This Lesser-Known AI-Focused ETF Quietly Outperformed VOO, SCHG, & QQQ Last Year

Is This Tech-Heavy ETF in

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Current Price: $35.66

Portfolio Purpose: Growth 📉

With 2026 off to a fresh start, many investors are wondering how artificial intelligence will continue to shape the U.S. economy and equity markets.

Personally, I believe Technology (XLK) will remain a key driver of market gains, with sustained AI-related capital expenditures supporting GDP growth in the years ahead.

For investors who remain bullish on AI but don’t want to pick individual tech stocks, the Alger 35 ETF (ATFV) may be worth a closer look.

In this article, I’ll discuss ATFV’s performance, portfolio construction, and why—despite my hold rating—it remains an ETF worth monitoring.

Will AI Demand Continue? 💻

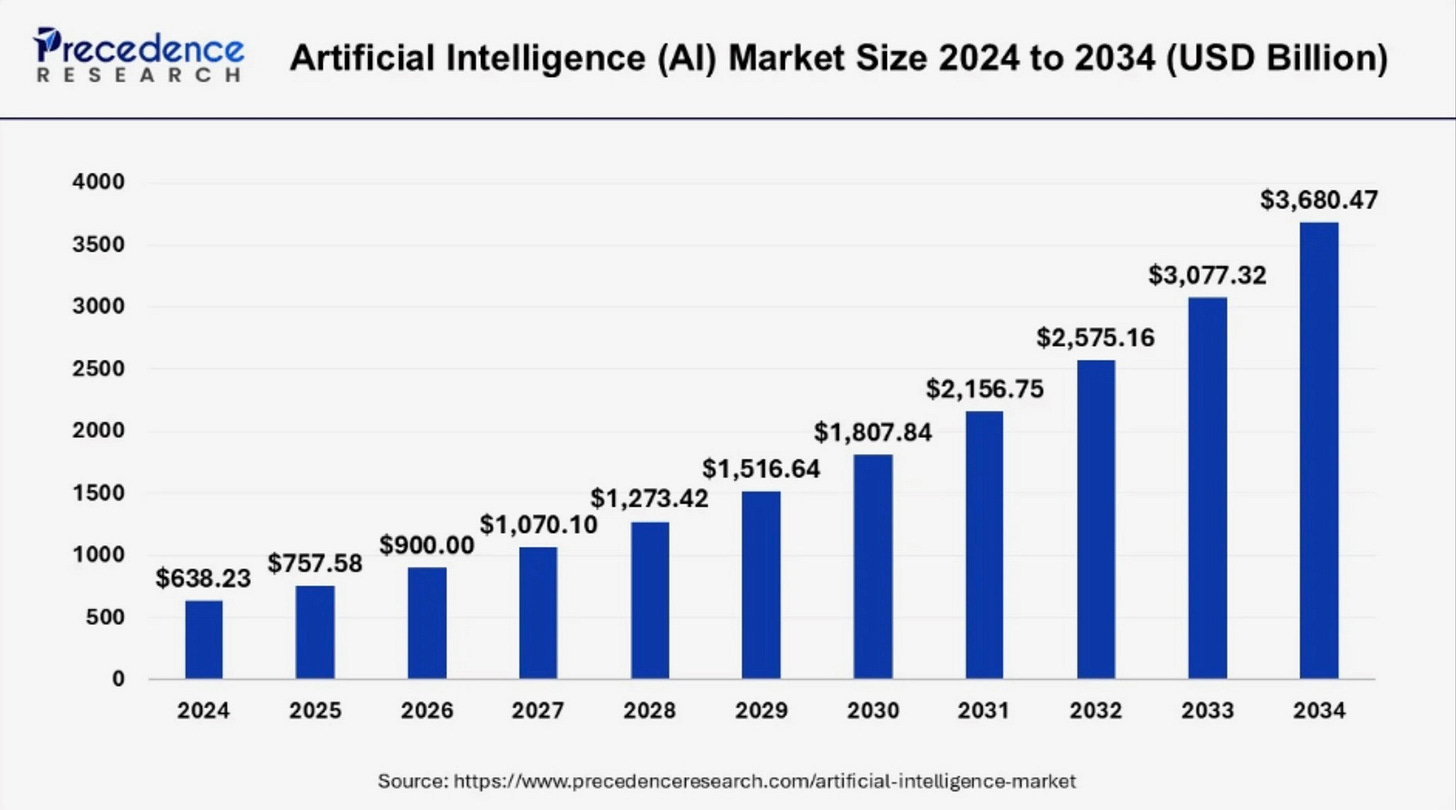

AI enthusiasm remains near all-time highs, but the key question is longevity. According to estimates from Precedence Research, the global AI market is expected to more than quadruple to nearly $3.7 trillion over the next eight years

If those projections materialize, stocks and ETFs with meaningful exposure to AI beneficiaries should continue to benefit.

That said, technology is not my strong suit. I’m far more familiar with income-focused sectors like REITs (XLRE) and BDCs (BIZD). I’m also very much a Warren Buffett–style investor, which means simplicity, durability, and long-term thinking.

Still, I believe AI will continue reshaping the U.S. economic landscape. As a result, I’ve recently tilted a portion of my portfolio toward growth—primarily through ETFs with significant exposure to the sector. That’s where ATFV comes in.

Portfolio Construction 👷🏾

ATFV does have a heavy growth tilt, but it isn’t overly concentrated in technology.

Communication Services (XLC) is the largest sector at ~30%

Technology is the second-largest allocation

Healthcare (XLV) also plays a meaningful role

This diversification is what I like most about ATFV. Investors get strong growth exposure without the extreme sector risk seen in some funds. For comparison, the iShares Future AI & Tech ETF (ARTY) allocates roughly 85% of its portfolio to technology—offering higher upside, but also significantly more downside risk during corrections.

ATFV’s healthcare exposure also provides a potential buffer during periods of economic uncertainty, as healthcare stocks are often viewed as defensive.

Strong Performance Over the Past Year 📉

Sector performance over the past year helps explain ATFV’s results:

Communication Services: +19%

Consumer Staples (XLP): –2%

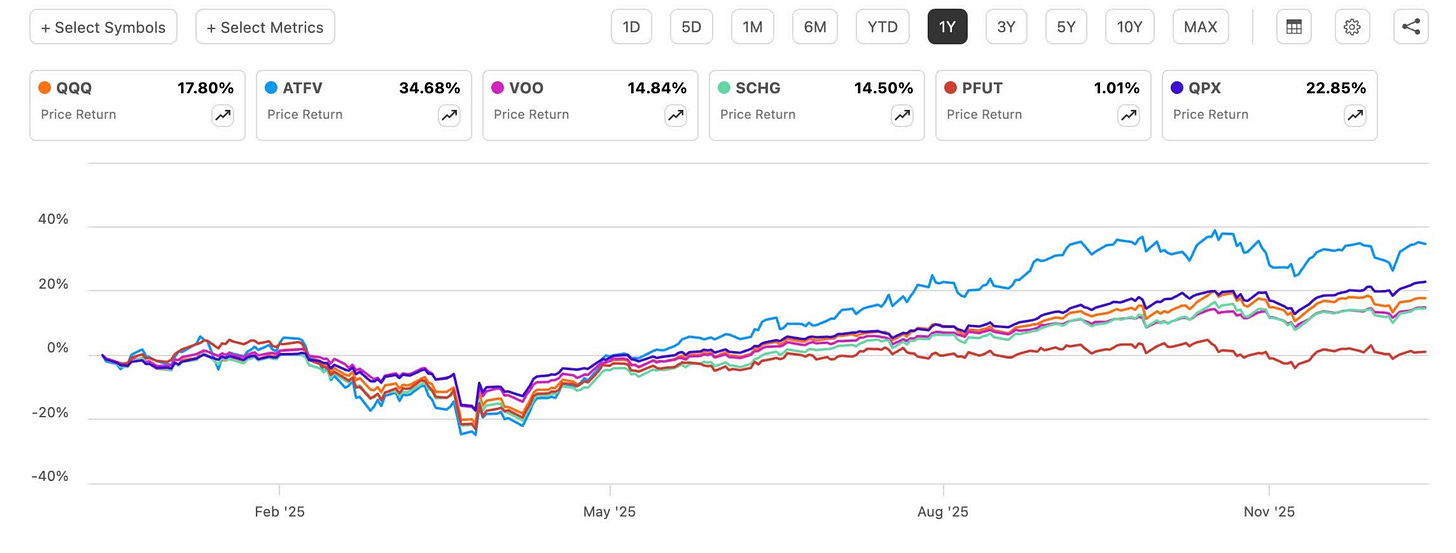

Thanks to this positioning, ATFV has delivered nearly 35% returns over the past year, significantly outperforming:

Schwab U.S. Large-Cap Growth ETF (SCHG)

Invesco QQQ Trust ETF (QQQ)

Vanguard S&P 500 ETF (VOO)

That’s impressive company to outperform.

One reason for this performance is ATFV’s active management. I believe actively managed funds can outperform passive ones when executed well, and ATFV’s results over the past year support that view.

The fund typically holds around 35 stocks (currently 34), with mega-cap leaders like NVIDIA (NVDA), Microsoft (MSFT), Alphabet (GOOG), and Amazon (AMZN) dominating the top positions.

Long-Term Track Record & Costs 💵

ATFV launched on May 3, 2021, and since inception:

ATFV: ~82% total return

VOO: ~65%

QQQ: Outperformed ATFV

SCHG: Led the group at ~91%

Performance has been solid, though not category-leading.

The fund’s 0.55% expense ratio is reasonable for an actively managed ETF. While SCHG’s ultra-low 0.06% expense ratio is hard to beat, ATFV is still cheaper than peers like Putnam Sustainable Future ETF (PFUT) and AdvisorShares Q Dynamic Growth ETF (QPX).

NAV growth has also been strong, with double-digit annual gains since inception and over 40% growth year-to-date.

ATFV also carries a five-star Morningstar rating, which adds some credibility to the strategy.

Downsides to Consider ↘️

There are a few drawbacks worth noting:

Annual distributions, rather than quarterly

Low yield (~0.20%), making it unsuitable for income investors

Distributions taxed as short-term capital gains

Because of this structure, ATFV is better suited for tax-advantaged accounts like a Roth IRA, particularly for retirees focused on long-term appreciation rather than income.

Valuation is another concern. ATFV currently trades at a P/E of ~33.5x, higher than both the S&P 500 and the Russell 3000 Growth Index. For investors considering entry, waiting for a meaningful pullback may improve margin of safety.

Risks ⚠️

While ATFV has outperformed QQQ, VOO, and SCHG over the past year, past performance is no guarantee of future results.

Risks include:

Smaller asset base

Less than five years of operating history

Higher expense ratio than passive alternatives

Relative underperformance versus SCHG and QQQ over longer periods

Bottom Line ✅

I like ATFV’s concentrated portfolio, active management, and strong recent performance. However, valuation concerns, fund size, and longer-term comparisons keep me at a hold for now.

For investors bullish on AI who want diversified growth exposure without extreme concentration, the Alger 35 ETF is absolutely worth keeping on the watchlist. Especially, on a meaningful market correction.

How do you think AI will affect overall market performance in 2026?

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha.

Here’s How: Click the Seeking Alpha link here. Click investing group, subscribe now, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Very interesting indeed, and worth monitoring. Thank you for sharing this.