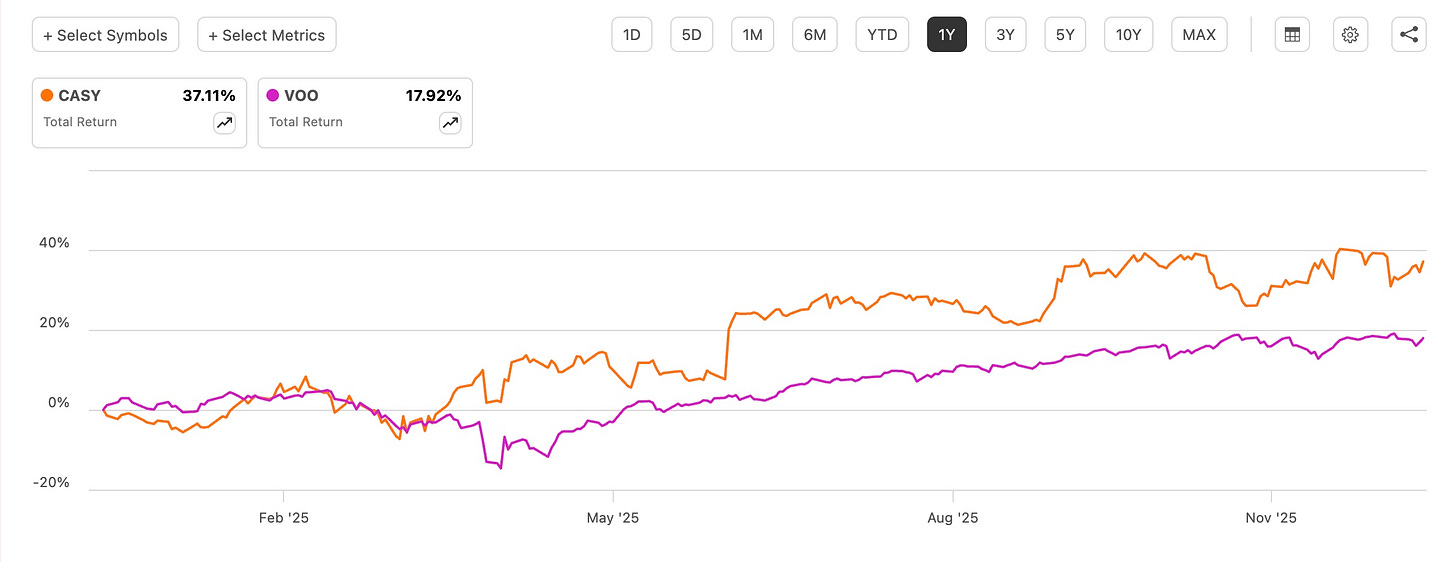

This Dividend Growth Stock Has Doubled The Total Return Of The S&P In The Past Year!

"An Overlooked Dividend Growth Stock To Consider On A Pullback"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Casey’s General Stores (CASY) is a stock that first popped onto my radar nearly two years ago. At the time, I was bullish, and for good reason.

The company combined strong fundamentals, a loyal customer base (my girlfriend stands by their pizza), and what I believed to be an undervalued share price, giving it the potential for attractive long-term capital appreciation.

Despite its modest dividend yield, CASY looked like an ideal holding for dividend investors who value quality, consistency, and growth.

Since then, the stock has delivered. Casey’s has significantly outperformed the S&P 500 (SP500), rising more than 88% versus roughly 34% for the index. That level of performance is impressive.

Especially, given the economic uncertainty created by higher-for-longer interest rates and rising unemployment. In my opinion it’s a testament to the company’s execution and resilient business model.

However, despite being one of my favorite companies fundamentally, their valuation now tells a very different story. In the past year the stock has continued to outperform, up over 37% compared to roughly 18% for VOO.

Another Double Beat — But With a Catch ⁉️

While many consumer-based companies have struggled over the past year, Casey’s continued to outperform. In its FY26 Q2 earnings, the company delivered another solid quarter:

EPS: $5.53, beating estimates by $0.33

Revenue: $4.51 billion, exceeding expectations by $10 million

Yet, despite the beat, shares sold off following earnings. Part of this reaction likely stems from valuation concerns. But it was also influenced by sequential declines in EPS and revenue versus the prior quarter.

Short-term volatility doesn’t concern me much. I focus on longer-term trends. And across nearly every metric, Casey’s continues to deliver double-digit growth:

EPS growth: +14%

Revenue growth: +14.2%

Gross profit: +17% year-over-year to $1.12 billion

EBITDA: +17.5%, with margins expanding to 41.5%

Inside same-store sales rose 3.3% for the quarter, and 13% for the year, driven largely by prepared food and beverage sales. This increased by $468 million year-over-year. Even fuel sales grew modestly, despite lower fuel prices.

Operationally, CASY continues to execute at a very high level.

2026 Outlook: More Growth Ahead ↗️

Management expects the momentum to continue into fiscal 2026:

Inside same-store sales growth: 3%–4%

EBITDA growth: 15%–17%

Store expansion: ~500 new locations

This combination should support double-digit growth in both revenue and earnings, reinforcing Casey’s competitive advantage among convenience store operators.

A Quietly Excellent Dividend 💵

I believe one of the most under-appreciated aspects of Casey’s is its exceptionally well-covered dividend.

Free cash flow payout ratio: just 12.1%

Quarterly dividend: $0.57 per share

Estimated quarterly dividend payments: ~$21 million

Quarterly free cash flow: ~$160 million

Free cash flow rose year-over-year to $176 million, helped by lower CAPEX. This leaves ample room for continued dividend growth and aggressive buybacks.

I expect another dividend increase soon, likely in the range of $0.06–$0.08, bringing the quarterly dividend to $0.63–$0.65.

Management also raised its buyback guidance to $200 million, up from $125 million previously.

Balance Sheet Remains Strong ⚖️

Casey’s balance sheet provides plenty of flexibility:

Available liquidity: $1.7 billion

Cash: $492 million

Leverage: 1.7× (within management’s 2.0× target)

Short-term debt: just $101 million of $2.35 billion total

This positions the company well to continue growing—or to weather any macroeconomic turbulence.

The Problem: Valuation Has Run Too Far 😬

Despite all of this strength, valuation is now the primary risk. This is something investors should be aware of. When a company’s valuation is no longer logical, this puts you at high risk of underperformance going forward.

Reason being is no stock goes up forever. At some point, it will crash or correct. The more it goes up, the farther it will likely fall in a correction.

CASY currently trades at nearly 32× earnings, and the share price has clearly outpaced underlying earnings growth. While the business may continue to perform, history shows that buying even great companies at stretched valuations often leads to subpar future returns.

Before earnings, the stock traded near $563. And as I write this, shares are around $558—still far too expensive in my view.

Final Thoughts: Hold, Not Buy (Yet) 💭

Casey’s General Stores remains a high-quality business with excellent execution, strong cash flows, and a growing dividend. However, after such a strong run, valuation risk now outweighs near-term upside.

I maintain a HOLD rating on CASY. For new investors, patience is key. I would become much more interested in the stock following a 20%–30% correction, ideally at prices below $500.

Sometimes the best move—even with great companies—is simply to wait.

What do you think?

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.