Perspective of the Week

"Dividends Are Real Money"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

And I want to help you do that by investing in stocks that pay dividends.

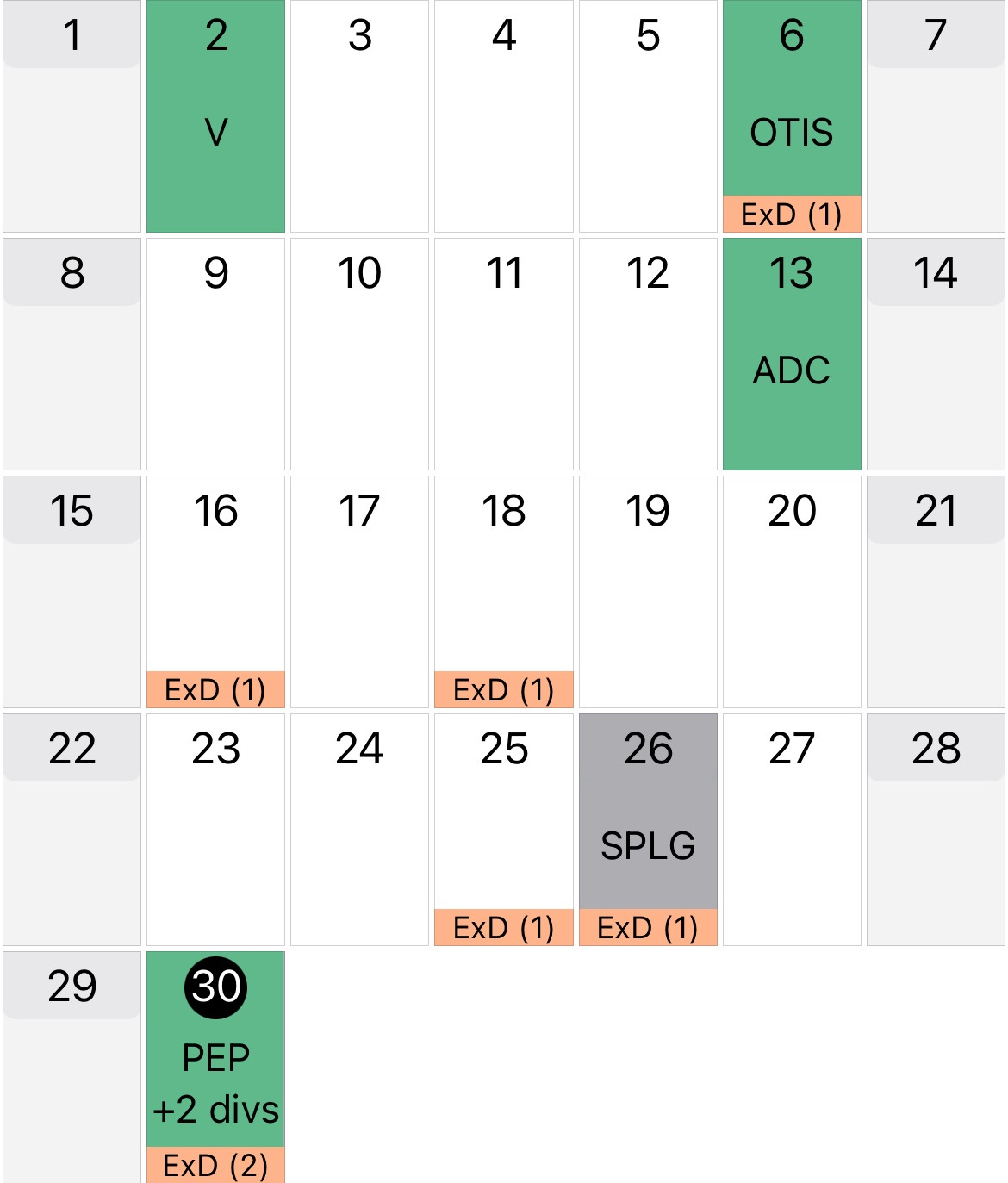

Today, June 30th, I received four dividend checks to close out the month. When I was building my portfolio, my goal was to buy quality stocks that I assumed would pay me for years to come.

While dividends aren’t always guaranteed, buying quality stocks with strong cash flows enables a company to not only pay consistent dividends, but grow them over time as well.

When I began dividend-investing, I also wanted to emulate as close as possible my active duty pay schedule. Getting paid every two weeks. Just like I did when I was working.

I knew that when I retired, my military pension was only going to come once a month, so that could take some getting used to.

While I don’t typically get paid bi-weekly, I do receive multiple dividend checks, depending on the month. Sometimes I receive dividends nearly bi-weekly, sometimes once every week, sometimes they’re bunched together (like next month), and other months it’s more scattered like this month.

Some of these I reinvest back into the same company, and others I receive and invest them where I see fit. And usually, this mean reinvesting them back into positions I’m still building, or ones I consider undervalued at the moment.

The four stocks I received dividends from today were:

Pepsi (PEP)

Schwab U.S.Large-Cap Growth ETF (SCHG)

Schwab International Dividend Equity ETF (SCHY)

SPDR Portfolio S&P 500 ETF (SPLG)

Although the screenshot from my app says SPLG paid me on the 26th, I actually received dividends from them today.

Additionally, because I hold these in a taxable account, I can use my dividends for bills, vacations, etc. As previously mentioned, all my dividends get reinvested back into the portfolio as of now. But because I hold them in a taxable account, I can use them in case of an emergency and not get penalized if I held them inside, let’s say a Roth IRA.

So, while dividend investing may be viewed as boring as your dividend snowball takes time to grow, every little bit counts. And reinvesting your dividends speeds up the process. Furthermore, this is a step closer to financial freedom. Remember, nothing is more important than time.

There’s a reason why the rich & successful always say:

TIME IS MONEY.

Like & subscribe if you’re active duty, a veteran, or just love investing.