Why Credit Cards Are Keeping You Broke

"Change Your Money Mindset"

Recently, I was asked by a family member to help them with a household bill that they said would cost anywhere between $2,000 - $5,000.

They suggested I could easily put it on my credit card. They don’t normally use credit cards, so they always ask me when they don’t have the money upfront for a large expense. I mentioned how it wasn’t smart to use a credit card if one didn’t have the funds because of the usually high interest rates. They responded by saying that credit cards were for when you didn’t have the money.

I wanted to share this story because this is how so many people are stuck working well into their 60’s & 70’s. THE WRONG KIND OF DEBT!! Credit cards are tools that could help you build wealth. But if used incorrectly, they can keep you working well past retirement age.

The average interest rate for a credit card in America is currently 24.33%!

And every month right after pay day, the first thing I do is pay off all of my credit cards. Why? I do not want the balance to roll over with an APR like that!

Think about it. The more credit card debt you have, the less money it leaves you to invest. Smart usage of credit cards can be used to pay for vacations, or to even pay bills. I currently have 4 credit cards and all of them are used for different things.

The key thing is to pay them off in full at the end of the month.

My American Express (AXP) platinum card is primarily used for big purchases and travel. This card get me access to airport lounges, purchase protection, car rental insurance, and travel credits.

I have one credit card I mainly use for gas since they offer more cash back on gasoline purchases.

And my other two I use for everyday expenses. since they offer cash back. And the cash back I receive can be used to invest if I choose. Or to cover unexpected expenses like car maintenance, small household items, or even groceries.

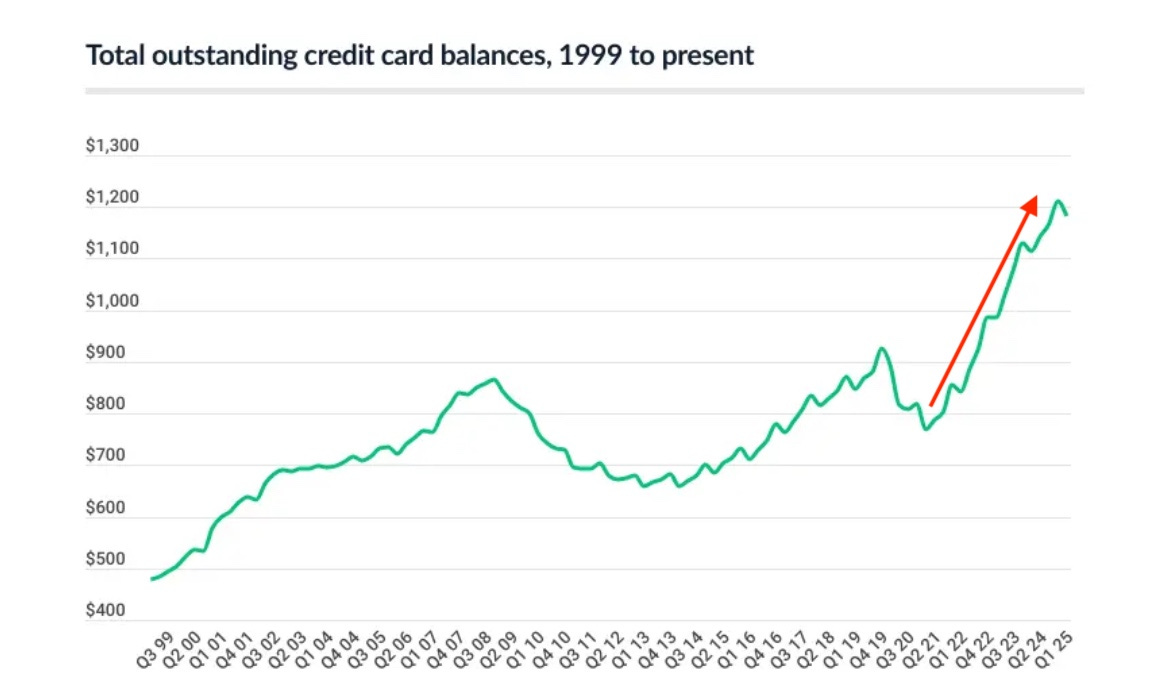

Below is a chart of surging credit card debt over the past few years. You can see credit card debt really started to increase around the time the Federal Reserve increased interest rates in 2022.

While the economy and consumer have remained resilient, it’s apparent consumers are currently facing financial distress as a result of higher for longer interest rates.

Since emergencies happen unexpectedly, relying on credit card debt is what is likely keeping you broke. They aren’t mean to be used when you don’t have the money. Credit cards are to be used when you do have the money, but want to use them instead to receive perks.

And if you do find yourself in credit card debt, make it a priority to pay it off. Because high credit card debt can lead to other problems like stress, or worse financial problems such as bankruptcy.

Most importantly, credit card debt keeps you broke and working!

Like & subscribe if you’re active duty, a veteran, or just love investing.