Perspective Of The Week

Why Investing In The Stock Market Beats Buying Real Estate

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective.

Here we take a simple approach to building wealth. And although everything often seems so simple, people miss opportunities by over complicating, especially when it comes to investing.

When it comes to investing, whether you talk about it with your friends, family, or co-workers, everyone seems so fascinated with buying physical real estate for some reason.

And this is because owning a physical property is something tangible. It’s easy to point to a building or home you own and say, “Hey, look, this is my property.”

And everyone knows real estate usually goes up over time. But what people fail to realize is buying a home is not always an asset, at least not right away. Unless maybe you buy it in cash but most people don’t have that kind of money laying around.

This is why banks will finance you a mortgage for 30 years at a fixed-rate. Right now, because of inflation, home prices and interest rates have skyrocketed.

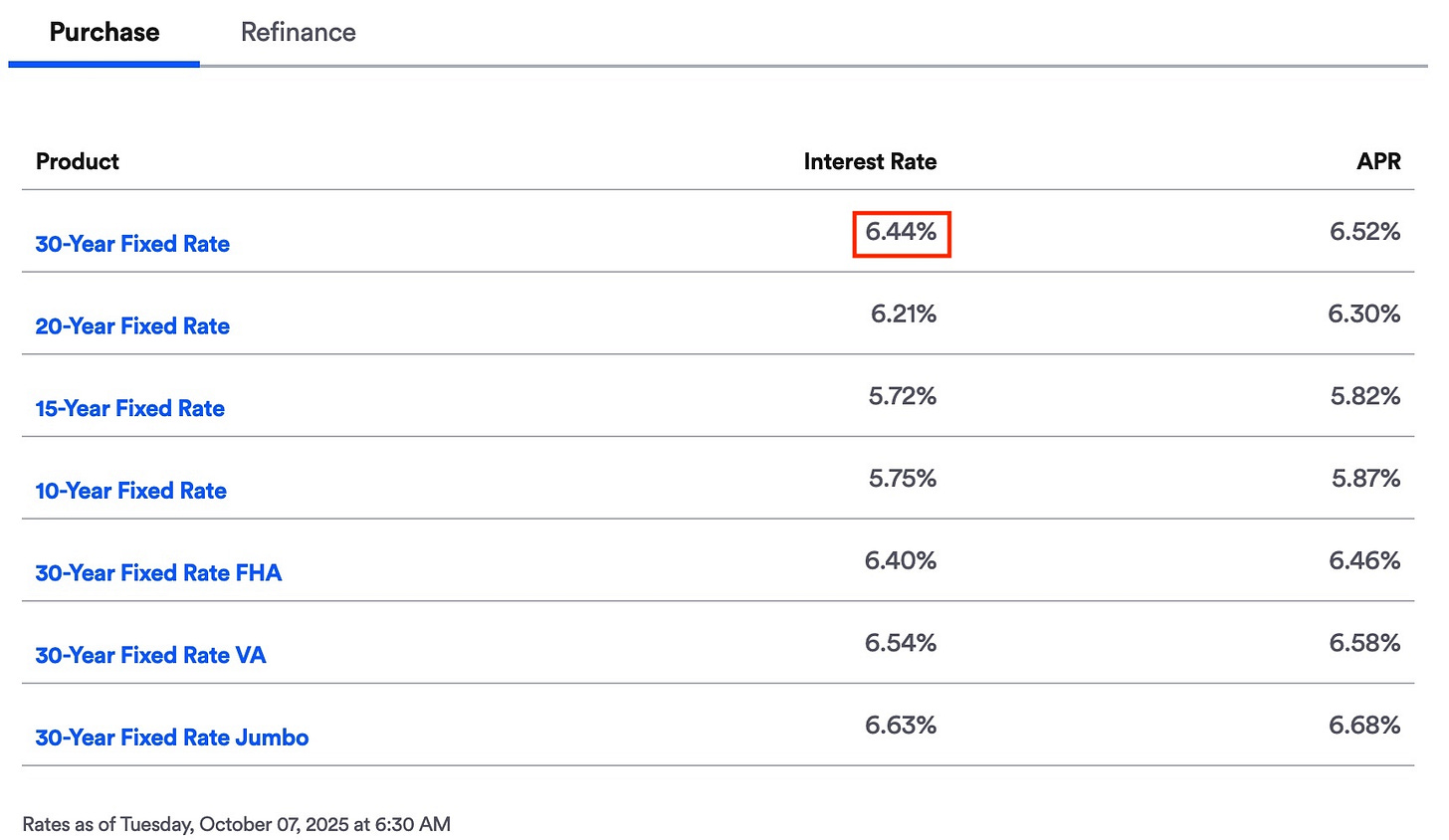

Buying a home today with a 30-year fixed-mortgage rate would be 6.44%. And if you told someone how expensive it is, their response would likely be:

“But the Federal Reserve just lowered interest rates and they expect to continue lowering them.”

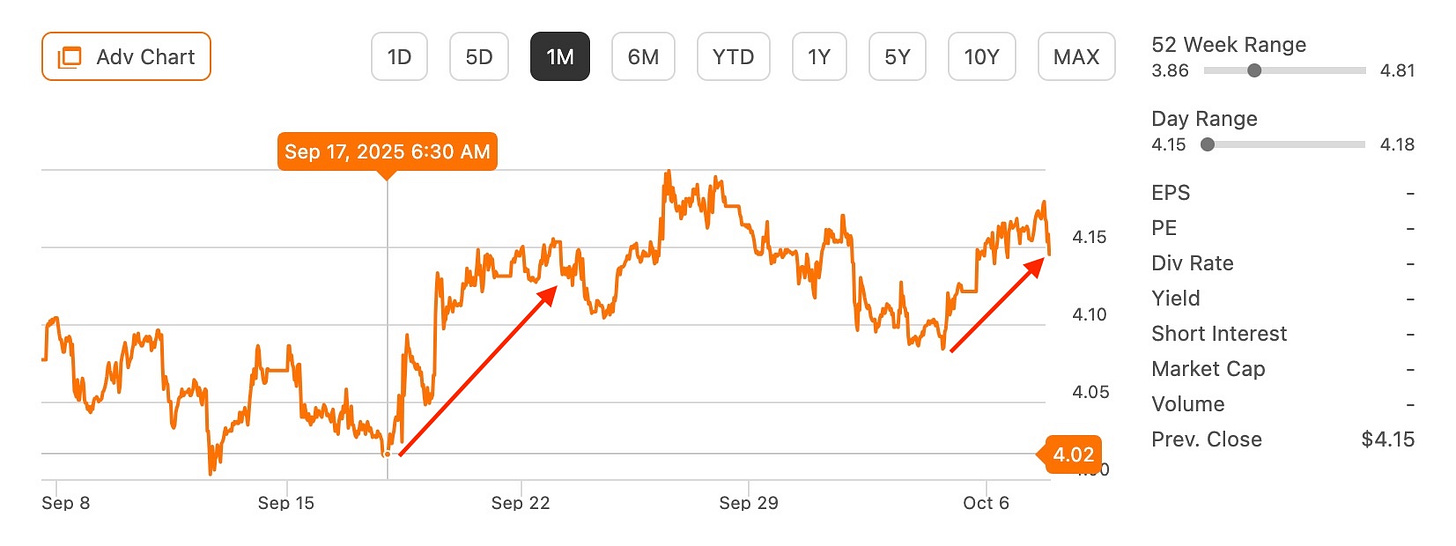

While this is true, the FED does not control or manipulate long-term interest rates. So, just because short-term interest rates go down, this doesn’t mean the same for fixed-mortgage rates.

This is why when they cut interest rates by 25 basis points on September 17th, long-term rates actually went up as you can see in the chart below. So, in short, the FED controls short-term interest rates, not long-term rates.

As a result, mortgage rates could stay elevated. And while people say they can just refinance when interest rates are much lower, most never mention how the terms of your loan restart.

And this doesn’t include maintenance or HOA fees. Home ownership comes with a lot of costs. I’m not trying to say owning a home is a bad investment, but a home that is not paid off is a liability and not an asset. Like stocks, homes are better held for the long-term, and usually go up over time.

I know someone who personally bought a home in 2023, when interest rates were their highest in recent years. And they were told to just refinance once rates come down.

It’s now over 2 years later and mortgage rates are still above 6%. That’s more than 2 years of paying a high interest rate. And while the difference between 2% and 6.44% doesn’t seem like a lot, it is!

Remember, compound interest works both ways.

This is why the late Charlie Munger called it the 8th wonder of the world and to not interrupt it unnecessarily. But this is when receiving compound interest on investments, not paying it.

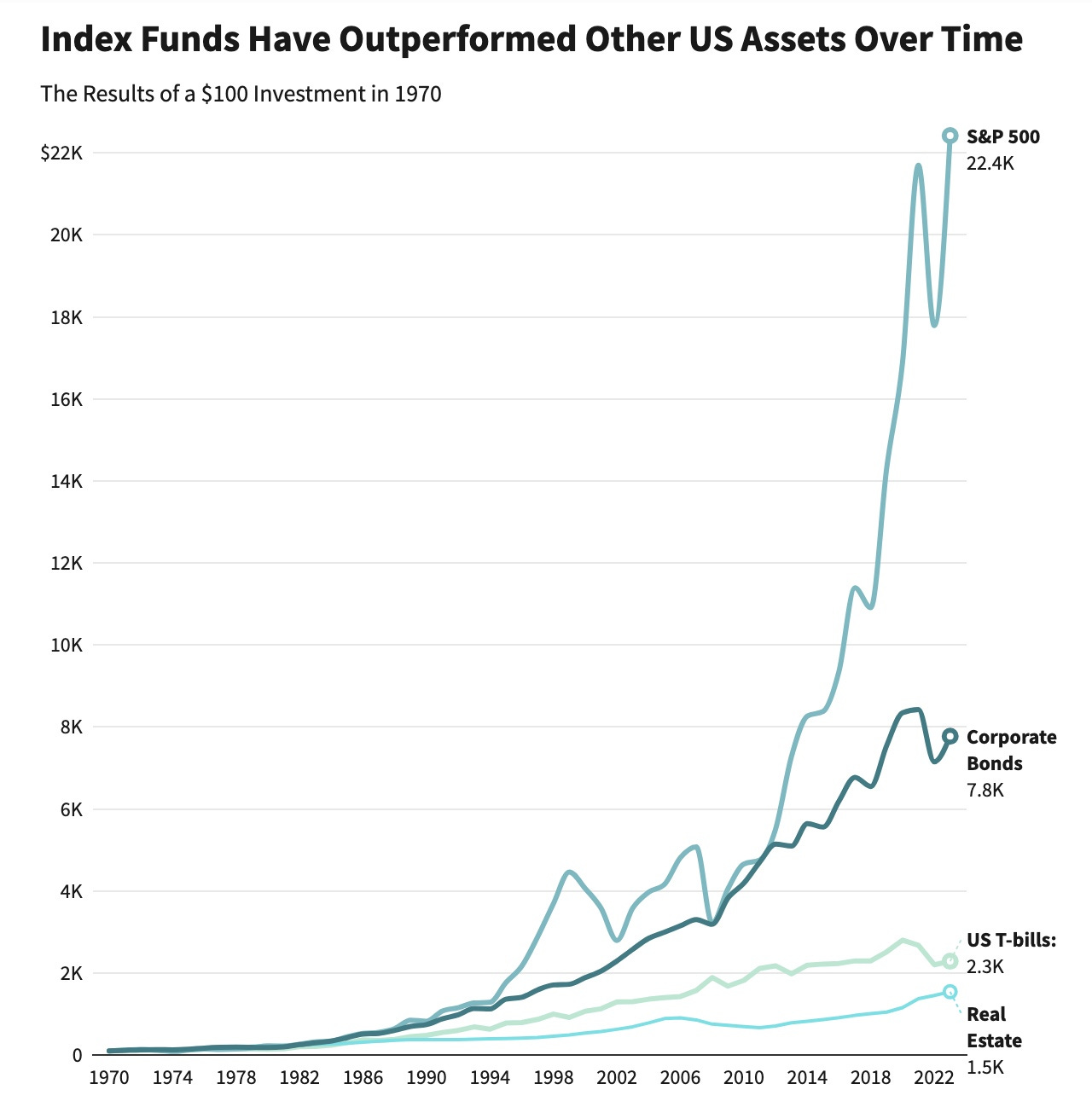

Below is a chart of how index funds have performed vs real estate since 1970. A $100 investment in 1970 in an S&P 500 index fund would be worth $22,400 today. The same in physical real estate would be worth $1,500.

Past performance is no guarantee of future performance, but investing in the stock market requires no maintenance fees, HOA, or dealing with tenant issues. Additionally, you don’t pay capital gains taxes on it until you sell your stocks.

But you will have to pay taxes on the dividends you receive. With physical real estate, you’re required to pay property taxes every year as long as you own the property.

I know someone who bought a property in California in 2020 and sold recently. Although they made a nice profit, his reason for selling was rising fees. And the reason for those rising fees? Inflation.

When you buy individual stocks there are no fees associated. Just buy and hold. And if a company pays a dividend, management usually raises this every year to match, or exceed inflation .

For example, one of my favorite REITs VICI Properties (VICI) raised their dividend last month by 4%. The current rate of inflation is 2.9%, up from 2.7% the month prior.

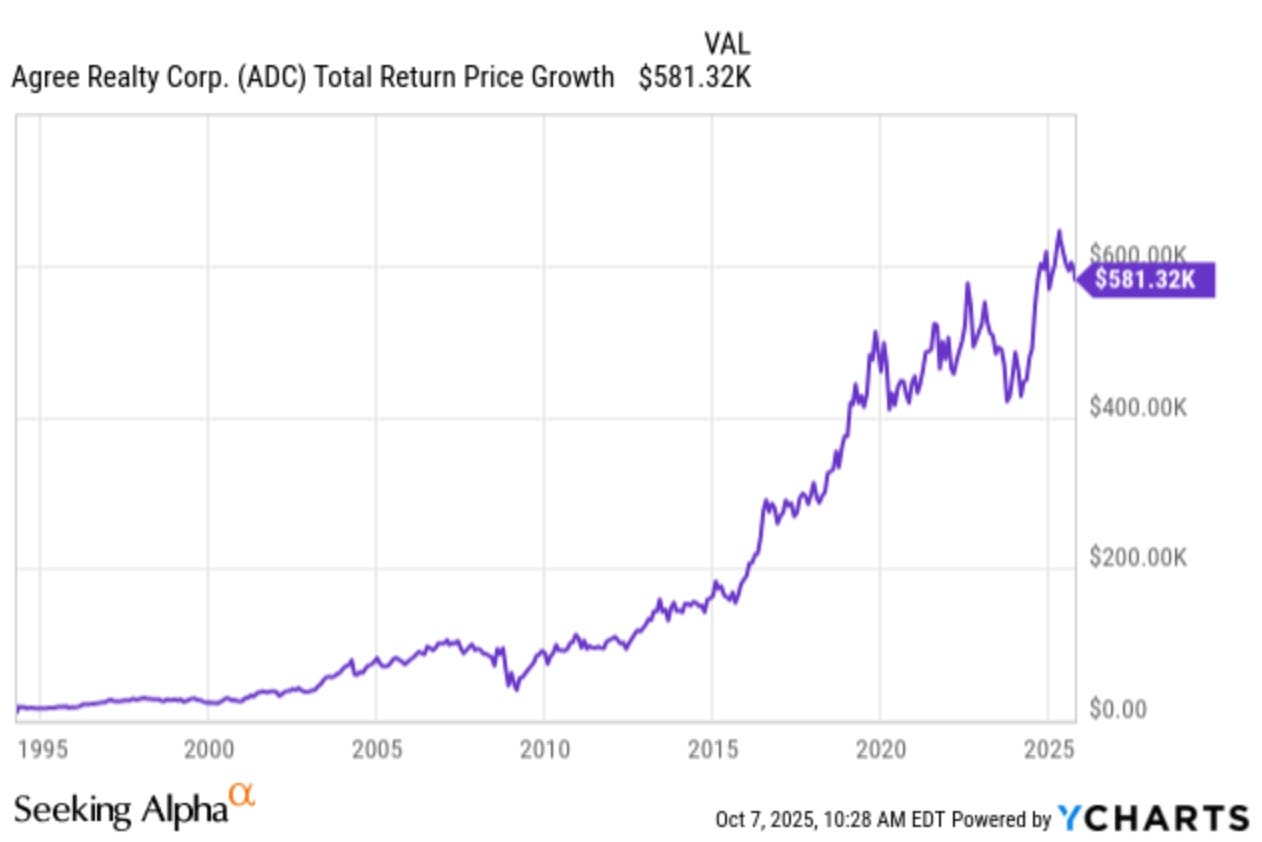

Below is a chart of one of my favorite REITs, Agree Realty (ADC). ADC has been around since 1994 and pays a monthly dividend, which they switched to a few years ago.

If you had invested $10,000 into ADC in 1994, it would be worth close to $600,000 today. No fees or property taxes, just collecting dividends every month. For a perspective, let’s say you had this same amount in cash from a property you sold. And invested that $581,320 into Agree Realty today.

At their current price of $69.87, this would give you 8,320 shares. Using their current dividend of $0.256, this would net you $2,129 a month. All profit. If you owned a home today and rented it out, there’s no way you could net $2,129 in profit a month.

Even if your tenant was paying over your current mortgage, you’re likely making a few hundred bucks a month in profit. And if something expensive breaks, this eats into your profits for the year. Unless, like I said earlier, you bought the property in cash, or it has been paid off for years.

This is why I prefer to invest in REITs, or Real Estate Investment Trusts. These were literally created by Congress in 1960 to give small, everyday investors access to real estate at cheaper prices.

And if you’re over 59 1/2 and have a Roth IRA, you can withdraw your dividends tax free. REITs are required by law to pay out 90% of their taxable income. This is why most have yields over 5% and are attractive amongst retirees.

While owning physical properties is great and all, owning a stock portfolio that pays you more than a tenant is likely to pay over your current mortgage is more attractive in my opinion.

Like the stock market, physical real estate suffers crashes and corrections too. And like physical real state, you can also take out a loan against your portfolio as well, similar to a HELOC, or Home Equity Line of Credit. This is called an SBLOC, Securities Backed Line of Credit.

And I’ll leave you with this:

There’s nothing wrong with owning both. But if I had to pick, I would focus on building an income-generating portfolio first. And them move into physical real estate.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Real estate vs. stocks isn’t that simple. Leverage, taxes, and inflation flip the math fast. REITs look clean on paper—until yields compress and taxes bite. Real estate looks messy—until inflation pays down your fixed debt. Neither wins automatically. The investor who knows which risk they’re actually holding does.