Why Buying Overvalued Companies Can Lead To Underperformance

"Buying At The Right Price Is The Most Important Investment Lesson"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

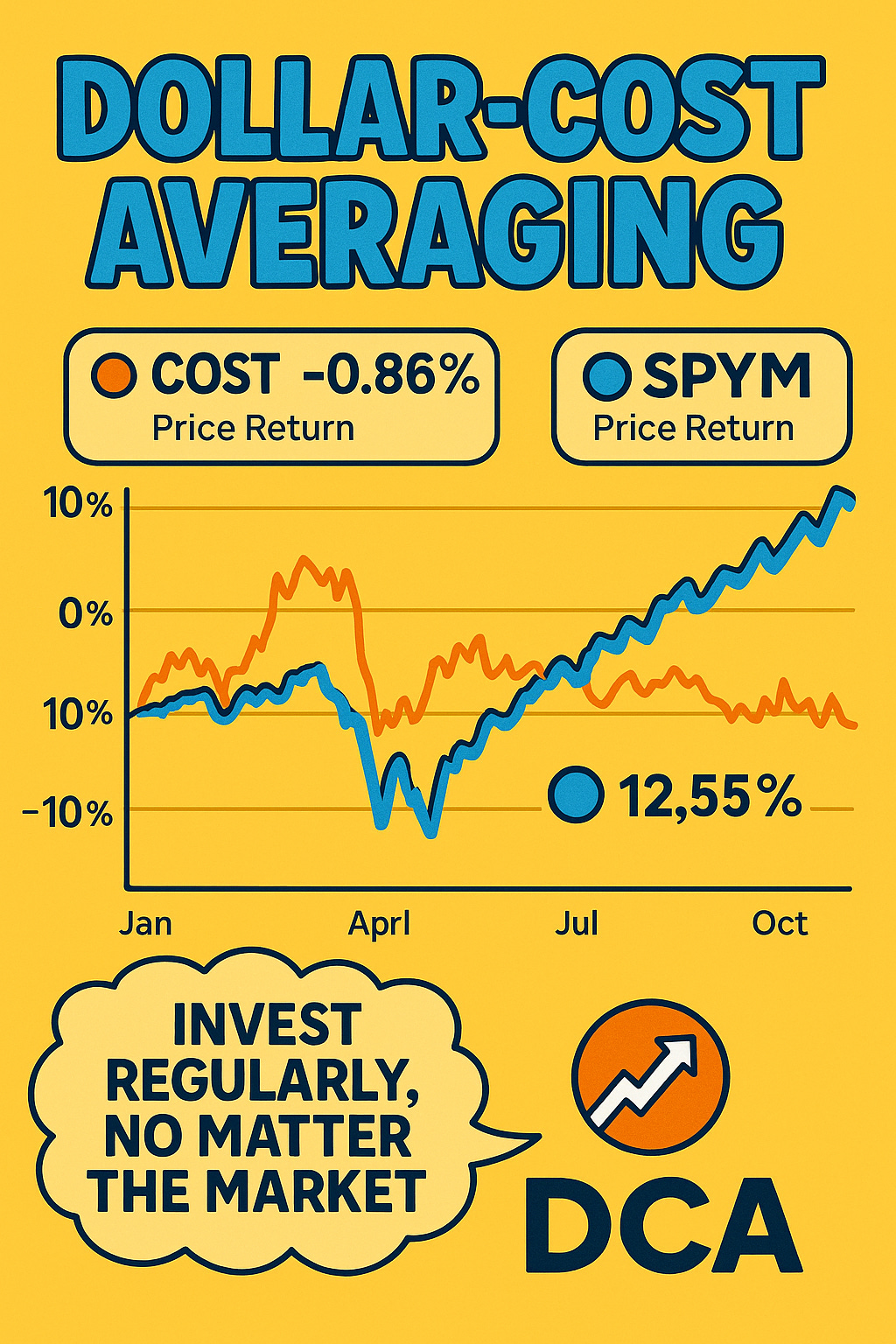

The above chart shows two companies:

✅ Costco (COST)

✅ State Street SPDR Portfolio S&P 500 ETF (SPYM)

With the stock market pulling back in the last week or so, this is even more of an indication of why buying a quality stock at the right price is most important.

Every so often the market experiences corrections, or what I like to call “shake out” periods. This is when non-investors who bought hyped, or popular stocks and pushed their prices into overvalued territory get shaken out of the market with panic selling.

Quality stocks will typically rise over time. But stocks never ever move in a straight line.

Don’t believe me? Pick any high-quality company and google their 10 or 20-year stock chart.

Buying a company, even if it’s a quality one like Costco when it’s overvalued can lead to underperformance. This is because when it drops, the share price can take years to recover if ever.

Costco is in the red in the past year and has fallen from their 52-week high of $1,078. If you bought near here without knowing anything about market fluctuation, you’ve likely sold already as the stock has suffered a $183 price drop.

While ETFs don’t offer as much price appreciation as individual stocks, they typically see less downside because of their diversified portfolios.

This is why Warren Buffett says to buy a low-cost index fund and hold it for 20 years.

SPYM, formerly SPLG is up over 12% in the past year compared to Costco, down over 2%. While Vanguard S&P 500 ETF (VOO) is the most popular S&P 500 ETF to buy, SPYM does the same exact job and has a lower expense ratio. The only difference is SPYM is smaller in assets under management, or AUM, making them less liquid.

Most notably is the ETF is nearly 8x cheaper and is only $3.46 away from their 52-week high of $81.14

VOO currently trades at $607, down from $634.13.

Moral of the story?

Buying hype stocks leads to overvaluation. The higher the price, the higher chances of them falling harder & faster in a market crash or correction.

Everyone’s a genius in a bull market.

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha for 2 weeks FREE. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

This is not financial advice. This is for educational purposes only. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.