Visa's Rangebound Price Could Hint At A Recession

"Long-Term Investors Should Take Advantage Of This Dividend Compounder"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

When it comes to high-quality businesses, I can say with confidence that Visa Inc. (V) is one of the best companies an investor can own. Yet despite its elite fundamentals, the stock is up only single digits over the past year. In fact, Visa’s share price has remained rangebound for roughly six months.

In my view, this underperformance has little to do with Visa’s execution and far more to do with macroeconomic uncertainty. The market appears to be pricing in the possibility of a recession over the next year or two. And I largely agree with that assessment.

Another Earnings Beat Amid Declining Sentiment 🏆

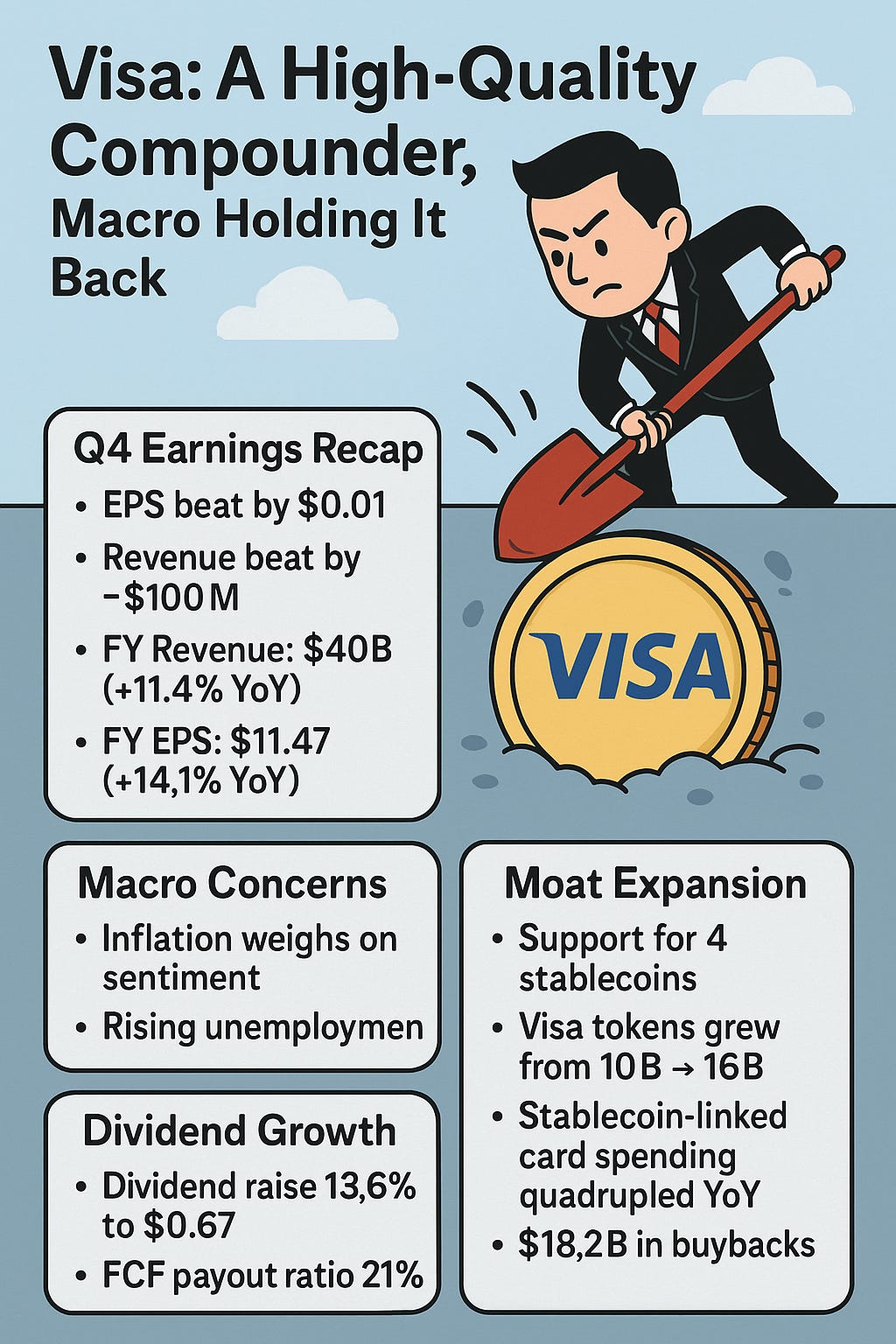

Visa once again proved why it’s a best-in-class business with a strong Q4 earnings report in late October.

Q4 highlights:

EPS: Beat estimates by $0.01

Revenue: Beat expectations by ~$100 million

Quarterly revenue: $10.7 billion

Full-year results:

Revenue: $40.0 billion (+11.4% YoY)

EPS: $11.47 (+14.1% YoY)

Peer Mastercard (MA) reported similar performance, with revenue and EPS growth of roughly 15% and 11%, respectively. While Visa’s growth slowed modestly from the exceptional pace seen in 2023–2024, sustaining double-digit growth in today’s environment is a clear testament to the company’s fundamentals.

Is Consumer Sentiment Signaling a Recession? 🤔

Consumer sentiment has trended lower in recent years as inflation has pressured household budgets. While sentiment improved in December, this was likely driven by holiday spending and temporary government-related tailwinds.

Despite interest rates being lower than last year, it will likely take time before consumers feel meaningful relief. At the same time, signs of labor-market weakness are beginning to emerge.

Key macro concerns include:

Rising unemployment

The steepest decline in private employment in over two years

Increased loan defaults

Elevated household and credit card debt

While markets currently price in roughly a 25% probability of a recession, I believe the risk over the next year or two is higher. Because markets are forward-looking, this helps explain why Visa’s share price has remained under pressure.

Why This Creates an Opportunity 💡

For long-term investors, macro uncertainty can be an advantage. And I’ve been adding shares in the $320–$330 range. But I am hopeful for a potential pullback closer to $300, which would represent a compelling long-term entry point in my opinion.

Visa’s fundamentals remain intact, and any macro-driven weakness should be viewed as an opportunity rather than a warning sign.

Activity: Solid Results, High Expectations 👍🏾

Despite concerns about consumer spending, Visa’s activity metrics remained healthy during the quarter.

Q4 activity metrics:

Payment volumes: +8% YoY to $14 trillion

Transactions: +10% YoY to 258 billion

While both metrics were flat compared to the prior year’s growth rates, Visa is often held to an exceptionally high standard. In my view, maintaining this level of growth during a slowing economy is impressive and was a key driver behind Visa’s double-digit earnings growth.

Network Expansion & Innovation 🏗️

Visa continues to widen its moat through technology investments and network expansion.

Key strategic initiatives:

Expanded card issuance and settlement currencies

Support for four stablecoins across four unique blockchains

Deployment of VisaNet, an AI-enabled processing platform designed for easier scaling and faster deployment

Management also highlighted strong traction in digital payments:

Visa tokens grew from 10 billion to 16 billion since May 2024

130 stablecoin-linked card programs across 40+ countries

Stablecoin-linked Visa card spending quadrupled year-over-year in Q4

These initiatives position Visa well for the next phase of global payments.

Another Double-Digit Dividend Increase 💵

Visa’s sub-1% dividend yield may not appeal to income investors at first glance, but dividend growth is where the real value lies.

In October, they raised their dividend 13.6% to $0.67, exceeding my expectations.

Cash flow strength:

Q4 free cash flow: $5.49 billion

Q4 dividends paid: $1.15 billion

FY free cash flow: $21.57 billion

FY dividends paid: $4.63 billion

FCF payout ratio: ~21%

In addition, Visa returned significant capital to shareholders through buybacks:

$5 billion in Q4

$18.2 billion for the full fiscal year

This capital-light business model makes Visa a textbook dividend compounder.

Management Still Expects Double-Digit Growth ↗️

Even with macro risks rising, Visa’s management remains confident.

Management expects double-digit growth in the upcoming fiscal year

Q1 is expected to deliver the strongest top-line growth due to timing effects from pricing actions

This guidance reinforces Visa’s resilience and pricing power.

Long-Term Upside Remains Attractive 📉

In the near term, I expect Visa to continue trading in the $330–$340 range until economic clarity improves. If macro conditions deteriorate further, a drop below $300 would represent a high-conviction buying opportunity.

Looking longer term:

FY 2028 price target: ~$442

In a soft-landing scenario, Visa could reach this level faster than expected

Bottom Line ✅

Visa’s recent underperformance has far more to do with macro uncertainty than deteriorating fundamentals.

While near-term volatility is likely if economic conditions weaken, Visa’s:

Double-digit earnings growth

Capital-light business model

Strong balance sheet

Consistent double-digit dividend increases

..seems to position the company well for strong long-term returns.

For patient investors, Visa remains a high-quality compounder worth accumulating. Particularly on macro-driven weakness.

Happy Investing!

If you’re looking to create passive income and build your wealth from one of the top rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started. ☎️

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.