Perspective Of The Week

"Outpace Inflation By Owning Quality Dividend-Paying Companies"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

Even if you’re not an avid investor, you’ve likely heard the word inflation thrown around the past few years. As a result of the pandemic in 2020, inflation seemingly grew out of control due to the rapid printing of money. And prices to rose significantly as a result.

This led to the Federal Reserve raising interest rates their fastest in history from 2022 to 2023. And although the FED has lowered rates a total of 100 basis points since, the President’s tariffs have led to increased uncertainty surrounding how long interest rates will remain elevated.

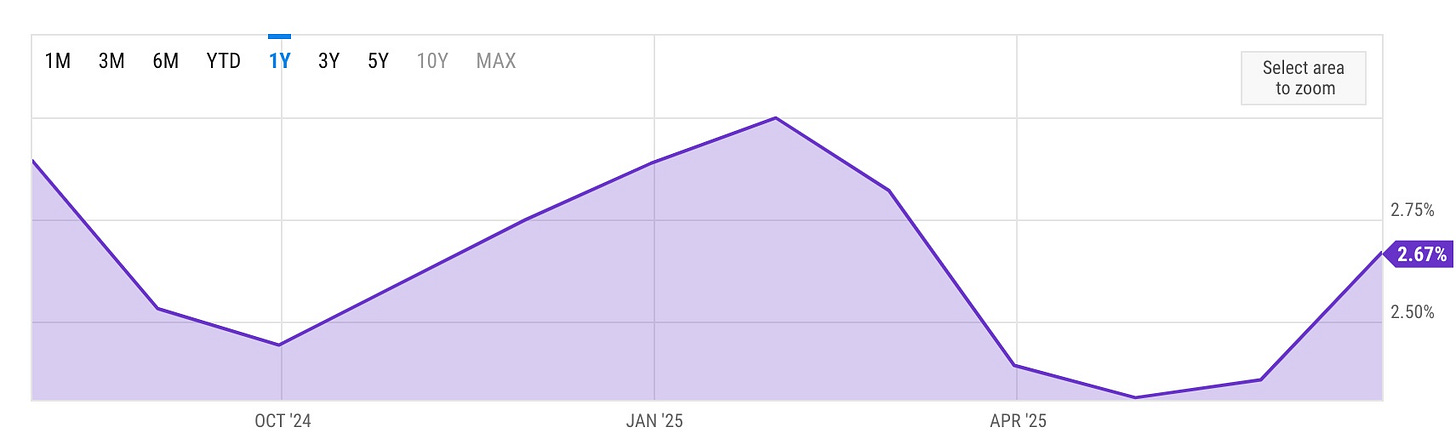

In the chart below, you can see how inflation has risen since April, when President Trump implemented tariffs during Liberation Day. The current rate of inflation sits at 2.67%. And with more tariffs expected to come online next month, inflation could rise further in the coming months.

If so, the anticipated two rate cuts we were expected to see will likely not happen. In short, this means the prices of goods will likely get more expensive and the cost of borrowing will remain higher for longer. Meaning home, auto, business, and personal loans will have higher interest rates.

This will also impact businesses as they typically borrow money (debt) to grow. And as a result, this could have a negative impact going forward as they will have to pay higher amounts of interest on borrowed debt, cutting into earnings.

So the moral of the story is putting your hard-earned money in a savings account thinking that it is safe is a sure-fire way to destroy your wealth.

If you want to play it safe, sure you can place your money into a CD or high yield savings and safely collect a higher rate, around 4% - 5%. But as interest rates come down over time, so will CD and high-yield savings rates.

But one way to consistently beat inflation is by owning quality dividend stocks.

As previously mentioned, the current rate of inflation is 2.67%. Below are 3 stocks that I own that not only have significantly higher yields than the current rate of inflation, but that have given me pay raises above the rate of inflation in the past year.

Pepsi (PEP): Dividend yield 3.83%

Last dividend increase 5% to $1.4225 a share in February 2025.

Altria (MO): Dividend yield 6.82%.

Last dividend increase 4.1% to $1.02 a share in August 2024. Expecting another $0.02 - $0.04 raise next month.

U.S. Bancorp (USB): Dividend yield 4.32%.

Last dividend increase 4% to $0.52 a share in July 2025.

While dividends are never guaranteed, high quality companies usually raise their dividend every year, similar to a pay increase at your job. The difference is you don’t have to do any work, just buy & hold to collect a steady stream of income.

Owning non-dividend paying stocks like Amazon (AMZN) and Tesla (TSLA) are also great companies to own to grow your wealth, but stocks that pay dividends can help you grow your wealth while also outpacing inflation.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Keep posting great content. This was excellent.