Perspective Of The Week

Get Paid From Credit Cards Like Buffett

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

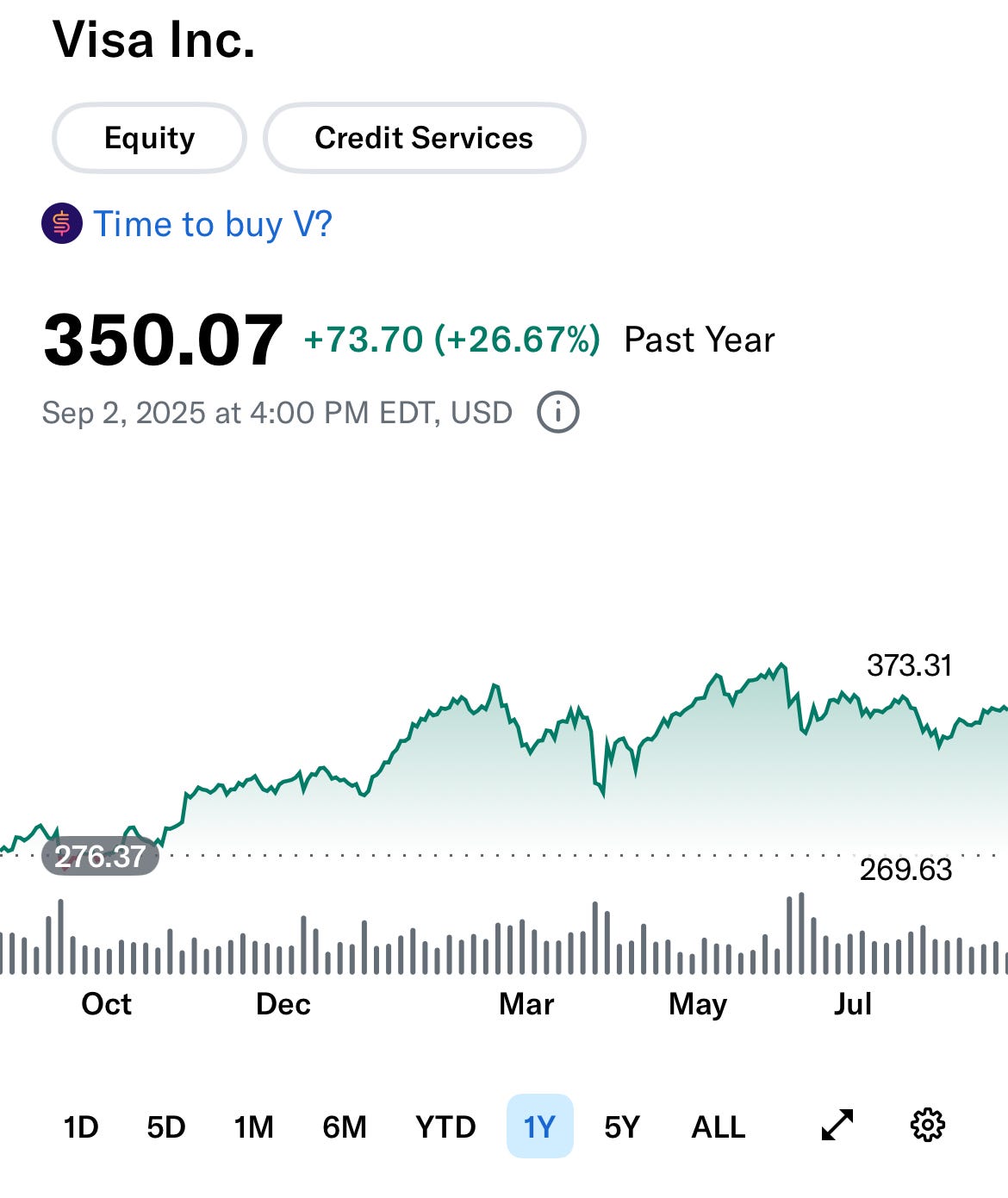

Today I received dividends from one of my favorite dividend growth stocks, Visa (V) as you can see from the chart below. Aside from Visa, I’m set you receive 5 additional dividend checks this month, making September one my largest month of the year in dividends.

But today I want to discuss why I own Visa. Currently, Visa is one of my largest positions in my portfolio by cost basis. In the chart below you can see Visa is up 73.70% in the past year.

My cost basis on Visa is $266 a share, so I’m up close to 32% since I bought. As a dividend-focused investor who seeks both income & growth, Visa’s main purpose in my portfolio is long-term capital appreciation. Because of the price, the stock currently has a yield of less than 1%, currently lower than the S&P average.

For investors looking to live off income, Visa may not be a good fit inside your portfolio. But for those who are more growth focused, or looking for long-term capital appreciation to go along with a growing dividend, then Visa just may be right for you.

Below you can see over the past 5 years Visa has underperformed everyone’s favorite ETF, Vanguard’s S&P 500 ETF (VOO) in total returns, up 67.60% compared to 92.90% for the latter.

But over the longer-term, Visa has significantly outperformed the ETF, up 430.54% compared to 288.95%, showing why they’re one of the best long-term stocks for growth. This also shows why stocks are better held for the long run.

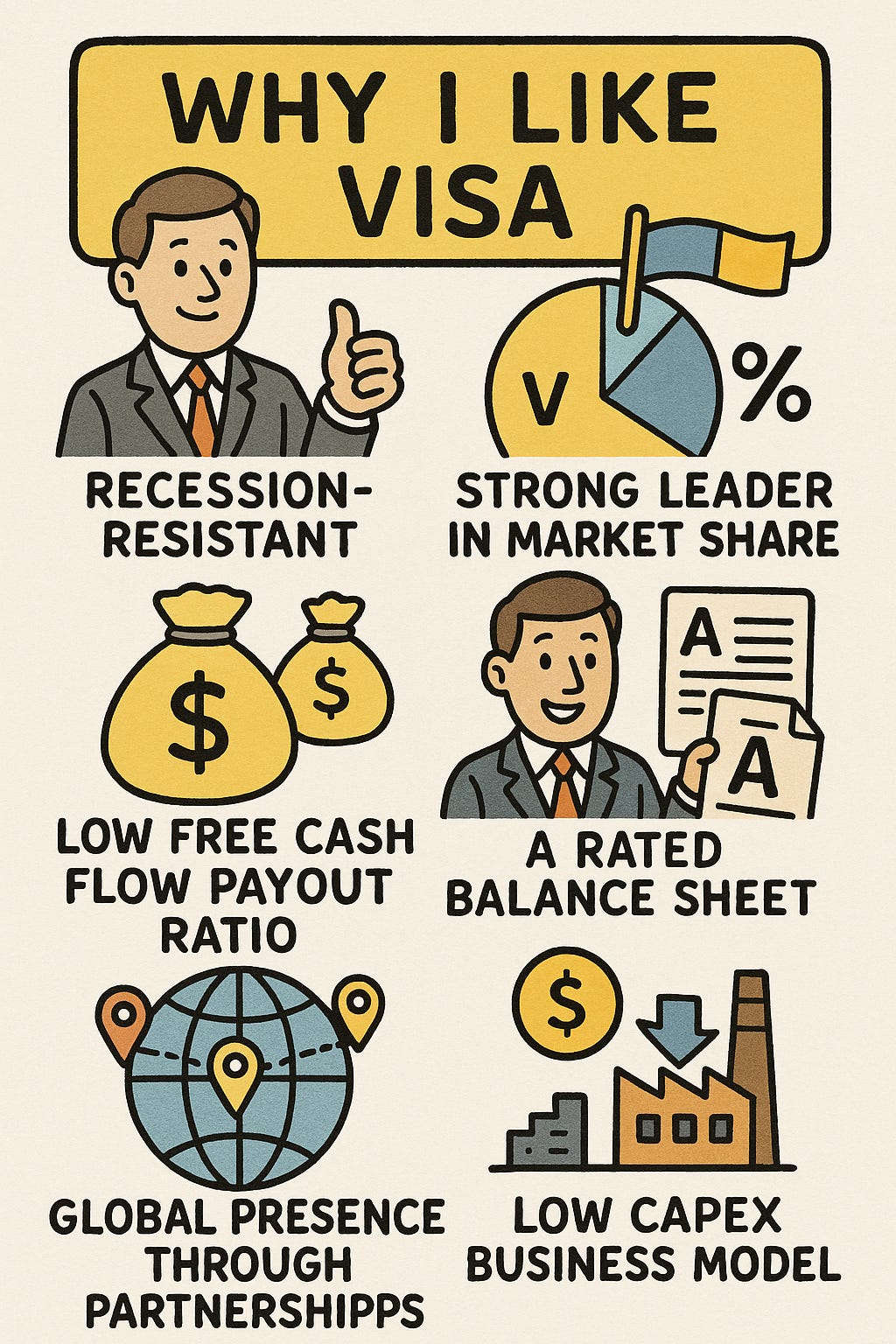

And while past performance doesn’t guarantee future performance, Visa’s fundamentals suggests they are likely to continue dominating and seeing strong returns for the foreseeable future.

Visa, along with Mastercard (MA) and American Express (AXP) are three of the major credit card companies. Additionally, Visa accounts for nearly 37% of all credit cards in circulation and has a market share of 52.2%. They also process over 60% of debit card transactions in the U.S.

So, whenever consumers swipe their credit or debit cards, Visa shareholders like myself get paid. Moreover, it’s likely that most adults hold either a credit, debit, or some kind of card that processes their payments through Visa.

Unlike AXP, Visa & MA are payment processors while AXP is both a processor & issuer, meaning Visa doesn’t hold consumer debt. So, the company isn’t impacted by rising credit card or impacted by financially-constrained consumers like American Express. They can experience less transactions however.

The chart below sums up why Visa continues to be one of the best growth stocks and one of the best performers inside my portfolio. Because credit card companies are great long-term stocks that typically experience higher growth in the double-digits, this is also likely the reason Warren Buffet owns all three companies.

And most importantly, because Visa’s free cash flow payout ratio is typically in the low teens, the company is likely to continue rewarding me with strong, double-digit pay raises every year for the foreseeable future.

Like their peer Capital One Financial Corporation’s (COF) slogan, What’s in your wallet? If you’re reading this, there’s a high probability you hold a Visa card of some sort. And as a dividend investor and Visa shareholder, it’s great to get paid from consumer transactions.

Like & subscribe if you’re active duty, a veteran, or just love investing.

I love how you make this simple to understand! Investing is something I’m interested in but quite frankly, it’s over my head 😅