One Of The Best Stocks For Monthly Income

“Collecting Monthly Income From REITs”

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

As primarily an income investor, REITs play a huge role within my portfolio. I’ve always preferred the idea of earning passive income through the stock market vs physical real estate.

REITs are often overlooked by investors because of their typical low growth. REITs, on average, see about 3% to 4% growth. Some may see higher growth, but investors should expect 3% to 4%.

And they don’t see extreme price swings like Technology stocks; they’re more like the tortoise & the hare.

Their main objective should be for providing income. That’s why they’re popular with retirees. Boring, but they provide slow & steady income streams.

And the one mentioned today, Agree Realty (ADC), happens to be one of my favorites that pays monthly.

ADC was actually one of the first stocks I analyzed back in 2023 when I was just starting out on Seeking Alpha. At the time, I would constantly get comments about how REITs were unattractive because they were highly sensitive to interest rates.

And while this is true, quality stocks never stay down long. And as an investor, you should see this as an opportunity.

Back in May of 2023, I compared Agree Realty to the popular, monthly-paying Realty Income (O). I said that I viewed ADC as more attractive although they were less popular. All in all, I just thought they were a better quality REIT.

Then, ADC had a share price around $65 a share and O $59 a share. Both dropped significantly in October of 2023. Agree Realty fell to around $54, while Realty Income dropped to around $47.

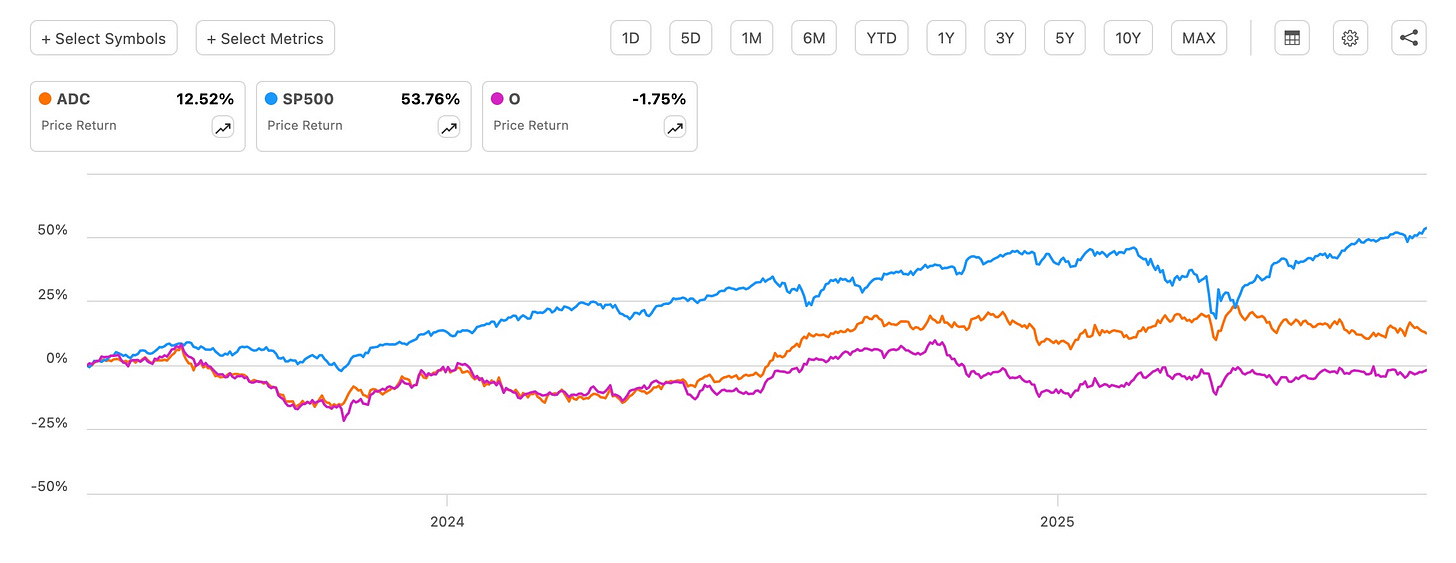

The chart below shows their price returns since May of 2023. ADC is up 12.53% while O is actually down roughly 1.5%. The S&P has continued to climb, up nearly 54%. So, this is one reason why investors prefer to stay away from REITs, their slow growth.

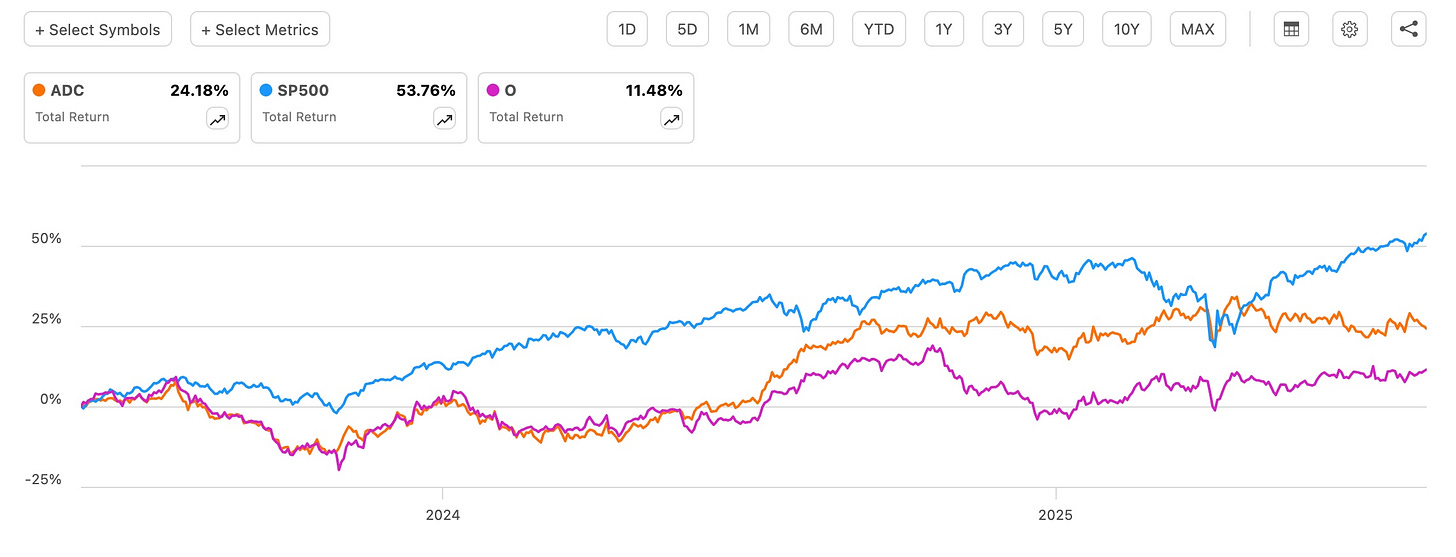

But if you buy at the right price like any stock, REITs can be very rewarding. The chart below shows their dividends, or total returns since May 2023. Still, investors may consider these disappointing in comparison to the S&P.

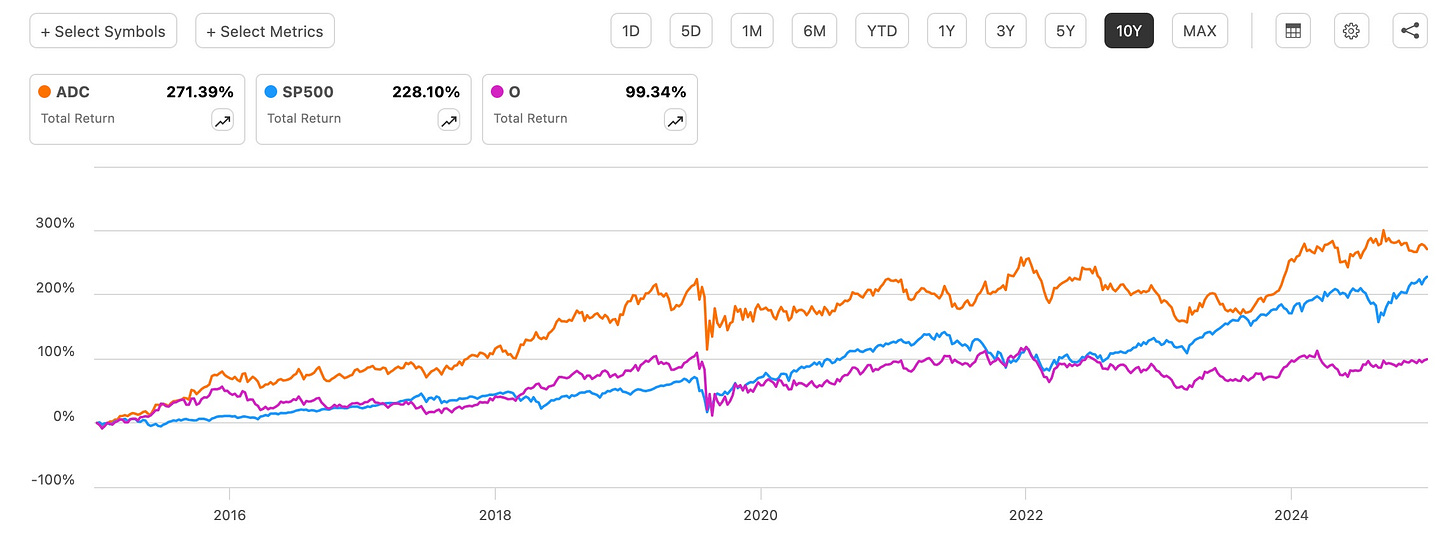

But here’s an example why Warren Buffett said stocks are very unsafe for tomorrow and safer for the long run. Over a 10-year period, Agree Realty has outperformed the S&P and Realty Income in total returns, up over 271% compared to 228% for the index and just 99.34% for O.

And going forward I expect Agree Realty to outperform both the S&P and Realty Income. ADC recently had their credit rating upgraded to A- by Fitch. Think of this like a credit score. The higher the score, the better interest rate you’re likely to get. With the addition, ADC is 1 of only 13 REITs with a credit rating of A- or better.

So, this will give Agree Realty better and cheaper access to capital for growth over the long run. This could also positively affect the share price, meaning they could see strong upside over the next few years.

ADC reached a 52-week high around $80 a share. O’s 52-week high is $64.88. While REITs typically offer lower growth, my cost basis on Agree Realty is around $58 a share. So, from $58 to $80, I saw a near 38% gain in just price. My point is buying at the right price and holding long-term is how you build wealth over time.

And in the next two years I think Agree Realty will be in the mid $80’s, or even higher. So, no REITs won’t see strong price appreciation like a Tesla (TSLA), NVIDIA (NVDA), Microsoft (MSFT), or Walmart (WMT). But they will provide stable, and reliable income.

And because Agree Realty leases and collects rent from companies like Walmart, Starbucks (SBUX), Costco (COST), and Auto Zone (AZO), the likelihood of them continuing to deliver strong total returns is highly likely.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Solid breakdown. ADC’s stability and upgraded credit rating make a strong case for long-term income investors who value dependable returns over flashy growth.

Keep up the good work!