Perspective of the Week

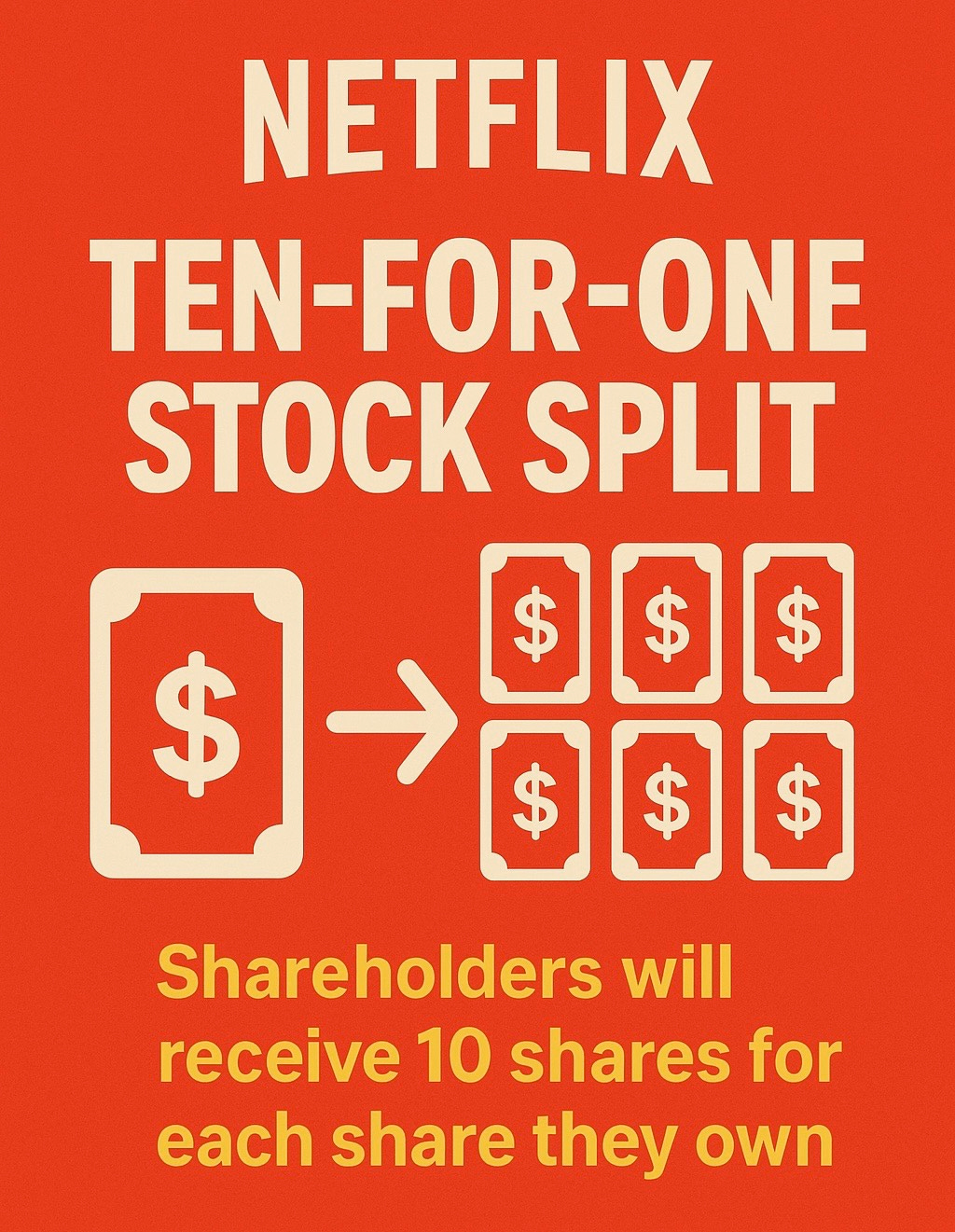

"Netflix 10-for-1 Stock Split"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

One of the largest companies in the world, Netflix (NFLX), just announced a 10-for-1 stock split.

The split-adjusted price is expected to start trading on November 17, 2025. So, mark your calendars if you’re looking to pick up more shares!

Stock splits are usually conducted by fundamentally strong companies to make the price more accessible for new investors & company employees.

It’s important to remember that stock splits change nothing about the company fundamentally.

On the flip side, stock splits are often considered less attractive for existing shareholders due to shareholder dilution.

For Example:

If you owned shares in a company that had 100 shares available (shares outstanding), a 10-for-1 stock split would increase shares to 1,000.

If you owned 50 shares before the stock split, your 50% ownership in the company now decreases to 20%.

One way companies can increase or decrease ownership is by buying back existing shares outstanding, or issuing new shares.

Issuing shares allows companies to raise capital without taking on any debt.

In current environments like now, (high interest rates), issuing shares is usually the preferred way for companies to raise money for growth.

Buying back shares are good for companies that pay a dividend.

Another Example:

If a company pays a quarterly dividend of $0.50 a share, this means they would pay an annual dividend of $2.00.

If the company had 1,000,000 shares outstanding, this means they would pay shareholders $500,000 each quarter, or $2 million annually.

One way companies save money is by repurchasing shares.

If the company buys back 20% of their shares, this reduces the amount of cash they need to pay shareholders.

A $2.00 annual dividend on 800,000 shares outstanding is $1,600,000, saving the company $400,000 annually.

The extra $400,000 can now be used elsewhere for growth, etc.

The way a company moves is so important as it tell an investor a lot about the business. It is all about the “why” they are doing something.

Will it benefit me, the shareholder, going forward?

If yes, how so?

Knowing this is key to becoming a successful investor.

If you’re looking to start investing check out our investment group over on Seeking Alpha for 2 weeks FREE. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Like & subscribe if you’re active duty, a veteran, or just love investing.