Perspective Of The Week

"Compound Interest Works Both Ways"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. Here we take a simple approach to building wealth. And although everything often seems so simple, people miss opportunities by over complicating, especially when it comes to investing.

I will say investing is difficult. Although I may make things sound simple, and they often are because of my experience, it’s not for everyone. If it was everyone would be rich.

Growing up I was scarred by credit cards because of my family members misuse of them. So, for a good portion of my Naval career, I avoided credit cards. But this was because of how I grew up. I grew up watching family members put items on credit cards when they didn’t have the money.

They would purchase things and pay the minimum balance every month. Interest rates were never discussed because, honestly, I think they didn’t understand them or maybe didn’t care. Ultimately, they were just wasting their money every month. And this was because of financial illiteracy.

As a result, this led to compound interest taking over and their credit card balances growing instead of decreasing. And this then often lead to diminishing credit.

Life comes at us and sometimes; we have unexpected emergencies that may result in a revolving balance for a short time.

But often more than not this comes from a lack of financial understanding. Credit cards are tools and should viewed as such. My belief is if you don’t have the money to purchase an item, then you shouldn’t bother putting it on a credit card.

Use your credit card wisely. If you have one that has 0% interest for say 6 months to a year, and you want to use it to purchase items that you know you can pay back before the interest is due, then it is smart to use the credit card as a no interest loan.

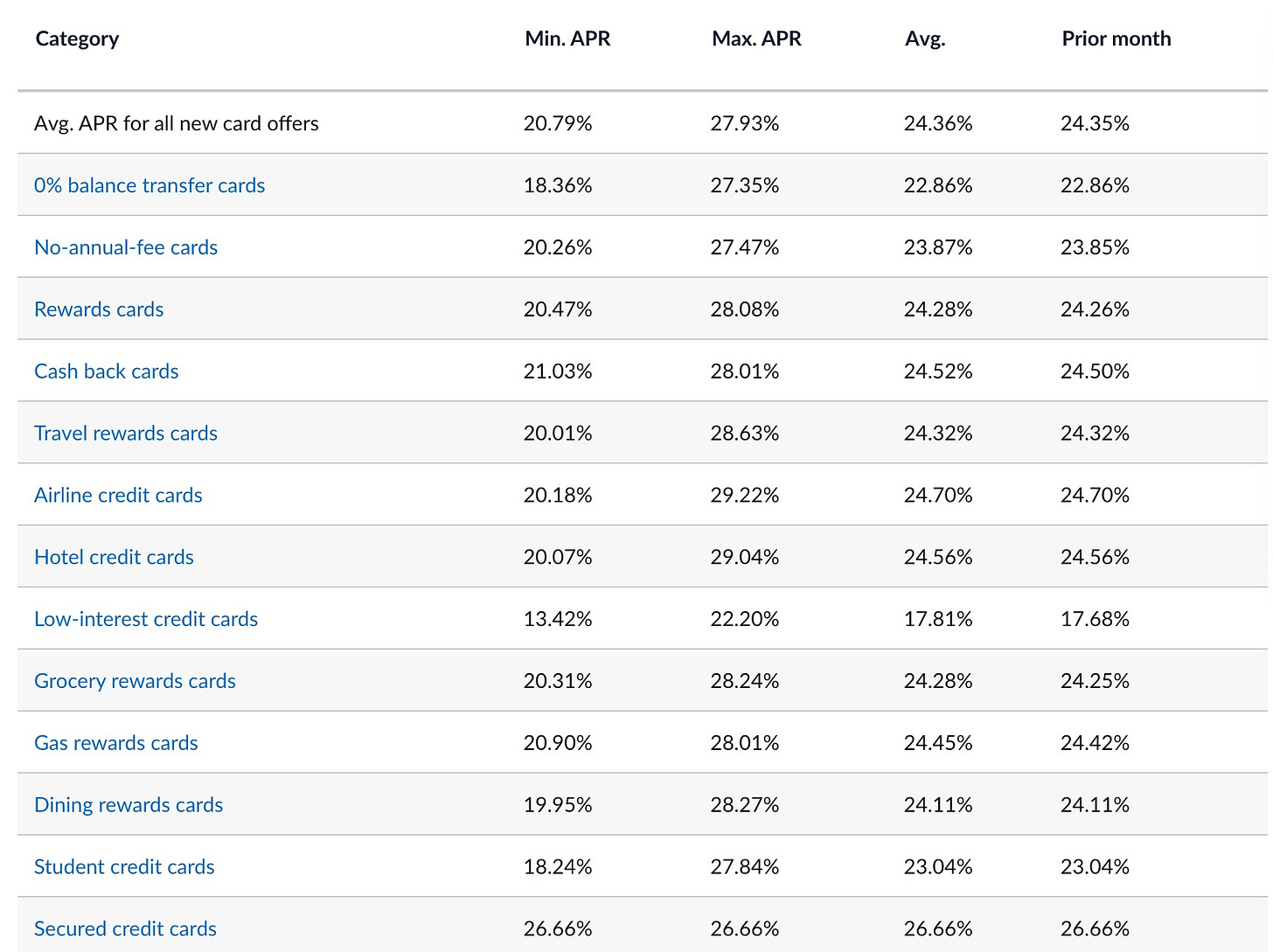

Below is the average credit card interest rate in the U.S. today. The average interest rate is 24.36%.

If you have a lower credit score than this is likely higher. Credit cards usually have high interest rates even if you have a great credit score. This is how banks make money. But the interest rate doesn’t really matter if you’re financially responsible and pay it off each month before the bill is due.

If you’re reading this and you invest frequently, then it’s likely because you’re financially responsible and don’t have a lot of credit card debt.

But that debt is often a reason people fail to invest. Because their money is being paid out each month to different entities. There’s nothing left over to invest when you’re busy paying more interest than principle on a credit card(s).

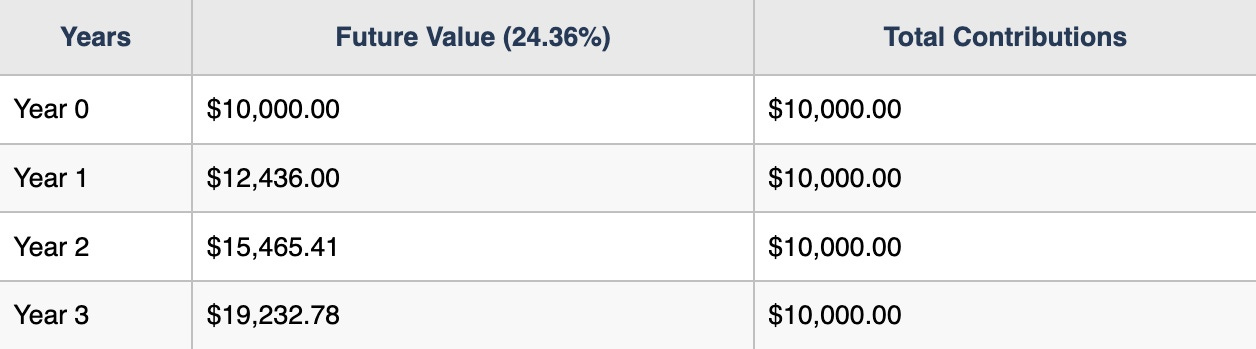

People often think, I make good money, I can afford to pay $100 a month to a credit card. But they don’t often understand that compound interest works both ways. If you have a $10,000 credit limit and you max it out and pay $100 a month at 24.36% interest, you’re not even covering the interest from that last month!

Using a compound interest calculator, a $10,000 balance at 24.36% interest would be $12,727 by the end of the year. Over a 3-year period this would grow to $19,233, nearly double.

I use a period of three years because financial illiteracy has consumers spending years paying back their credit cards.

Perfect example: A financially irresponsible family member of mine.

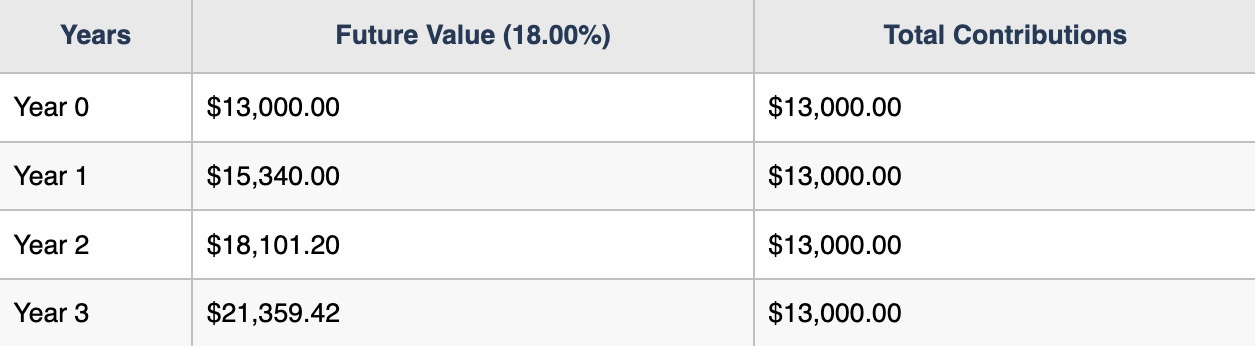

A few years ago he mentioned to me that Navy Federal Credit Union had approved him for a credit card for $13,000. Knowing he may not use that credit card wisely, I advised against it.

Needless to say he didn’t listen. Fast forward three years later and he maxed it out and is still making payments towards the balance. His current APR is 18%.

I don’t know how much in payments he’s making towards his balance. But if I had to guess, I would say no more than than the minimum requirement.

For this example’s sake, let’s say it’s $100 a month. Below is how much your balance would be over a 3-year period at 18%. Your balance would amount to $21,359 after 3 years.

After paying $100 a month for 3 years you have only contributed $3,600 to the $8,359.42 in interest you accumulated!

While I don’t agree with this way of managing credit card debt, I want to re-iterate that this is exactly the thought process that keeps people working.

And I want to share how changing your thought process, basically turning a negative into a positive is a simple way to become successful in investing.

Most adults own some sort of debit, credit card, or both. If so, it’s likely a Visa (V) or Mastercard (MA). Both of these are payment processors (think transactions), meaning they are not responsible for holding consumer debt like American Express (AXP) or JPMorgan Chase (JPM).

All four are great companies and pay dividends. So, while most adults have one or multiple credit cards that pay these companies, why not get paid to own a piece of the company?

Credit card companies like Visa are likely here to stay. Yes, the world is shifting to digital assets, but the companies mentioned are innovating as well.

I also did an exercise with that same family member; I asked him to pull out his debit cards. I asked him what did they all have in common?

After a few seconds, he mentioned that all 3 said, “Visa”. My reply was “exactly.” You pay Visa, Visa pays me in the form of dividends.

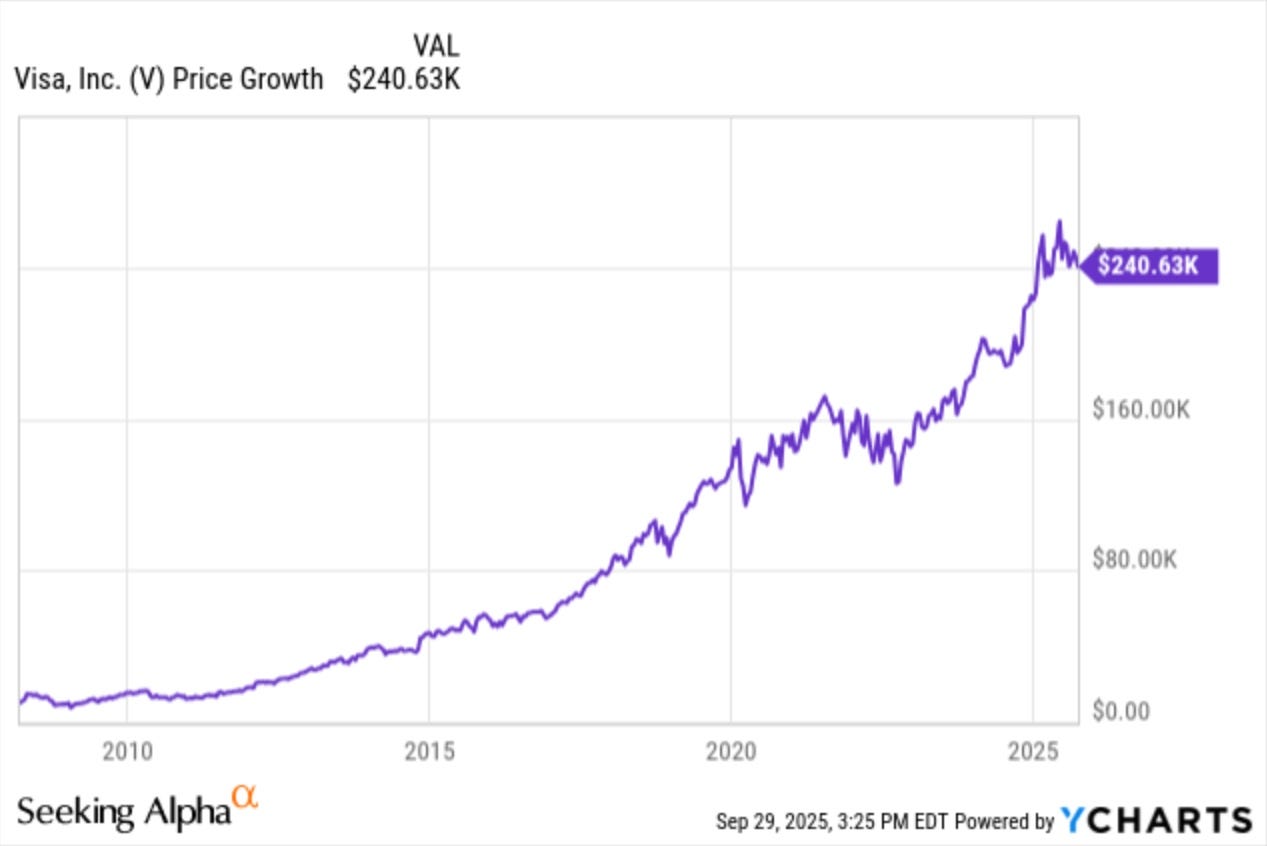

Visa is one of my largest holdings in my portfolio and one I consider to be a never sell. The chart below shows how much money you would have today if you had invested $10,000 into Visa in 2008. The total would be more than $240,000 not including dividends.

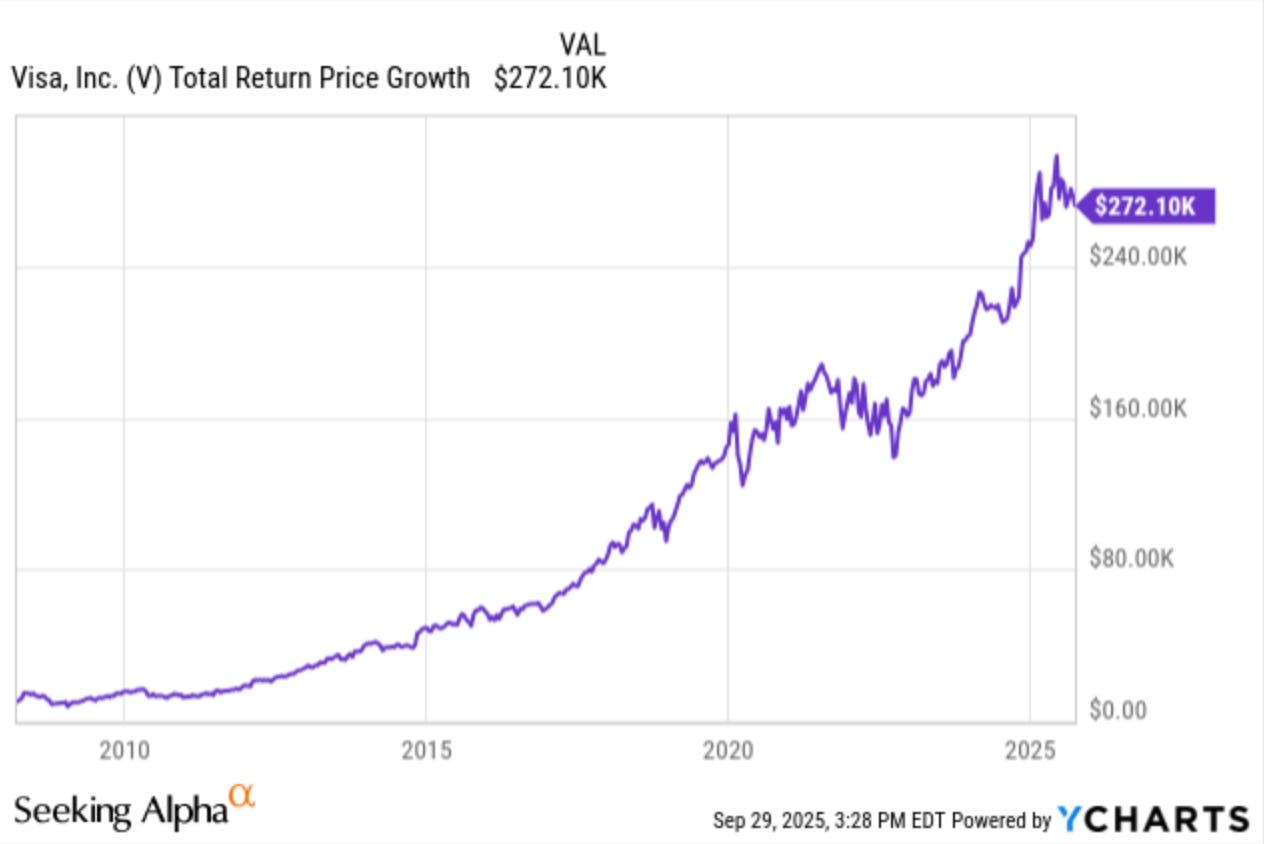

Including dividends, this would over $272,000!

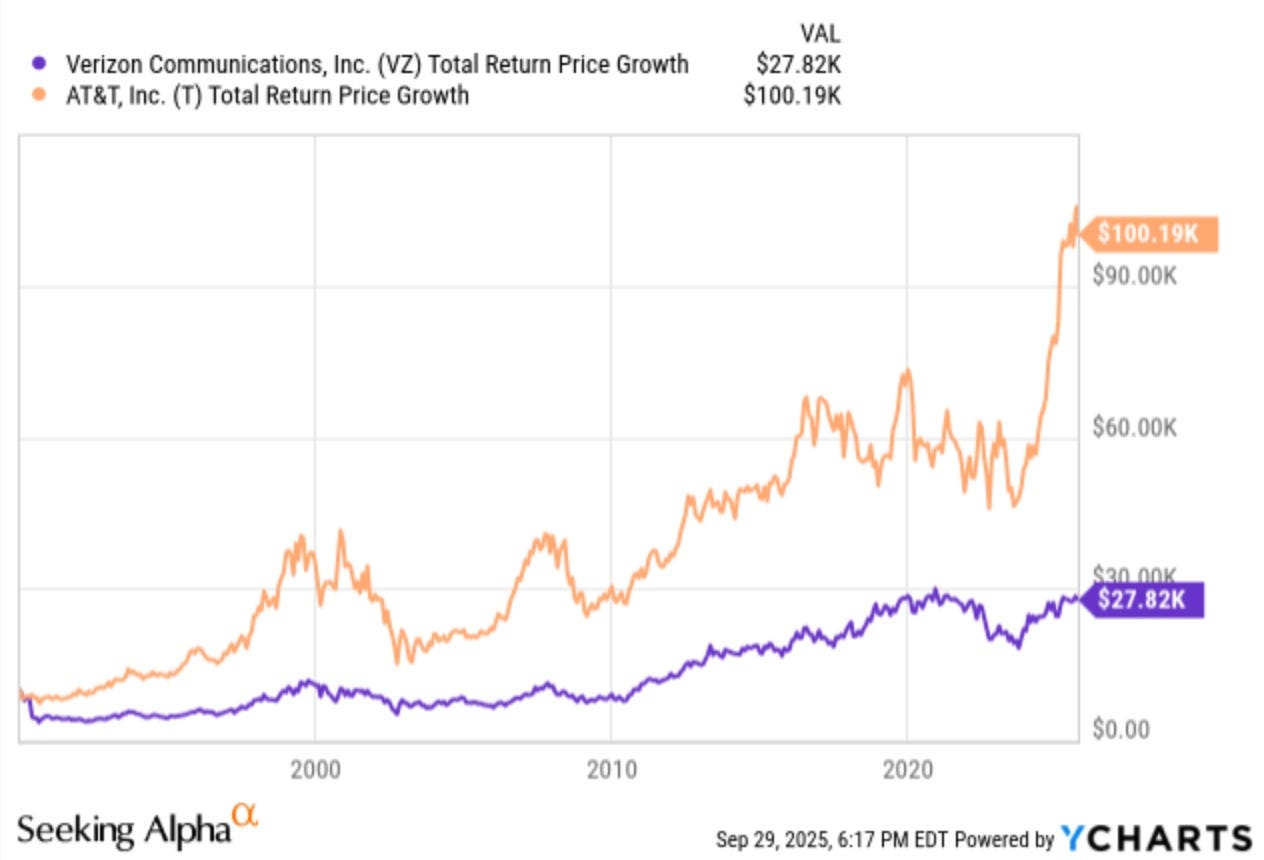

For many investors, Visa is not extremely appealing due to their low yield below 1%. While companies like Verizon (VZ) and AT&T (T) have higher yields, Visa makes up for their low yield in growth.

If you invested $10,000 into AT&T at the company’s inception, your investment would be worth a little over $100,000. The same invested in Verizon at inception would be worth close to $28,000, disappointing when compared to Visa & AT&T.

However, companies like Verizon have their place inside a portfolio, depending on your investment strategy. But I wanted to highlight that using credit cards the correct way, or better yet looking to get paid from something consumers use daily is a way to to build wealth.

This thought process gets you thinking about money differently. And again, compound interest works both ways.

So, instead of paying interest on a credit card for years at a time and getting charged interest, use that $10k to invest in company that owns the credit card and collect compound interest.

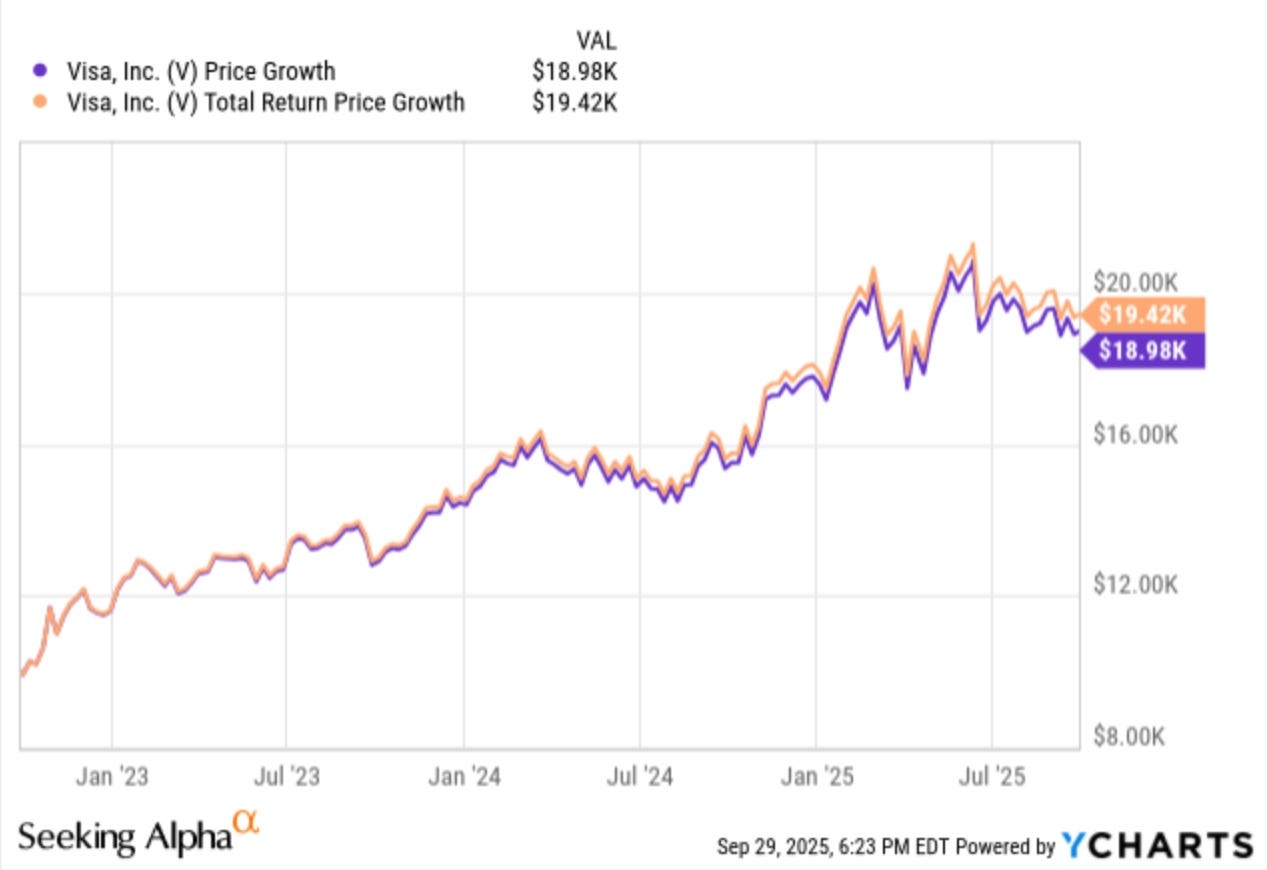

Below is how much you would have if you invested $10,000 into Visa in the past 3 years instead of maxing out your $10k limit on your credit card. You would have close to $19,000 if you didn’t reinvest dividends and $19,420 if you did reinvest them.

The late Charlie Munger once said: Compound interest is the eighth wonder of the world and never interrupt it unnecessarily.

Like & subscribe if you’re active duty, a veteran, or just love investing.