Article Of The Week

Keep Investing Simple Stupid with SCHD (K.I.S.S.)

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

And the platform allows writers to share one article once a week free of charge. So, I like to share them with all my current & future subscribers. (Linked below)

At the Dividend Collection Agency my goal is to teach investors how to be successful do-it-yourself (investors) by keeping things simple. Most people want to invest but are too afraid because of their relationship with money (but let’s save this topic for another time).

While investing is risky, not investing is even riskier. Like anything, investing can be either simple or hard. One way to make this simple is by investing in ETFs. However, everything has two sides. Have you ever seen a one-sided door? A one-sided house? How about a one-sided story? Like the saying goes: “Every story has two sides”.

With ETFs, investors give up some capital appreciation that they could get with individual stocks. For example, an ETF that holds NVIDIA Corp (NVDA) won’t see the same price appreciation as the individual holding.

In turn, you mitigate your downside risks with ETFs because they typically own hundreds of stocks instead of one. Additionally, ETFs are great for do-it-yourself investors getting their feet wet.

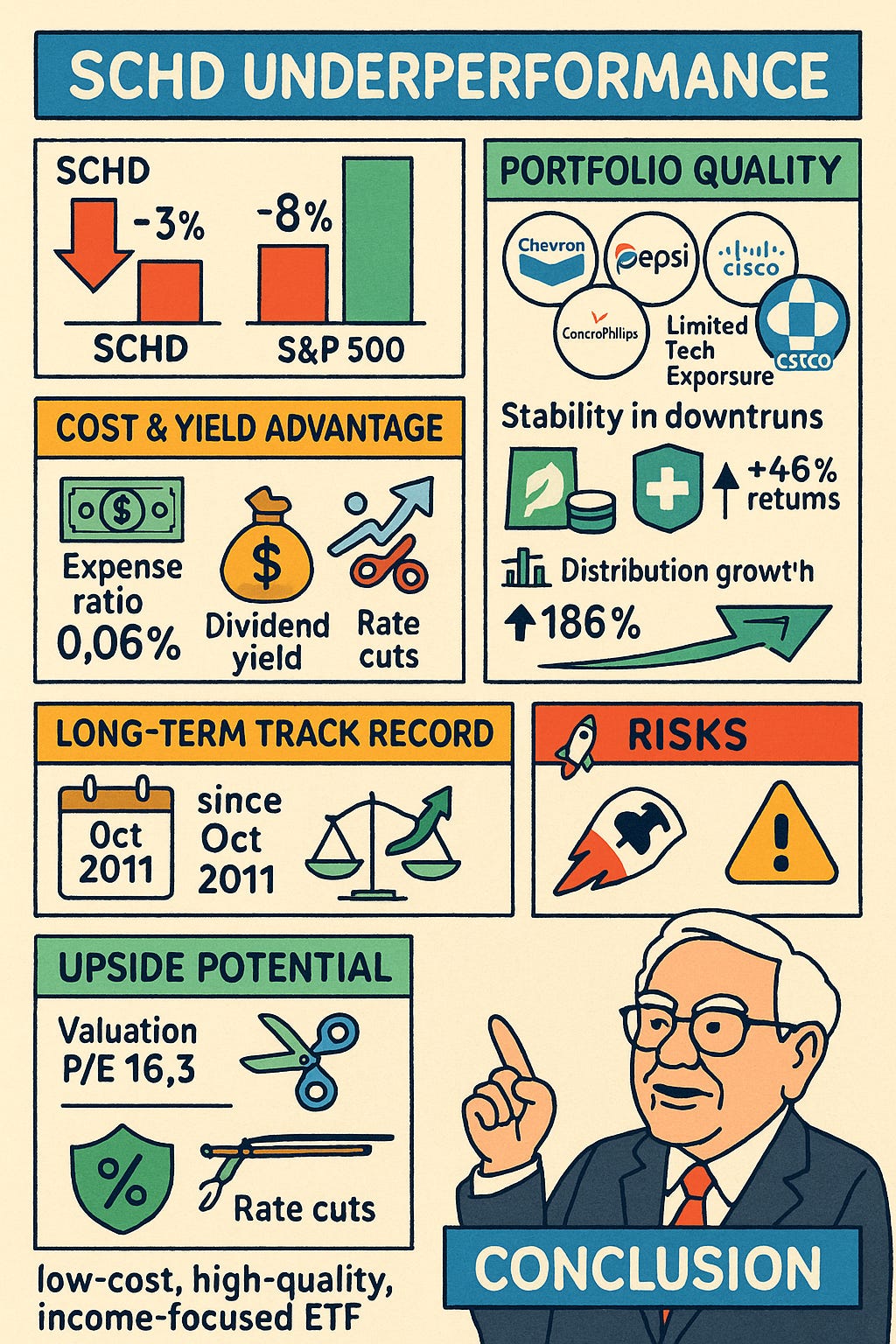

If you’re looking for passive income, one ETF that fits that criteria is Schwab U.S. Dividend Equity ETF (SCHD). However, over the past year, the ETF has underperformed the overall market. But investors should understand the purpose of the fund and why it has underperformed. I list those reasons in the article I’ve shared as this week’s article of the week.

Enjoy!

Like & subscribe if you’re active duty, a veteran, or just love investing.