Perspective Of The Week

"Is Inflation Lawful Theft? You're Losing Money By Not Investing"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Over the past 5 years I do think we’ve heard the word inflation thrown around more than we have before. At least it seems that way. And this is because of the money printing the government did during the COVID-19 pandemic.

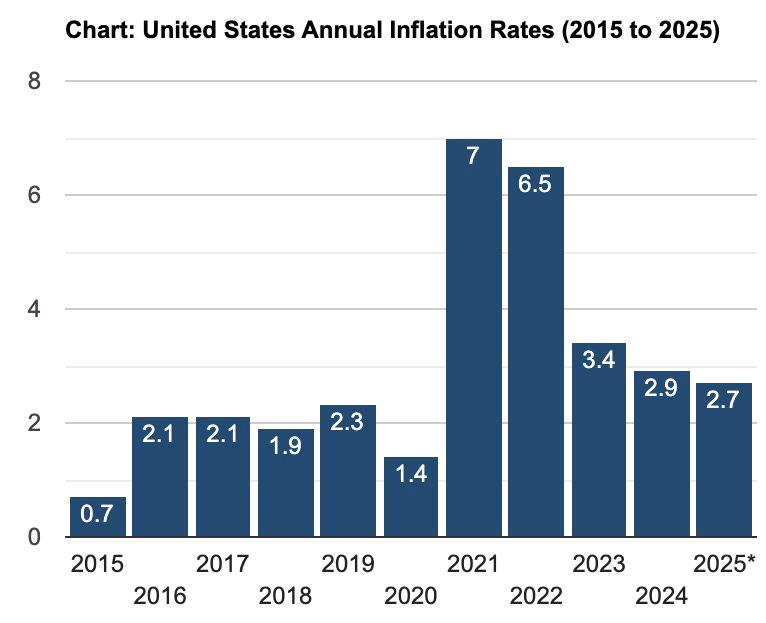

As a result, this caused inflation to spike, and in an effort to combat (inflation) the FED raised interest rates. And although inflation has since come down, now sitting at 2.7%, how many of you feel like prices are still high?

Me, personally, I remember in Summer of 2023, prices were sky high. Since, they’ve seemed to moderate somewhat. But let’s be honest, they likely won’t ever go back to what they were. Throw in the recent tariffs, and this gives businesses more excuses to be greedy.

If you’re reading this, it’s likely you’re familiar with inflation and know its definition. But if you don’t, in short: it’s the price increases of goods & services. So, when costs for businesses rise, then that increases the prices of goods & services to customers. In turn, companies may raise wages.

But there are other ways to increase profit without raising prices. For starters, company executives can take less salary increases / bonuses to absorb some of the increased costs. But we all know they are very unlikely to do that.

Why? GREED

In recent years, I’ve heard many consumers complain about prices outpacing wages. And that is the problem in America. Companies have raised prices so high, that wages cannot keep up.

But do prices actually have to increase so much? I don’t think so. Of course, a business’ costs usually increase, and over time, these costs are often passed on to you.

Imagine you own an 8-door apartment building.

They, of course, have associated costs. Maintenance, repairs, etc. And you pay for these expenses. We all know rent goes up over time. But what if this apartment building has been paid off for years? And none of your costs ever increased because no one in the chain ever raised theirs? Would you actually need to raise the rent?

Again, costs rise over time, but do they have to? What if that can of paint cost the same as it did 20 years ago? Your maintenance guy charged you the same rate he did 20 years ago? Lumber cost the same as it did 20 years ago?

Who says that these have to increase over time? The government? I say this because this is something to think about. Just because we were trained to think a certain way doesn’t mean it’s right and we can’t ask why.

Below is a chart of how inflation has risen and fallen over the past decade. Again, this increased in 2021 due to COVID and interest rates rose as a result. This means mortgage loan, credit card, and auto loan rates all increased. In other words, the cost of borrowing increased.

And most of us aren’t taught how to navigate these economic issues. One way is by investing. Most of us were taught to save money, keep it safe inside a savings account. However, if you’re not investing, you’re losing money.

The national average for a savings account is currently 0.39%. To put this into perspective, with your money sitting in the bank, the bank is loaning your money to other customers at a higher rate. So, when a customer comes in and need a loan, you and other customers money is what’s being used. And we all know these loans have significantly higher rates. This is one of the ways banks make money. And this is why banks will always win.

Additionally, 0.39% is significantly lower than the rate of inflation at 2.7%. That’s why when my colleagues or family members mention how they have so much money saved, I tell them they’re actually destroying their wealth without them even knowing it.

While there are many ways to invest, one way is by investing in higher-yielding dividend stocks. For example, a dividend stock we’re all likely familiar with, and who likely makes money off you is Verizon (VZ).

If you have them for your cellphone or internet service, then I make money from you as too since I own them in my portfolio. VZ has a current dividend yield of 6.26%, well-above the 2.7% inflation rate. And their purpose in my portfolio is for generating income.

This is how the rich & successful think about money. How can we get a higher rate of return? We don’t save money, we invest it in stocks, bonds, or other income-generating assets. Interest rates go up? We invest in stocks, bonds, high-yield savings, etc. Rates go down? Typically the stock market in general. So, if you’re scared to invest, you will always lose to inflation.

Another option instead of leaving your money in the bank is to make the bank pay you by collecting dividends. For example, U.S. Bancorp (USB), one of the largest U.S. banks has a dividend yield of 4.11%.

So, instead of giving them your money to lend out at a let’s say 10%, or sometimes higher, at least generate income by investing in a high-quality bank stock. REITs, BDCs, covered-call ETFs, or even regular ETFs are also additional ways to invest to collect dividends. And these typically have significantly higher yields, especially covered-call ETFs.

Then there’s owning rental properties, CDs, or placing your money in high-yield savings account that can also beat inflation. But as previously mentioned, when interest rates decline, so do those yields on your high-yield savings accounts and CDs.

So, I share this to say open that brokerage account today and start investing.

Like & subscribe if you’re active duty, a veteran, or just love investing.