Why Dividend Cuts Are Never Fully Priced In

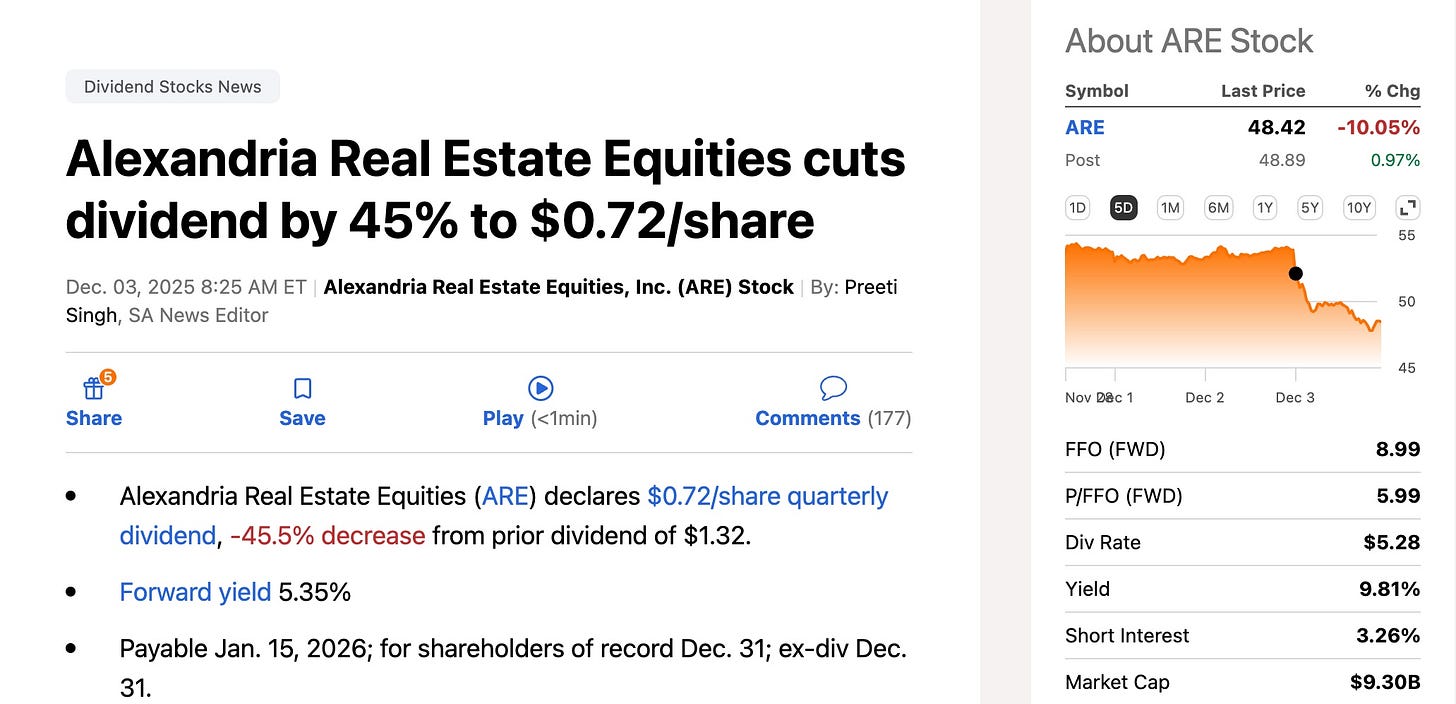

"Alexandria Real Estate Equities Recently Cut Their Dividend By 45%"

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

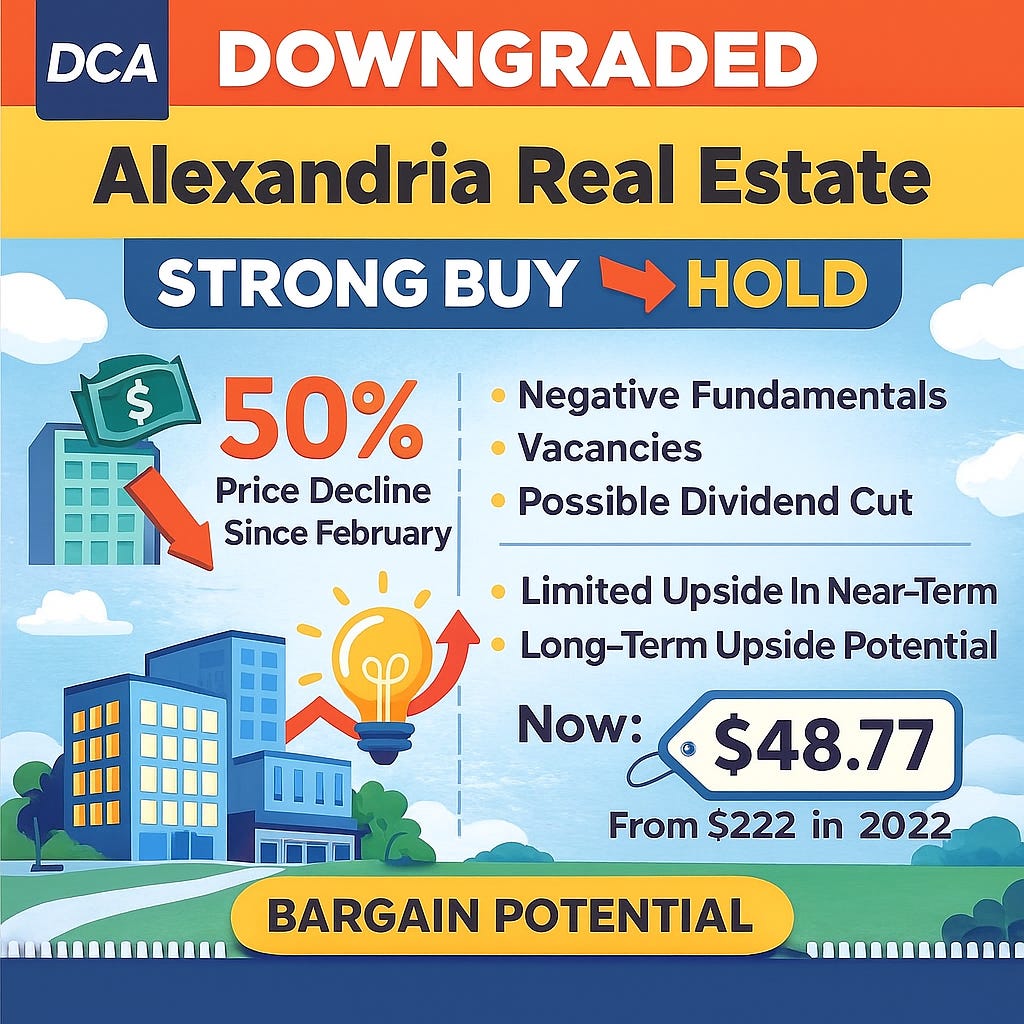

Current Price: $48.77

I don’t know everything, but I know a little about a lot. And this is one of the reasons I’m rated in the top 1% of financial analysts.

Listening to the wrong people can destroy your wealth.💰

I see so many “financial gurus” on social media promoting stocks or recommending what they heard from someone else without doing their own due diligence.

Being a successful investor requires the ability to think independently and in the future.

Anyone can get on social media and repeat what they’ve heard about stocks.

But not many people can analyze & intelligently write about them. Ask those “gurus” about the fundamentals of the stock they’re recommending and they’re likely to ignore you.

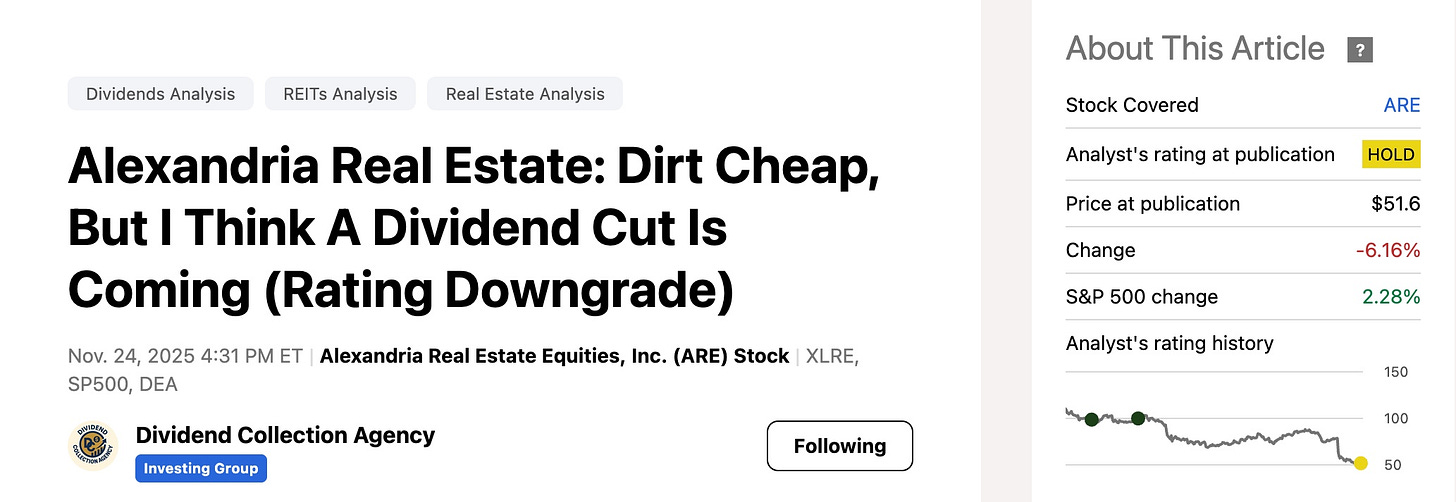

Nine days ago I wrote an article saying Alexandria Real Estate Equities (ARE) was going to cut its dividend.

Today it announced a 45% reduction.‼️

When a company cuts its dividend, this is usually followed by a decline in share price like ARE is currently experiencing. Dividend cutters also usually never see their share prices recover.

ARE traded over $220 in 2021. And I don’t think it will ever see that share price again. So, if you had bought near here, you’re down close to 80%.

It now trades near $49 a share and will likely go lower.

If you had invested in this stock when every other analyst was saying buy, you would have lost money. 📈

ARE has been a terrible investment in recent years. The REIT is down significantly in comparison to the S&P (SP500). I’ll admit I rated the stock a buy previously due to strong fundamentals at the time.

But this is why it’s important to keep tabs on your investments, no matter how quality you think they are. Fundamentals can erode over time.

Over the last year:

Over the last 3 years:

And the last 5 years:

Although I never invested in ARE, I provided updates for my readers on Seeking Alpha. And during my last thesis, the writing was on the wall, hence me downgrading them.

This is why I always say know what you own. If you can’t explain to a child, or anyone about the fundamentals of the stock, then you shouldn’t own it.

If you’re someone looking to create passive income and build your wealth, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started. ☎️

Happy Investing!

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

This is not financial advice. I am not a licensed professional. This is for educational purposes only. Please do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.