️

Liquidity remains adequate:

$1.8B cash & equivalents

$6.5B total liquidity

However, leverage is trending the wrong way:

Net debt / EBITDA:

1.9x last year

3.6x at end of Q3

Rising leverage during earnings weakness is a major red flag for dividend investors.

A Tempting Yield—With Too Much Risk ⚠️

Buying beaten-down stocks can lead to long-term outperformance. But LYB’s risks outweigh the reward at this stage.

Before considering a position, I think it’s important to see:

Sequential improvement across segments

Meaningful reduction in leverage

Clear evidence the turnaround is gaining traction

If a dividend cut occurs—even if partially priced in—I expect additional downside, potentially pushing shares below $40 to new 52-week lows.

Final Thoughts ✅

LyondellBasell’s biggest risk is dividend sustainability. Despite management’s confidence, a cut becomes increasingly likely within 6–12 months if operational performance fails to improve.

Lower interest rates may help. But likely not until late 2026 or 2027. Until then, protecting the balance sheet may take precedence over preserving the dividend.

I think the yield is tempting.

I think the downside risk is greater.

What do you think?

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.