Why Dividends Matter

Supplement Your Active Income With Passive Income

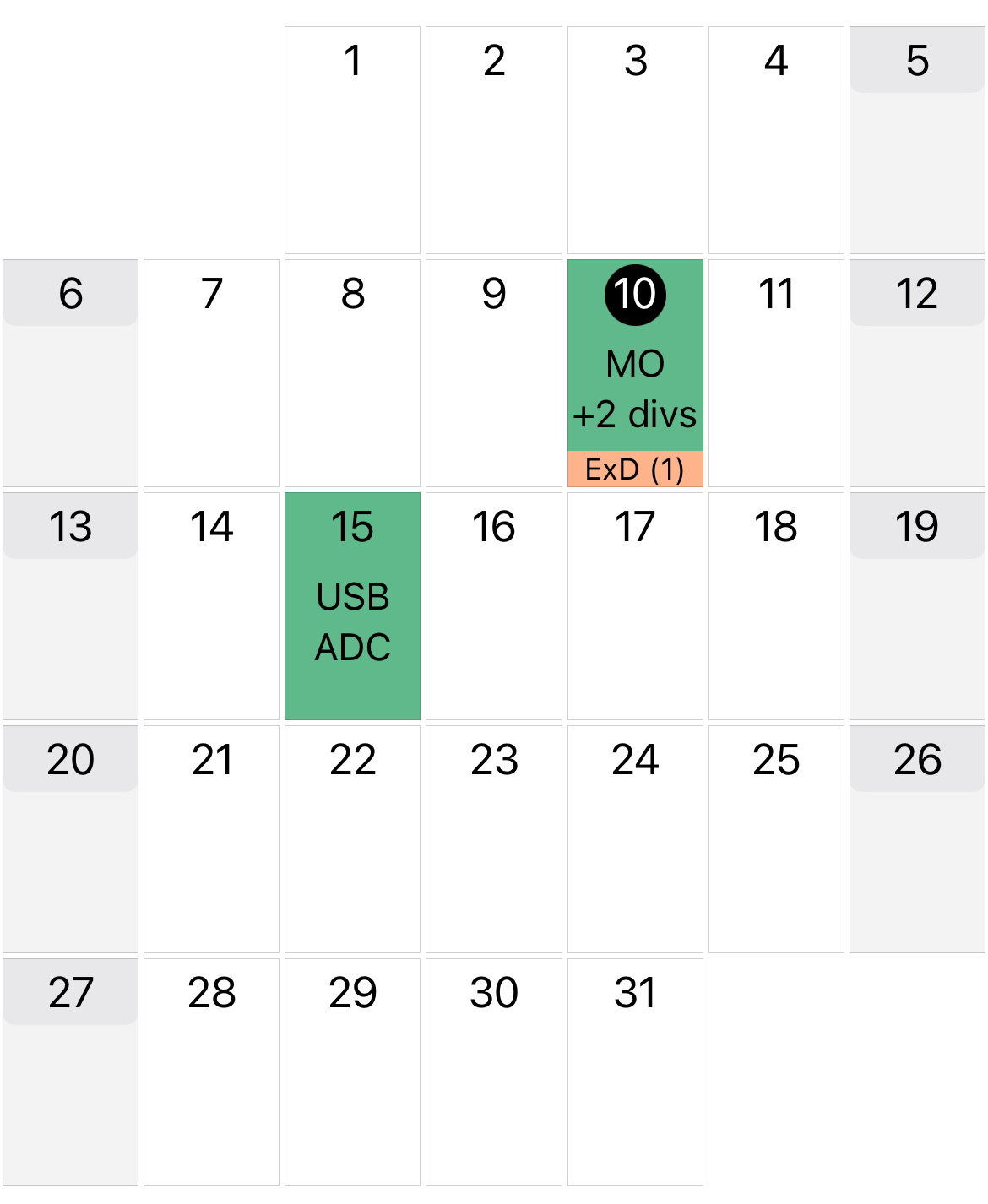

Today I wanted to share my dividends received, over $500 from three companies:

Altria (MO)

VICI Properties (VICI)

Build-A-Bear Workshop (BBW)

Build-A-Bear may surprise some of you. But the company is underrated and has been expanding rapidly. So, I think they’re here to stay and will continue to grow their dividends. The same goes for Altria and VICI Properties. People will continue to vacation to Las Vegas and smoke cigarettes or vape no matter what’s going on in the economy.

All three companies can be considered cyclical as they are impacted by a slowing economy and downturns like a recession. This is because consumers will likely see their finances tighten as job losses increase.

But one thing is certain, consumers will always travel, smoke & drink (Altria has a stake in Budweiser), and buy stuffed toys for the kids. Surprisingly, many adults shop at Build-A-Bear as well.

While some could say $500 is not that much money, imagine someone giving you $500 for nothing. This is also more than my monthly car payment. So, in a bind, I could use my dividends to cover it if need be. $500 is also enough to cover smaller expenses like some utilities, health & dental costs, vehicle repairs, or a small vacation.

To wrap things up, this is why dividends matter!

And reinvesting them will only grow your dividend snowball must faster. Moreover, one day your snowball will be big enough to cover larger expenses like your mortgage, or car payments. Freeing up your active income for investing to grow your wealth.

Like & subscribe if you’re active duty, a veteran, or just love investing.