Why Build-A-Bear Is Smashing Your Favorite Tech Stocks

"Building Wealth With Underrated Dividend Stocks"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly in the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

When it comes to investing in the stock market, many investors often chase the high flying, popular tech stocks like NVIDIA (NVDA), Microsoft (MSFT), or Palantir Technologies (PLTR). And while I think all three are great companies to invest in, investors often buy these at the wrong time, when they’re overly expensive.

This is what us experienced investors know as FOMO, or Fear Of Missing Out. As a result, this pushes the price to an excessive valuation because investors continue to pile in and drive up it up.

Buying quality stocks at low valuations is safer and the best way to build wealth, while buying overvalued stocks is significantly riskier.

For myself, I like to find high-quality stocks that everyone is overlooking. And the reason being is because these can sometimes be the true wealth builders as their often lower stock price does not reflect their quality. One stock that I have been bullish on for sometime now is one no one is likely thinking about, Build-A-Bear Workshop (BBW).

That’s right, who knew selling stuffed bears would be so profitable. But when looking to buy and own a stock, it’s more than just what the company sells. For me, BBW is still highly overlooked due to their business model. But they could be considered riskier as they are highly susceptible to economic risks that impact consumer discretionary spending.

But what investors are failing to look at is their expansion, both domestically & internationally. And it’s not just about growing for the sake of it, the retailer has been expanding strategically into places like the Las Vegas Strip & ICON Park in Orlando, Florida. They’ve also been entering into new countries nearly every quarter.

This is important because all of these places are high foot traffic areas, giving BBW more reach and visibility. And I also like the fact that the company pays a dividend and has no debt.

This not only rewards shareholders, but allows the company flexibility to expand at will because they have no debt to repay. And they can use this cash flow for dividend increases, or building new stores at a rapid pace, which they have been doing.

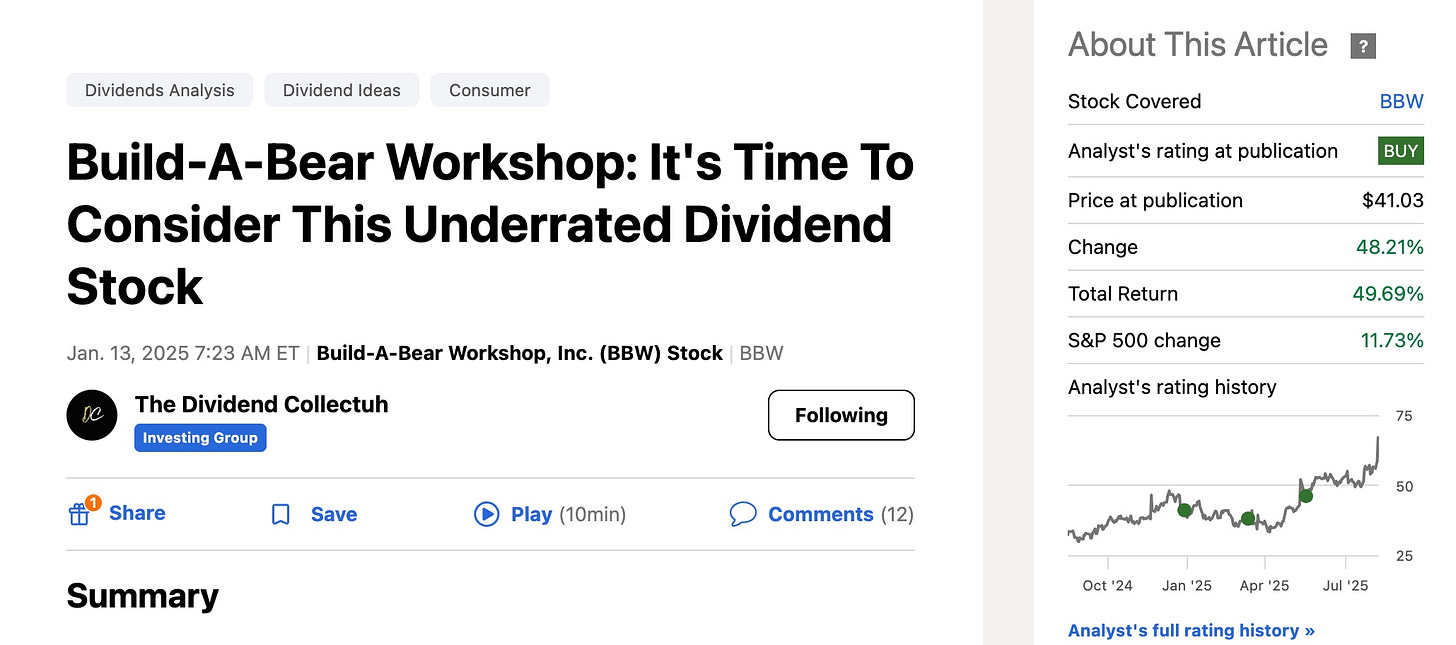

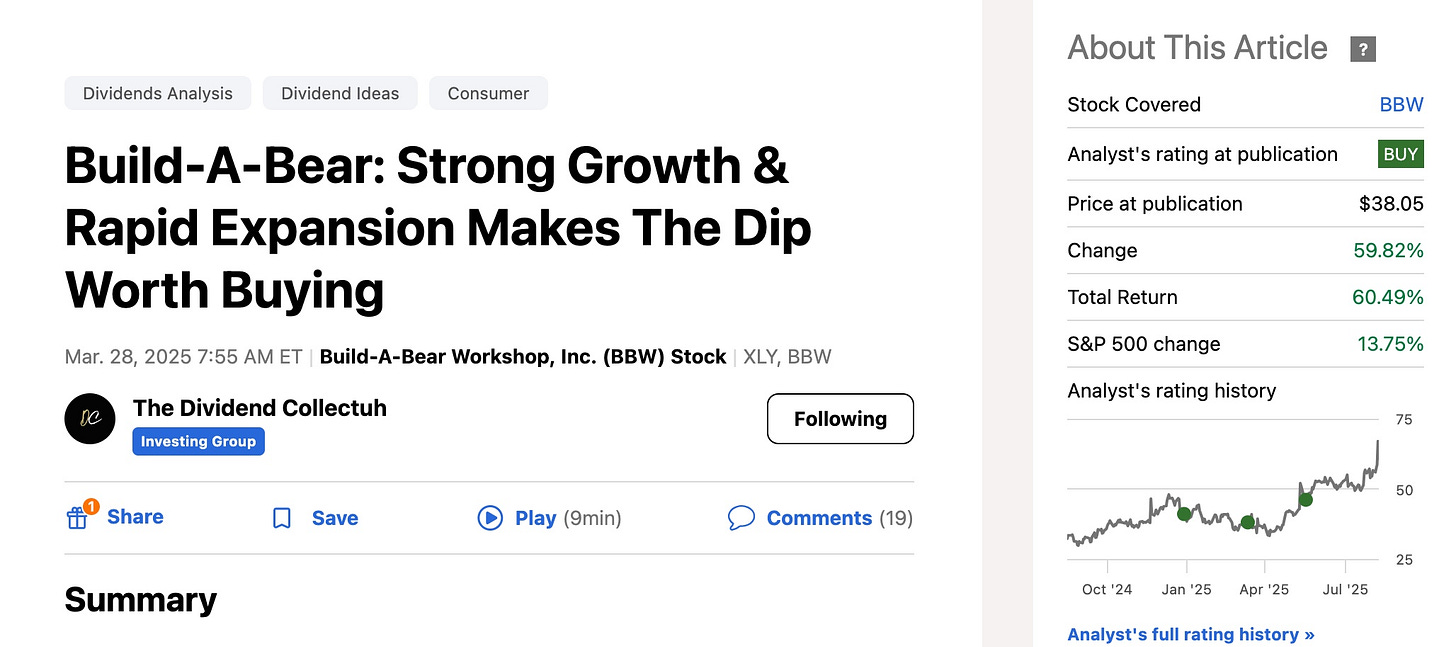

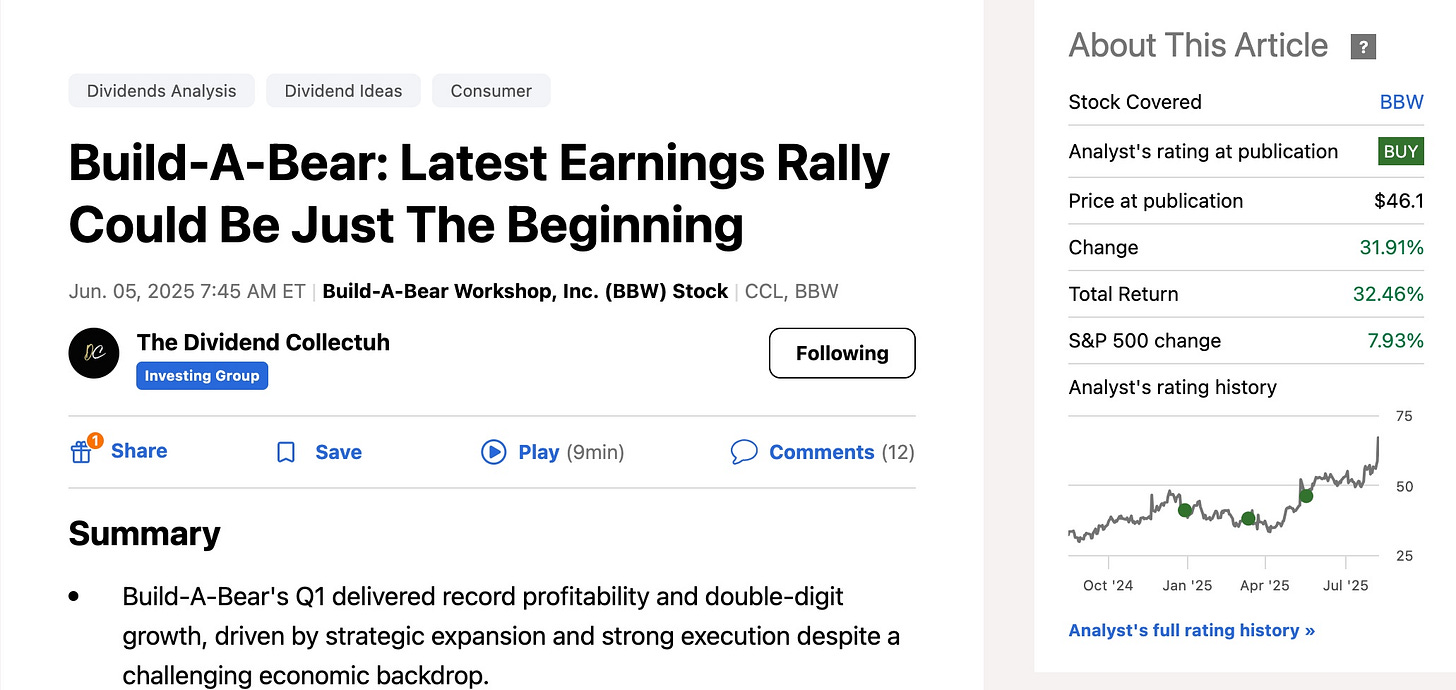

Below are Seeking Alpha articles I’ve written on BBW telling investors to buy:

Currently the stock is around $61 a share and recently made a new 52-week high of $70.01 after earnings. During the Liberation Day flash crash in April, the stock dipped into the low $30’s where I loaded up.

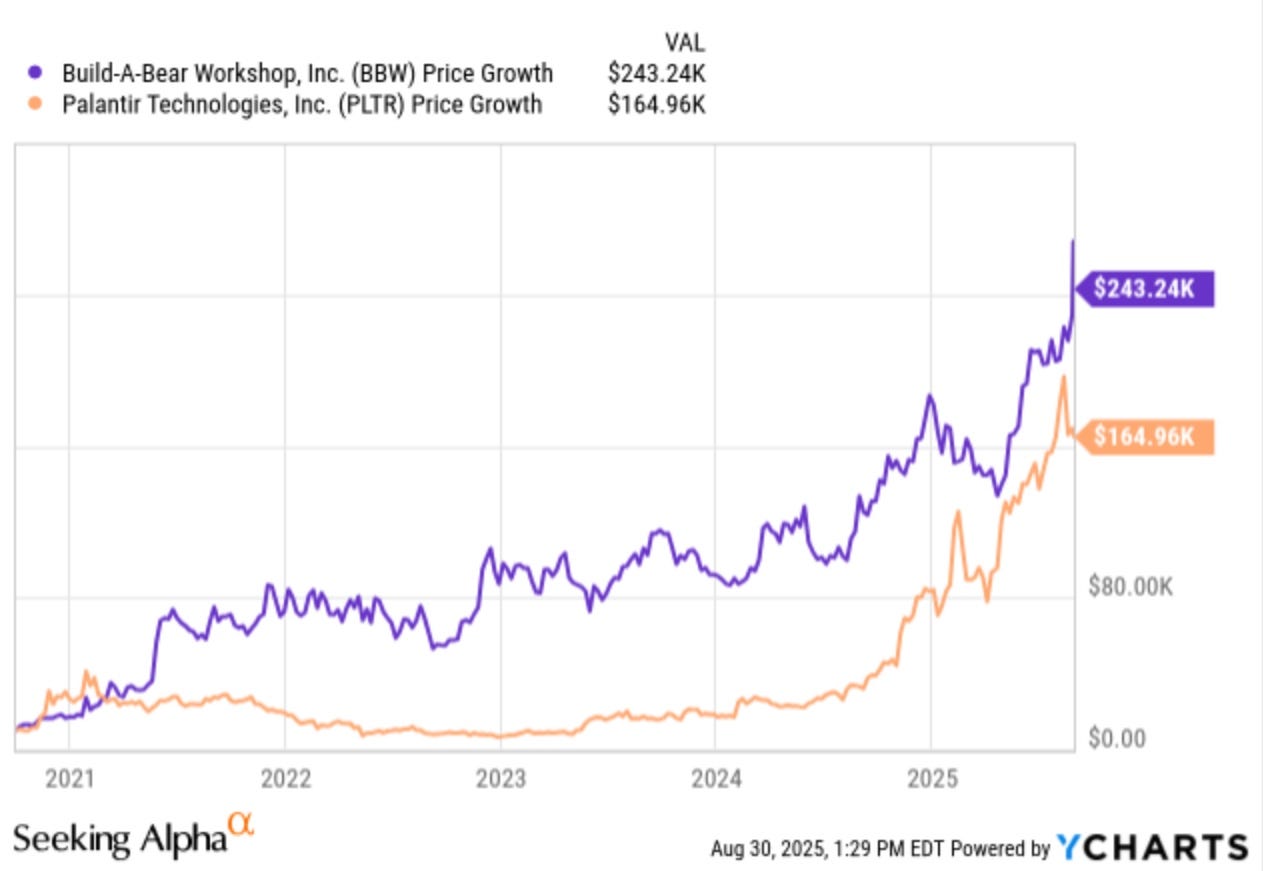

Here’s how much you would’ve made if you invested $10k into BBW 5 years ago:

Investing $10k into the retailer would be worth over $243,000 compared to roughly $165,000 for Palantir today. So, while investors have been chasing stocks like Palantir, BBW has been quietly outperforming.

Below is a chart of Build-A-Bear’s performance against well-known, high-quality stocks like Microsoft, Costco (COST), NVIDIA, & Palantir. BBW is up over 2,200%, far exceeding the 1,549% for Palantir, 1,202% for NVIDIA, 171.33% for Costco, and 125% for Microsoft.

And while past performance is no indication of future performance, I think BBW will continue to perform well in the coming years. At a forward P/E of just 15x, I think the retailer may be poised for significant upside over the long-term.

For more in-depth coverage of Build-A-Bear and other quality stocks, you can read more by following me on Seeking Alpha.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Really interesting take! I like the focus on overlooked, high-quality stocks like BBW instead of chasing hype. Strategic expansion, no debt, and a dividend make it a compelling long-term play.

Your content is gold, keep it coming!