The Difference Between Investing And Playing It Safe

"Don't Leave Money On The Table"

I recently spoke with a friend who sold his house. He had it for 5 years and made roughly $220,000 in profit. Smartly, he took some of the profit to pay off debt. The remaining, $140,000, he placed into a high-yield savings yielding 4%.

Placing money into a high yield savings is better than keeping it in the bank, that’s for sure. However, I quickly told him to put it in the market. While a high-yield savings is safer, not investing and choosing to play it safe results in the potential of money being left on the table.

And this money is in the form of dividend checks and capital appreciation.

So, I wanted to show the difference between playing it safe and taking a risk by investing in the stock market. And the thing is, you don’t have to take unnecessary risk. You can simply put your money into low-cost ETFs, or Exchange Traded Funds and let compounding do the work for you.

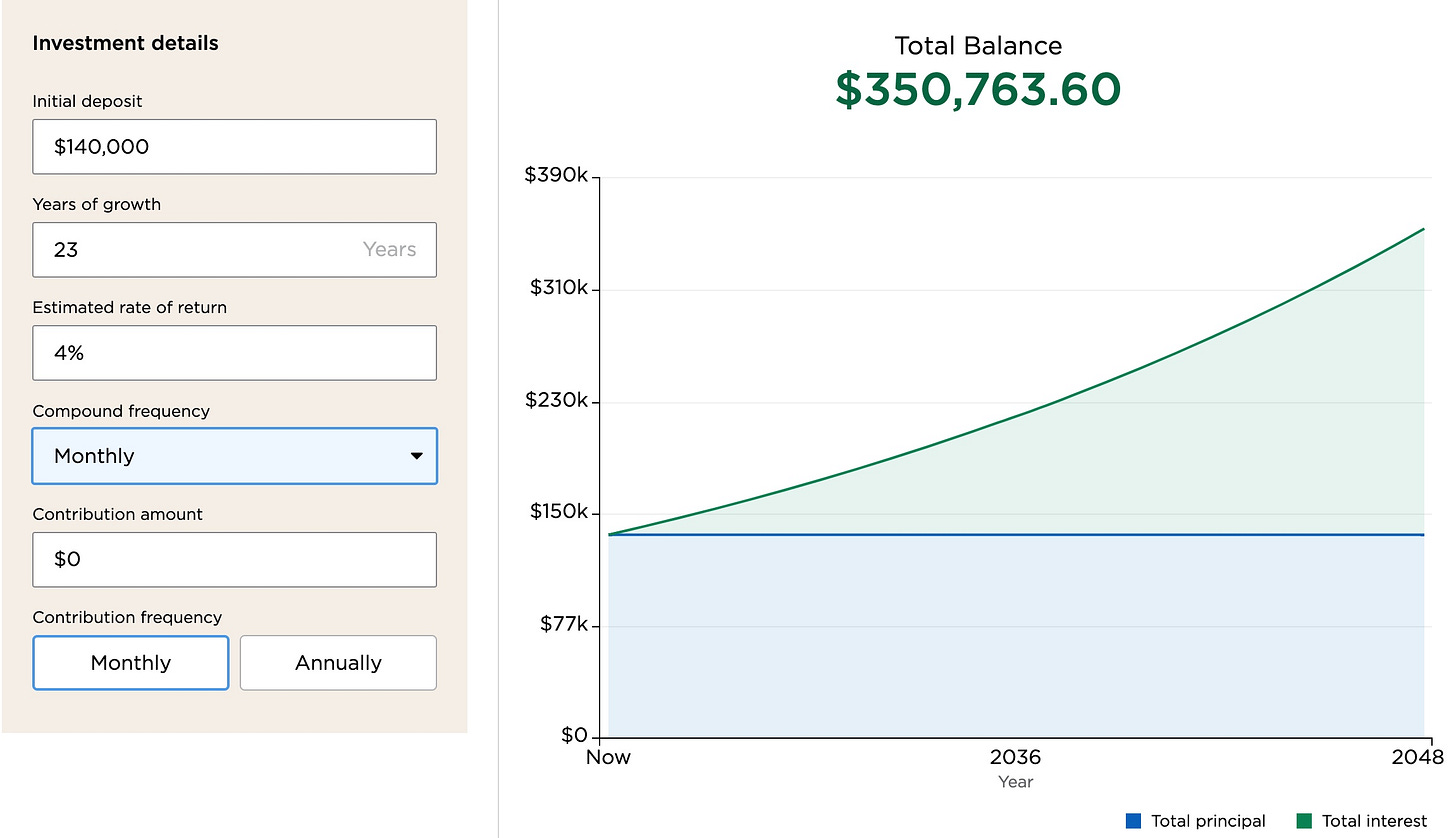

Below is how much you’re expected to earn on your $140,000 investment over a 23-year period at 4%. I used this time frame because my friend is 36 years old and can legally withdraw tax free from a Roth IRA at 59 1/2.

You would have almost $351,000 after 23 years, not bad for an initial investment with no additional capital added. But here’s how much you would have made if you placed the same $140,000 into two ETF’s 23 years ago. Past performance is no indicator of future performance, but this scenario is assuming similar growth for the next 23 years.

Furthermore, ETFs continue to rise in popularity amongst investors, likely due to their instant diversification while mitigating risk due to owning several, high quality companies.

Below is how much half of your $140,000 investment would be worth if placed into SPY, the oldest ETF that tracks the S&P 500. It would be worth almost $361,000.

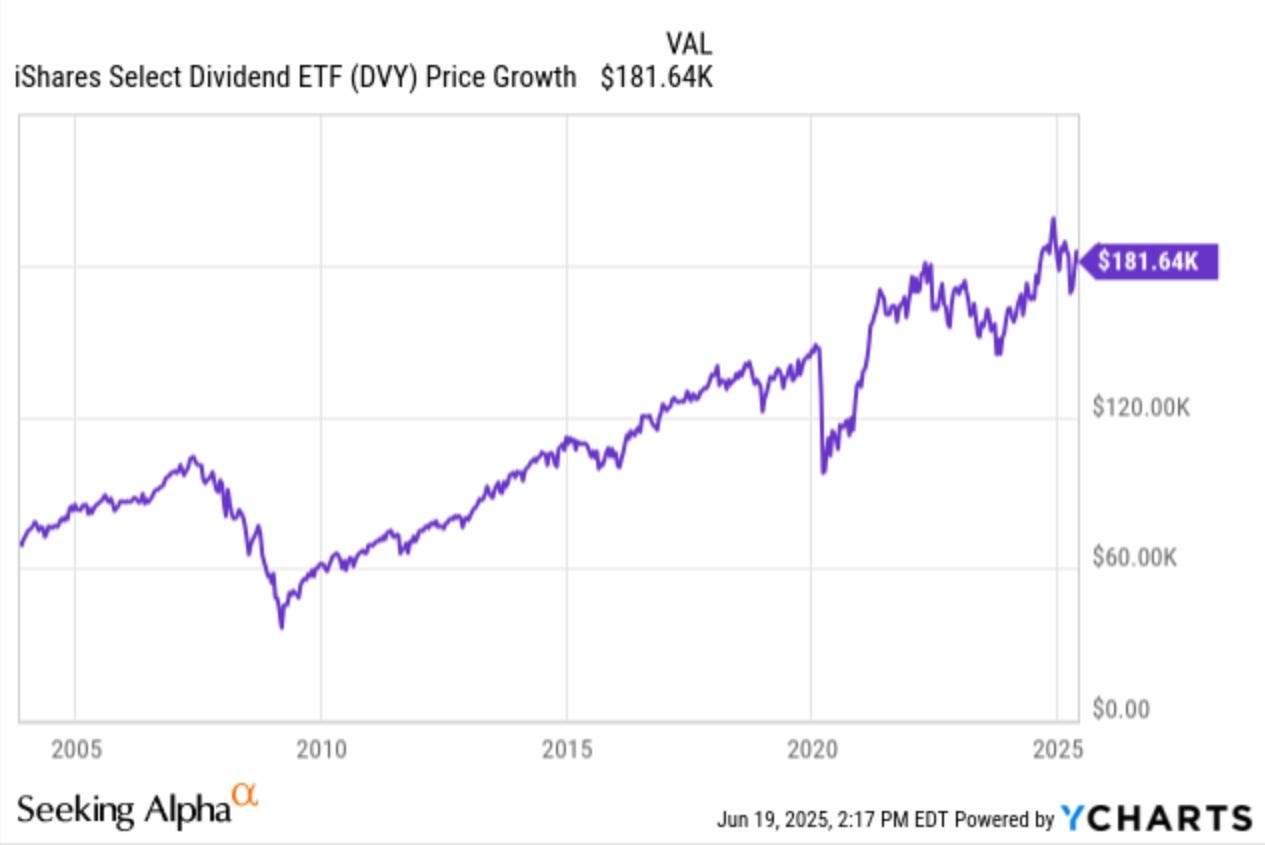

Placing the other half into a dividend-focused ETF like DVY would be worth almost $182,000. I used DVY because it is the oldest dividend-focused ETF with an inception date of November 2003, almost 22 years. So, this was relatively close for the scenario.

In total, you would have $542,600, not including dividends you would have received along the way. Including dividends, this would be significantly higher. I used these two ETFs because they offer a combination of growth & income. And while dividends are not guaranteed, they’re likely to continue growing from blue-chip companies with strong cash flows, or high-quality ETFs like SPY & DVY.

One advantage a high yield savings has over investing in ETFs is being charged annual fees, also known as expense ratios. These can be high, especially if you choose to invest in actively managed funds that sell covered call options. In my opinion, you should look for those with expense ratios less than 1%.

Both SPY & DVY have expense ratios of 0.09% and 0.38% respectively, meaning you pay an annual fee of $9 and $38 for every $10,000 invested. Again, past performance is no indication of future performance, but investing in high-quality investments and letting compound interest work in your favor can yield substantial results.

So, if you’ve recently sold a house or received a lump sum, and you’re not quite sure what do with it, consider investing it instead of playing it safe. It can make a world of difference.

Like & subscribe if you’re active duty, a veteran, or just love investing.