Perspective Of The Week

"Own A Piece Of The S&P For A Fraction Of The Price"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Many investors are familiar with the S&P (SP500). Warren Buffet often mentions investing in a low-cost index fund that follows the index. While many people have likely heard him mention this, how many have asked themselves the question of why he mentions this?

Index funds are those that follow major (indexes) like the S&P, Dow Jones Index (DJI), or the Nasdaq (NDAQ). The S&P consists of the top 500 companies on the stock market, so it’s often considered the benchmark.

Because of the index’s popularity, investors often pile into popular ETFs that follow it like Vanguard’s S&P 500 ETF (VOO) & SPDR S&P 500 ETF (SPY). And while these two ETFs are much more popular with investors, both trade over $500 a share.

Current price of VOO: $596

Current price of SPY: $648

Alternatively, another fund that follows the S&P is the SPDR Portfolio S&P 500 ETF (SPLG) that has a current price of $76.29 at the time of writing. While the ETF is much smaller with $82.62 billion in assets under management compared to $1.33 trillion for VOO, and $651.87 billion for SPY, SPLG’s performance has mirrored VOO & SPY.

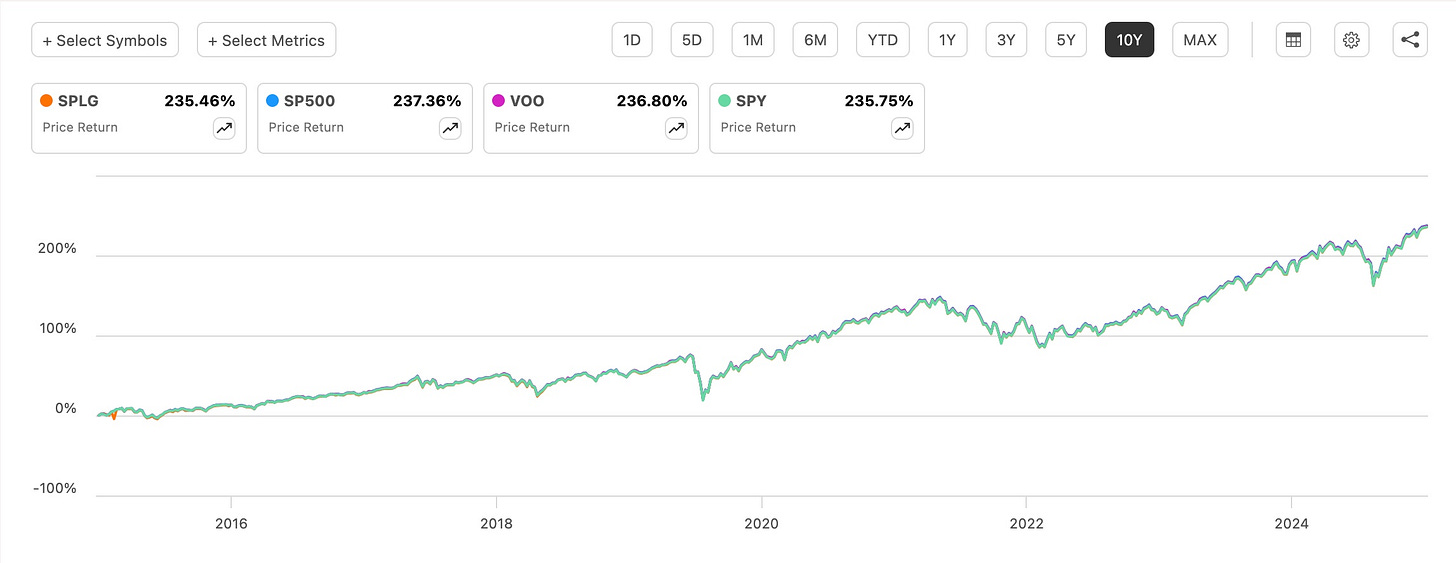

Below is a chart of each fund’s performance in terms of price appreciation over the past 10 years.

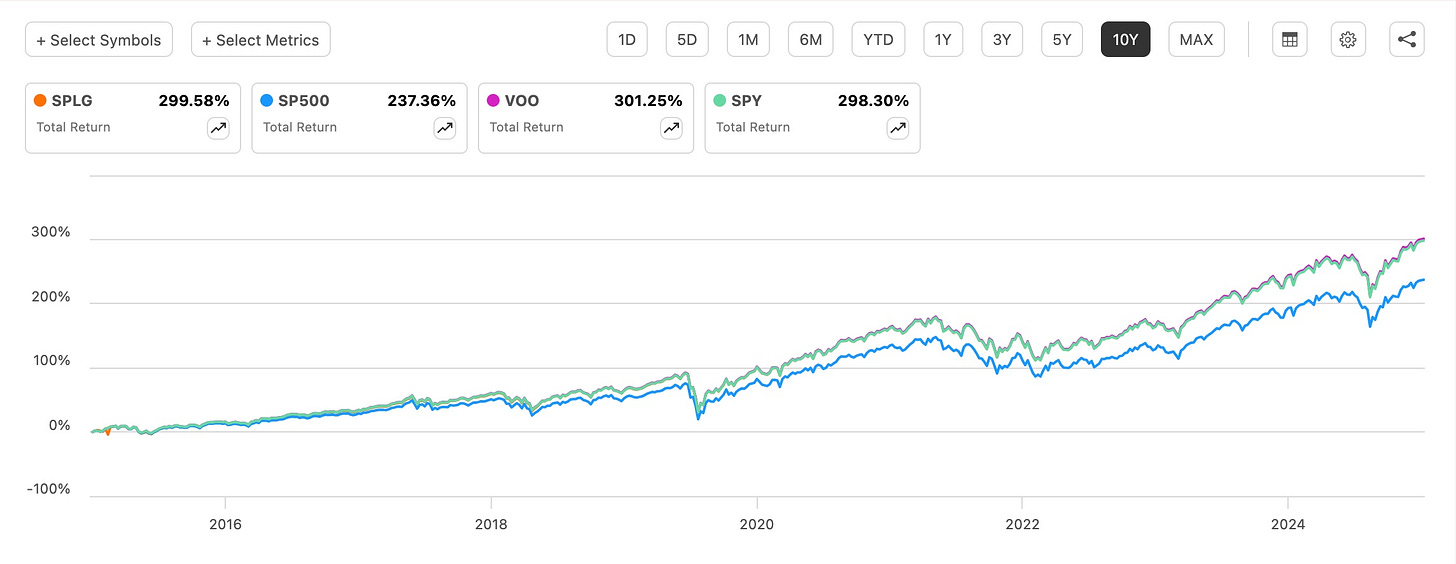

And below are the total returns over the past 10 years. VOO has beaten SPLG by less than a percentage.

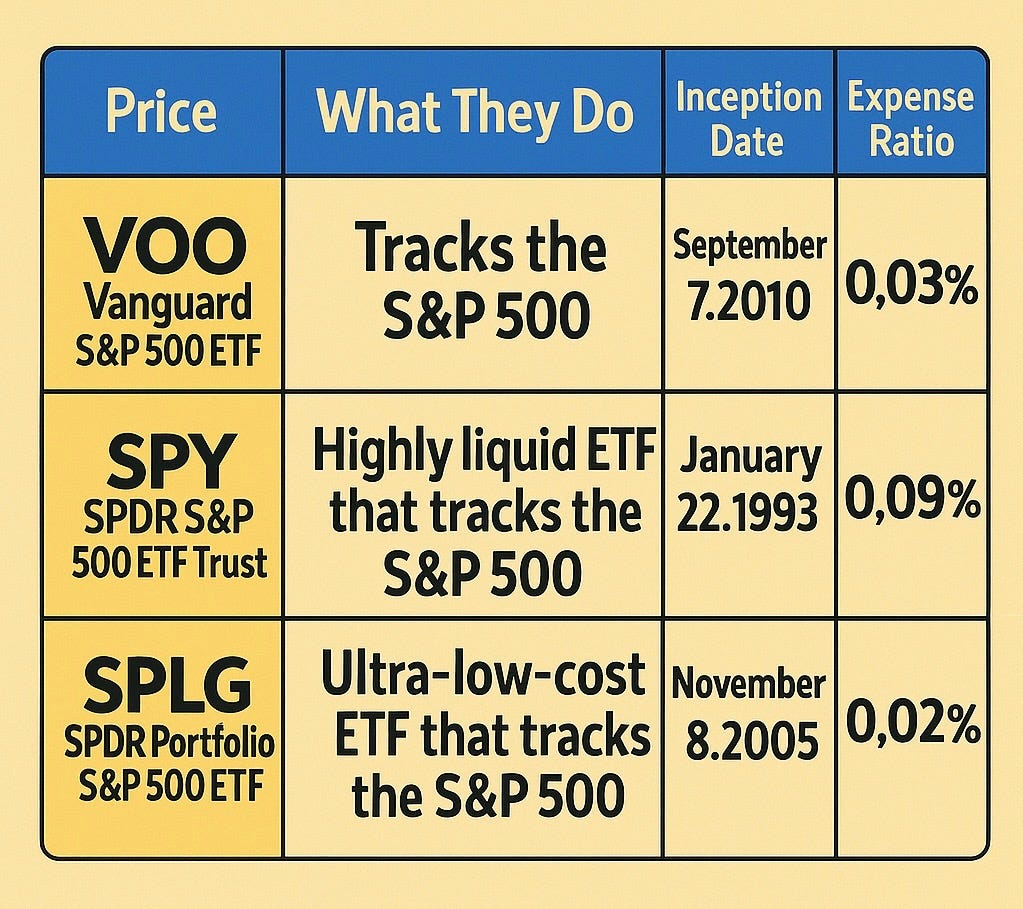

One way SPLG makes this up is their lower expense ratio of just 0.02%, compared to 0.03% for VOO, and 0.09% for SPY. While the difference seems minuscule, this is a difference of thousands of dollars over a long period of time. Below is how much you would pay annually if you invested $10,000 into each ETF:

SPLG: $2.00

VOO: $3.00

SPY: $9.00

So, imagine the cost if you had $500,000 or even $1,000,000 invested. It makes a difference. If you’re a new investor and looking to get exposure to the S&P at a much cheaper price, consider SPLG for your portfolio.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Great summary and explanation for why Warren Buffett recommends low cost ETF’s like THESE you’ve featured. Thanks Dividend_Collectuh! Got hopes for more income? — Recommend this read. — Charlie Whooph