This New 17% Yielding ETF Could Be A Future Superstar

"Get Income & Capital Preservation With TDAQ"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Over the years, I’ve grown increasingly fond of covered call ETFs. While many investors view them as risky or flawed instruments, I believe they can absolutely have a place inside a well-constructed, income-focused portfolio.

That said, like anything in investing, not all covered call ETFs are created equal. Many funds offer eye-catching yields, only to slowly erode investor capital through persistent NAV decay. As a result, investors must understand the trade-offs that come with these high-income strategies.

The encouraging part? Covered call ETFs are evolving.

With years of data now available, newer funds appear to be learning from the shortcomings of earlier strategies. Some are showing improved execution, better downside control, and stronger total-return potential.

One such fund is TappAlpha Innovation 100 Growth & Daily Income ETF (TDAQ). Despite its short track record, the fund shows early signs of delivering competitive income without immediately sacrificing NAV.

In this article, I’ll break down TDAQ’s strategy, performance, risks, and why income-oriented investors may want to keep it on their radar.

Who Is TDAQ? 📉

TDAQ is an ETF issued by TappAlpha and serves as the sister fund to TappAlpha SPY Growth & Daily Income ETF (TSPY). While TSPY has approximately 16 months of operating history, TDAQ launched more recently on September 4, giving it just over three months of live performance data.

Both funds share:

The same rules-based strategy

An expense ratio of 0.68% ($68 for every $10,000 invested)

A focus on generating daily options income

The primary difference lies in the underlying index exposure.

Rather than selling daily calls on the S&P 500 (SP500) via SPDR S&P 500 ETF Trust (SPY), TDAQ sells zero-dated (0DTE) call options on the Nasdaq-100 (NDX), using Invesco QQQ Trust ETF (QQQ) as its reference index.

This gives management more flexibility to adapt positioning based on intraday market conditions while leaning into the volatility typically associated with technology-heavy equities.

Understanding the 0DTE Strategy 🔚

Selling 0DTE (zero-days-to-expiration) options means the contracts expire the same day they are written. This reduces time risk and allows the fund to harvest premiums frequently—but it comes with a cost.

Upside is capped, particularly during strong bull markets.

If technology stocks—via vehicles like Technology Select Sector SPDR Fund (XLK)—enter an extended rally, TDAQ will participate in some upside. But this would be materially less than funds holding equities outright.

That’s why investors should view TDAQ as:

Income first

Capital appreciation second

The fund is specifically designed to perform well during volatile or range-bound markets, where frequent option premiums can meaningfully enhance total returns.

In addition to its options strategy, TDAQ also holds U.S. Treasury money-market exposure, First American Government Obligations Fund Class X (FGXXX), providing an additional source of income while limiting idle cash drag.

Limited Performance, but So Far, So Good 👍🏾

TDAQ’s short operating history may deter some investors, but the early results have been encouraging.

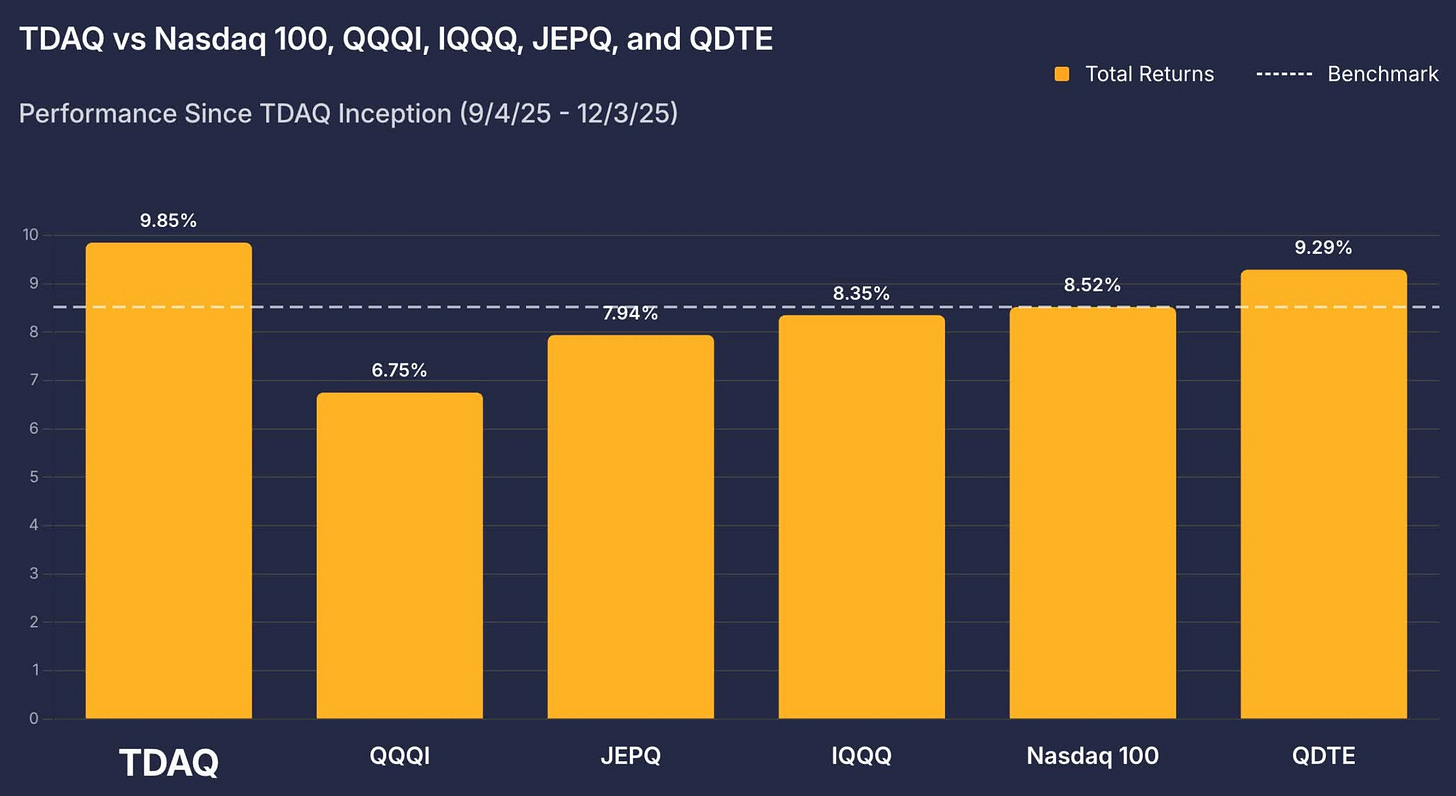

From inception through December 3rd, TDAQ delivered a 9.85% total return, outperforming notable covered call peers like:

Roundhill Innovation-100 0DTE Covered Call Strategy ETF (QDTE)

JPMorgan Nasdaq Equity Premium Income ETF (JEPQ)

NEOS Nasdaq-100 High Income ETF (QQQI)

This is notable given the structural differences between these funds.

Key Structural Differences 🔑

TDAQ sells daily 0DTE calls and does not hold equities directly.

JEPQ and QQQI hold underlying stocks and sell longer-dated, out-of-the-money calls.

JEPQ also utilizes equity-linked notes (ELNs) on up to 20% of assets, which can enhance income while dampening volatility.

Because JEPQ and QQQI own equities, they’re more likely to:

Preserve NAV over full market cycles

Capture stronger upside during sustained bull markets

That said, TDAQ’s rules-based approach offers predictability and consistency, which many income investors value.

Lessons From Sister Fund: TSPY 📝

While TDAQ’s history is limited, its strategy is not untested.

TSPY—the sister fund—has been operating for over a year, offering insight into how this model performs over time.

Over the past year:

TSPY’s NAV grew 15.42%

NAV growth reached 22.51% since inception

When comparing total returns, TSPY held its own against peers and trailed Vanguard S&P 500 ETF (VOO) by roughly 1%, while significantly outperforming other income-oriented options ETFs such as ProShares S&P 500 High Income ETF (ISPY) and remaining close to NEOS S&P 500 High Income ETF (SPYI).

If TDAQ mirrors even a portion of this performance—while leaning into tech-driven volatility—it could deliver compelling long-term results.

NAV Growth & Distributions 💰

Since inception, TDAQ’s NAV has grown approximately 5.5%, a positive sign given the tendency for some covered call funds to erode capital early.

Distributions

Current yield: ~17.37%

Payment frequency: Monthly

Average distribution: ~$0.375 per share

Distributions paid so far: 3

Notably, TDAQ’s distributions have been highly tax-efficient. According to recent 19a-1 notices, the last two distributions were 100% return of capital (ROC), with the first payment nearly identical.

This allows investors to defer taxes until shares are sold, making TDAQ particularly appealing for taxable accounts.

That said, there’s no free lunch. While 0DTE strategies can produce steady income, sharp market drawdowns can pressure NAV, requiring time and favorable volatility to recover.

Risks to Consider ⚠️

The primary risks facing TDAQ include:

Short track record

Smaller AUM (~$47 million)

Compared to peers like JEPQ and QQQI—both exceeding $1 billion in assets—TDAQ carries a higher risk of fund closure if asset growth stalls.

However, given:

The fund’s attractive yield

Proven execution via TSPY

Growing investor interest in 0DTE strategies

…I don’t currently see closure risk as a major concern.

Bottom Line ✅

TDAQ is not without risk—but it’s far from a speculative gamble.

The fund:

Leverages a tested strategy

Offers high, tax-efficient income

Has shown early NAV resilience

Benefits from technology-driven volatility

While I personally prefer at least a year of performance data before initiating a position, TDAQ’s 17%+ yield and early execution make it worth watching.

In a continued bull market driven by AI, easing rates, and economic growth, funds like JEPQ and QQQI may deliver superior capital appreciation. But for investors prioritizing current income, TDAQ could carve out a useful role inside a diversified income portfolio.

For now, my stance remains Hold—but it’s a promising hold.

And finally—happy holidays to everyone. May your income grow, your NAV stay intact, and your investments prosper in 2026!

Happy Investing!

☎️ If you’re looking to create passive income and build your wealth from one of the top-rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started.

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.