Perspective Of The Week

High Risk = High Reward

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

And I want to help you do that by investing in stocks that pay dividends.

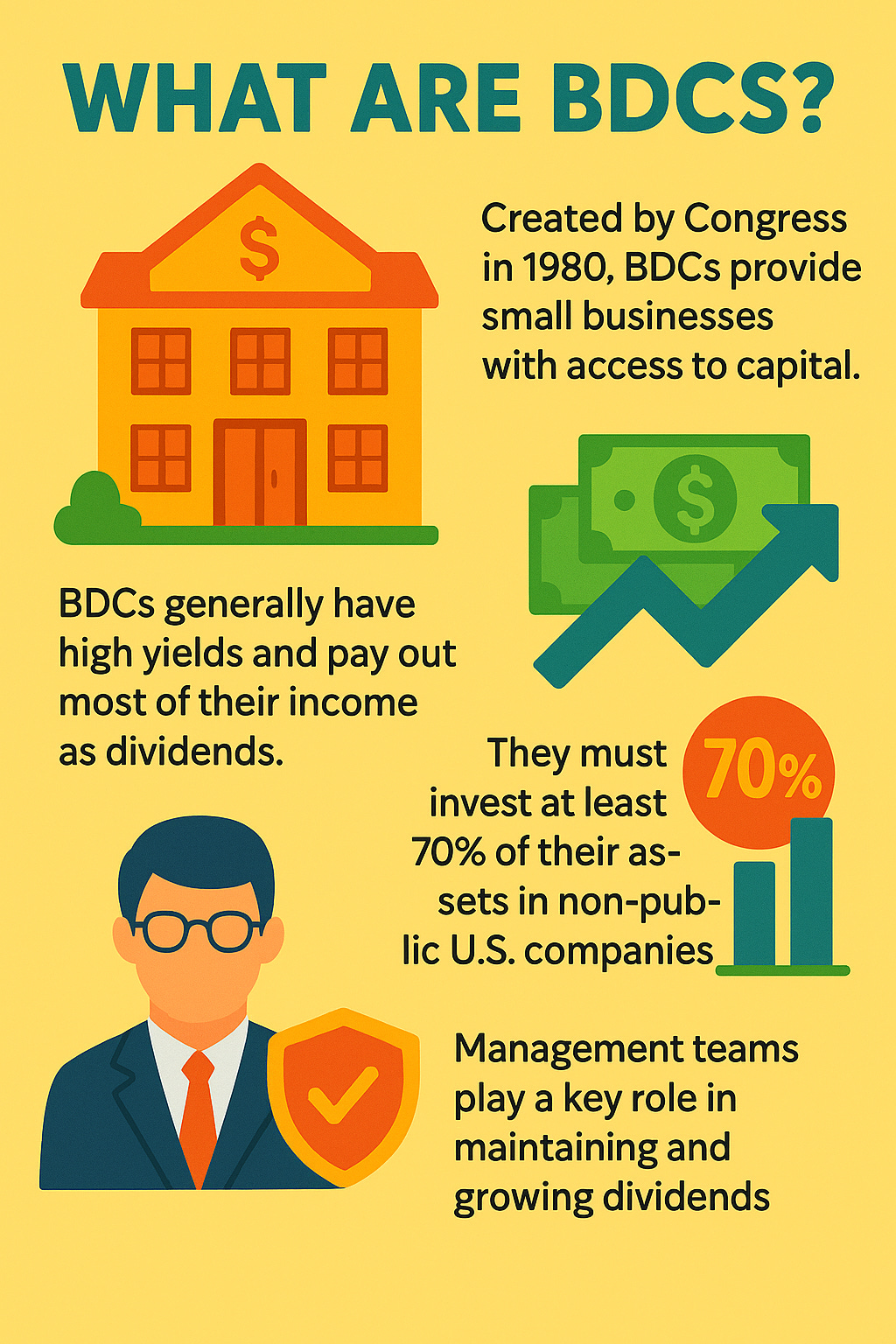

BDCs, or Business Development Companies are some of the most slept on investments in my opinion. While many investors view them as risky due to their business models, I view them as opportunities because of their significantly higher yields.

The S&P average yield is around 1.5%. In short, this means you need to invest a significantly higher amount of capital to receive a solid stream of income. Because BDCs have yields in the 8% - 9% range, you need less to receive more.

Like any sector, there are quality and not so quality companies. The same is true when investing in BDCs. So, you have to be careful when chasing those high yields. If you’re currently retired or looking for income right now, these are particularly attractive.

As previously mentioned, BDCs are viewed as risky and the reason being is that most of their investments are in smaller, private companies. And some of these companies are sometimes financially distressed due to their smaller sizes, which is also why many view them as riskier and standard banks are less likely to provide loans to them.

A few of my favorites are:

Ares Capital (ARCC): Price $23.07 Yield 8.36%

Blackstone Secured Lending (BXSL): Price $32.55 Yield 9.56%

Capital Southwest (CSWC): Price $23.26 Yield 11.88%

Essentially, BDCs are high risk - high reward investments. But in life, we have to take risks to get where we want to go.

Like & subscribe if you’re active duty, a veteran, or just love investing.