Perspective Of The Week

"Be Greedy When Others Are Fearful"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t need to need to work to traditional retirement age. I want to help you take control of your life by achieving F.I.R.E.

When the stock market is reaching new highs, everyone is a market genius all of a sudden. But the real geniuses are those who recognize a stock’s share price may be disconnected from their true value.

When the market is in a constant decline, investors start to panic. Everything becomes quiet as they look for safe, fixed-rate investments like money markets, CDs, or treasury bills. But staying invested in the market during times of volatility is key.

Picking individual stocks can be difficult, and is not for the faint of heart. But over the years I’ve grown to become a very good at this in my opinion. Of course, if you ask any investor, they’re likely to say the same thing.

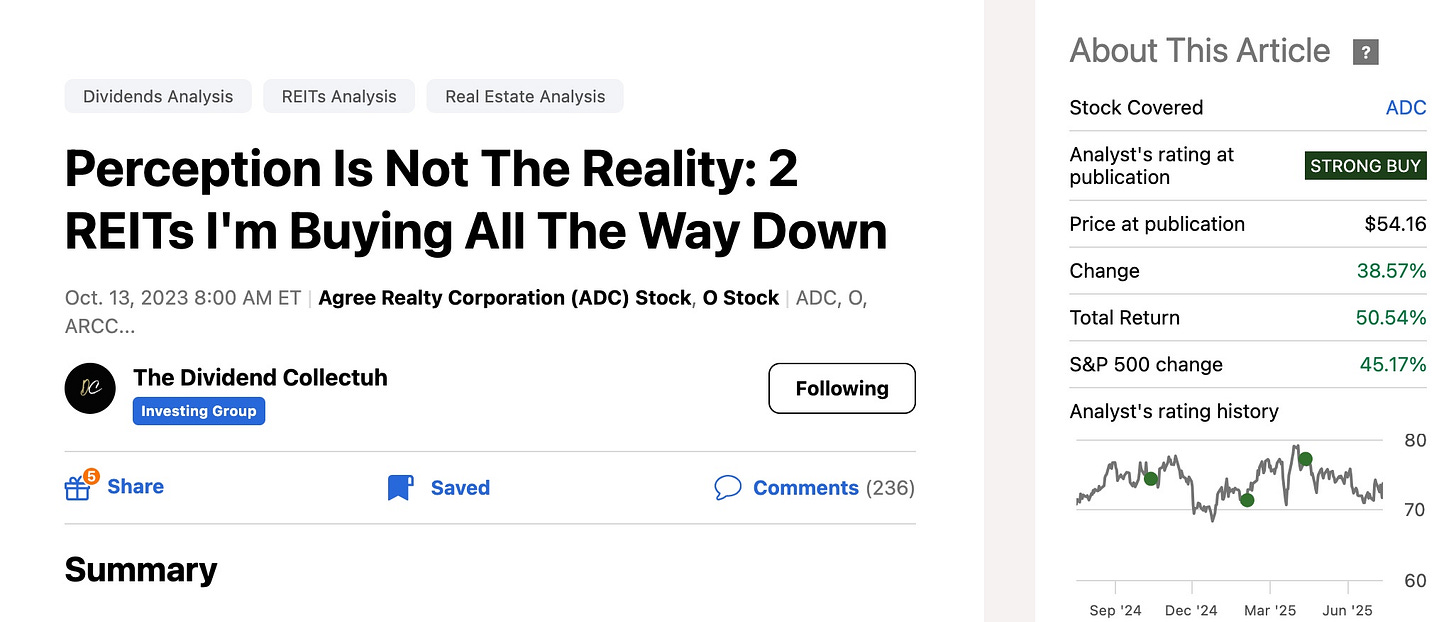

But many investors can’t put their money where their mouth is. As Warren Buffett famously said: Be fearful when others are greedy and greedy when others are fearful. Back in October of 2023, I wrote an article on REITs Agree Realty (ADC) and Realty Income (O).

Both had fallen to new 52-week lows and I told everyone to buy. With interest rates at historical highs due to the FED’s tightening cycle to battle inflation, many investors left REITs for dead. While REITs typically underperform during high interest rate cycles, buying them when they’re out of favor can lead to outperformance over the long-term.

Since the article, I’ve sold Realty Income but have continued to hold Agree Realty and will likely do so for the foreseeable future. ADC has a current dividend yield of 4.1% and pays $0.256 on a monthly basis.

But back then everyone told me REITs were dead money.

Agree Realty continues to have some of the strongest fundamentals in the REIT sector (XLRE), and I think they will continue to see price appreciation in the foreseeable future. But imagine if I had sold out of Agree Realty because of their price falling?

I would have missed out on strong capital appreciation and a growing, monthly dividend. And while REITs don’t see strong price returns, or may not be as attractive like some technology stocks, they’re great investments if you’re looking for passive income.

Warren Buffett has also stated that, “stocks are safe for the long run and they’re very unsafe for tomorrow”. Meaning, stocks can be volatile in the short-term. But if you buy and hold a quality stock, it will usually go up over time.

Below is a 5-year chart of the total returns of Agree Realty vs the S&P (SP500). The S&P significantly outperformed ADC in total returns, up 91.44% compared to just 36.64% for the latter.

But over a 10-year span Agree Realty has outperformed the index, up over 268% compared to 200% for the S&P.

Moral of the story? If you’re confident in the stock, buy the dip no matter what the market is doing as a quality stock’s share price will always catch up to its true value.

A declining stock price doesn’t necessarily tell the story. If you’ve done your due diligence and are confident in your stock-picking ability, then buying when stocks are out of favor can lead to market-beating returns.

In the short-term, stock prices follow news & headlines. Over the long-term the stock price follows the fundamentals.

So, when the market experiences dips, corrections, or crashes, you should view these as opportunities to add to your portfolio.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Loved this reminder! Fundamentals don’t vanish just because of price correction.