Looking For Income? Collect It Weekly From Crypto

If You're Bullish On Crypto, This Weekly-Paying ETF May Be A Hidden Gem

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

November & December, so far, have been rough for crypto investors.

Bitcoin (BTC-USD) slid sharply from its highs, dragging down AI- and crypto-exposed stocks with it. While I don’t currently own any crypto, it’s been on my radar for a future all-income portfolio. And one standout I’ve been eyeing is the Nicholas Crypto Income ETF (BLOX).

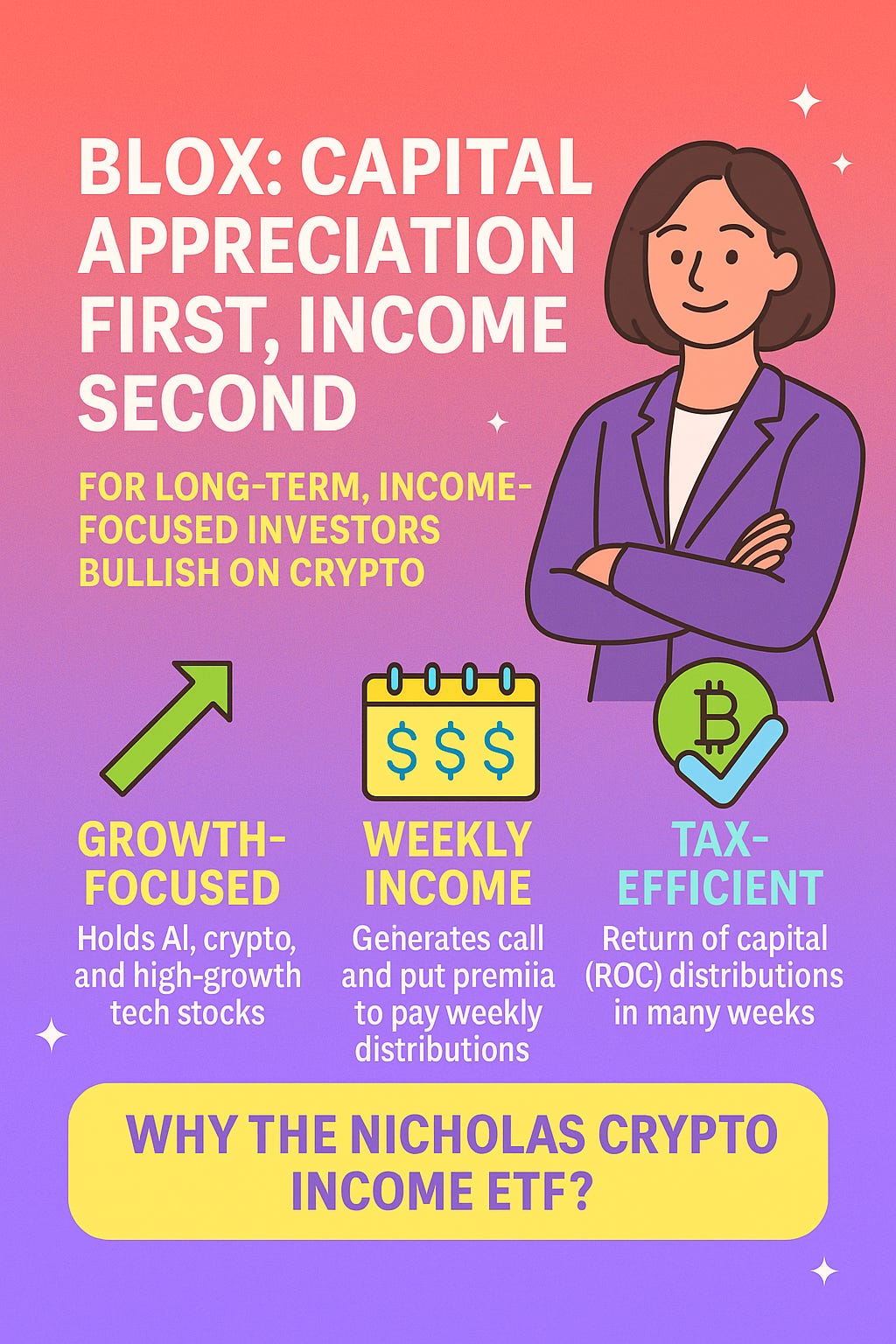

Unlike traditional covered-call ETFs that prioritize income at the expense of upside, BLOX uses a growth-first, income-second strategy. After the recent pullback, now may be an attractive entry point for long-term income investors bullish on crypto.

Why BLOX Is Different ⛓️

Most covered-call ETFs cap upside to maximize income. BLOX does the opposite.

Key features:

Growth-focused holdings include: Nvidia (NVDA), Taiwan Semiconductor Manufacturing Company Ltd (TSM), Coinbase Global Inc (COIN), Robinhood Markets Inc (HOOD)

Exposure to BTC-USD & Ethereum (ETH-USD) through ETFs: iShares Ethereum Trust EFT (ETHA), VanEck Bitcoin (HODL), & Fidelity Wise Origin Bitcoin Fund (FBTC)

Weekly income generated from call spreads, covered calls, and put selling

Most payouts are return of capital (ROC), making it tax-friendly 👍🏾

Even with a short track record after launching in June 2025, NAV performance has been strong:

1-month NAV: +16.95%

3-month NAV: +25.48%

This far exceeds the NAV performance of its peer, YieldMax Crypto Industry & Tech Port Opt Inc ETF (LFGY), which has lost roughly 30% since inception in January 2025.

What’s the Draw Today? 🃏

Crypto and AI stocks were hit hard in November. While sentiment is negative, the declines appear more like a reset after a massive run rather than a fundamental shift.

For long-term investors, this creates opportunity. 💡

BLOX’s combination of:

Growth potential

Weekly income

Tax-efficient ROC distributions

All this makes it appealing for income-focused investors who still want upside exposure.

Risks to Consider ⚠️

BLOX is higher risk than traditional income ETFs because:

Crypto is highly volatile

Prolonged downturns can force the fund to pay from NAV, leading to NAV erosion

High expense ratio (1.03%)

Investors should be prepared for sharp swings & potential income variability in bear markets.

Bottom Line ✅

BLOX’s early results suggest its growth-first approach may outperform higher-yield options over time. While recent volatility has pressured its share price, the ETF’s strategy and weekly income make it worth considering. Especially, if you believe in the long-term growth of crypto and related technologies.

For bullish, income-focused investors, Nicholas Crypto Income ETF (BLOX) could be a compelling addition to any portfolio.

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha 20% off for Black Friday. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

This is not financial advice. I am not a financial professional. This is for educational purposes only. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.