Perspective Of The Week

Knowing What You Own And Why You Own It

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Peter Lynch:

People are very careful; they spend hours getting $50 off on airplane flight. They look at everything and then put $10,000 in some crazy stock they heard on the bus. They have no idea what they’re doing… You buy good companies. Some work. You have to know what they do.

When it comes to investing it’s very important for investors to know what they own and why they own it. However, this isn’t easy and like anything, this takes time, effort, and often experience.

One of my favorite sayings is: TIME IN THE MARKET BEATS TIMING THE MARKET.

As a dividend investor, every company in my portfolio’s job is to pay me passive income. But how they do that job depends on the stock. Some are more growth- focused to generate income long-term, while others are used to generate income now. I developed this strategy for long-term success.

So, every time I choose a stock for my portfolio, I ask myself, “How will it fit in my portfolio?” “Does it do the job I need it to do?”

And this has helped me curb my emotions. Assigning a job to each company helps manage expectations. Every company is not going to grow like NVIDIA Corp (NVDA), or pay like Verizon (VZ).

Some of my dividend stocks are expected to provide strong, high single- to double-digit growth, while others are expected to provide me with little to no growth. Think REITs or BDCs. Those are my income vehicles. And this [income] is used to buy more growth-oriented stocks.

This brings me to the point of this article. You need to know what you own and why you own it. In the current high interest rate environment, many companies are feeling financially-distressed.

But high interest rates also benefit some sectors like the BDC [sector] (BIZD). And this is why BDC prices rose as investors looked to the sector for income and capital appreciation.

For example, Ares Capital (ARCC), the largest BDC, performed well from 2022 to the beginning of this year. From 2022 to 2023 the Federal Reserve raised interest rates their fastest in history to battle inflation. And kept rates steady until September of 2024.

Fast-forward to today, and ARCC & its peers have faced some headwinds, a result of lower interest rates and a stressed economy. So far, the FED has lowered interest rates 4 times (since 2022).

And this has resulted in lower interest collected on BDC loans, thus impacting their share prices negatively as investors fear many being forced to cut their dividends.

If you bought BDCs because of their high yields without knowledge of economic impacts to the sector, or heard about them on the bus as Peter Lynch would say, this would have caused you to react emotionally to their sell-off.

But for experienced investors with knowledge of how BDCs work, a sell-off should have been expected. And if you’re someone who invests for the long-term, then the price dips should have been viewed as an opportunity to buy more.

Many know BDCs act as banks for private companies. They make money by borrowing debt at fixed rates and lending to companies at floating rates. In short, the higher interest rates are, the more interest income BDCs collect. And vice versa.

When interest rates are gradually lowered like now, this typically results in tighter dividend coverage, negatively impacting share price performance.

BDCs have higher yields and are required by law to pay out most of the income they collect in dividends. This is why they are popular with retirees and income-focused investors.

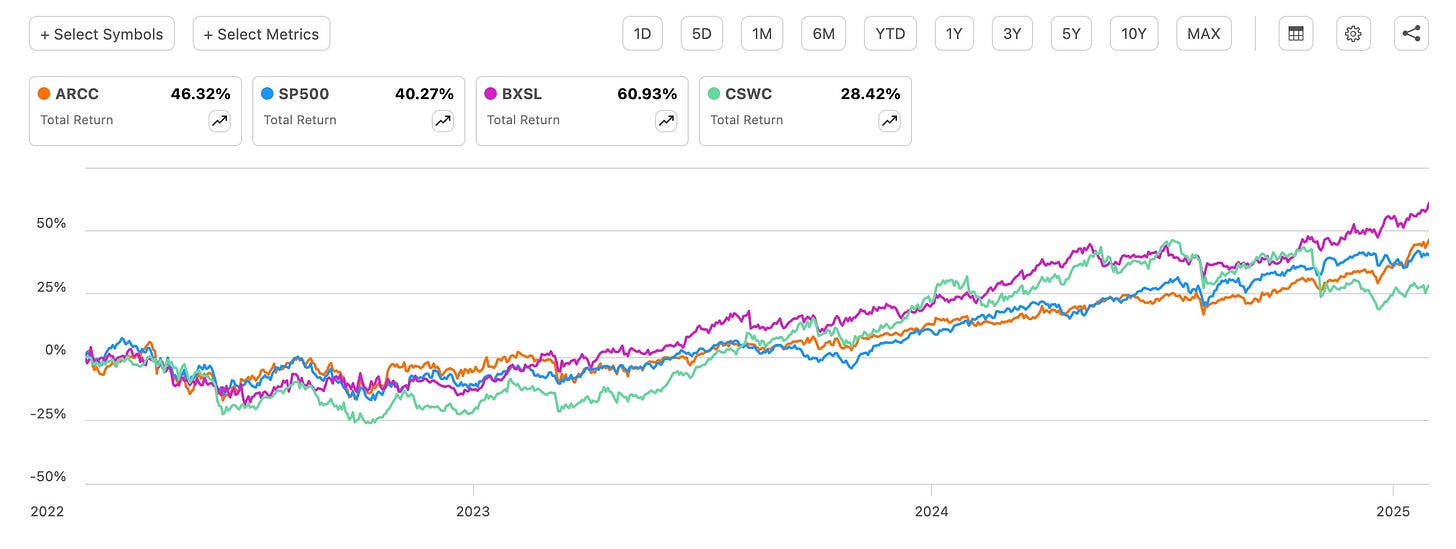

As I said, in a high interest rate environment, quality BDCs perform well. In the chart below, you can see that from March of 2022 to the beginning of 2025, some BDCs even outperformed the S&P (SP500).

Including dividends, ARCC outperformed the index, up 46.32% compared to 40.27%. My third favorite BDC, Blackstone Secured Lending (BXSL) outperformed the entire group, up nearly 61%. Capital Southwest (CSWC) also performed well.

When the FED lowers interest rates, this results in less income collected. Elevated rates can also lead to financial distress for BDC borrowers, which also lowers [BDC] income.

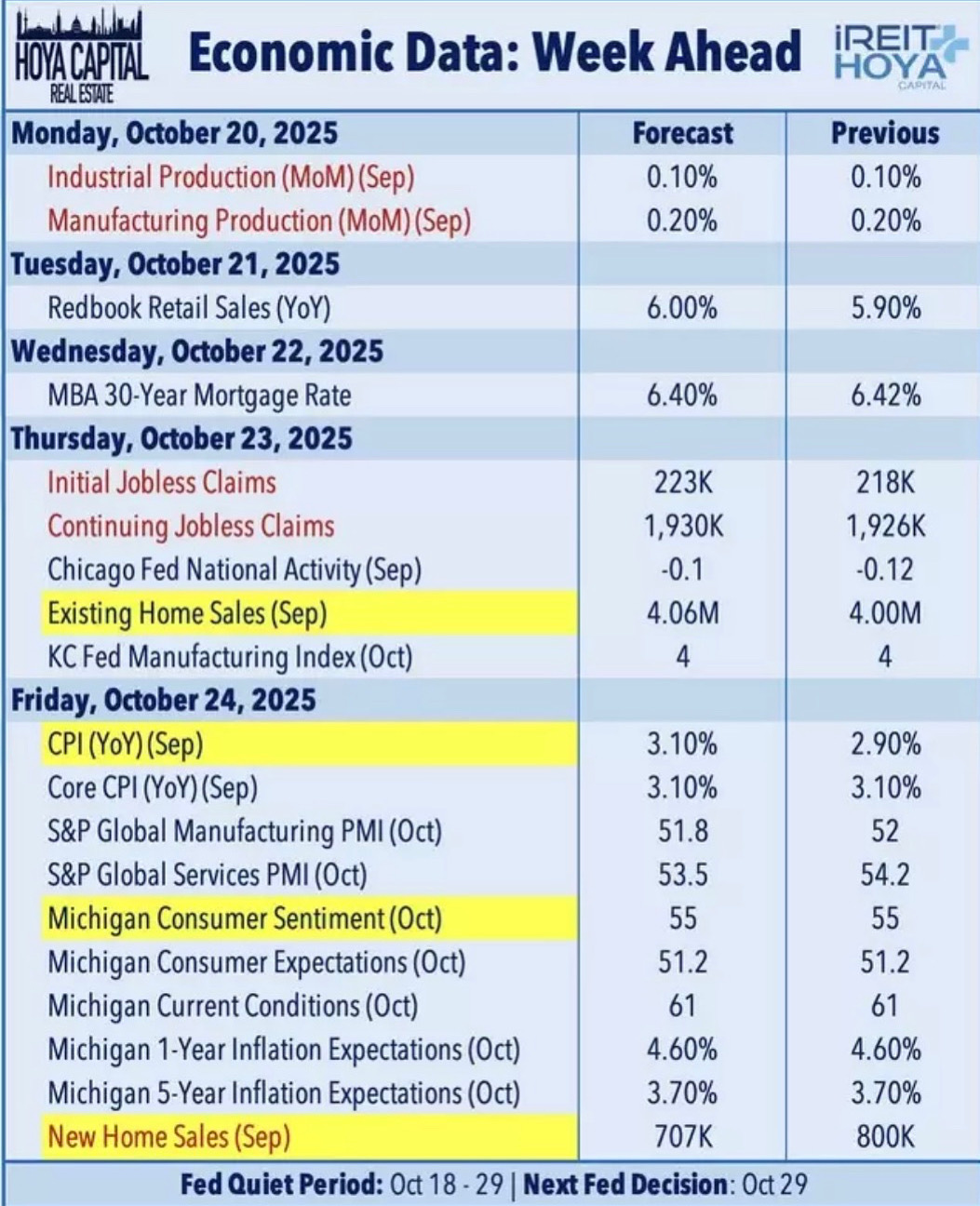

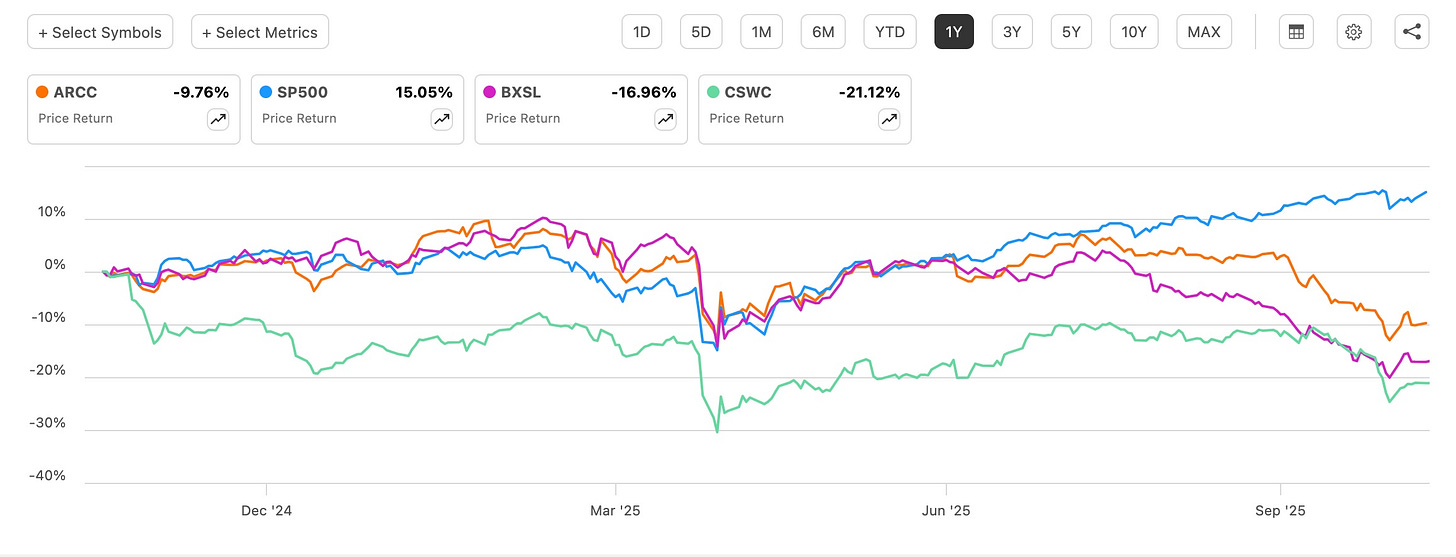

The FED started lowering interest rates in September of last year with a 50 bps cut. So far in 2025, they’ve lowered rates once with two more cuts expected this month and December. The stock market is a forward-looking machine, meaning it usually prices in good or bad news beforehand.

And this is evident by BDC performances in the last year. ARCC, BXSL, & CSWC are all in the red, while the S&P is up roughly 15%. This is why I say it’s prudent to know what you own and why you own it. Economic factors that impact your holdings are also important.

This helps you curb your emotions and make sound investment decisions. And this not only goes for BDCs or dividend-paying stocks; it’s for any type of investment.

If you’re looking to start investing check out our investment group over on Seeking Alpha for 2 weeks FREE. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Like & subscribe if you’re active duty, a veteran, or just love investing.

The emphasis on taking a simple approach and genuinely understanding what you own is a critcal reminder for anyone pursuing financial independence, and I truly value this insightful perspective.