Time Is Money

Get Your Time Back With Dividends

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age. I want to help you take control of your life, have F.I.R.E.

We’ve all heard the phrase, “Time Is Money” but I often wonder if people stop and think deeply about what that means. We hear successful people say this quite often. We even hear it all the time in movies.

But until I retired from the military, I never had the time to really think about what it means.

You see most of us spend the majority of our lives working. You’re told to go to school, graduate, go to college, graduate, get a job, get married, have kids, buy a house, work until traditional retirement age, pay bills along the way, and ultimately, die.

And this translates to money. And that money - you trade your time for it. I often hear military people say they already have a job lined up for when they retire. At 18 years old when I joined, I would often hear this. And I always wondered why they didn’t take a break after military retirement. Did they need to work?

And honestly, most do. Everyone has different financial obligations, but let’s be honest. Most of us work out of necessity, usually because of debt. Whether it’s a house, multiple cars, student loans, etc.

I luckily avoided all of those. I remember a few years ago, my superior who was an E-9 was retiring after 34 years of service. I curiously asked him was he going to work. His response was “Yeah, my wife said I have to work!”

I was a little taken aback because his kids were grown and it was just him and his wife that I knew of. Of course, I don’t know his financial situation, but his response made me think he was just trained to work. No matter if he made $10,000 or $15,000 a month, he would likely get a job.

I realize that’s most people. They’re trained from a young age, even the school system encourages it; the way our healthcare works encourages it. But what bothered me about military retirees is we get advantages that most civilians don’t. You’re able to collect a pension for the rest of your life at the age of 37/38 and get free healthcare.

To share a personal story, an Amazon (AMZN) recruiter reached out to me a couple of months before I retired after finding me on LinkedIn. I was a maintenance manager at my last duty station. And they were looking for someone to run their robotics maintenance team of about 90 people.

I was excited! We talked a bit, and she asked me was I ready to hear the offer. In total, including stock options, pay was about $220,000 a year. Hearing that, I was very excited. Especially as someone who’ve always lived below my means, $220,000 was more than enough.

She stated that the only catch was that I would essentially work very hard for that $220,000 which I was ok with. And that I would be on-call 24/7. At first thought, this wasn’t a big deal since I had 21 years of military service. Technically, you’re always on call and used to working long hours, sometimes for days straight with little sleep. So, I had already made up my mind I would take the job.

She stated they would reach back out but never did. Long story short, I’m glad they never called back. I would likely have been working long hours and not have the time or flexibility I have now.

As a freelance writer, I can get up and go where I want and when I want. I don’t have to get approved PTO or find someone to cover for me. I can work if I decide to or not or pull my work forward. That way I can still make money while I’m on vacation.

Sometimes I go to events put on by prior co-workers like retirements & promotions. And many don’t seem to recognize me. The last one I went to, a former co-worker said she didn’t recognize me and that I looked 10 years younger.

I used to be confused by this, but then I realized this is likely due to the lack of work stress. And we all know stress is one of the main causes of death. The moral of the story is time is more important that money.

Yes, money is very important, but time is the one thing you can never get back. If you lose $1 million, you can get that back. Once time is gone, it’s never coming back.

That’s why the elderly often talk about spending more time with loved ones or wishing they had traveled more in their younger years. And investing in dividends can give you that time back.

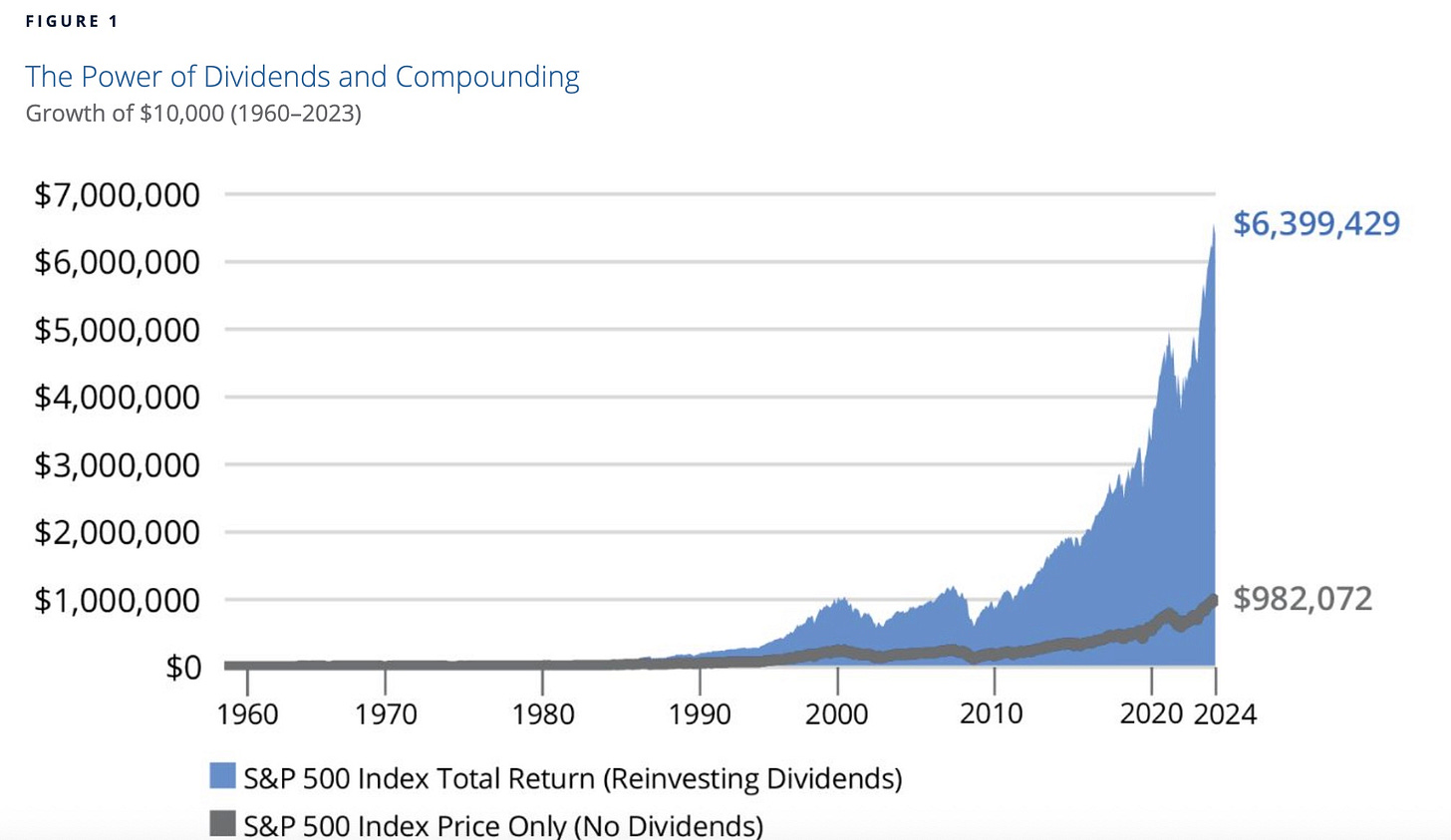

The chart below is how a $10,000 investment in an S&P index that paid dividends in 1960 would be worth at the end of 2024. Approximately $6.4 million. Excluding dividends, this would be worth less than $1 million. When investing for dividends, total returns matter!

My mother loves Pepsi (PEP), a stock that has been paying dividends for over 50 years. She’s been drinking it for as long as I’ve been alive. But imagine if she had invested $10,000 into PEP in her early years. She’s 75 now. She could live off the dividends alone!

That’s the power of investing, but most importantly, that’s the power of dividend investing!

Like & subscribe if you’re active duty, a veteran, or just love investing.