Perspective Of The Week

How To Borrow Against Your Assets And Why You Should Play The Long Game

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating. And we are here to help.

From Day Trader To Dividend Collector: The Lesson That Cost Me $9,000

A few years before I retired, I got really serious about investing. I tried my hand at day trading, but quickly found that strategy wasn’t for me. While day trading is fast and exciting, just as fast as you can make money, you can also lose that money.

The goal of day trading is to make money during the highs and avoid the lows. But no one can actually time the market 100% of the time. So, ultimately, not a sustainable strategy for long term wealth building. I learned this lesson the hard way when I decided to hold on to my investments instead of taking profit.

The result?

I lost out on $9,000 that I had made in a week. I was devastated. From that moment on, I switched to dividend investing. Boring, simple, yet effective. Sustainable long term. Plus, getting paid no matter what the market is doing is highly attractive.

Bull market? Quality companies continue to pay dividends.

Bear market? Quality companies continue to pay dividends.

Owning high quality businesses with strong fundamentals not only provide consistent income but also the potential to see pay increases every year through dividend raises.

Dividend stocks are slow- but are steady and scalable. The real magic comes from time and compounding.

Building The Dividend Snowball

Many investors crave instant gratification. They want results now, not 10 years from now. But building wealth takes time and patience.

Since I’m retired and have other income sources, I don’t need to live off my dividends for a while. But in the next 5 to 10 years, that’s my plan.

Until then, I will continue to buy, hold, and reinvest - one dividend paycheck at a time.

The Wealth Strategy Nobody Talks About: Borrowing Against Your Assets

The ability to borrow against your assets is highly overlooked. Having a long-term investing strategy is boring to some. But continuing to dollar-cost average consistently allows you to not only build your wealth, it allows you to leverage money against these assets.

So, the more you have, the more you’re able to borrow. Most people know about borrowing against your home equity called Home Equity Line of Credit, or HELOC.

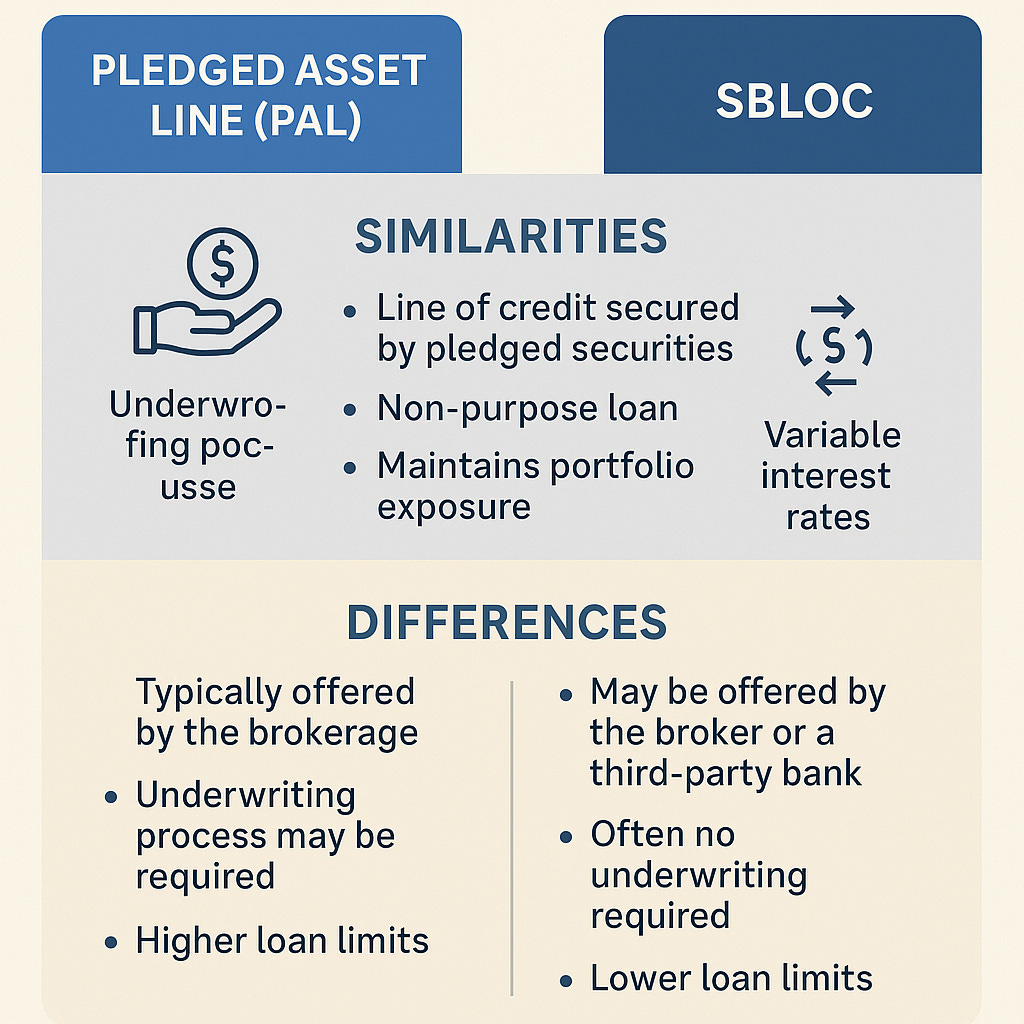

But you can do the same against your stock portfolio. This is called a Securities Backed Line of Credit, or SBLOC. Your brokerage allows you to take out a a loan against your assets with some conditions.

So, essentially, if you have a solid portfolio, you can apply for a loan. You can use this loan to start a business, pay college tuition, taxes, or purchase real estate like an apartment complex, etc.

The exception is you can’t use this loan to buy more stocks.

And like any other loan, this has to be paid back with interest. The terms of the loan are usually set by your brokerage. Think of it like a credit card. If you pay the minimum payment, the longer it will take to pay back and the more interest you pay.

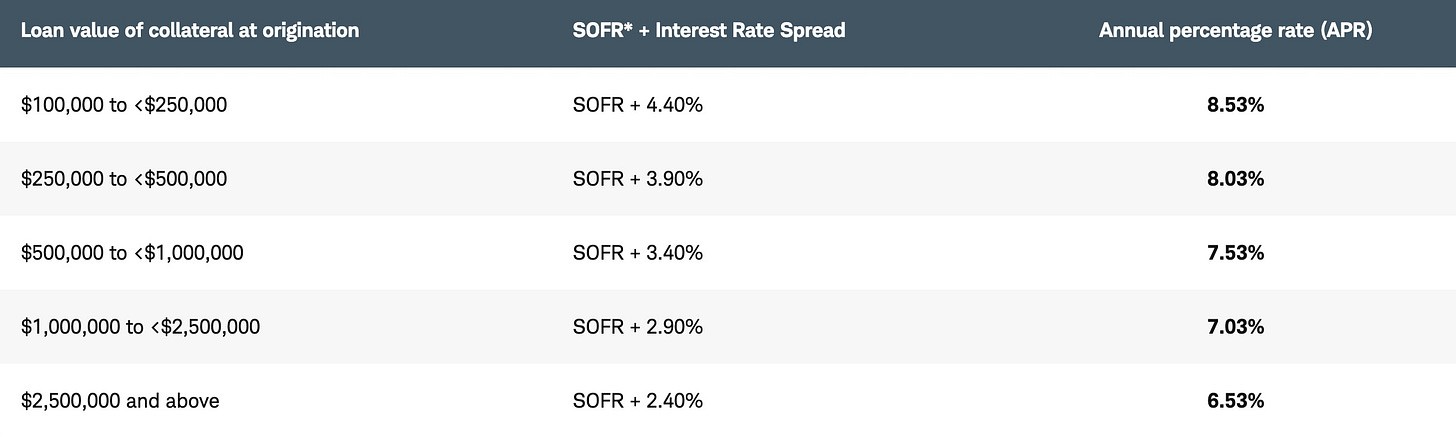

The key is to use the loan to buy assets that generate a higher return than your current loan. Usually, your brokerage requires a $100,000 minimum in assets, but this could vary depending on your brokerage.

Let’s say your portfolio was worth $500,000. You could apply to borrow 50% - 70% of what it’s worth. And sometimes brokerages will even let you borrow up to 100%. So, you can get a loan for let’s say $250,000 that you could use to buy a home, or start a side business.

The rich & wealthy use this strategy frequently because selling stocks creates a taxable event. Because debt isn’t taxed and your portfolio can continue to go up in value, they borrow against it instead. So, instead of selling their stocks, and losing money - they allow it to continue to grow.

An SBLOC is done by an application process with your brokerage account. Below are the steps to apply. If approved, you can simply invest the money how you see fit.

Like anything, there are risks involved with having a SBLOC. If the stock market experiences a crash or correction and your portfolio drops below a certain value, your brokerage can do what is called a margin call.

Meaning they could require you to put more cash in your account, or to repay back your loan. They can also sell your assets to repay it. So, you risk your brokerage liquidating your portfolio.

This is why it’s prudent to invest in high-quality stocks. If these do see a share pullback, usually their share prices bounce back quickly because of their quality. Quality stocks typically don’t stay down too long. Moreover, they usually don’t drop as much as lower-quality stocks either.

Below is another chart I created comparing a SBLOC to what is known as a Pledged Asset Line. The two are very similar in nature.

Below are the current interest rates for a Pledged Asset Line with Charles Schwab. As mentioned previously, the more your borrow, the lower your interest rate will be. Once short-term interest rates come down, these will drop in tandem.

This is also another reason why the rich & wealthy don’t like to do business when interest rates are high. This is because interest rates on loans are affected by the Federal Reserve’s current interest rates. The higher short-term interest rates are, the higher the interest rate on your loan will be.

In my opinion, this is why President Trump has been adamant about the FED lowering interest rates. Trump is a billionaire. He knows taking out loans at the current rate will require him to pay back a lot in interest.

The current Fed fund rate is between 4.00% and 4.25%. But this is expected to decline in the coming months. So, the cost of borrowing will be lower. This also impacts the interest rates on things like high-yield savings accounts, money market accounts, and Certificates of Deposits.

So, if you ever wonder why the rich and wealthy say to never sell your assets, but instead borrow against them. This is the reason. Playing the long game always wins.

This is why gurus like Warren Buffett, Peter Lynch, and Charlie Munger have always been adamant about buying and holding stocks for the long-term.

If you can’t see yourself owning the stock for many years, or you don’t know why you bought it, then you probably shouldn’t own it.

Buy…Borrow…Die.

Happy Investing!

Try Out iREIT + HOYA Capital On Seeking Alpha For 2 Weeks

If you want to build passive income, particularly through REITs, check out our investing group over on Seeking Alpha for 2 weeks FREE.

Click the blue links Investing Group or Learn more on my profile.

Like & subscribe if you’re active duty, a veteran, or just love investing.