Ride The Gold Rally With This 12% Yielding ETF

Get Growth & Income With KGLD

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Precious metals have garnered significant attention in recent months amid elevated economic uncertainty.

Higher-for-longer interest rates, rising recession probabilities, surging U.S. debt levels, and ongoing geopolitical tensions have all contributed to renewed investor interest in hard assets.

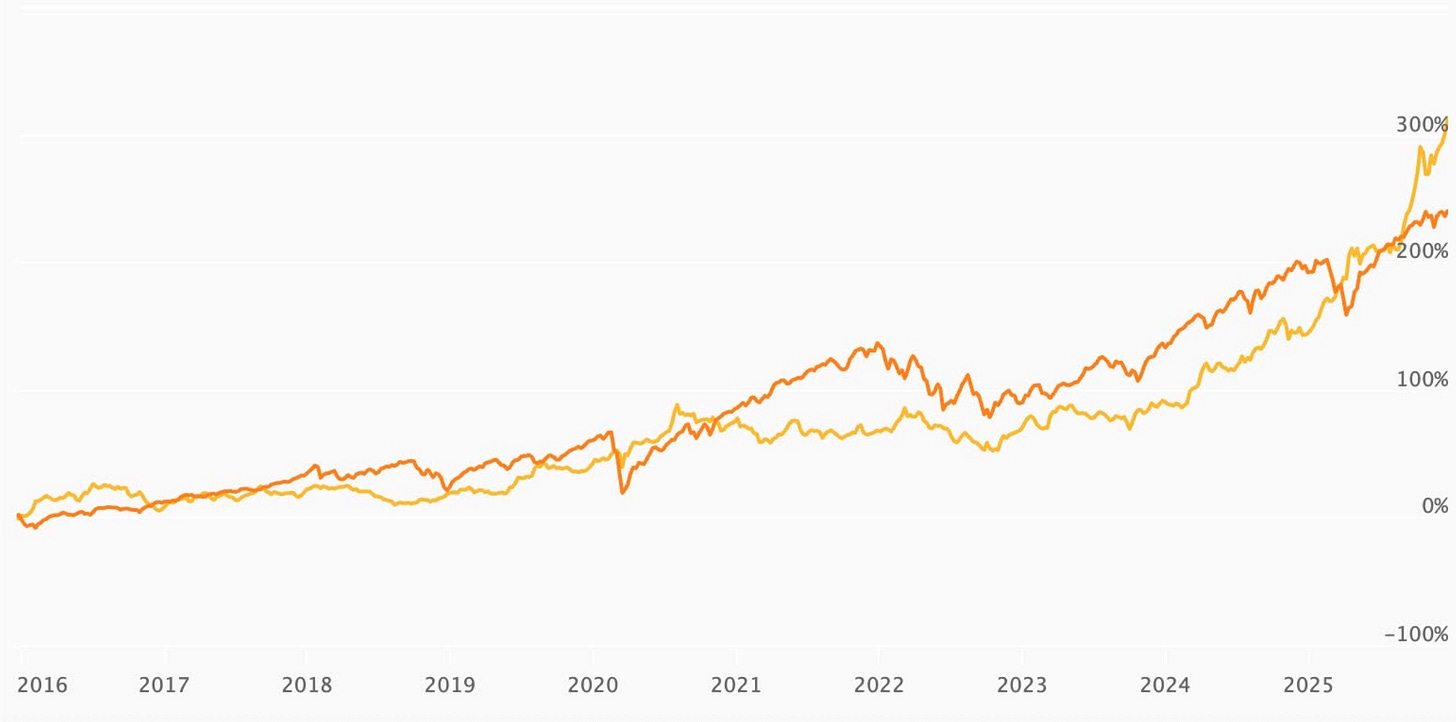

The chart below shows how Gold has performed vs the S&P in the past decade. You can see how 2025 gold has surged in performance.

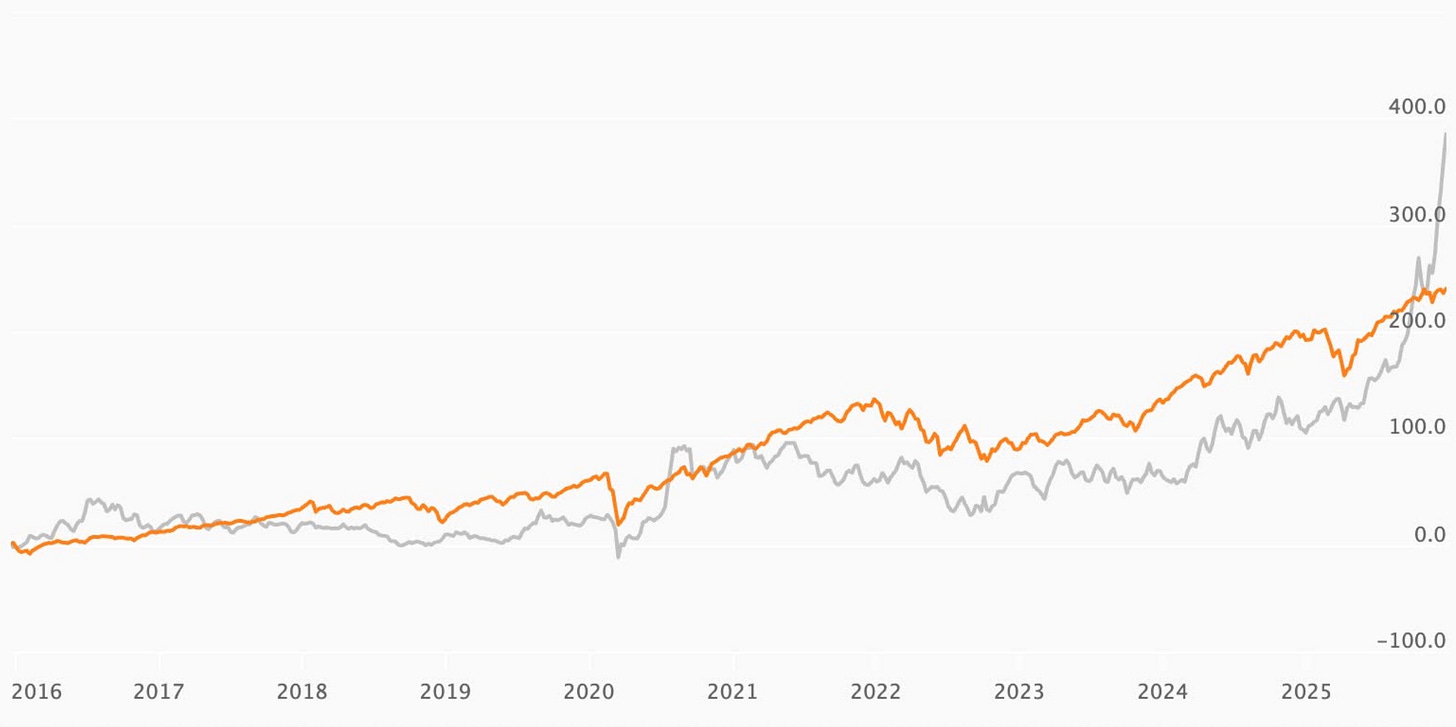

The same for Silver.

As a result, gold—via SPDR® Gold Shares ETF (GLD)—and silver—via iShares Silver Trust ETF (SLV)—have rallied meaningfully. With 2025 coming to a close, I believe this rally still has legs, at least in the near- to medium-term.

For income-focused investors who share this outlook, Kurv Investment Management’s Gold Enhanced Income ETF (KGLD) may offer an attractive way to ride the trend—while collecting substantial monthly income along the way.

With a distribution yield north of 12% paid monthly, investors are not only positioned for potential gold-driven upside but are also compensated with passive income during the ride.

In this article, I’ll break down what makes KGLD unique, why it carries elevated risk, and why—despite those risks—I’m initiating a Buy rating on the fund.

Why Gold? 🔑

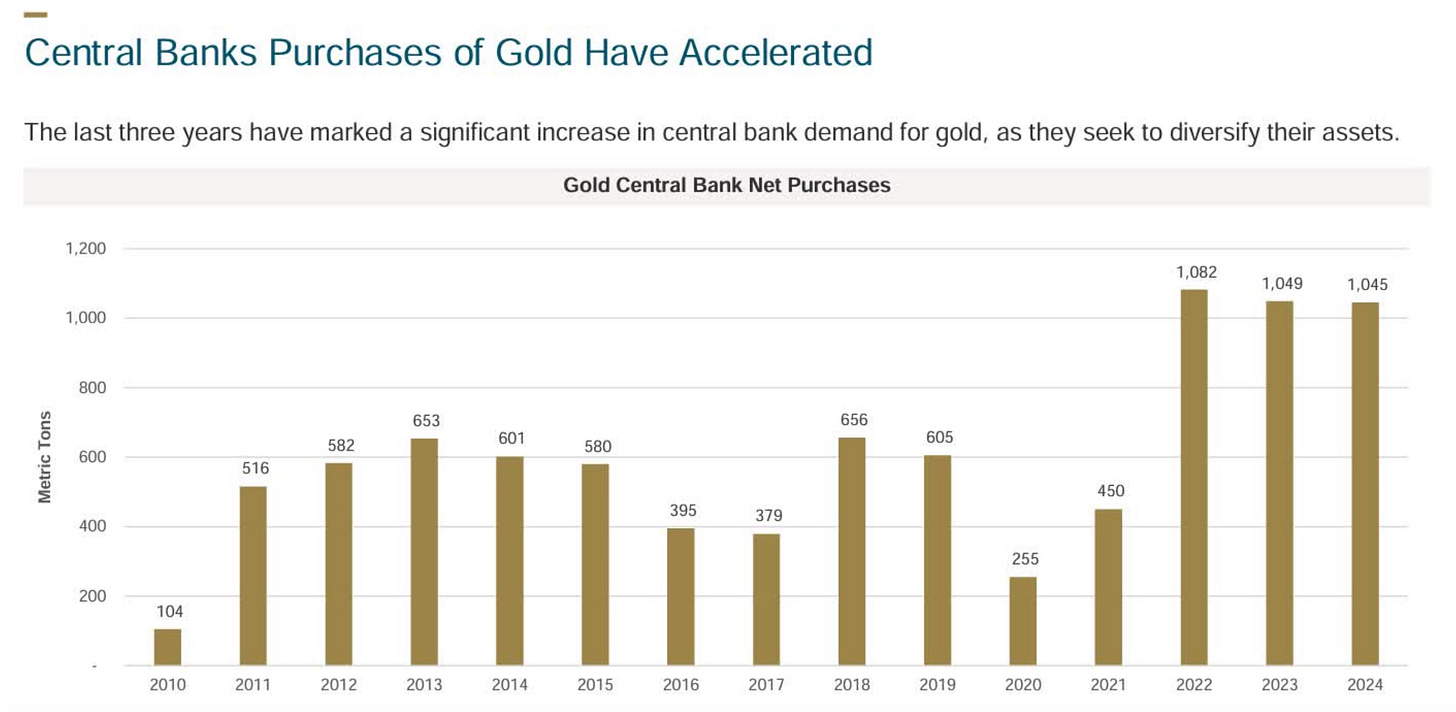

Gold’s outperformance in recent years hasn’t been driven solely by economic uncertainty. One major tailwind has been aggressive central-bank buying. Since 2022, global central banks have been steadily increasing their gold reserves, reinforcing gold’s role as a monetary hedge.

Historically, gold has served as a store of value during inflationary periods and times of macro stress. I remember vividly during the 2008 Global Financial Crisis—while on active duty—how “buy and hold gold” became a common refrain.

Fast-forward nearly 18 years. While the U.S. economy is not currently in recession, gold’s recent price action may be signaling elevated risk ahead.

For months, I’ve argued that recession probabilities have been understated. While recent GDP data has pushed modeled recession odds lower—closer to 25%—strong AI-driven growth and resilient consumer spending could still delay a downturn.

Add to that expectations for gradual rate cuts over the next year, and a near-term recession may indeed be avoided.

However, uncertainty remains elevated. Tensions in Venezuela, ballooning U.S. debt, trade tariffs, and geopolitical instability are unlikely to disappear anytime soon.

In that environment, gold and precious metals should remain well supported—and that’s where KGLD comes into play.

The Bullish Case For KGLD 🐂

As noted earlier, KGLD currently sports a distribution yield above 12%, paid monthly. This means investors benefit from both potential price appreciation tied to gold and consistent income.

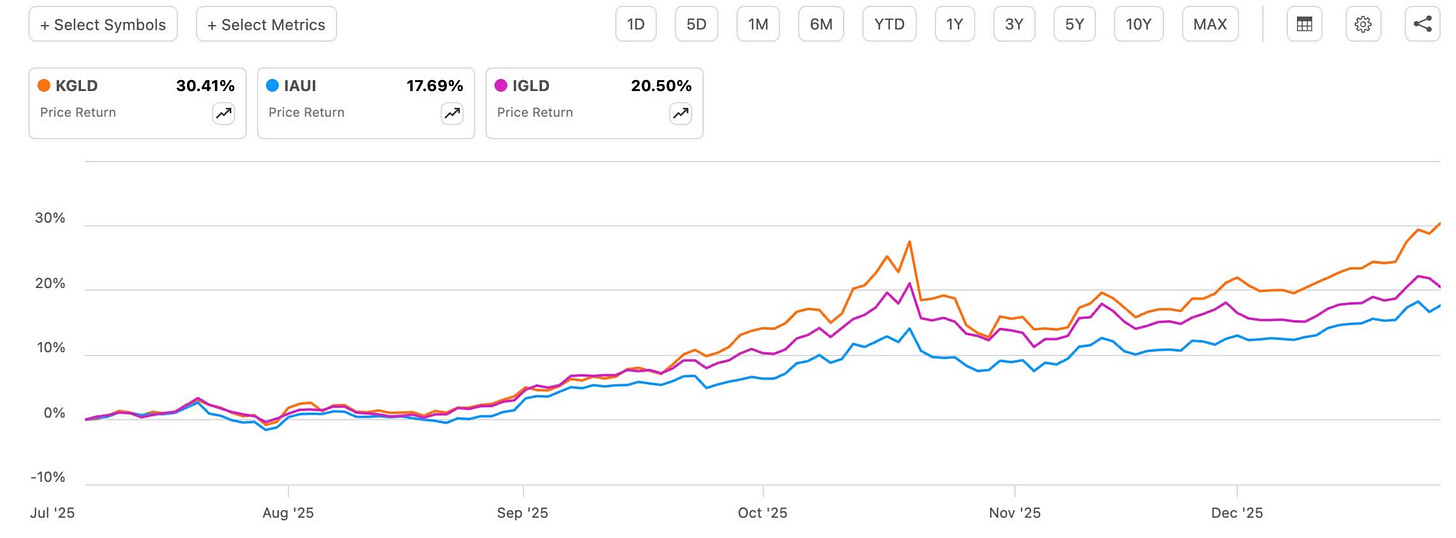

One caveat is the fund’s very short track record. KGLD launched on July 8, 2025, giving us less than a year of data. Ideally, I prefer to evaluate at least 12 months of performance, but what we’ve seen so far has been impressive.

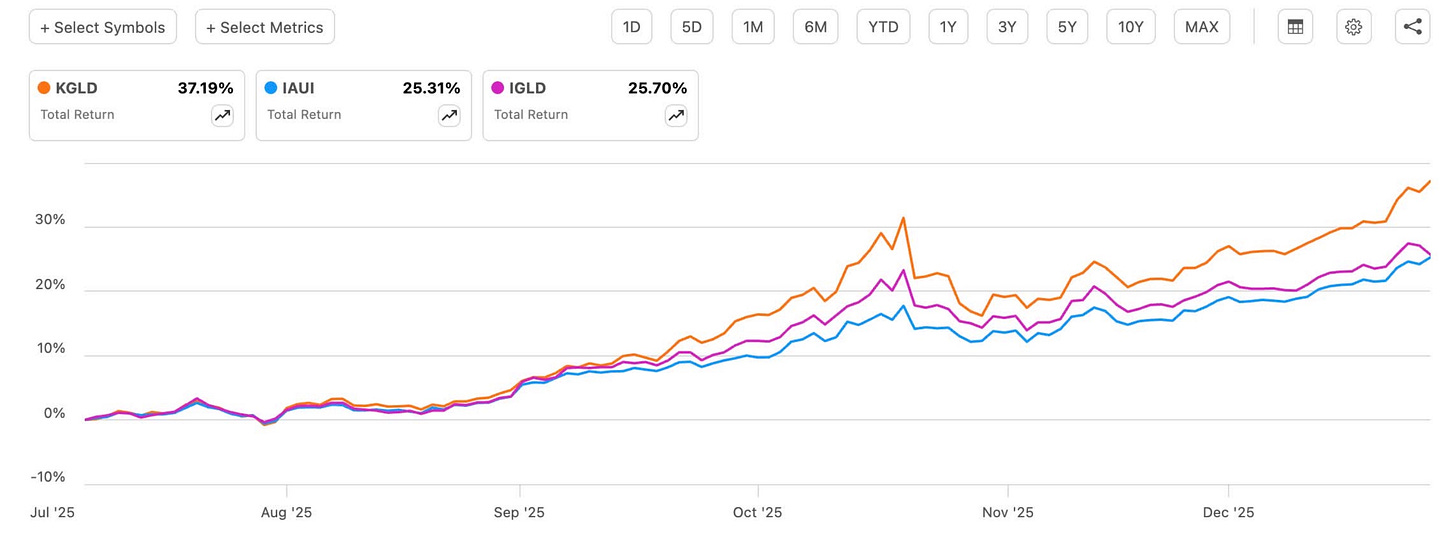

Since inception, KGLD has significantly outperformed peers such as:

NEOS Gold High Income ETF (IAUI)

FT Vest Gold Strategy Target Income ETF (IGLD)

KGLD is up over 30%, compared to roughly 18% for IAUI and 21% for IGLD over the same period.

When factoring in distributions, KGLD’s total return rises to 37.19%, versus 25.31% for IAUI and 25.70% for IGLD.

Notably, IGLD currently carries the highest yield at 21.88% and has a longer operating history dating back to 2021. IAUI’s yield is slightly higher than KGLD’s at 12.53%. Despite this, KGLD has delivered superior total returns.

Strategy & Portfolio Construction 👷🏾

KGLD remains significantly smaller than its peers, which may partly explain its agility. IGLD has close to $500 million in AUM, while IAUI—launched roughly a month earlier than KGLD—has nearly $300 million.

KGLD employs a synthetic options-based strategy. Rather than owning physical gold, the fund sells call options on gold ETFs and ETPs, covering roughly 80% of assets. No more than 25% is allocated to any single ETF or ETP.

This approach caps upside during sharp rallies but generates steady option premium. To mitigate downside risk, the fund also sells out-of-the-money protective puts and may utilize leverage opportunistically.

While leverage can enhance returns—likely contributing to recent outperformance—it also increases volatility and downside risk.

A large portion of KGLD’s assets is invested in U.S. Treasuries, which helps stabilize the portfolio and provides an additional source of income.

Expense Ratio Considerations 💲

KGLD’s 1.00% expense ratio is higher than both IAUI (0.78%) and IGLD (0.89%). That equates to $100 annually per $10,000 invested.

Personally, I prefer expense ratios below 1%. However, covered-call and options-based ETFs often come with higher costs. For some investors, outperformance can justify higher fees, and if gold continues to rally, all three funds should perform well.

NAV Growth & Sustainability ↗️

One reason KGLD stands out is its strong NAV growth since inception. Covered-call ETFs are often plagued by NAV erosion due to high distribution payouts.

So far, this hasn’t been an issue for KGLD. Compared to IAUI—which launched in June—KGLD has delivered meaningfully stronger NAV performance over the 1-month, 3-month, and since-inception periods.

While NAV erosion remains a long-term risk, it has not yet materialized meaningfully for KGLD.

Tax-Efficient Distributions 🗂️

KGLD’s distributions are predominantly classified as return of capital (ROC). With the exception of the first distribution in August (76% ROC), subsequent distributions have averaged around 91% ROC, with the remainder classified as net investment income.

This makes KGLD particularly attractive for taxable accounts, as ROC defers taxation until shares are sold or the cost basis reaches zero.

By contrast:

IGLD’s distributions are taxed as ordinary income, making it more suitable for tax-advantaged accounts like a Roth IRA.

Traditional gold ETFs are taxed as collectibles, with rates as high as 28%.

From a tax perspective, KGLD holds a clear advantage.

Risks To Consider ⚠️

Despite its strengths, KGLD carries notable risks:

Short operating history

Smaller AUM

Use of leverage

Capped upside due to call selling

Gold has rallied sharply, and a correction is inevitable at some point. Recent pullbacks—particularly in silver—highlight this risk. Should gold experience a steep or prolonged correction, KGLD could underperform, especially due to leverage.

Some analysts expect a pullback as early as next year. I believe gold’s structural tailwinds remain intact, a correction within the next 12–18 months is plausible.

Bottom Line ✅

While gold’s strong rally increases the risk of a near-term pullback, I believe economic uncertainty will remain elevated long enough to support continued outperformance in the near- to medium-term.

KGLD’s superior total returns, strong NAV performance, tax-efficient distributions, and double-digit monthly yield make it a compelling—albeit higher-risk—option for income-focused investors bullish on gold.

Given its performance relative to peers and my outlook for precious metals, I am initiating a Buy rating on KGLD.

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.